-

Die Gesichter der Branche – David Klemm von Mastercard

„Die Digitalisierung des Zahlungsverkehrs hat mich von Anfang an fasziniert,“ betont David Klemm, der bei Mastercard für das Geschäft auf der Händlerseite in Central Europe verantwortlich ist, während unseres Gesprächs…

-

Die Gesichter der Branche – Nicola Breyer von Qwist

Qwist, ehemals als Finleap Connect bekannt, etabliert sich als führendes Zahlungsinstitut, das nach dem Zahlungsdiensteaufsichtsgesetz (ZAG) regulierte, innovative Lösungen für die Geschäftswelt anbietet. Mit einem klaren Fokus auf intelligente Automatisierung…

-

On the test bench: Digital Assets auf dem Vormarsch?

Wie sieht es mit den Digitalen Assets aus – sitzen sie noch auf der “Test Bench” oder sind sie schon mitten im Spiel? Ein Panel unserer Veranstaltung „Banking Exchange“ diskutierte…

-

Die Gesichter der Branche – Lena Hackelöer von Brite Payments

Lena Hackelöer ist Gründerin und CEO von Brite Payments, einem Unternehmen, das sie 2019 in Schweden gegründet hat. Lena teilt Einblicke in das Leben einer CEO, die zwischen Hochleistungs-Meetings auch…

