Großbritannien ist für die EU einer der wichtigsten E-Commerce Märkte. In 2019 entfielen 34% der Online-Verkäufe in Westeuropa auf die UK. Jetzt möchte Mastercard Großbritannien als Konsequenz des Brexit ab Oktober 2021 als „inter-regional“ klassifizieren, was dazu führt, dass Interbankengebühren für „Card not present“ (CNP)-Transaktionen von Kunden aus Großbritannien um das fünffache steigen werden. Visa hat kürzlich angekündigt, dass sie nachziehen werden, das Implementierungsdatum wurde jedoch noch nicht genannt.

Konsequenzen der Interchange-Reklassifizierung für Händler in der EU

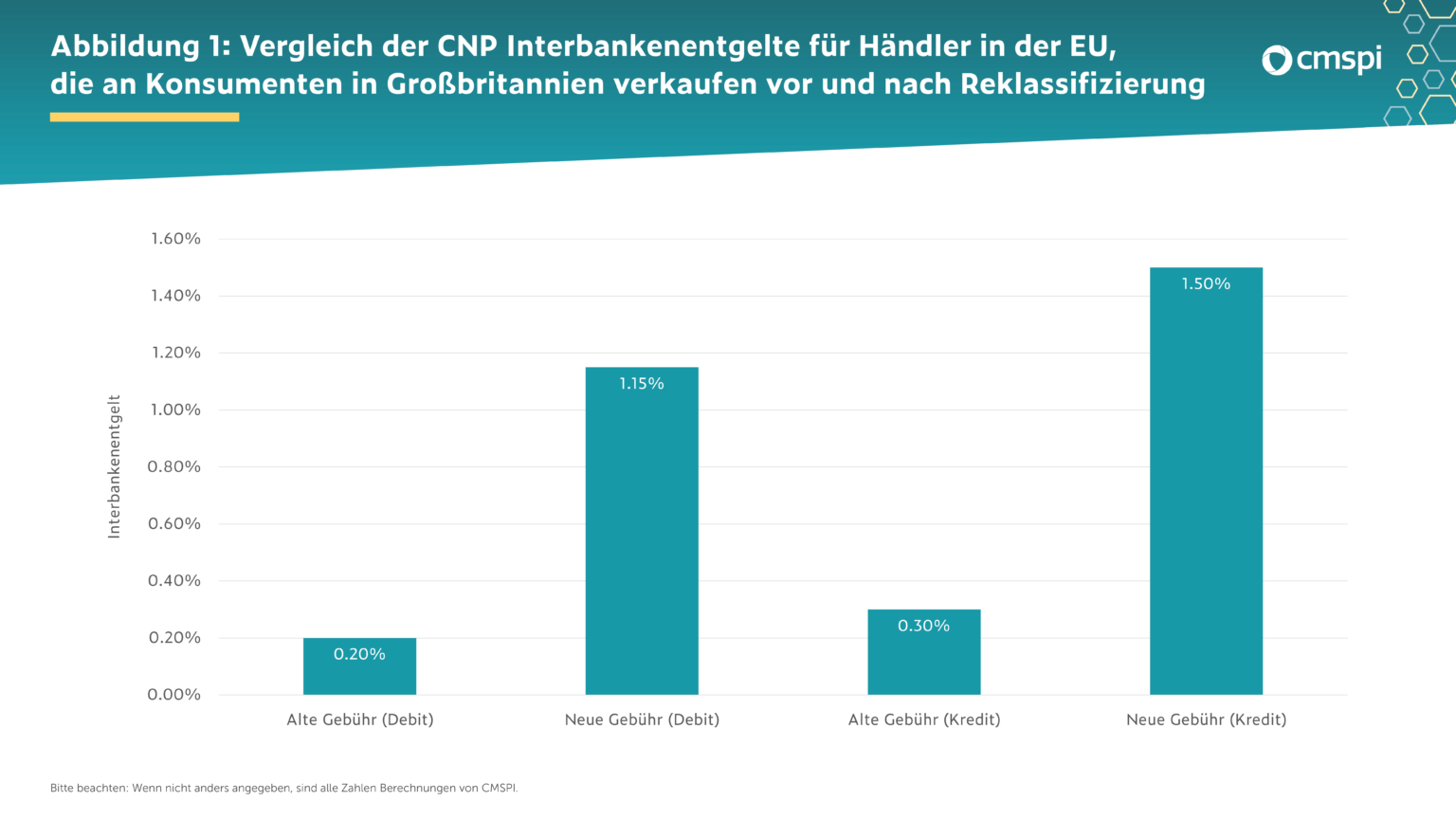

Die jüngsten Ankündigungen bedeuten, dass Interbankengebühren für EU-Händler, die online an britische Konsumenten verkaufen, von 0,2 % auf 1,15 % für eine Debit- und von 0,3 % auf 1,5 % für eine Kreditkarten-Transaktion ansteigen werden, wie in Abbildung 1 dargestellt. Die Interbankengebühren werden vom Händler an die kartenausgebende Bank des Karteninhabers gezahlt und können bei großen Händlern 80 % der Gesamtkosten für die Annahme von Kartentransaktionen ausmachen.

