-

The cards are being reshuffled: Lucrative niches in the fintech market

A guest article by Dr. Andreas Spengel, Senior Vice President Market Development at Mastercard Germany & Switzerland Fueled by the digital transformation and changing customer needs, European fintechs have been shaking up the payment world for several years now with their new, often disruptive business models. Thanks to their lean organisation, agile working methods and…

-

Look me in the eye, customer: With FIDO2 to the passwordless bank

Thanks to the FIDO2 standards, customers can finally authenticate themselves with biometric features on the Web. In our article, the IT consulting firm highlights adorsys why FIDO2 is the authentication standard of the future and why fiddling with passwords and TANs will no longer be necessary in the future – regardless of the device. adorsys…

-

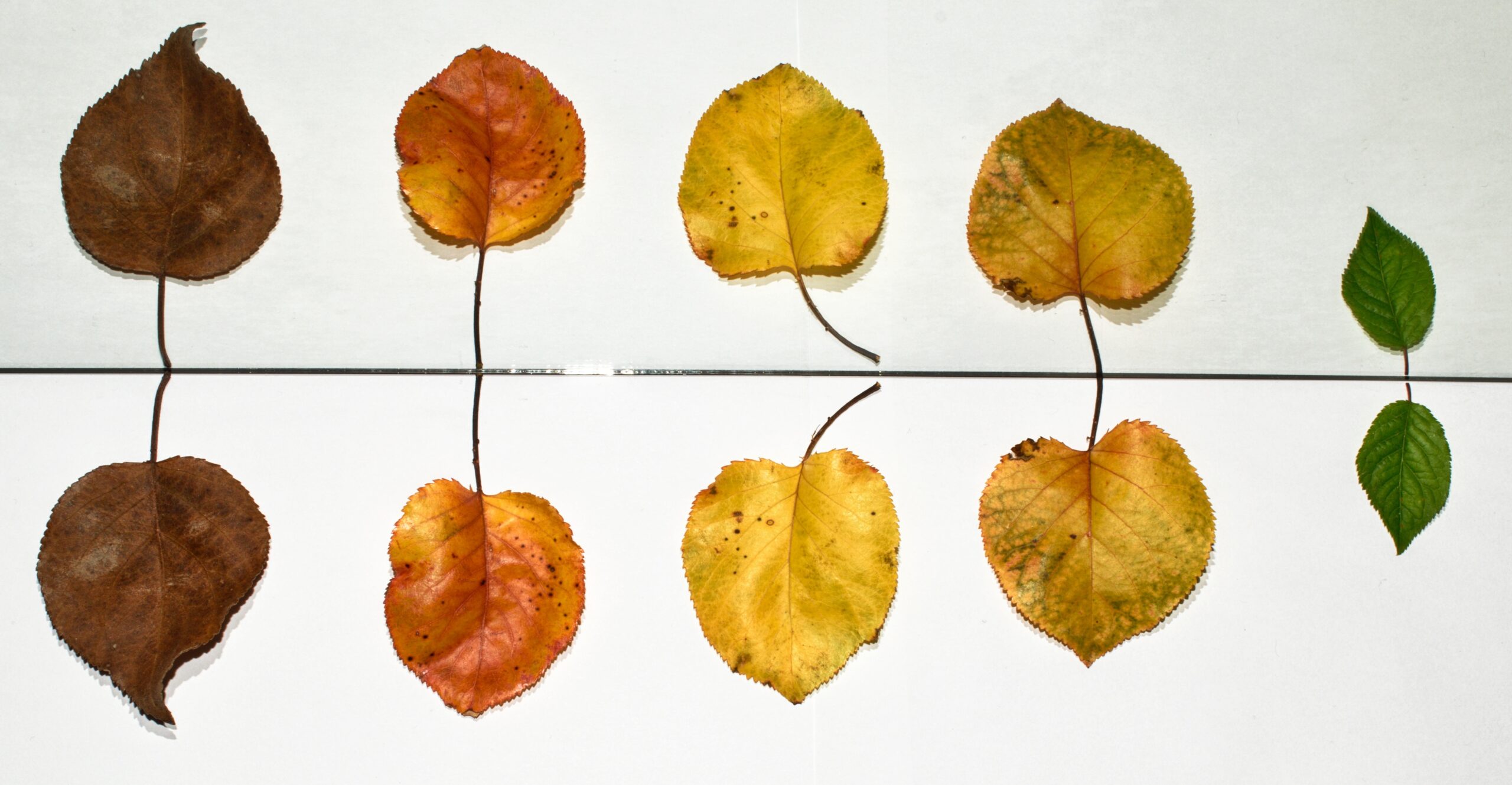

Green ETFs – The next hype or real future opportunity ?

At the latest since the climate protection movement “Fridays for Futures” gained massive global momentum in 2019, the topic of sustainable investment has also become an increasingly important issue for financial service providers, investors and the wider society. Just this month, Greenpeace drew attention to this again when activists landed a paraglider on the roof…

-

Don’t believe the hype: Bitcoins solve one problem – and create many new ones

The bitcoin price has been fluctuating and rising rapidly, breaking the $60,000 barrier for the first time in mid-March. Many media outlets are reporting almost daily on the cryptocurrency’s soaring fortunes, and Google searches are on the rise. Bitcoin are fondly heralded as the new saviours, touted as “crisis-proof” and described as the saviours of…

-

The European super app will soon shape lives

