While at the beginning of the iPhone the motto was rather ‚there is an App for that‘, but for some time now we have been seeing a kind of counter-movement to so-called super apps.

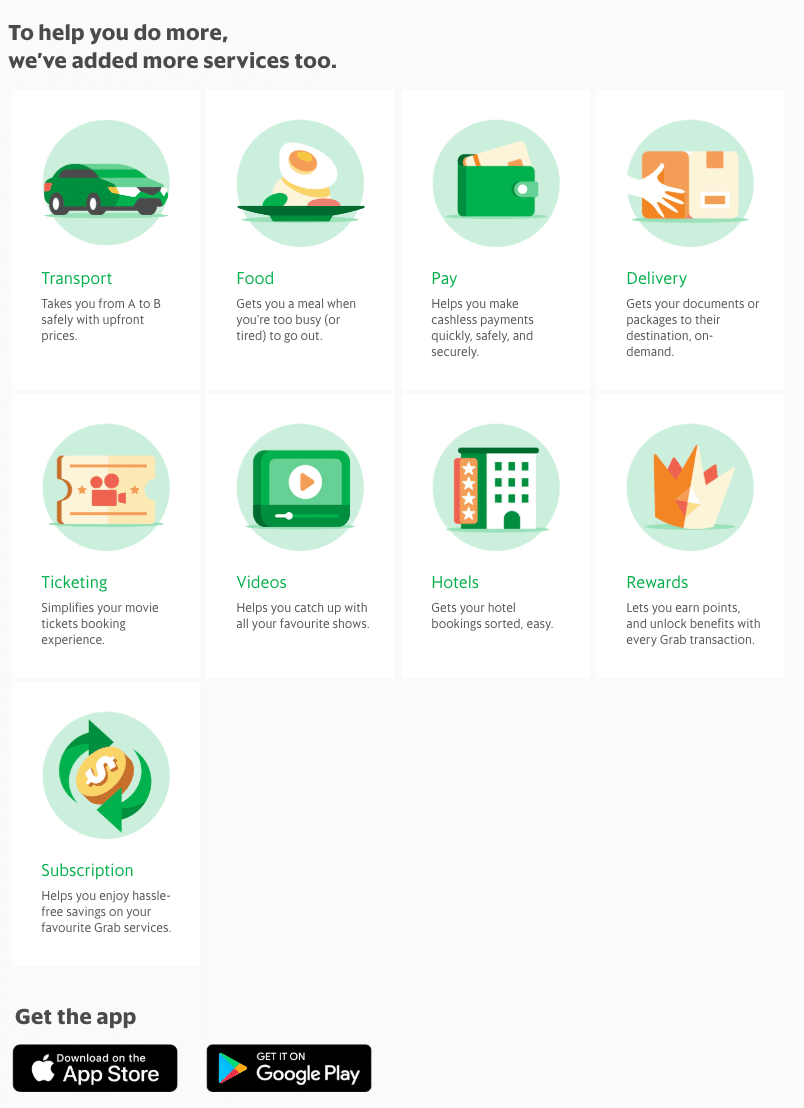

The combination of different services in a single app. Often it starts with a few functions (food or taxi), but then more and more services follow in the same place (payment, chat, shopping, delivery etc).

A trend that originated or was able to originate from the „greenfield“ approach, especially in Asia, and this has now also found imitators in other areas.

WeChat or Grab showed the way. Services like Uber are doing it right now. They are creating super apps or so-called Omni apps.

https://www.abacusnews.com/tech/ubers-new-look-old-news-china/article/3030914

In other areas there was a counter-movement a few years ago: Google or Facebook unbundled their apps and both now have a whole range of different apps in the App Store.

https://www.fastcompany.com/3054603/why-the-great-app-unbundling-trend-is-already-in-trouble

https://www.theverge.com/2018/10/18/17996640/google-eu-android-antitrust-ruling-app-unbundling-european-commission-chrome-search

As so often there isn´t just one way, and yet I asked the team who they thought was capable of a super app or whether we’d rather use „Feature Driven App“ as an app?

Everyday relevance, customer centricity, digital excellence and virality are the key words that are needed for this. Is it banks, search engines or mobility providers that impose themselves?

Here are the team´s opinions:

Kilian Thalhammer:

I believe in the „Use Case Driven App” – not the Super App – often one (myself included) think in categories not in features. I want to go from A to B – the jump at the destination to also buy, and all of this by using the same Super App goes often too far. The worlds „Travel“, Shopping, Social, Finance will have „Super Apps“ in them. Not always free of overlap, but focused. In my opinion, the Chinese approach will not be globally duplicatable.