Händler in Europa müssen also laut Schätzungen von CMSPI, der global führenden, unabhängigen Payment-Beratung, für die gleiche Anzahl und Höhe an Transaktionen durch die Reklassifizierung statt 21,48 Mio. € nunmehr 117,54 Mio. € an Interbankengebühren zahlen, eine Erhöhung von 96,06 Mio. €, in einer Zeit, in der Läden geschlossen und Online-Transaktionen oftmals die einzige Möglichkeit sind, das Geschäft aufrechtzuerhalten.

Ist das erst der Anfang?

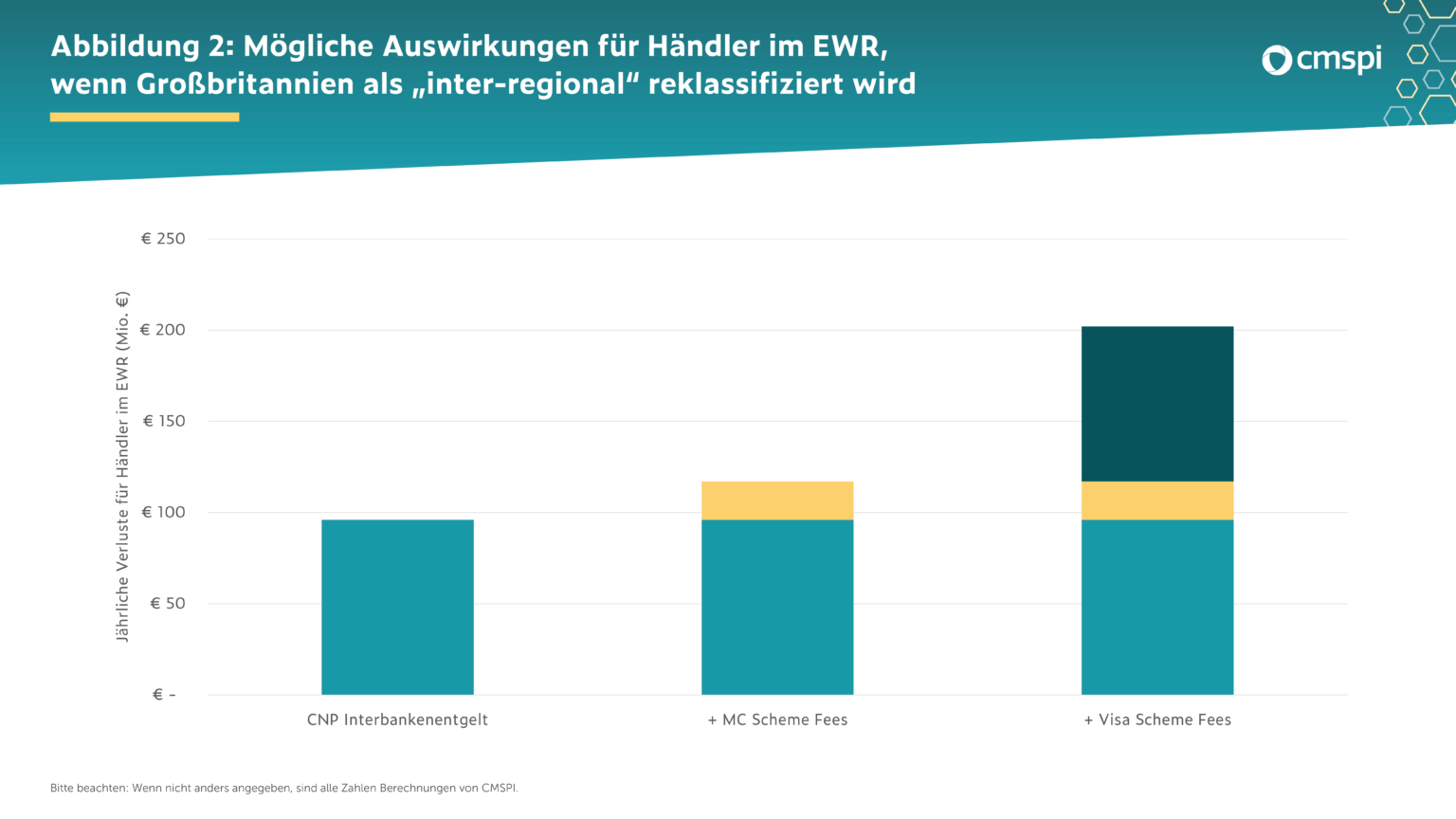

CNP-Transaktionen britischer Konsumenten in der EU sind nur eine kleine Teilmenge der Transaktionen, für die diese Reklassifizierung langfristig von Relevanz sein kann. Die zusätzlichen Kosten von 96,06 Mio. € können somit der erste Schritt für viele theoretische Erhöhungen sein:

- Die Klassifizierung als „inter-regional“ könnte auch auf Mastercard Scheme Fees angesetzt werden, was diese von ca. 0,197 % auf den interregionalen Durchschnitt von ca. 0,77 % (CMSPI-Schätzungen) erhöhen würde – und das nicht nur im E-Commerce.

- Geschätzte Mehrkosten für europäische Händler: +20,99 Mio. € (+117,05 Mio. € gesamt)

- Visa könnte auch noch Scheme Fees reklassifizieren.

- Geschätzte Mehrkosten für europäische Händler: +84,99 Mio. € (+202,04 Mio. € gesamt)

Die folgende Grafik stellt die verschiedenen Entwicklungsstufen dar. Stand heute sind wir bei Schritt 1 angekommen, Händler sollten jedoch darauf vorbereitet sein, dass sie jährlich insgesamt mehr als 202 Mio. € zusätzlich zahlen müssen, wenn sie an Kunden in oder aus Großbritannien verkaufen, sollte die Reklassifizierung weitergehen.