A guest contribution by Björn Goß AliPay, PayPal, Google Wallet or Square – The race for the banking super app in Europe and why a European super app is only a matter of time We’ve known for a long time that the financial world is headed for massive change. 2020 was therefore only an acceleration…

-

Can money be made with Open Banking?

A guest article by Dr. Peter Robejsek, Vice-President at Mastercard. Benefiting from new technologies and driven by the PSD2 payment services directive, the number of Open Banking use cases in Germany is continuously increasing. After all, open banking offers enormous opportunities to enable innovation not only through traditional products and services, but also to substantially…

-

Quo vadis pension? The Riester (non)reform from a fintech perspective

A guest article by Dr. Alexander Kihm, Managing Director Raisin Pension GmbH In the last week of January 2021, there was a declaration of bankruptcy. A complete failure in pension policy. Why? And what does this actually have to do with Fintech? To understand this, we must first take a short trip back in time.…

-

5 Jahre MIF-Regulierung: Welche Vorteile sind für Händler europaweit noch übrig?

Vor ziemlich genau fünf Jahren beschloss die Europäische Kommission, die multilateralen Interbankenentgelte für Debit- und Kreditkartentransaktionen europaweit auf 0,2 % bzw. 0,3 % zu regulieren. Heute stellt die globale, unabhängige Payment-Beratung CMSPI fest, dass ein Großteil der Einsparungen in einem “Hau-den-Maulwurf-Spiel” mit anderen Gebühren erodiert wurde und weitere Regulierung notwendig ist. MIF-Regulierung in 2015 Die…

-

Im Jahr des Bullen: Das sind die fünf Blockchaintrends in 2021

Ein Gastbeitrag von Patrick Hansen 2020 war viel los und viele sind vermutlich erleichtert, das Jahr endlich hinter sich gelassen zu haben. Obwohl mit neuen Regulierungen in Deutschland und der EU, über spannende neue Blockchain Projekte im Finanzsektor und der Industrie, bis hin zum neuen Bitcoin Allzeithoch im Dezember einiges dabei war, richtet sich der…

