-

Look me in the eye, customer: With FIDO2 to the passwordless bank

Thanks to the FIDO2 standards, customers can finally authenticate themselves with biometric features on the Web. In our article, the IT consulting firm highlights adorsys why FIDO2 is the authentication standard of the future and why fiddling with passwords and TANs will no longer be necessary in the future – regardless of the device. adorsys…

-

Green ETFs – The next hype or real future opportunity ?

At the latest since the climate protection movement “Fridays for Futures” gained massive global momentum in 2019, the topic of sustainable investment has also become an increasingly important issue for financial service providers, investors and the wider society. Just this month, Greenpeace drew attention to this again when activists landed a paraglider on the roof…

-

Payment & Brexit – What additional costs will German and European merchants face?

The UK is one of the most important e-commerce markets for the EU. In 2019, the UK accounted for 34% of online sales in Western Europe. Now, as a consequence of Brexit, Mastercard wants to classify the UK as “inter-regional” from October 2021, which will result in interchange fees for “card not present” (CNP) transactions…

-

Don’t believe the hype: Bitcoins solve one problem – and create many new ones

The bitcoin price has been fluctuating and rising rapidly, breaking the $60,000 barrier for the first time in mid-March. Many media outlets are reporting almost daily on the cryptocurrency’s soaring fortunes, and Google searches are on the rise. Bitcoin are fondly heralded as the new saviours, touted as “crisis-proof” and described as the saviours of…

-

There’s life in the old dog yet: purchase on account

Given the current situation, who is surprised by these figures? Almost everyone from the DACH region has shopped online in the past Corona year. This is the result of the E-COM Report DACH published today (available for download at the bottom of the page) – a survey of 4000 consumers in Germany, Austria and Switzerland,…

