Together with Google, the German Savings Banks and Giro Association (DSGV) has commissioned a representative GfK survey on banking products. What was to become a study on customer behavior in the age of smartphones and online banking is basically a testimony to years of ignorance and failure to offer customers, who have now gone digital, a corresponding range of services. Because the result of the study is about as surprising as the realization that the earth is not flat: almost no financial product transaction without an online touchpoint.

It is not clear why it took another study to understand that society is largely digital. Above all, because this is the fourth GFK study on this topic since 2010. Perhaps these studies in cooperation with Google are simply fancy and this year the DSGV can at least stick another sticker in its diary of effort.

But what the study certainly is, an evidence of incapacity of the established banks and above all the savings banks in whose cooperation the study took place this year.

61% of bank customers searched online for banking products – 2013

According to the same study, more than half of bank customers, 61 percent, were already looking for banking products online in 2013. Four years later, the figure was already 89 percent, and in the current study – surprise: 92 percent. This is in line with the Digital Index of ZDF, which has been recording the progress of digitization for almost seven years now, and one could have looked at it from time to time. Or you could have simply opened your eyes. This study has now been around for almost 10 years and the digitization of society has been taking place for a much longer period of time. If one looks at the developments of the established banks in this context, one sees an anatomy of the omissions.

Meanwhile, at the Sparkasse, you see yourself in a very good position. Dr. Joachim Schmalzl, Managing Director of the DSGV, says: “Our customers interact with their savings bank in many different ways. But whether online or offline: They rightly expect the same reliable service in all channels. That’s why we have closely interlinked the channels and are working to further optimize this integration. Our digital agenda focuses on linking the Internet branch, S-App and on-site consulting. That sounds good at first, but it does not reflect the developments of recent years. The digital agenda is taking place at an analogous pace and is evidence of a lack of focus and will.

Banks and savings banks as digital life companions

The expert roundtable customer loyalty “Banks and savings banks as digital life companions”, to which the home & farm supplier of the savings bank, Star Finanz, invited in April of this year, also fits in with this. The article is worth reading – even if it hurts that Dr. Christian Kastner, managing director of Star Finanz says:

“(…) Only 50 percent of this takes place in the digital world today. And not because the savings banks don’t want that, but because the customers don’t want that. Especially ‘on the country side’, the savings banks still have many customers who do not trust the online banking services of their institution. They definitely won’t trust any banking at Amazon.” In Germany, almost one of three people now use a language assistant such as Amazon Echo. Among the “younger” under 40 years of age, the figure is as high as 48 percent. The digital German citizen dares to do completely different things.

Dr. Christian Kastner adds: “I am deeply convinced that the banks and savings banks will only be successful in the long term if they transfer what they have built up – namely security, customer relations and the analogue platform they have in the Republic today – into the digital world. And the analog platform will then still be the big advantage“.

Sentences where one has to check twice from which time they are. If the Savings Banks’ home and farm supplier has gotten stuck in the last decade, how is a Savings Bank supposed to adapt its solutions to the present? If Schmalz sees the S-App as a part of the digital agenda, why doesn’t a customer feel anything of it?

By digital agenda, do you mean the blockade attitude at the launch of Apple Pay a year ago and the cry for opening the NFC interface of the iPhone? Where on the digital agenda is the further development of yomo, the attempt of the savings banks to respond to the development of the Challenger banks? Since the official end of the beta phase of yomo on 19.12.18, the topic has been quiet. Alsom in the Appstore you seem to be in maintenance mode with yomo. Or is the highly praised S-App actually an expression of the digital agenda? If so, which one?

Conclusion: One has always made an effort

Of course, in recent years there have been repeated efforts at retail banks or the savings banks. There have been attempts to find an answer in different ways to the attacks of the Challenger banks and Tech Giants. Many industry representatives commented favorably on these efforts: the retail banks are making an effort and cooperation with individual Fintechs was praised all over the place.

One was glad when after years of blockade they started to jump on one or the other digital train. But “always made an effort” is the worst of all evaluations in the job reference and it is just not enough to be in the lower midfield. In the future we have to stop congratulating for what should be taken for granted.

“In the future we have to stop congratulating for what should be taken for granted.”

There is no reason to praise oneself and this explicitly refers to the leadership. The people in the engine room have to be protected to be able to work at all under such blind flight.

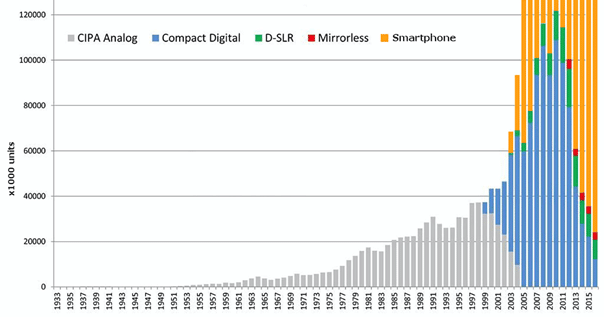

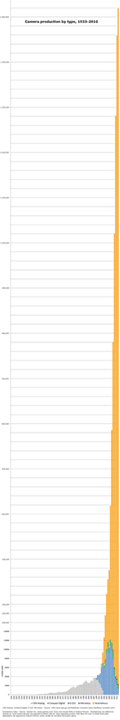

By the way, what happens if you don’t find an answer to change, the development in the field of photo cameras is recommended. Especially these two graphics. If we take this comparison, retail banks are developing from analog cameras to digital cameras. While the development should actually be moving towards smartphones.