WeChat is also not a Super App, but an ecosystem of its own that has managed (of course locally favored) to achieve an analogous, if not higher relevance than the GAFA’s. There won’t be 20 of them. At the end the exciting question is – if there is still room for a „Super App“ in the sector of finance or will the topic be so commodized that it will be lost in all others?

Maik Klotz:

There won’t be a super app. I don’t believe in the Swiss pocketknife, but in dedicated, use-case apps. The WeChat example works in exactly one market and could not be reproduced anywhere. Amen.

Jochen Siegert:

If you define vertical apps that consolidate multiple use cases per vertical as a „super app“, then we’ll see super apps too. You can already see it today in the sharing area, where previously separated different sharing use cases or apps are now consolidated into a single app. With Uber you can drive a taxi, eRoller and eBike plus a kind of car-sharing agency in Berlin. The same with Sixt with rental cars.

Car sharing and high-quality limousine service consolidated into one app. Last example „xNow“ where things like taxi (Freenow), car sharing (DriveNow), parking (Parknow), shop (Chargenow) are consolidated into one app. But a super app like in China with WeChat, where de facto everything runs over one app from chatting, shopping, P2P payment, taxi ordering, delivery services etc. we won’t get to see here, first of all because of our antitrust law :).

Nicole Nitsche:

Powerful super apps, driven by machine learning and perfect personali-zation across many industries and product groups, become a central way to the customer. Super apps are constantly changing their function and form. They are powerful databases that use more than one media channel, sometimes as an app, sometimes as a classic desktop page, sometimes as a skill or voice bot. Much more is conceivable. They cover all the needs of their users as far as possible, accompanying them day and night if necessary. Mobility is an important element, as are messages, shopping and logistics and – most importantly – payment. They also master things that other services do not. Payment – including a simple payment button, the associated payment processing and a wallet system – is perhaps the most important functionality. The constant availability and localization of the user is another.

No wonder that many potential super apps have their origin in mobility: Grab in the Far East, Uber in North America. Super apps understand their users. Personalization is the fuel for success. Comprehensive profiling, including the most consistent possible localization of the user, is essential for success. A European digital all-rounder must negotiate skillfully with the digital top dogs of tomorrow and cleverly aggregate databases.

„Many potential super apps have their origin in mobility.“

In addition, the need must actually emerge and be accepted as such by the markets. Who this will be in Europe is still completely unclear to me.

Mariam Wohlfahrt:

Last year I saw Anthony Tan the founder of Grabpay on stage at Money2020. It’s really impressive how Grab has grown from a pure transport payment service to a mega order tool for everyday things. Could we imagine today that FreeNow could also provide us with food and groceries tomorrow, make everyday life easier and make it a universal payment method? That’s not absurd. As long as taxi driving is still very expensive and cheap rides are not really available, it will be difficult to find a broad mass for it. This could change in any case. But then the question arises to what extent FreeNow can hold its own against Uber. Since Uber floods Berlin with Jump, it gets much more relevance for everyday life. In my opinion, FreeNow should now enter into smart cooperations with food services. Food on demand immediately available, could become a real Gamechanger.

Jürgen Weiß:

In my opinion, there will be no super app in Europe like WeChat in China. There are several reasons against this: Communication especially Messenger (but also Calls and Video) is a must for such an app and no European Messenger has managed to gain significant market shares so far.

The same applies to social media. Also, here the top dogs are too big to be easily replaced. In addition, the local antitrust law would destroy such an app already in the germ. In Europe there is too often no chance because of all the dangers. But what we will surely see are „feature driven apps“ that are not limited to just one topic.

That means, it will go beyond pure Single Function Apps and not only own functions will be extended but the topic cooperation will play an essential role. Not exactly the strength of large German companies – but if they don’t learn it, reality will hit them even harder.

Ultimately, the question of Super App vs. Feature Driven Apps is also more philosophical. The ecosystem is the end user device and whether you call different sub-functions in an app or different apps may not be so important.

It is important to make things that customers like to have together comfortable. Negative example: Multibanking Apps. In the context of cooperations it would be possible to get along easily with a 2FA / SCA login. Here not everyone would have to cook his own soup. That’s why I’m convinced that anyone who doesn’t know how to cooperate will lose in the end.