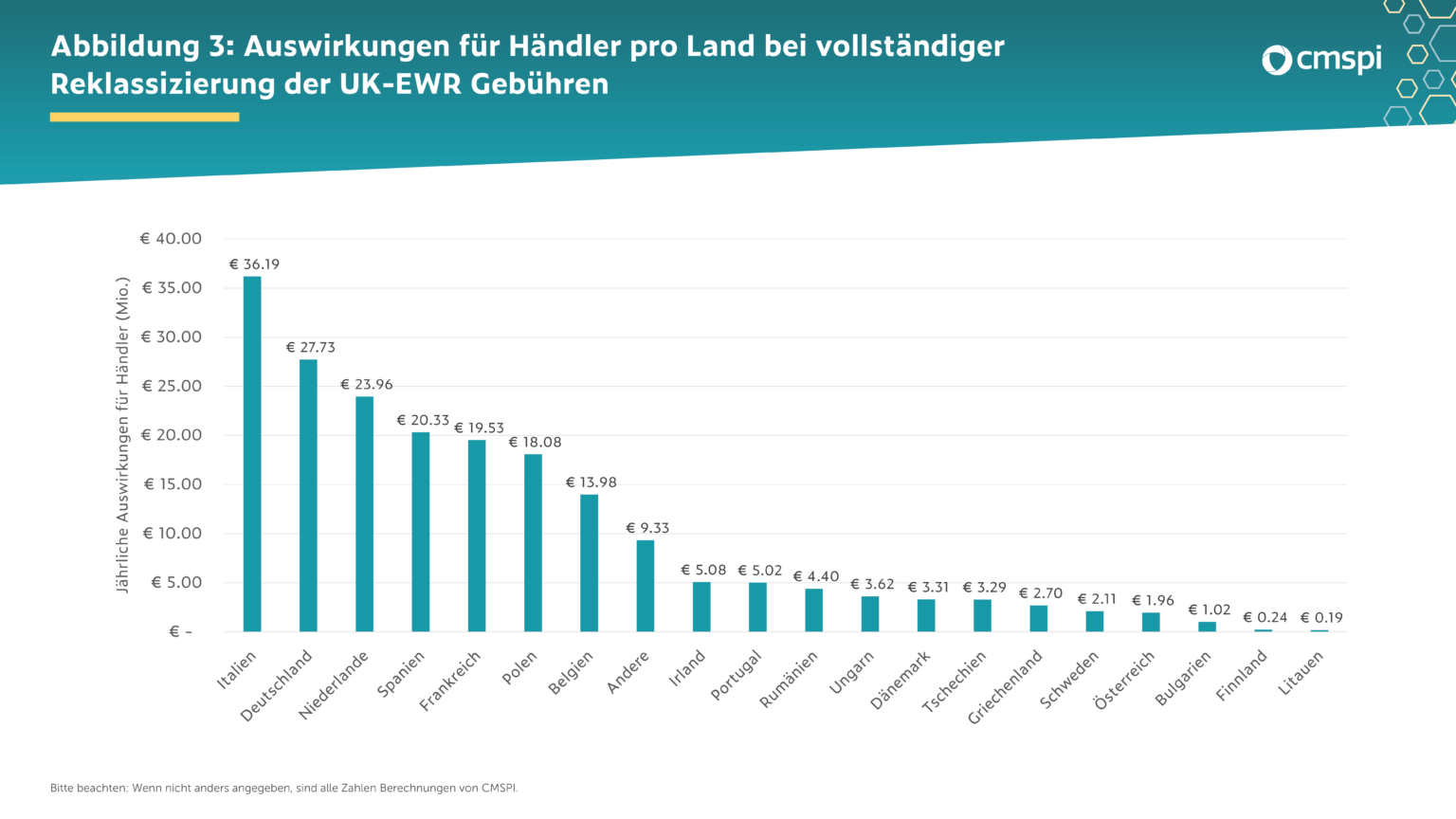

Deutsche Händler haben zweithöchste Zusatzkosten

Bei einer vollständigen Reklassifizierung von Großbritannien als „inter-regional“ (Scheme Fees, Interbanken Gebühren, Visa und Mastercard) berechnet CMSPI, dass europäische Händler ca. 202 Mio. € jährlich mehr zahlen müssen, als sie jetzt für die gleichen Transaktionen zahlen würden.

Aus diesen 202 Mio. € würde Deutschland fast 14% tragen und so müssten deutsche Händler mit Mehrkosten von bis zu 27,73 Mio. € rechnen.

Ursache? Regulierungs-Lücken

In 2015 hat die EU-Verordnung über Interbankenentgelte (Interchange Fee Regulation; IFR) Obergrenzen für Interbankengebühren für Kartentransaktionen im Inland und innerhalb des EWR von 0,2 % (Debitkarten-Transaktionen) und 0,3 % (Kreditkarten-Transaktionen) festgelegt.

Die Verordnung regelt jedoch keine „inter-EEA“ Transaktionen (d.h. solche, bei denen sich der Händler innerhalb des EWR befindet und der Verbraucher eine Karte verwendet, die außerhalb des EWR ausgegeben wurde). Für solche Transaktionen wurde stattdessen zwischen der EU und den Kartensystemen eine zusätzliche Abmachung getroffen, diese Gebühren zu senken. Die Obergrenzen für „card present“-Transaktionen wurden aus der Verordnung übernommen (0,2 % bzw. 0,3 %) während Obergrenzen für „card not present“-Transaktionen von 1,15 % und 1,5 % vereinbart wurden. Genau diese Gebühren werden nun auch für britische Verbraucher bei Online-Transaktionen gelten werden. Das Vereinigte Königreich hat zwar die Verordnung als Teil des Austritts aus der EU beibehalten, Visa und Mastercard hindert jedoch nichts daran, das Vereinigte Königreich bei seinen Transaktionen mit EU-Händlern als „inter-regional“ zu klassifizieren.

