2021 is still young and we are taking advantage of this for a detailed look back and forward. Because nothing has changed the world and our industry as much as the Corona pandemic.

Corona set new challenges – without postponing digitization

Financial institutions around the world have had to provide emergency relief in the form of suspended mortgages or channelling government assistance programmes, while at the same time increasing reserves for losses. They have also been forced to watch the value of non-performing loans continue to inflate. Despite all this, we have seen continued investment in open banking and digital financial services as the pandemic accelerated the shift towards online and mobile-first customer journeys. Financial institutions needed to be nimble and innovative in the current climate. For this, they need startups, like us as technology partners, to provide infrastructure and bring expertise to help financial institutions maneuver in the “New Normal”.

The digital trend is here to stay

Of course, digitalisation has not just been on everyone’s lips since Covid-19. Over the last few years, fintechs have already evolved from analogue to digital, while banking has changed from a closed to an open process. This has made financial services more accessible to both consumers and businesses.

The pandemic accelerated this development – it forced radical changes in customer behavior by shifting key aspects of the economy to the Internet and increasing customers’ willingness to go digital. We assume that a habituation effect will occur here with the customer. The digital trend is here to stay.

As the world continues to explore Corona, we expect more executives to explore different use cases for Open Banking that bring immediate benefits to their business and operations. This is possible by improving customer retention, conversion, risk prevention and liability management. We have already seen this with a growing focus on investing in remote customer acquisition, onboarding and risk assessments.

Banking products in the changing pandemic

From a product perspective, the pandemic has increased demand for digital onboarding, resulting in record growth for digital offerings. While this is very encouraging, it presents two challenges for financial services providers: verifying identity and confirming the origin or destination of funds. This is where Open Banking has shone. Account verification through Open Banking – for example, through a FaceID in a banking app, rather than having to manually pick out the sort code and account number – can do both seamlessly, while also increasing conversion rates. In fact, we’ve seen a huge demand for easy account access in recent months, so we decided to make it a standalone product called Account Check – with API abstractions and supporting documentation.

And even beyond digital onboarding, financial institutions got creative to help during the crisis: Norwegian company goscore, for example, partnered with us to create Sprovid – a service that helps more than 400,000 furloughed Norwegians apply for rent discounts until they can return to full pay.

What will 2021 bring? A look ahead

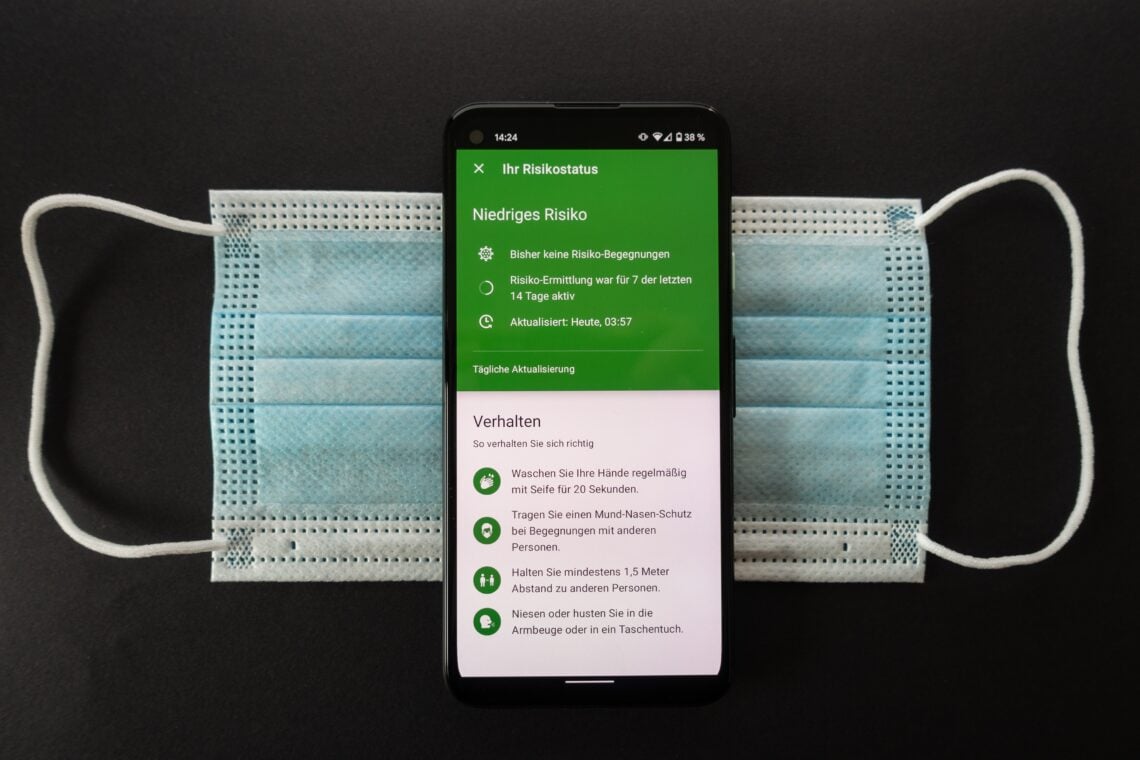

In the coming year, we expect Open Banking to become and remain a central component of the customer journey. If only because Corona will not be abruptly over in 2021. The renewed German hard lockdown shows how important it is to offer customers at least digital alternatives, but even better full-fledged experiences.

During 2020, we have seen European financial institutions becoming increasingly aware of the commercial opportunities that Open Banking offers. Over the next twelve months, we expect to see more financial institutions investing in Open Banking and integrating technology into the first step of the customer journey. Not only will this create a simpler, more intuitive banking experience for customers, but from a business perspective it will also enable a simple sign-up process while reducing risk. A win-win situation for all.

Payment Initiation Services (PIS) will become the standard for account deposits in 2021. Payment initiation is the cornerstone of Open Banking and potentially the most inclusive payment method in the industry. It allows customers to make payments and transfers with anyone from anywhere, within a bank’s app or website. Looking ahead to 2021, we believe PIS will be increasingly used to enhance people’s financial experience. This opens up new opportunities for consumers and businesses and takes digital finance to the next level. An important trend is also towards aggregated data.

Currently, most financial service providers’ open banking offerings are limited to access to a customer’s checking account and the ability to initiate payments and aggregate accounts.

In 2021, we expect to see new services that go a step beyond just account aggregation to add significant value for customers. Income verification is a great example of this – it gives lenders insight into customers’ income based on real-time financial data that comes directly from users’ bank accounts, regardless of their location.

“In 2021, we expect to launch new services that go a step beyond just account aggregation to create value for customers.”

The development of such products will help to simplify all aspects of customers’ financial lives and improve accessibility and financial inclusion – all securely and socially distanced from the comfort of their own homes.