In recent days, some neo-brokers have added new functions to their product range. Among other things, Revolut offers the well-known function of multibanking for German customers.

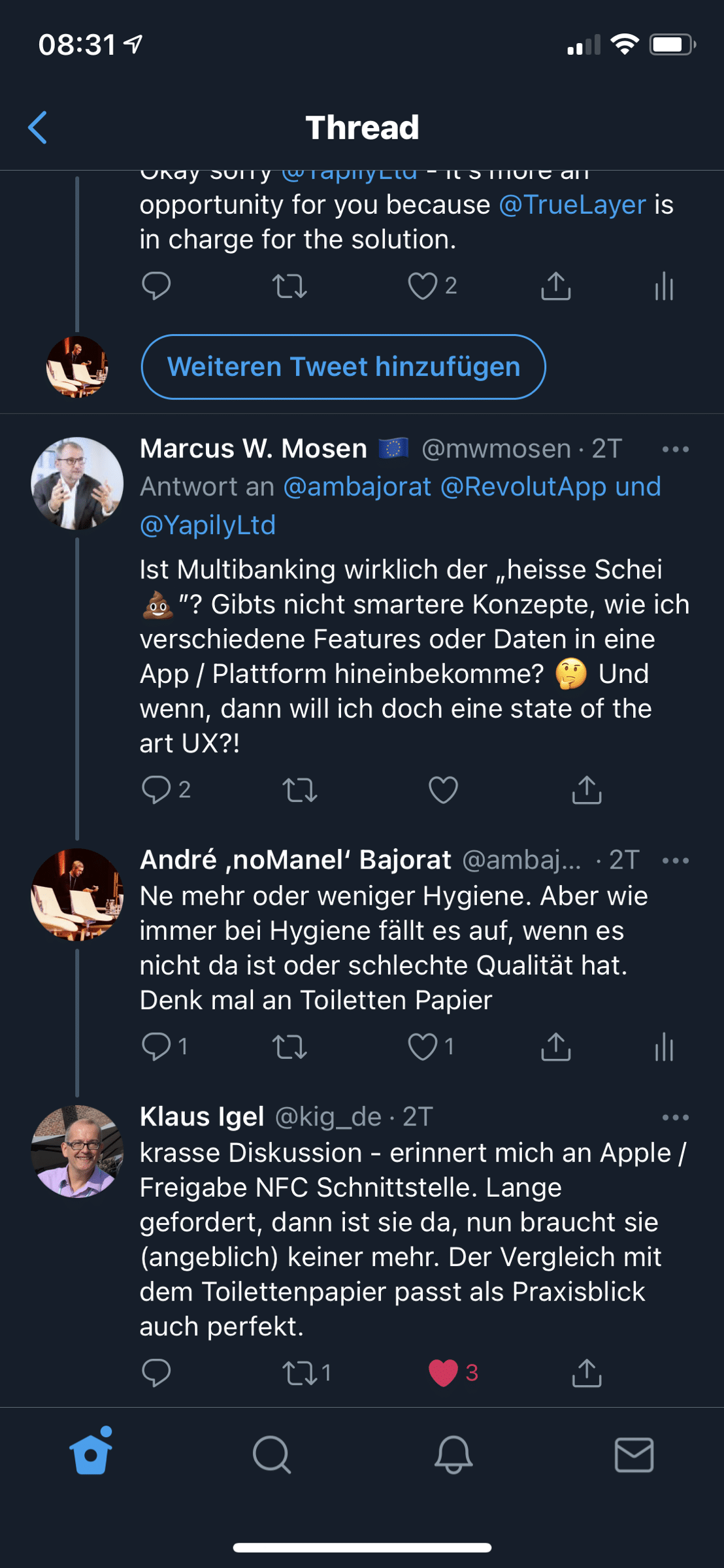

At Twitter This was followed by a discussion about what Multibanking for a bank – strategic issue or rather a small feature? The comparison that came to mind was that of hygiene products or, more specifically, toilet paper. For me, these items are the typical commodity items – they have to function well and reliably and are particularly conspicuous when they are not available or function poorly – which is then rather unpleasant with regard to toilet paper in particular.