-

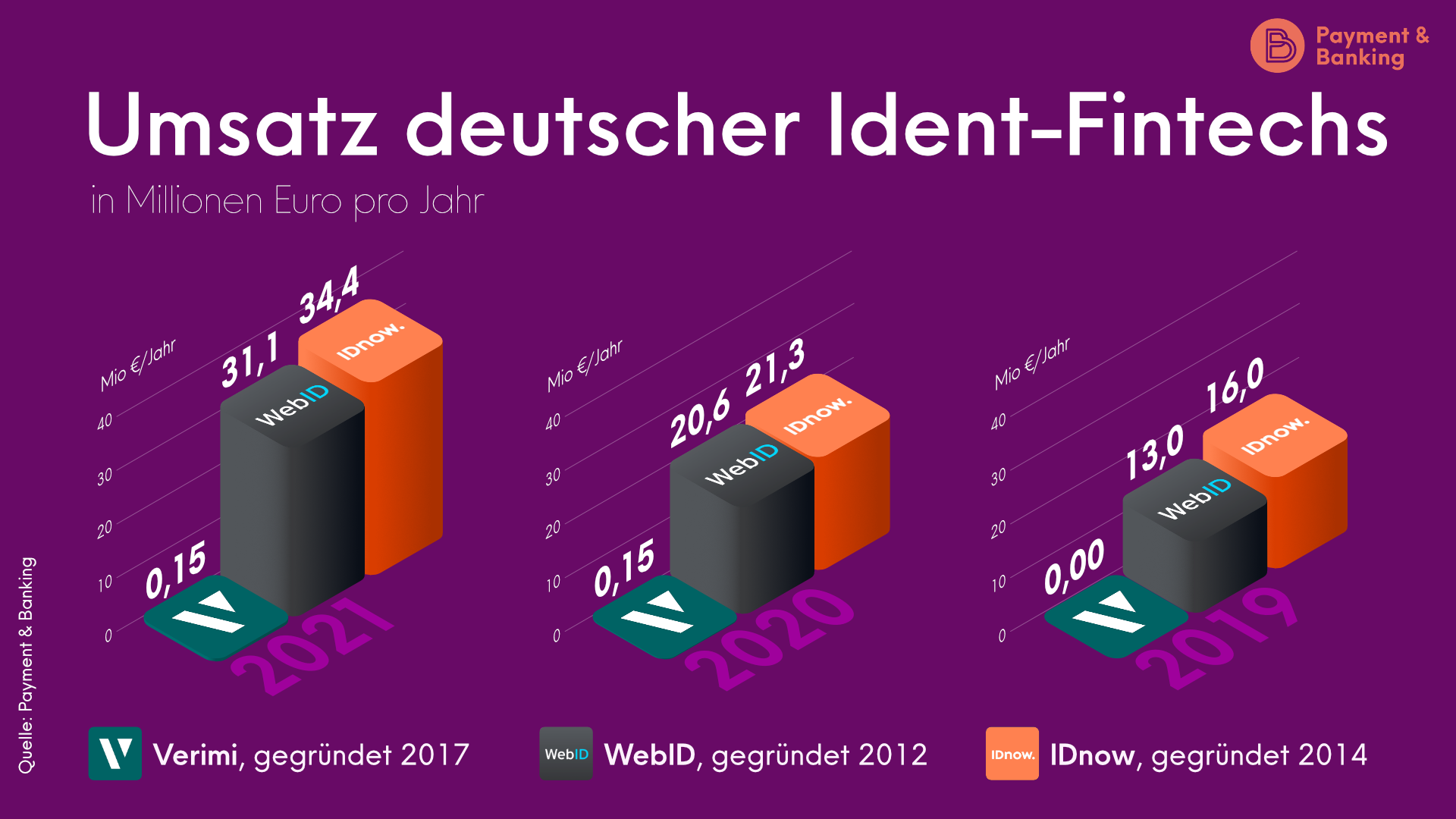

Umsätze deutscher Ident-Fintechs im Vergleich

Ein Bericht der Süddeutschen Zeitung über Verimi, einem Ident-Joint-Venture der Konzerne Deutsche Bank, Allianz, Lufthansa, Springer, Samsung, Giesecke & Devrient, VR-Banken und Bundesdruckerei hat für Aufsehen gesorgt. Verimi hat, laut…

-

Die Gesichter der Branche – Svitlana Sidoruk von zinsbaustein.de

Svitlana Sidoruk, als Director Acquisition bei zinsbaustein.de tätig, bahnte sich einen außergewöhnlichen Pfad in die Welt der Fintechs. Getrieben von einer Passion für Zahlen und Immobilien, hat sie eine einzigartige…

-

PSD3, PSR und die Auswirkungen der FIDA-Regulierung

In dieser Episode von „Alles Legal“ zum Thema „PSD3“ besprechen Peter Frey, Gründungspartner bei Annerton, und Payment and Banking-Redakteurin Christina Cassala noch einmal über den geplanten Vorschlag der EU-Kommission zur…

-

Mit der Kaffeetasse auf dem Weg nach oben: Mirko Krauel, CEO von Otto Payments

Von einem ambitionierten Banklehrling in Rostock bis hin zum CEO von Otto Payments in der pulsierenden Hansestadt Hamburg, bei einem der traditionsreichsten Versandhändler Deutschlands: Mirko Krauel hat einen beeindruckenden Weg…

-

Die Gesichter der Branche – Patrick Löffler von givve

Für Patrick Löffler, Gast des aktuellen Interviews, gab es definitiv ein Leben vor dem Fintech. Als passionierter Eisbach-Surfer hatte er zunächst nicht nur ein Print-Magazin für Surfer an den Start…

-

Die Gesichter der Branche – Uwe Stelzig von IDnow

Kaffee scheint im Leben von Uwe Stelzig eine enorm wichtige Bedeutung zu haben, denn nicht nur beginnt sein Tag mit einer Tasse, um danach ans Tagwerk zu gehen, sondern er…

-

Die Gesichter der Branche – Tobias Gubo von anybill

Anybill hat Kassenzetteln den Kampf angesagt und digitalisiert Bons, die Käufer:innen im Handel erhalten. Statt einer App auf dem Handy scannen Kund:innen einfach den QR-Code und erhalten einen digitalisierten Zettel.…

-

Vorhang auf: Der „Fintech des Jahres“ Award

Trommelwirbel, Tusch und Ovationen – all das erwartet unser Fintech des Jahres 2023. Gekürt werden wieder herausragende Fintechs, Geschäftsmodelle, Unternehmer:innen und die besten Kooperationen sowie der beste Exit. Die Ehrung…

-

Solaris, Orderbird, Mambu – die wichtigsten Personalmeldungen aus dem August

In der Branche herrscht ein munteres Kommen und Gehen und Jobs werden gewechselt. Wir behalten den Überblick und fassen die wichtigsten Personalmeldungen zusammen.

