-

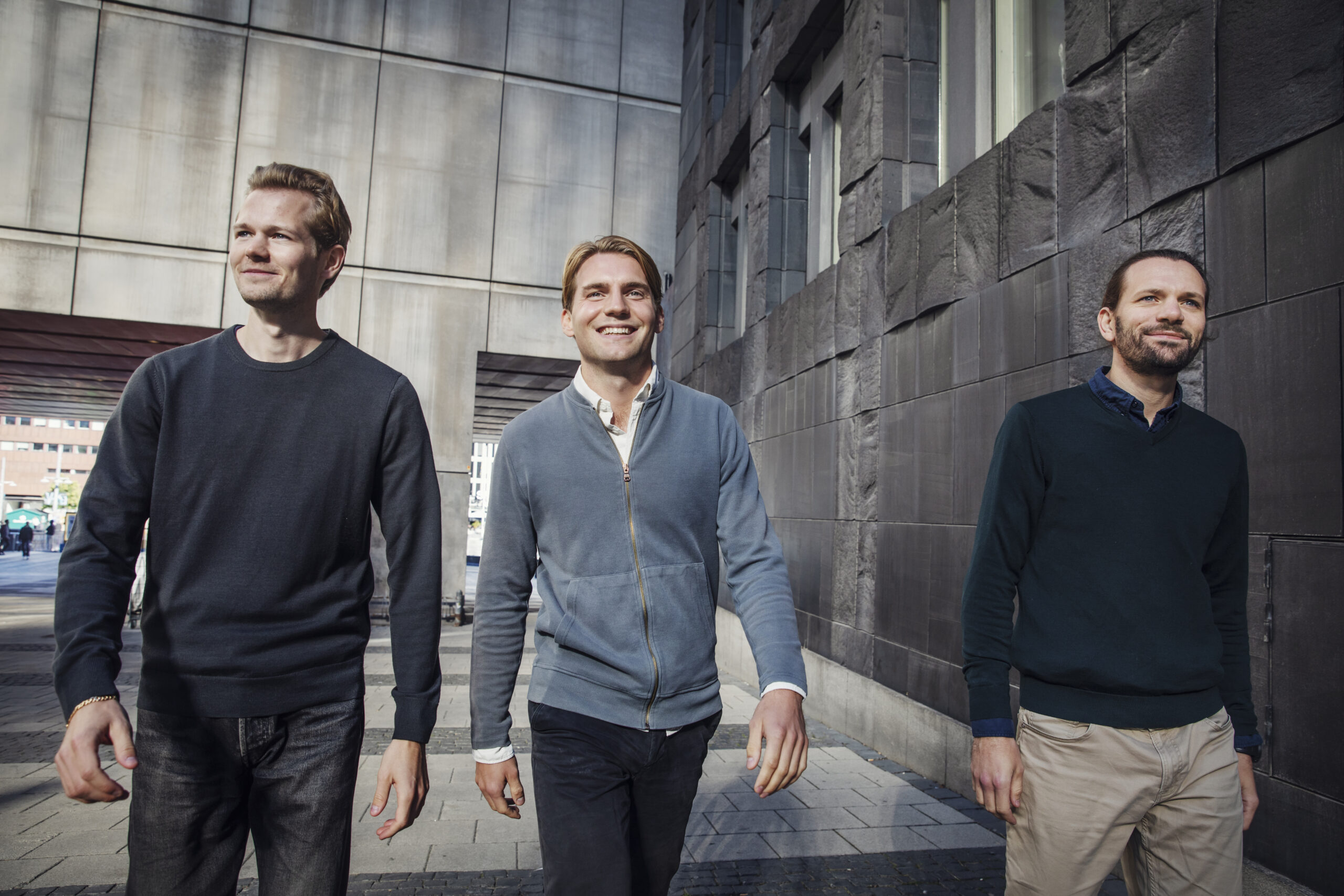

Former Tink employees launch fintech Atlar and raise five million euros

The Swedes are an innovative people and have often been ahead of the game when it comes to fintech. Now the new fintech startup Atlar, founded by three former Tink employees, Joel Nordström, Joel Wägmark and Johannes Elgh, is launching. With Atlar, companies can communicate directly with banks via a novel layer to seamlessly and…

-

Expansion of the product range: Ginmon and Upvest announce cooperation

Low interest rates, rising inflation and an ever-widening pension gap are putting a strain on consumers, and in times of uncertainty it is becoming increasingly difficult to put money aside for emergencies or even for the future. Even participation in the capital market has long since ceased to guarantee high returns. At the same time,…

-

Wind of change? Is the turnaround for fintechs imminent?

