Unsere Analyse: Was bedeutet dieser Schritt fürs Kartengeschäft, Kunden und last but not least xPay/DK & Paydirekt?

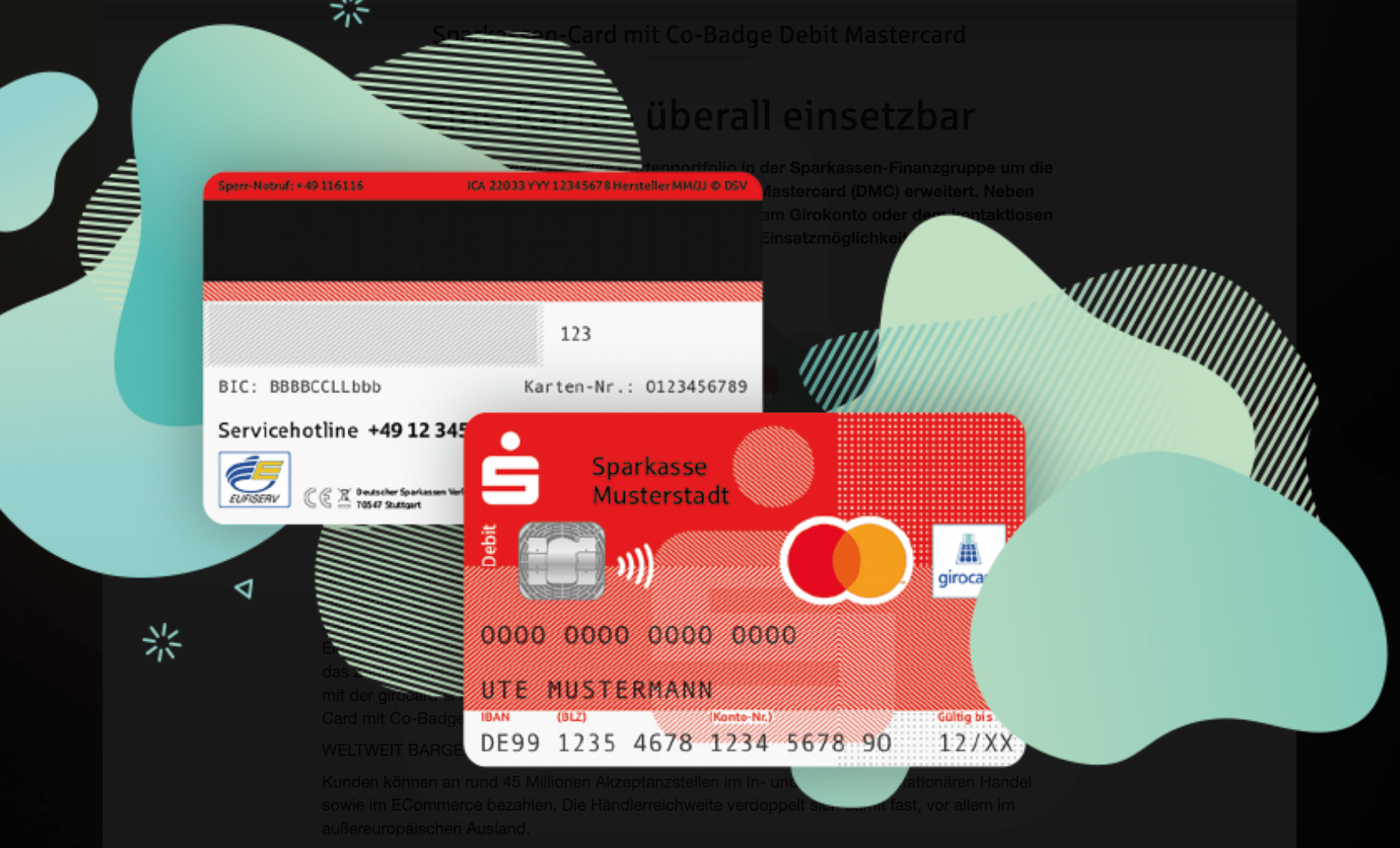

Diese Woche wurde bekannt, dass die Sparkassen-Finanzgruppe die bekannte Girocard mit Mastercard Debit fusioniert. Mastercard Debit soll offensichtlich das bisherige Maestro-Logo für den internationalen Einsatz ersetzen. Wir wiesen hier bei Payment & Banking schon vor einigen Wochen auf diese Tatsache als Gerücht hin. Reine Debitkarten auf Basis Mastercard sind in Deutschland keine wirkliche Neuerung. Diese werden längst von der Deutschen Bank, Commerzbank, sowie vielen Neobanken wie N26, Fidor Bank und weiteren ausgegeben. Auch die Sparkassen Finanzgruppe hatte schon ein Pilotprojekt mit der Sparkasse Siegen. Das Revolutionäre an dem Ansatz der Sparkasse ist nun die Fusion der Girocard mit Mastercard Debit. Damit wird das Beste aus beiden Welten zusammengebracht. Die (für den Handel günstigere) nationale Akzeptanz der Girocard, Sicherstellung der breiten nationalen Akzeptanz bei KMUs für den Kunden bis hin zur internationalen Nutzung als Zahlungskarte an allen Mastercard Akzeptanzstellen und Geldautomaten. Natürlich, und das ist wohl der wichtigste Schritt: Die Karte kann dann “überall” im Internet eingesetzt werden, endlich!! Die Sparkassen folgen dem seit Jahrzehnten sehr erfolgreichen französischen Modell, wo die dortige Cartes Bancaires mit Mastercard und VISA auf einer Karte harmonisch koexistieren. Die Auswirkungen dieses aus Kundensicht sehr begrüßenswerten Schrittes der Sparkassen sind weitreichend.

Sparkassen fallen xPay / DK in den Rücken?

Wie ich bereits in meinem ausführlichen Artikel zu xPay/EPI vor einigen Wochen schrieb: Die Debitprodukte der internationalen Schemes Mastercard / VISA lösen längst sämtliche Akzeptanzprobleme der Kunden. National und international sowie Online und am stationären Terminal. Die Herausforderungen für die handelnden Personen hinter der kreditwirtschaftlichen Initiativen xPay/DK werden noch stärker ein “besseres” Produkt zu liefern.

Wenn der Kunde mit seinem Konto über seine Sparkassen-Karte “überall” bezahlen kann, wie wahrscheinlich wird dann das fusionierte Produkt, welches aus der xPay-Initiative genutzt? Bedeutet der Schritt auch der Bruch mit Paydirekt, welches zuletzt aggressiv nur noch von Sparkassen sowohl auf Akzeptanzseite als auch Karteninhaberseite propagiert wurde?

Sparkassen kannibalisieren mit Mastercard Debit ihr Kreditkartengeschäft, oder auch nicht?