This in turn made me think about the so-called „hygiene articles in banking“. That is, what you don’t really win with, but what is badly done or not available, is very unpleasant and drives the customer away in the long run. So actual must-haves – but of course these can diverge individually. That’s why I also asked the team what they consider to be the top 5 items in the bathroom – er, in online banking?

Ahead my five features on top of the basics are:

- Multibanking

- Yes I also want to be able to see my other accounts / cards / accounts at my ‚house bank‘.

- Scan and Pay

- Since Gini, typing out bills really doesn’t have to be anymore. Anyone who can’t do that is out.

- Apple / Google Pay

- In fact, mobile payment has become a must-have for me. And I don’t want any isolated solutions.

- A very good mobile app

- Without a state of the art app it does not work for me. Please be able to use the functions provided by the operating system.

- Search

- Possibly underestimated by many. But for me, an essential part of good banking: a search of everything.

Kilian Thalhammer

I’m not in multi-banking mode yet, I don’t use it but it’s on the to-do list to try it out, right after cleaning out the basement of course. Maybe the christmas days will give something. But if I had it, what would I expect:

- A very good mobile app (no HTML pages)

- a very good UX

- an integration of the means of payment – so that I don’t notice it at all

- a good reporting functions – usable Excel export :-) – yes!

- The ability to handle all service incidents via the app/online – I don’t want to call anywhere or write letters.

- no integrated SCA procedure – that even my grandma understands

For me, the account is and remains commodity. No emotion whatsoever. Important, but unfortunately still not hygienic, is a smart integrated credit function that also recognizes what I need, warns me when money is missing and invests „too much“ money. Despite FinTech, AI and other buzz words – this feature has not made it into the banking world (maybe the blockchain will help).

Maik Klotz

Multibanking is basic. That alone does not get any user behind the stove, but if it is missing, it is noticeable. In the end, it’s all about what you do with the „multibanking“ feature, and this is where the wheat is separated from the chaff, because the type of integration or implementation makes the small but subtle difference. To integrate an account retrieval is nice, but to be able to make a transfer at the competition from the house bank app as well is nicer. What is interesting here is the attitude of the neo-banks, who are displaying the same blockade as the retail banks have done in the past. So multibanking is hygiene factor. But what is made of it is the exciting question.

Must-haves or basics for me are: Apple or Google Pay, push notifications for incoming and outgoing payments. Mobile app that meets current UX standards – no bloatware. Widget support for my Android or iPhone. Transfer templates or smart auto-complete. Easy way to quickly share IBAN. Outbank comes pretty close to all of that, though they run the risk of getting more and more bloated.

By the way, there are enough concepts for this, you just have to implement them.

Jochen Siegert

But I would speak less of hygiene and more of basic features. A feature alone has never been a product, but products need basic features to really work. Example desired? Apple Pay alone is really just a feature but the banks that were late to the Apple Pay party found that their checking account product no longer works from the customer’s perspective without the Apple Pay feature.

Klaus Igel

Even if the question about the basic features of a banking app seems quite trivial at first, I consider the definition of these to be largely individual. For example, a „power user“ requires excellent multibanking / sophisticated search functions, a „payment nerd“ the availability of modern payment features, a „stand user“ needs an intuitive user interface / understandable SCA methods and the head of a medium-sized company good reporting features and the ability to approve orders in dual control principle. The list could be continued almost indefinitely. The same also applies to the provider/bank side, i.e. to offer the things in the standard that are important for one’s own clientele. Retail banks thus have different basics than neo-banks, commercial banks, etc.

In the example discussed via Twitter at the neobank Revolut, I see multibanking as a very useful feature, since the typical customers of a neobank usually have several bank accounts. All the more shocked I was after my first field test how poor/incomplete the implementation was. All the more so, as the topic itself is „old hat“ and the more modern variants based on PSD2 APIs are already available in considerably better quality.

I find the knee-jerk reaction of some representatives of the neo-banks just as crass, who shoot down every customer request in this direction with the argument „you don’t need it / old school“. And to briefly draw a connection to hygiene products – imagine a visit to the supermarket with the aim of buying toilet paper. In the first shop you are told „nobody needs it“ and in the second shop you are offered daily newspapers for this purpose. Listening to customer wishes certainly doesn’t hurt in banking either.

Conclusion

As we can see, the requirements are indeed very different. Maybe Maik is right with his article on Google Banking and once again the platforms become the saviours for the masses.