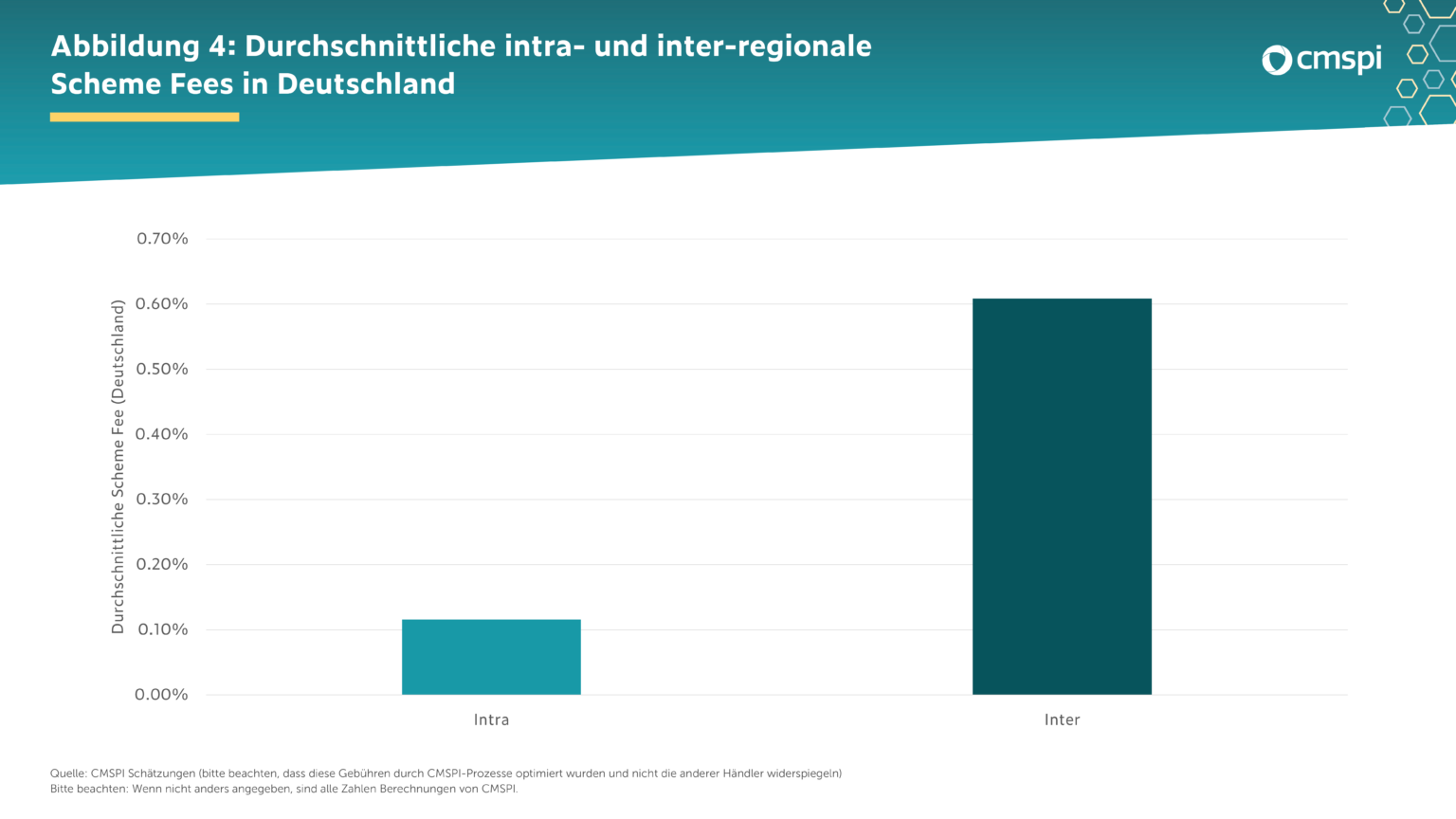

Die Verordnung war ein bedeutender Sieg für Händler und Verbraucher in Europa. Die angekündigten Änderungen zeigen jedoch wieder einmal deutlich, dass große Lücken in der Gesetzgebung klaffen und dadurch immense Probleme entstehen. Ein deutliches Beispiel dafür sind Scheme Fees, die unreguliert sind. Sie werden von Händlern über ihre Acquirer an die Kartensysteme gezahlt. Unsere Daten deuten darauf hin, dass die sukzessiven Erhöhungen der Scheme Fees seit 2015 dazu geführt haben, dass Händler heute mehr als 1 Mrd. der 9,4 Mrd. € an jährlichen Einsparungen durch die Verordnung nicht mehr erhalten. Die Brexit-Neueinstufung ist in diesem Zusammenhang besonders besorgniserregend, da „inter-regionale“ Scheme Fees deutlich höher sind als die Gebühren innerhalb des EWR. Die folgende Grafik zeigt zur Veranschaulichung durchschnittliche Systemgebühren für Deutschland.

Ganz zu schweigen von den Interbankenentgelten; ein weiteres Muster, das sich abzuzeichnen droht, ist, dass Interbankenentgelte für nicht regulierte Transaktionen und Kartenarten erhöht werden – wie z. B. in der EU für solche mit kommerziellen Karten. CMSPI schätzt, dass die Änderungen von 2020-2021 an Mastercards Corporate Prepaid Interchange europäische Händler jedes Jahr zusätzlich 15,5 Millionen Euro kosten werden. Obwohl der Brexit den Kartenystemen nun ein „gutes“ Argument für weitere Gebührenerhöhungen liefert, geschieht dies vor dem Hintergrund ähnlicher Veränderungen, die Händler seit Jahren signifikante Zusatzkosten bescheren.