The world-famous song “Wind of Change” by the band Scorpions intoned the end of the Cold War in 1990 and gave us all the feeling of a “turn for the better” with our Russian neighbors. Since February 24, we have been abruptly taught otherwise, and since April 27, we have known officially through our Chancellor…

-

Embedded finance fintech Banxware raises 10 million euros

Embedded finance is undoubtedly one of the hypes of the past year. In Germany, the fintech Banxware, founded in 2020, is one of the first to significantly shape and advance the topic in Germany. Now the company has raised €10 million in a seed expansion round led by Element Ventures. D4 Ventures, FinVC and Varengold…

-

Introducing 5 new fintechs we don’t know yet

Everything already there, everything already seen? Not true. What else is there to come? A lot! From now on, we will prove in our loose episodes on new fintechs on the market that Germany is still a place of founders who still come up with something new in the finance, payment and banking industry. We’re…

-

inVenture gives private investors access to venture capital funds

Leaving money exclusively in the bank is no longer a good idea. There, “thanks” to negative interest rates, it becomes less, not more, the longer it sits. The solution is to invest in different asset classes in a diversified manner. Young fintechs in particular are establishing themselves on the market because they minimize the hurdles…

-

Influencer marketing in the financial industry

Two marketing surveys published a few months ago by the German Digital Economy Association and the Influencer Marketing Hub clearly show: activating one’s own target group through influencer marketing as part of the online marketing strategy will become even more important in the future. And fintech and banks have also long been working with influencers…

-

Money magnet fintech – is the attraction weakening?

For years, money just poured into fintechs. Only recently did investor enthusiasm seem to wane somewhat. An inventory of not only the unicorn herd. To be the next Uber, that would be something. This, or something similar, is probably the more or less silent dream of startups when it comes to finance. And so is…

-

The cards are being reshuffled: Lucrative niches in the fintech market

A guest article by Dr. Andreas Spengel, Senior Vice President Market Development at Mastercard Germany & Switzerland Fueled by the digital transformation and changing customer needs, European fintechs have been shaking up the payment world for several years now with their new, often disruptive business models. Thanks to their lean organisation, agile working methods and…

-

Introducing 5 new fintechs we don’t know yet

Everything already there, everything already seen? Not true. What else is there to come? A lot! That Germany is still a place of founders, who still come up with something new even in the finance, payment and banking industry, we prove from now on in our loose episodes on new companies in the finance industry.…

-

Introducing 5 new fintechs we don’t know yet

Everything already there, everything already seen? Not true. What else is there to come? A lot! That Germany is still a place of founders, who still come up with something new even in the finance, payment and banking industry, we prove from now on in our loose episodes on new companies in the finance industry.…

-

NumberX – ex-Revolut and Anyline executives launch new fintech

New fintech NumberX launches app-based payment card based on open banking principle. Mastercard is on board as a strategic partner. Claudio Wilhelmer, previously Country Manager DACH of the London-based neobank Revolut, and Matthias Seiderer, previously Chief Revenue Officer of the Viennese AI technology company Anyline, are joining forces: With their new fintech company NumberX, they…

-

Quo vadis pension? The Riester (non)reform from a fintech perspective

A guest article by Dr. Alexander Kihm, Managing Director Raisin Pension GmbH In the last week of January 2021, there was a declaration of bankruptcy. A complete failure in pension policy. Why? And what does this actually have to do with Fintech? To understand this, we must first take a short trip back in time.…