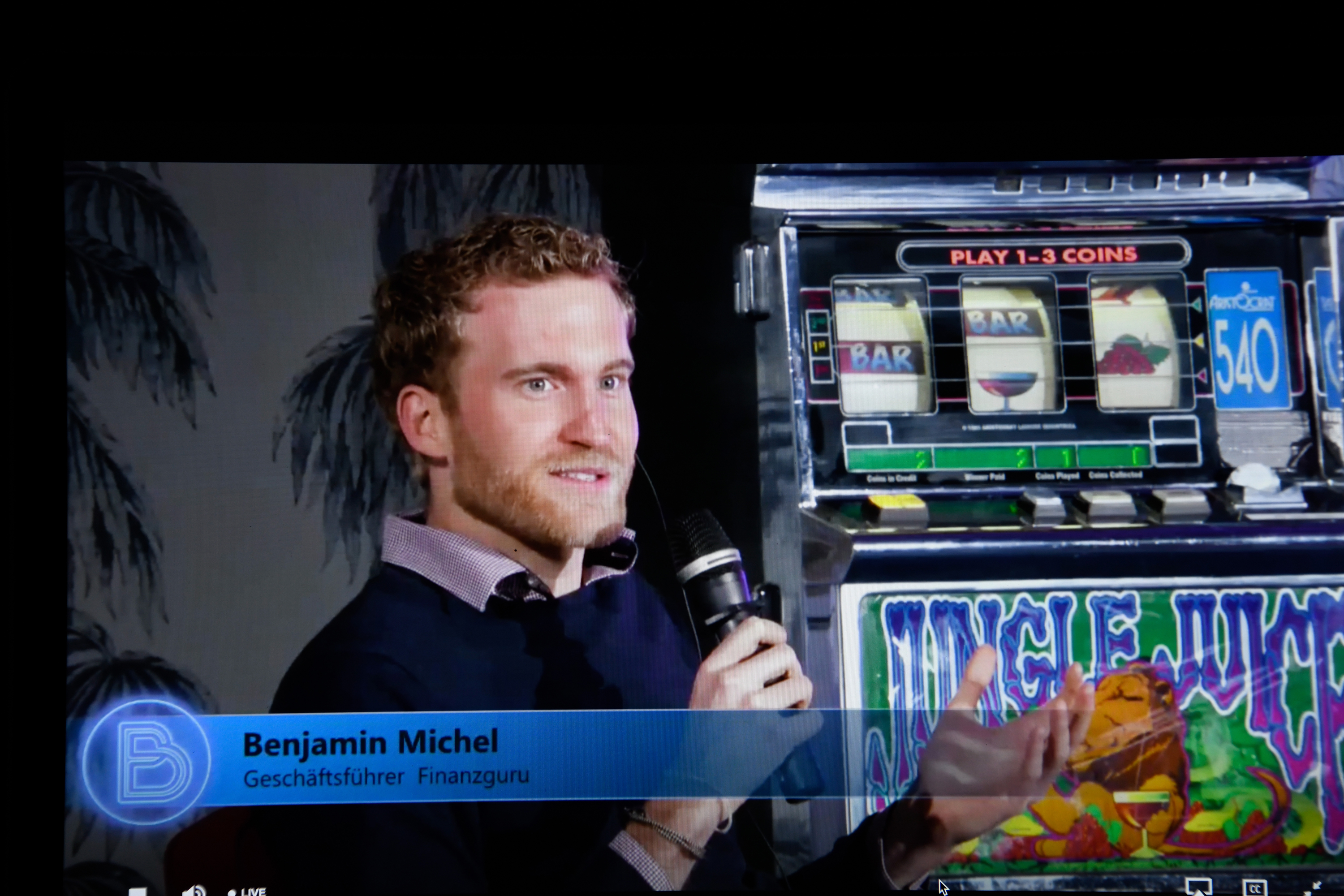

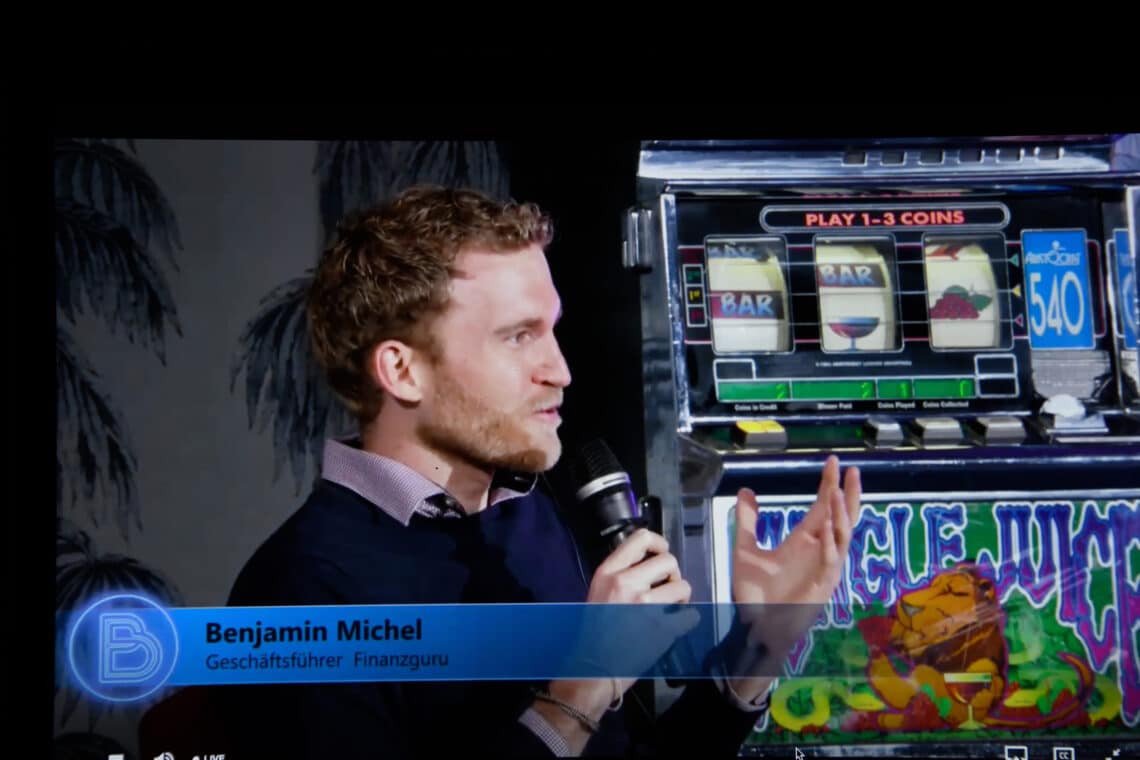

A video interview with Benjamin Michel (finance guru) at the Banking Exchange 2020

For the first time in the event history of Payment & Banking, the Banking Exchange, which was otherwise designed as an “invite only” event, took place in a stream accessible to all. Our goal was to live what other events only preach: digitalisation with all its possibilities, according to our credo: doing is as we want it, only more blatant!

Out of necessity became a virtue! The BEX20 was broadcast for the first time in the history of PaB events from the specially built BEX TV studio in the Hotel 25hours in Frankfurt.

In the studio live only the presenters with their respective panel guests – either live or remotely switched on, and a large team of light and sound technicians, cameramen and many other TV-like helpers in the background. TV can’t feel any different!

A conference is only as good as its participants and the quality of the panels is only as good as their speakers. This also applied to the past Banking Exchange, which this year, adapted to the situation, had to take place in a completely different way than we would all have liked. The participants were remotely connected and followed the ten panel discussions and the four keynotes in the live stream and blog for watching and reading, and met in slack and chat for discussion and networking. Some speakers also took part in the discussion digitally.

But not all of them. A number of them made their way to the 25h in Frankfurt under all caution and in compliance with the hygiene rules and thus contributed to the success of the event.

Benjamin Michels from Dwins, better known as a finance guru – and thus almost a bit of a TV star, because he was one of the first from the finance scene to appear with his twin brother in the format “The Lion’s Den”, thrilled the jury and collected important capital. But much more important than the money, according to Michels, was the brand awareness that financial guru gained through his appearance on television.

You don’t play with money – but what else can you do with it? The Personal Finance Manager can support customers, but how exactly this works is discussed by Dr. Carolin Gabor (finleap/Joonko), Benjamin Michel (finance guru) and Dr. Bernd Storm van’s Gravesande (IconicFinance) with Sibylle Strack (Kontist).

One thing is always important for a good personal finance manager: relevance to everyday life But how do you get it? For Storm van’s Gravesande, this is where target groups and, above all, what they want count. This is exactly where Gabor came in, for whom two points are of primary importance: firstly, what you can find out with the Personal Finance Manager, and secondly, the question of the customer’s pain point, i.e. what really moves the customer.