-

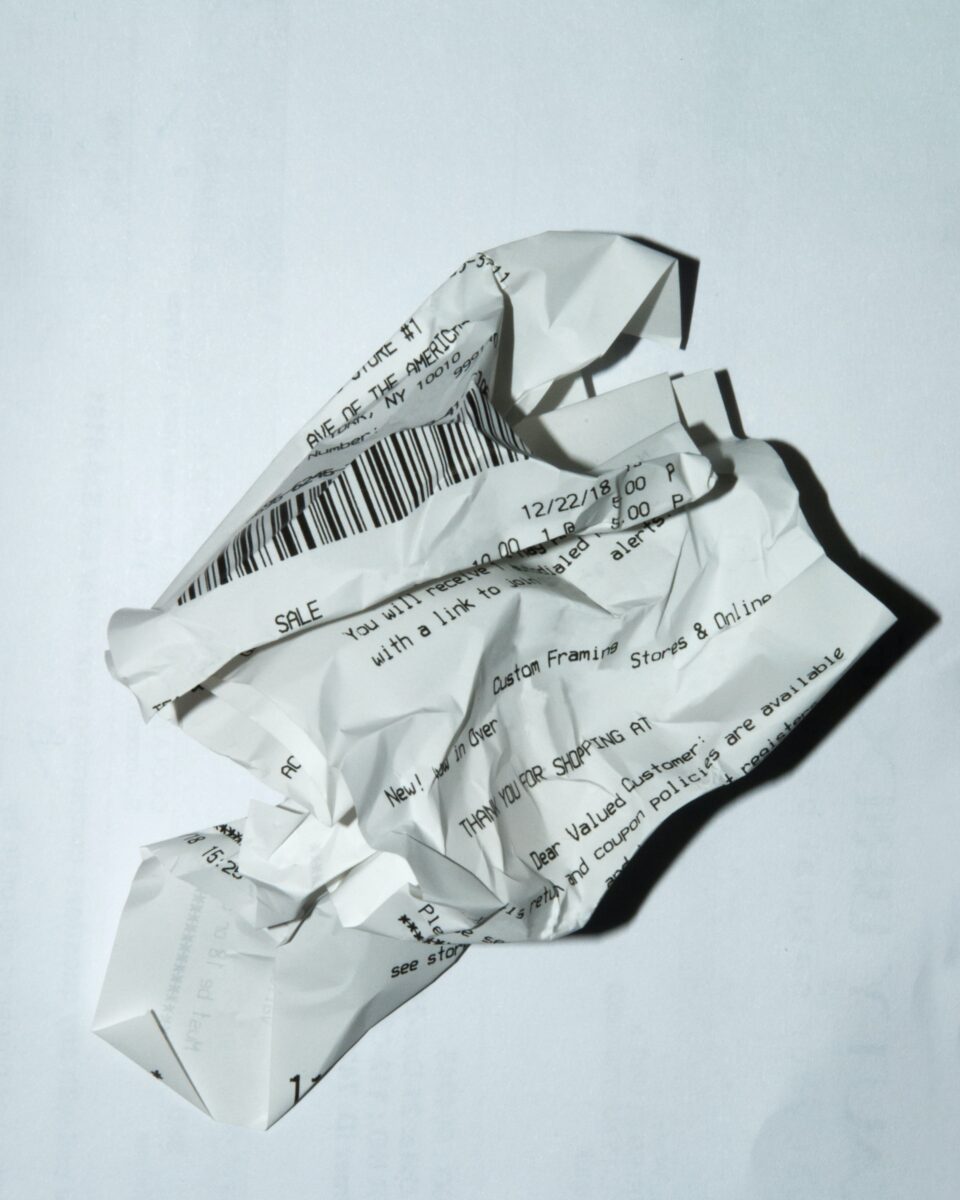

Digital cash register receipt as data platform

The year 2020 as the Year of the receipt To call it a global pandemic would not be an accurate description. Nevertheless, the topic has developed relatively quickly in Germany. After the legal requirement and obligation to issue receipts came into force in January 2020, small retailers or bakers were more likely to be seen…

-

Corona and the financial industry – a review and outlook

2021 is still young and we are taking advantage of this for a detailed look back and forward. Because nothing has changed the world and our industry as much as the Corona pandemic. Corona set new challenges – without postponing digitization Financial institutions around the world have had to provide emergency relief in the form…

-

2020: High-speed digitization for financial institutions and FinTechs

Digital transformation has long been a central topic in the economy. Financial institutions have also been planning and implementing increased digitalisation for a number of years. However, the Corona crisis and the resulting nationwide restrictions have undoubtedly rapidly accelerated the pace at which new technologies and processes are being brought to market. Just before Corona…