Wenn jeder Kunde eine Mastercard Debit als Sparkassenkarte besitzt, was soll dann noch der Grund für eine getrennte Mastercard oder VISA Kreditkarte sein? Auf den ersten Blick kannibalisiert die Sparkasse ihr Kreditkartengeschäft. Auf den zweiten Blick vielleicht sogar weniger. Ich denke an die zusätzlichen Interchange-Erträge der Kunden, die bislang keine Kreditkarte besaßen, aber die Debit nun mehr im Ausland und Online einsetzen. Auch hilft der Blick in die “Kartenländer” Frankreich, UK und USA. Dort existieren Debit und Kreditarten bei den dortigen Banken auch weiterhin harmonisch nebeneinander.

Endlich deutsche Debitkarten in Apple Pay

Bislang taten sich deutsche Banken und Sparkassen schwer die Kundennachfrage nach der Girocard in Apple Pay zu bedienen. Fragt man drei Insider in Banken und Sparkassen dazu, hört man fünf Meinungen. Ein häufig genannter Grund wäre Apple, die noch eine technische Einbindung der Girocard entwickeln müssten. Selbst wenn dies ginge, könnte Girocard nicht bei Apple Pay online genutzt werden. All diese Probleme sind mit dem Schritt der Sparkassen gelöst.

Grundlage für einen späteren lukrativen Exit der Girocard an Mastercard oder VISA?

Viele andere europäische Länder haben ihre nationalen Payment Schemes lukrativ an Mastercard verkauft. Ist der Schritt der Sparkassen gar ein erster Schritt für einen späteren Exit des Girocard-Verfahrens an Mastercard oder Visa? Damit könnten die notwendigen Investitionen in die europäischen Instant Payment-Scheme-Träume der Banken bei EPI/PEPS-I finanziert werden. Hier stehen die paar Verbands/Gremienmenschen ohne jegliche P&L/Produktverantwortung in ihrem Leben und die paar Produktleute aus Banken auf verlorenen Posten gegenüber den zehntausenden Mitarbeiten von Mastercard und Visa. Aber Realitäten interessieren in den politisch aufgeladenen Diskussionen im “Reality Distortion-Field” wenig, bis das harte Erwachen am Markt und Kunden kommt. Im Onlinepayment gegen PayPal haben es die gleichen Kollegen ja schon so 1:1 durchgemacht, was sie, trotz des “Erfolgs” nicht davon abhält das gleiche Rad im Payment, noch größer und das auch noch europäisch drehen zu wollen.

Zurück zur MC Debit und Girocard: Die Sparkassen sind einen mutigen, aber insbesondere aus Sicht der Kunden und des Marktes sehr konsequenten und begrüßenswerten Schritt gegangen! Neben dem großen Lob dafür bleibt noch viel Platz für weitere Spekulation, wie es weiter geht. Payment bleibt weiter spannend!

