Im März 2019 wurde die Apple Card im Rahmen des Special Events vorgestellt und ist seit September 2019 in den USA verfügbar. Und das wird auch erst mal so bleiben.

Apple Card, nur ein Baustein von vielen für Apples Ökosystem

Payment ist ein für Apple wichtiger Baustein, da “bezahlen” eine hohe Alltagsrelevanz hat. Wir müssen ständig und überall bezahlen, sei es im E-Commerce, stationären Handel oder die letzte Stromrechnung. Alles, was Alltagsrelevanz hat, ist für Ökosystemanbieter wie Apple, Google, Facebook und viele mehr dementsprechend wichtig, denn wenn ein alltagsrelevantes Thema von dem Ökosystem abgedeckt wird muss der Nutzer selbiges nicht mehr verlassen und bleibt in seiner Blase. Deshalb kann man mit dem Smartphone Fotos machen, Nachrichten schreiben oder Musik hören. So weit nichts Neues. Der Alltag ist aber nicht bei allen Menschen gleich. Oder wichtiger: Der Alltag wird nicht in jeder Kultur auf die gleiche Art und Weise bewältigt.

Während in China Wechat für die Lösung aller Alltagsprobleme genutzt wird, sieht die Welt außerhalb Chinas völlig anders aus. So hat Wechat z.B. in den USA oder Europa keinerlei Relevanz. Deshalb bietet Apple auch länderspezifische Dienste und Funktionen an, weil sie eben in manchen Ländern Sinn und in anderen Ländern keinen Sinn ergeben.

Apple Card, ein amerikanischer (Alp-)Traum

Die Apple Card wurde für den amerikanischen Markt designed und da funktioniert der Zahlungsverkehr anders als in Europa. Das US-Modell basiert auf einer permanenten Verschuldung und einer Rückzahlung ohne feste Laufzeit.

Dem Inhaber der Apple Card wird also Geld geliehen, das er nach verschiedenen Regeln schrittweise zurückzahlen kann. Es ist ihm überlassen, wie viel er zurückzahlen möchten. Apple berechnet dazu einen individuellen Zinssatz (den effektiven Jahreszins, für Annual Percentage Rate). Dieser liegt zwischen 13.24 Prozent und 24.24 Prozent, was für amerikanische Verhältnisse nicht sonderlich hoch ist, für unsere Verhältnisse schon. Das Geschäftsmodell der Apple Card ist in Europa aufgrund (oder Dank) zahlreicher staatlicher Schutzmaßnahmen in der Forma also in der Form nicht anwendbar.

Auch eine der wichtigsten Funktionen, das Apple Card Cashback, wird schwierig. Apple gibt 1 bis 3 Prozent Cashback. 1 Prozent gibt es bei der Nutzung von Apple Pay, 2 Prozent bei der Nutzung der Apple Card und 3 Prozent beim Kauf im Apple Store. Apple kann das, weil sie dafür die in den USA hohen Interchange Gebühren von 2 Prozent einfach an den Kunden weitergeben. Da wir in Europa das auf 0,3 Prozent gedeckelt haben wird das so nicht funktionieren. Anders ausgedrückt: Eine Apple Card außerhalb der USA wäre ein teures Hobby für Apple. Oder man holt sich das Cashback vom Händler wieder, wie zum Beispiel Curve es tut. Dazu muss man aber mit vielen Händlern sprechen, was die Sache aufwändig macht.

Was Apple selbst zur Apple Card angekündigt hat

Apple gibt immer eine Aussicht auf die Dienste und Funktionen die man in Zukunft erwarten kann. Bei der Vorstellung von Apple Pay im Sommer 2014 endete die Präsentation von Eddy Cue, Senior Vice President bei Apple, mit den Worten “we working hard to bring Apple Pay to even more countries”. Klare Ansage.

https://youtu.be/oHN673Vi9eo?t=426

Als wiederum die Apple Card im März 2019 von Jennifer Bailey vorgestellt wurde, schloss sie die Keynote mit den Worten “Apple Card will be coming to the Wallet App in the U.S. this somer and we think you are going to love it”. Kein Wort über Europa oder andere Länder. Während Apple Pay bereits ein halbes Jahr später in England startete, ist es auch ein Jahr später bei der Apple Card ruhig. In keinem anderen Land ist die Apple Card bis heute gestartet und obwohl es seitdem weitere Events von Apple mit Produktankündigungen gab, gibt es keinerlei Hinweise, dass sich das ändern wird.