-

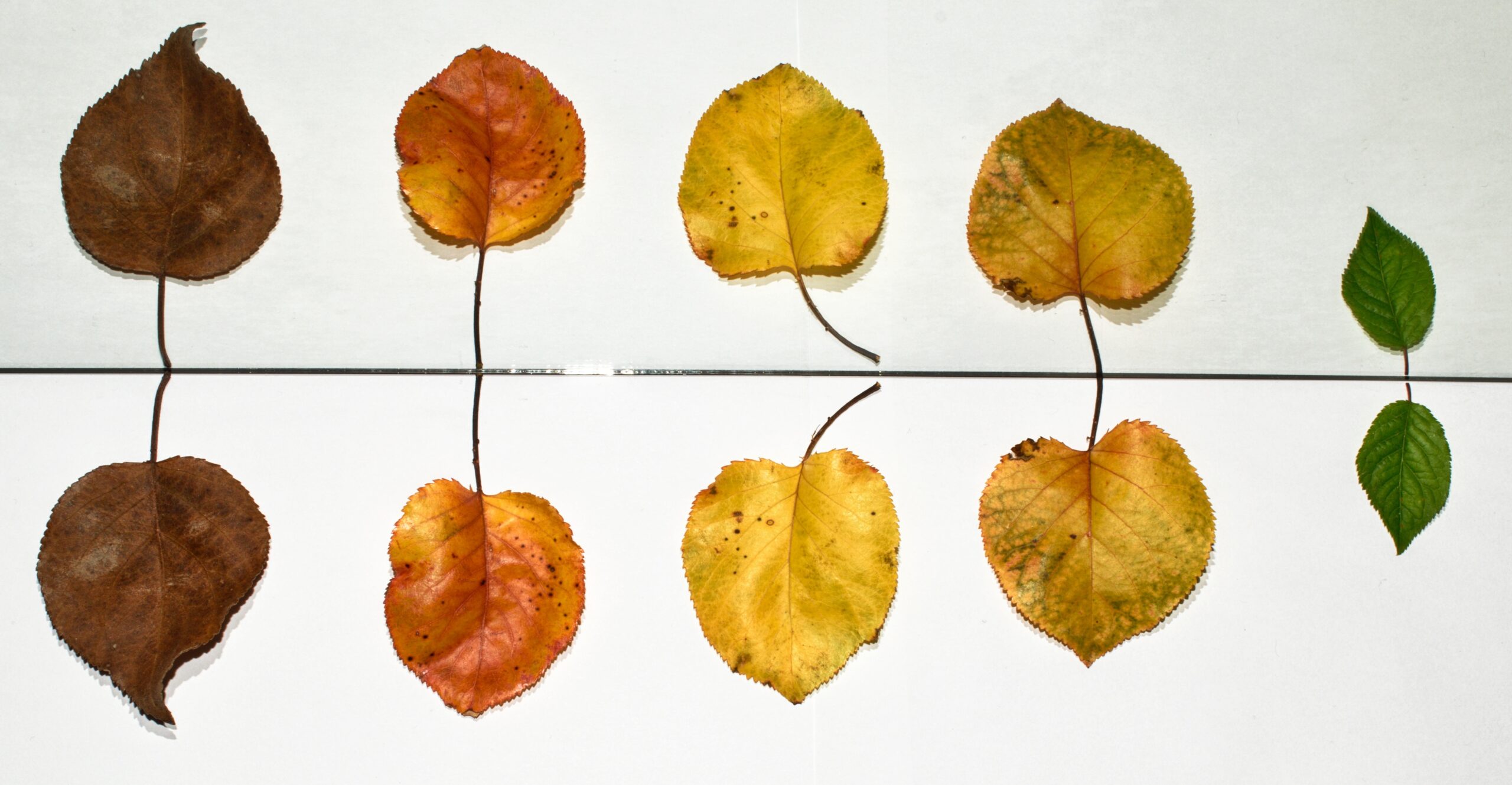

Green behind the ears

With the scandal surrounding the Greensill Bank, the German financial centre is sliding into its next misery. Municipalities are particularly affected, and that’s not such a bad thing. Because it is another sign that deposit insurance and Bafin need to be reformed. The payment and banking scene is undeniably never boring. Not a month goes…

-

Initiative launched: Together against IBAN discrimination

With the “Accept my IBAN” initiative from leading fintechs such as Wise (formerly Transferwise), N26, Klarna, Revolut, Raisin and SumUp, consumers can now report “IBAN discrimination”. The EU regulation in force since 2014 does provide that holders of accounts within the EU can pay within the member states without any problems. But unfortunately, the reality…

-

Payment Exchange: Our business has become more digital through Corona

Jost Wiebelhaus, owner and founder of the Frankfurt running shop in the #PEX21 speaker interview The Payment Exchange 2021 is in the starting blocks. This year there are two events. The first part of #PEX21 will take place on 25 March 2021. We’re streaming live for you on the web. We’re also unpacking the digital…

-

Introducing 5 new fintechs we don’t know yet

Everything already there, everything already seen? Not true. What else is there to come? A lot! That Germany is still a place of founders, who still come up with something new even in the finance, payment and banking industry, we prove from now on in our loose episodes on new companies in the finance industry.…

-

The European super app will soon shape lives

A guest contribution by Björn Goß AliPay, PayPal, Google Wallet or Square – The race for the banking super app in Europe and why a European super app is only a matter of time We’ve known for a long time that the financial world is headed for massive change. 2020 was therefore only an acceleration…

-

NumberX – ex-Revolut and Anyline executives launch new fintech

New fintech NumberX launches app-based payment card based on open banking principle. Mastercard is on board as a strategic partner. Claudio Wilhelmer, previously Country Manager DACH of the London-based neobank Revolut, and Matthias Seiderer, previously Chief Revenue Officer of the Viennese AI technology company Anyline, are joining forces: With their new fintech company NumberX, they…

-

Driving the Blockchain Industry: Christine Kiefer

No one can avoid the topic of blockchain and cryptocurrencies now. Reports and podcasts on this industry are increasing daily and startups are sprouting like mushrooms. Investors see a bright future in blockchain, which is why the money is loose. But undeniably, the percentage of women involved with cryptocurrency is far below that of men.…