Was meinen die anderen Kollegen von Payment&Banking dazu?

Kilian Thalhammer

Ist das wirklich neu oder ist das nicht der Tod auf Raten für Maestro (und sind wir ehrlich, braucht das noch jemand sowas wie VPay, Cirrus und andere Kunstkreationen der Payment Branche)? Und der Gegenpol zu den Ausflügen in die “Girocard Only” Welt? (kleines Strohfeuer) und nun endlich online fähig (auch wenn es ein Armutszeugnis ist, dass man dies mit der Girocard nicht geschafft hat). Was bleibt der GC ? – eine Argumentation über den Preis (oder über “Nationalismus” wie es uns die Franzosen vormachen), damit kann man sich am Markt halten aber vorwärts denken und entwickeln schaut anders aus. In a nutshell – vom Kunden gedacht – endlich – das wird sich auszahlen. Nur für wen (außer dem Kunden)?

Maik Klotz

Ich hab die Mastercard Debit der Sparkasse Siegen – die übrigens nicht Apple Pay unterstützt. Ansonsten ist die Mastercard Debit der Sparkasse Siegen die bessere “Girocard”, da eben Kreditkarte welche sofort aufs Konto bucht. Die nun angekündigte Girocard mit Mastercard Scheme, also der Kombination aus Girocard und Debitcard ist nicht so richtig neu: Mit der Fidor Smartcard ist schon seit Jahren eine ähnliche Lösung vorhanden.

Der Kunde hat mit der Kombination den Vorteil wirklich überall bezahlen zu können (eben auch online) und der Weg zu Apple Pay ist ein leichter. Welches Scheme aber am POS verwendet wird, wenn der Kunde gefragt wird, ob er denn mit Karte zahlen möchte, ist eine aus meiner Sicht spannende Frage. Ansonsten halte ich den Zug für einen überraschenden, guten Schachzug. Wer weiß, vielleicht ist dass das langsame Ende der Girocard.

Marcus Mosen

Meine spontane Reaktion auf diese “News” via Twitter war diese: Tweet. -) Bei näherer Betrachtung stellen sich natürlich sehr wohl einige Fragen, u.a.:

- Wie will man ein “Gegenpol” gegenüber den Internationalen Schemes aufbauen, wenn man letztlich zumindest beim Auslandseinsatz auf sie angewiesen bleibt?

- Wie will man dem deutschen Endkunden den “Patchwork” an Branding und an Zahlungsmethoden und -abläufen erklären, die sich aus diversen Debitkartenprodukten (Girocard, Mastercard-Debit, Visa-Debit), diversen Kreditkarten-/Chargekarten-Produkten (Mastercard, Visa), Online-Bezahlprodukten (Giropay, Paydirekt) oder diversen Mobilepayment-Produkten (Girocard-Mobile, Apple Pay, Google Pay) ergeben?

- Macht die Girocard-Online, die einige Girocard-Fans noch gerne sehen möchten, jetzt überhaupt noch Sinn?

- Wie viele Produktteams, Marketingbudgets (bankintern), WKZ-Vereinbarungen (mit den Schemes), Fundingrunden (z.B. für Paydirekt) vernebeln die Transparenz eines möglichen ROI, der sich aus den möglichen diversen Fee-Erträgen ergibt?

- Ergeben sich daraus weiterreichende Konsequenzen bei jeglichen aktuellen (#DK) oder künftigen (#EPI) strategischen Überlegung der DK im bargeldlosen Zahlungsverkehr?

- Hat die Sparkassen-Entscheidung die Handlungsspielräume bei andere Bankengruppen verringert oder erweitert?

Nüchtern betrachtet hatten die Sparkassen wohl keine andere Wahl diesen Schritt zu gehen. Denn Mastercard will den Maestro-Brand beerdigen. Und auch Visa setzt künftig auf Visa-Debit statt auf V-Pay. Hier stellt sich die Frage, ob Visa vielleicht auch daran interessiert ist Co-badging Portfolien, die bisher ein Maestro-Logo haben, mit ihrem neuen Debitprodukt “hineinzugrätschen”.

Die Entwicklungen im bargeldlosen Zahlungsverkehr in Deutschland erinnern immer wieder an die Echternacher Springprozession. Das Dilemma hierbei ist nur, dass mit dieser “slow motion” nicht der “speed to market” sowie die Klarheit einer Produktpositionierung erreicht wird, die im digitalen Zeitalter vom Verbraucher (zunehmend) oder auch von dem einen oder anderen Händler erwartet werden. Interessant wird übrigens auch sein, welche neuen Varianten für die Akquirier aus der stärkeren Durchdringung der internationalen Brands ergibt. Dem Wettbewerb auf der Issuing- sowie der Akzeptanzseite wird es sicherlich nicht schaden.