-

Companies in the FinTech sector: Myos GmbH

The industry has grown up and has long outgrown its infancy. There are so many companies that shape the industry but not all of them are equally well known. Who are the companies that are the glue between finance and digital technologies? In our series “The Companies of the FinTech Industry” we give companies or…

-

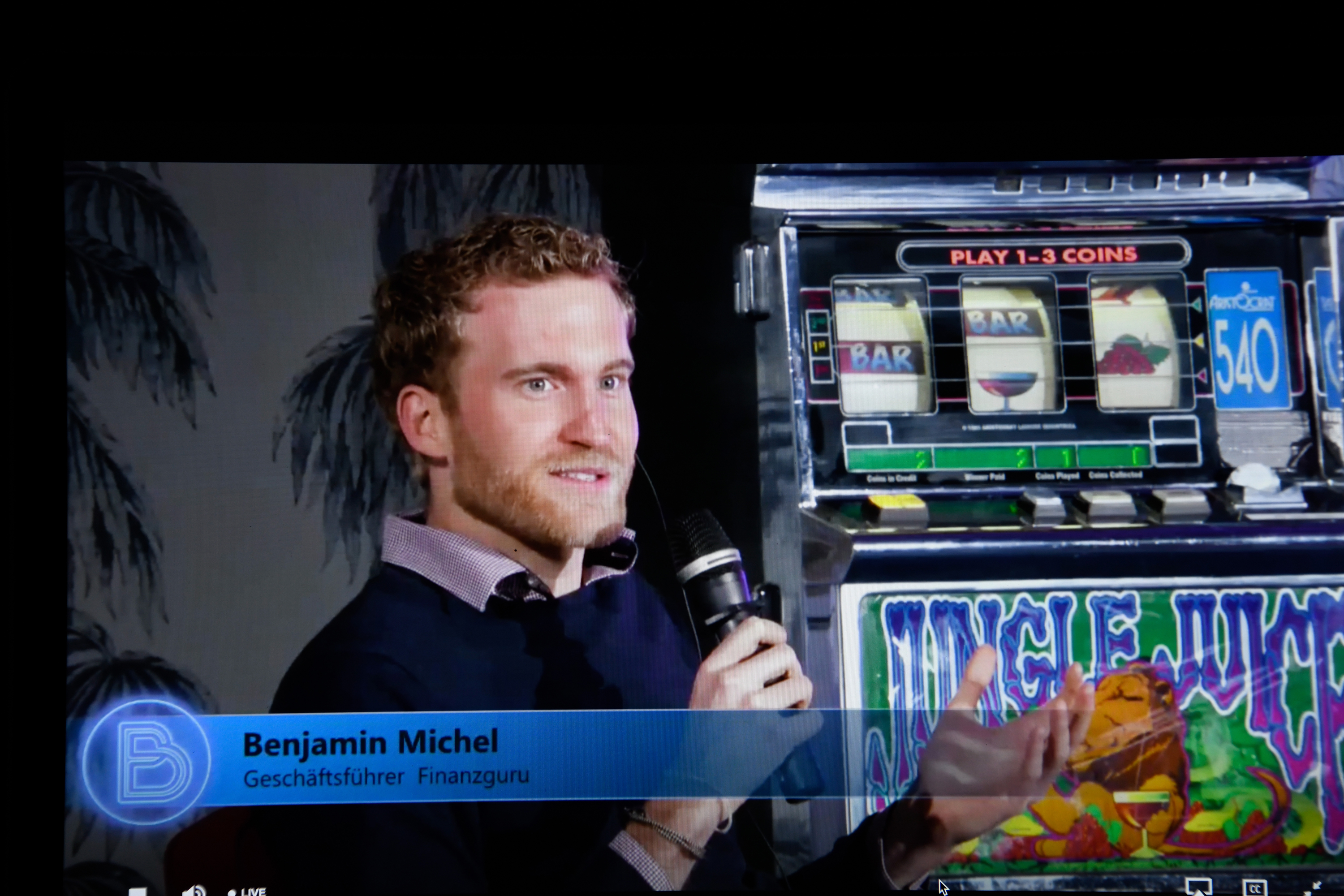

“Best to be afraid of us.” The future of Personal Finance Management

A video interview with Benjamin Michel (finance guru) at the Banking Exchange 2020 For the first time in the event history of Payment & Banking, the Banking Exchange, which was otherwise designed as an “invite only” event, took place in a stream accessible to all. Our goal was to live what other events only preach:…

-

Is Tesla the new Wirecard?