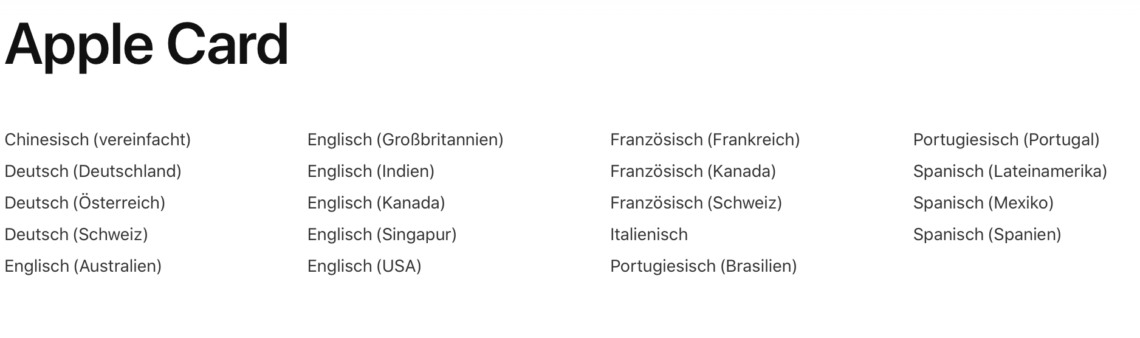

Eine Liste der länderspezifische Dienste findet man bei Apple selbst. Und dort taucht auch die Apple Card auf. Man achte auch die sehr genau Wortwahl bei der Auflistung: Deutsch ist nicht Deutschland, sondern nur die Sprache.

Tim Cook sagte im September 2019 im Gespräch mit der Bild wörtlich “Wir wollen die Karte gerne überall anbieten. Bankprodukte müssten allerdings Land für Land eingeführt werden, weil Banken und Vorschriften überall unterschiedlich seien. Aber wir wollen damit auch nach Deutschland kommen.“ Was sich nach einem klaren Statement anhört, ist am Ende viellleicht keins. Ein „Nein“ auf die Frage hätte negative Presse gebracht und natürlich alles verbaut. Sag niemals nie, gilt natürlich auch in diesem Kontext. Aber seine Aussage heißt am Ende leider gar nichts, außer das Apple natürlich gerne überall die gleichen Produkte und Dienste anbieten möchte, aber wenn es nicht geht (oder keinen Sinn macht) dann eben nicht. Und es ist ein einfaches zu sagen: Die Banken und Vorschriften sind überall so tricky als zu sagen rechnet sich alles nicht. Denn technisch wäre es für einen Bankpartner wie Goldman Sachs ein sehr lösbares Problem, wenn eine Banklizenz vorhanden ist. Am Ende hat man Apple Pay ja auch in die verschiedenen Länder bringen können und bei der Apple Card sind die Abhängigkeiten viel geringer, denn im Grunde braucht es nur einen einzigen Bankpartner und nicht wie bei Apple Pay möglichst viele.

Apple Card außerhalb U.S.: Sag niemals nie

Sag niemals nie, gilt auch bei der Apple Card und man hat schon Pferde kotzen sehen. Am Ende geht es um Wahrscheinlichkeiten der mit Wettbewerbsdruck, Kundennutzen und Geschäftsmodell zusammenhängt. Wenn morgen Google ein vergleichbares Produkt erfolgreich bringt, ändern sich die Spielregeln. Bezahlen alle Deutschen ab morgen in Deutschland mit der Kreditkarte, ändern sich die Spielregeln. Findet Apple eine Möglichkeit mit der Apple Card in Europa Geld zu verdienen (zB. Abo-Modell), ändern sich die Spielregeln. Dazu kommen die vielen Spielregeln, die Apple selbst aufstellt, aber niemand kennt.

Deshalb kann es natürlich ganz anders kommen. Letztes Jahr im Juli hat Apple für Europa die Apple Card als Trademark angemeldet. Haben sie das getan, weil es ein Routine-Vorgang ist, oder ein Launch-Plan dahinter steht? War die Aussage von Tim Cook gegenüber der Bild am Rande des Oktoberfest 2019 nur diplomatisch oder wirklich so gemeint? Wir wissen es nicht. Es gibt sicher Gründe dafür, aber eben auch viele dagegen.

Und über die Gründe, warum Apple Card nicht oder eben doch nach Deutschland kommt, kann man sehr geteilter Meinung sein. Deshalb hier auf die beiden Artikel mit Pro und Contra verwiesen wird. Fernab der ausführlichen Begründungen zeichnet sich zumindest im Moment absolut und rein gar nichts ab, dass die Apple Card nach Deutschland, Europa oder überhaupt in ein anderes Land außerhalb der USA kommen wird. Keine Gerüchte oder Hinweise in irgendeinem Code – nichts. Wer aber eine Karte sucht, die funktional zumindest einiges zu bieten hat, der kann sich bei Klarna, Curve oder Revolut bedienen. Manche bieten sogar eine Metall-Karte, die zwar nicht so schick ist wie die Apple Card, aber besser als nichts.