Christina Cassala

-

Die Gesichter der Branche – David Klemm von Mastercard

„Die Digitalisierung des Zahlungsverkehrs hat mich von Anfang an fasziniert,“ betont David Klemm, der bei Mastercard für das Geschäft auf der Händlerseite in Central Europe verantwortlich ist, während unseres Gesprächs…

-

Die Gesichter der Branche – Nicola Breyer von Qwist

Qwist, ehemals als Finleap Connect bekannt, etabliert sich als führendes Zahlungsinstitut, das nach dem Zahlungsdiensteaufsichtsgesetz (ZAG) regulierte, innovative Lösungen für die Geschäftswelt anbietet. Mit einem klaren Fokus auf intelligente Automatisierung…

-

On the test bench: Digital Assets auf dem Vormarsch?

Wie sieht es mit den Digitalen Assets aus – sitzen sie noch auf der “Test Bench” oder sind sie schon mitten im Spiel? Ein Panel unserer Veranstaltung „Banking Exchange“ diskutierte…

-

Die Gesichter der Branche – Lena Hackelöer von Brite Payments

Lena Hackelöer ist Gründerin und CEO von Brite Payments, einem Unternehmen, das sie 2019 in Schweden gegründet hat. Lena teilt Einblicke in das Leben einer CEO, die zwischen Hochleistungs-Meetings auch…

-

Umsätze deutscher Ident-Fintechs im Vergleich

Ein Bericht der Süddeutschen Zeitung über Verimi, einem Ident-Joint-Venture der Konzerne Deutsche Bank, Allianz, Lufthansa, Springer, Samsung, Giesecke & Devrient, VR-Banken und Bundesdruckerei hat für Aufsehen gesorgt. Verimi hat, laut…

-

Die Gesichter der Branche – Svitlana Sidoruk von zinsbaustein.de

Svitlana Sidoruk, als Director Acquisition bei zinsbaustein.de tätig, bahnte sich einen außergewöhnlichen Pfad in die Welt der Fintechs. Getrieben von einer Passion für Zahlen und Immobilien, hat sie eine einzigartige…

-

PSD3, PSR und die Auswirkungen der FIDA-Regulierung

In dieser Episode von „Alles Legal“ zum Thema „PSD3“ besprechen Peter Frey, Gründungspartner bei Annerton, und Payment and Banking-Redakteurin Christina Cassala noch einmal über den geplanten Vorschlag der EU-Kommission zur…

-

Mit der Kaffeetasse auf dem Weg nach oben: Mirko Krauel, CEO von Otto Payments

Von einem ambitionierten Banklehrling in Rostock bis hin zum CEO von Otto Payments in der pulsierenden Hansestadt Hamburg, bei einem der traditionsreichsten Versandhändler Deutschlands: Mirko Krauel hat einen beeindruckenden Weg…

-

Die Gesichter der Branche – Uwe Stelzig von IDnow

Kaffee scheint im Leben von Uwe Stelzig eine enorm wichtige Bedeutung zu haben, denn nicht nur beginnt sein Tag mit einer Tasse, um danach ans Tagwerk zu gehen, sondern er…

-

Die Gesichter der Branche – Tobias Gubo von anybill

Anybill hat Kassenzetteln den Kampf angesagt und digitalisiert Bons, die Käufer:innen im Handel erhalten. Statt einer App auf dem Handy scannen Kund:innen einfach den QR-Code und erhalten einen digitalisierten Zettel.…

-

Vorhang auf: Der „Fintech des Jahres“ Award

Trommelwirbel, Tusch und Ovationen – all das erwartet unser Fintech des Jahres 2023. Gekürt werden wieder herausragende Fintechs, Geschäftsmodelle, Unternehmer:innen und die besten Kooperationen sowie der beste Exit. Die Ehrung…

-

Solaris, Orderbird, Mambu – die wichtigsten Personalmeldungen aus dem August

In der Branche herrscht ein munteres Kommen und Gehen und Jobs werden gewechselt. Wir behalten den Überblick und fassen die wichtigsten Personalmeldungen zusammen.

Trending

Sponsoren und Partner

Schleichwerbung

Der beste Newsletter ever

Mit dem Payment & Banking-Newsletter versorgen wir dich täglich mit News, ausgewählten Artikeln und Kommentaren zu aktuellen Themen, die die Finanz-Branche bewegen. Meld Dich an!