A contribution from Robin Brass Wirecard has long been the most traded and hotly discussed share in Germany. Many people ask themselves whether Tesla does not also have many parallels with Wirecard.All in all, the picture does indeed show some parallels, but also some major differences, which should certainly not only be of interest to…

-

The stationary trade – a swan song?

A guest contribution from Bjorn Wessel Corona is changing the world and with it the trade. Not through new insights, but rather by accelerating existing developments. What took 5-10 years before is now happening in 3 months. In retail, the “final breakthrough” of eCommerce, long awaited by some and feared by others, has become visible…

-

Unternehmen der FinTech Branche: Mambu GmbH

Die Branche ist groß geworden und längst aus den Kinderschuhen heraus gewachsen. Es gibt so viele Unternehmen welche die Branche prägen aber nicht alle sind gleichermaßen bekannt. Wer sind eigentlich die Unternehmen, die den Klebstoff zwischen Finanzen und digitalen Technologien bilden? In unserer Reihe “Die Unternehmen der FinTech Branche” geben wir Unternehmen oder Startups aus…

-

Unternehmen der FinTech Branche: Holvi GmbH

Die Branche ist groß geworden und längst aus den Kinderschuhen heraus gewachsen. Es gibt so viele Unternehmen welche die Branche prägen aber nicht alle sind gleichermaßen bekannt. Wer sind eigentlich die Unternehmen, die den Klebstoff zwischen Finanzen und digitalen Technologien bilden? In unserer Reihe “Die Unternehmen der FinTech Branche” geben wir Unternehmen oder Startups aus…

-

Banking-Trends: Diese digitalen Lösungen und Technologien verändern die Finanzbranche

Wie kaum etwas zuvor verändert die voranschreitende Digitalisierung die Spielregeln im Bankensektor. Aufgrund der heutigen Möglichkeiten, seine Bankgeschäfte jederzeit, ortsunabhängig und stark personalisiert vorzunehmen, haben sich die Kundenerwartungen an Banking-Produkte und -Services verändert. Die Folge: Etablierte Finanzdienstleister sind mehr denn je gezwungen, in innovative Techniken zu investieren und Technologietrends im Blick zu behalten. Wir schauen…

-

paydirekt and giropay merger-Girodirektkwittpaycard 2.0 – the new normal?

Thought about #dk – what is the situation and development? Banks are talking about merging paydirekt and giropay Just over a week ago, some news appeared in the press, in which people speculated about the merger of paydirekt and giropay – once again. The Kwitt service is also to be merged with the other payment…

-

Digital currencies: Europe threatens to lose its access

Bitkom publishes information paper “Digital Euro on the Blockchain“ Not only practically all central banks worldwide are discussing the topic of digital central bank money, but also commercial banks, technology- and financial companies and, of course, politicians are involved in the wide-ranging discussion about the advantages and disadvantages of CBDCs. One thing seems clear to…

-

Head to head – race: After Revolut, Klarna is again the most valuable Fintech

Well, who now? Just last week, Revolut was named the most valuable Fintech in Europe, with a funding of 500 million dollars and a valuation of around 5.5 billion dollars. Barely seven days later, the British company has already been pushed from the throne again. The Swedish payment service provider Klarna could now climb the…