These can be very different topics, such as savings or vouchers – but they also affect very different people who have different problems in everyday life. A mother with two children and a professional life has to pay attention to different points in her finances than a full-time student with a small part-time job. You have to get a feel for the life of the respective customer, explains Gabor, and create a financial home in which the respective customer feels comfortable. The important thing is that no one wakes up and thinks to themselves, great, today you can finally start thinking about finances and insurance. For most customers, banking is not particularly interesting, so you have to make it easy for them. “Making the right recommendations and at the same time making it as comfortable as possible for the customer is important to us at Finanzguru,” says Michel.

PSD2 was an important signal here – and a real accelerator. “It was a starting signal for a race to develop a platform,” said Storm van’s Gravesande. The goal is a strong European player that can be thought of in broad terms, with N26 usually serving as a role model. You have to seize the right opportunities to achieve this – for Gabor, Check 24 is the company that is a nose ahead. Because Check 24 is adding more and more services and increasingly integrating financial services as well.

Why is it so difficult for banks in particular to make such changes? “Banks are trapped in their history,” says Storm van’s Gravesande, “which often makes it difficult to develop further.” The long-term relationship with the customer, which is based on trust, is central to Michel’s approach, because that’s how the customer realizes that you’re acting in his best interests. Personal Finance Managers have the advantage that they are the interface between the customer and the company and that they can build up this long relationship. What inspires Michel about the banking sector? There he is quite directly: “Nothing.”

And in the future, who should you fear? If Amazon were to take on further services and even financial services, it could quickly become one of the winners in the industry, as Gabor suspects. Michel sees finance guru at the forefront. “It’s best to be afraid of us.” It’s the only way to become a leading player – in a few years you can verify it.

So who better to talk to than about “celebrity” through TV appearances, about necessary brand awareness of Fintech products in B2C and about his assessment of the possible future of Personal Finance Management.