-

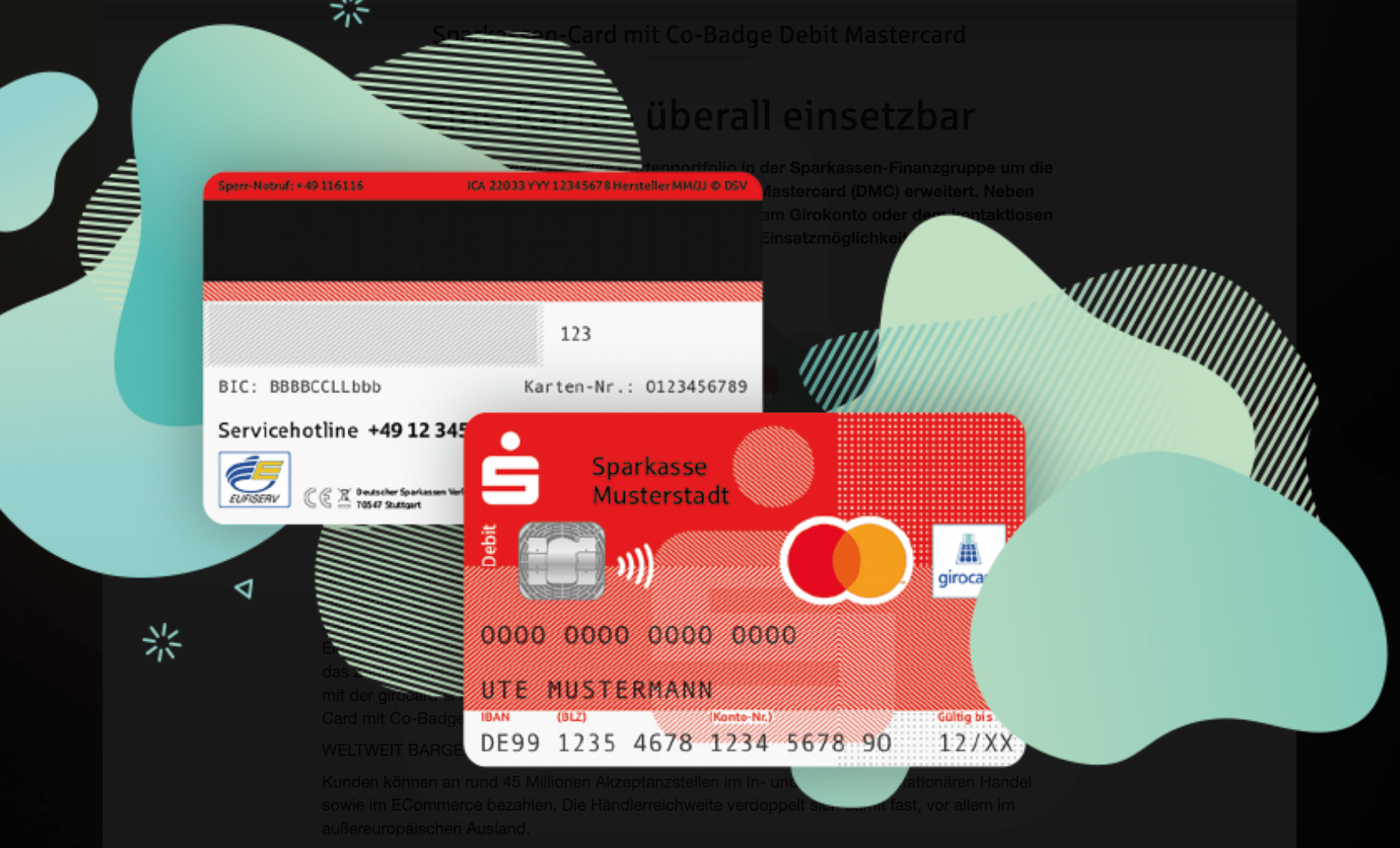

Sparkasse merges Girocard with Mastercard Debit

Our analysis: What does this step mean for the card business, customers and last but not least xPay/DK & Paydirekt? It became known that the Sparkassen financial syndicate is merging the well-known Girocard with Mastercard Debit. Mastercard Debit is obviously intended to replace the previous Maestro logo for international use. We here at Payment &…

-

Cashless payment transactions put to the test in Germany and Europe

An article by Marcus W. Mosen The banks in Europe and Germany are certainly not bored at the moment. And with the corona virus, a new challenge is now being added: many projects that until recently were considered of the highest strategic importance could now lose importance thanks to corona. Just a few weeks ago,…