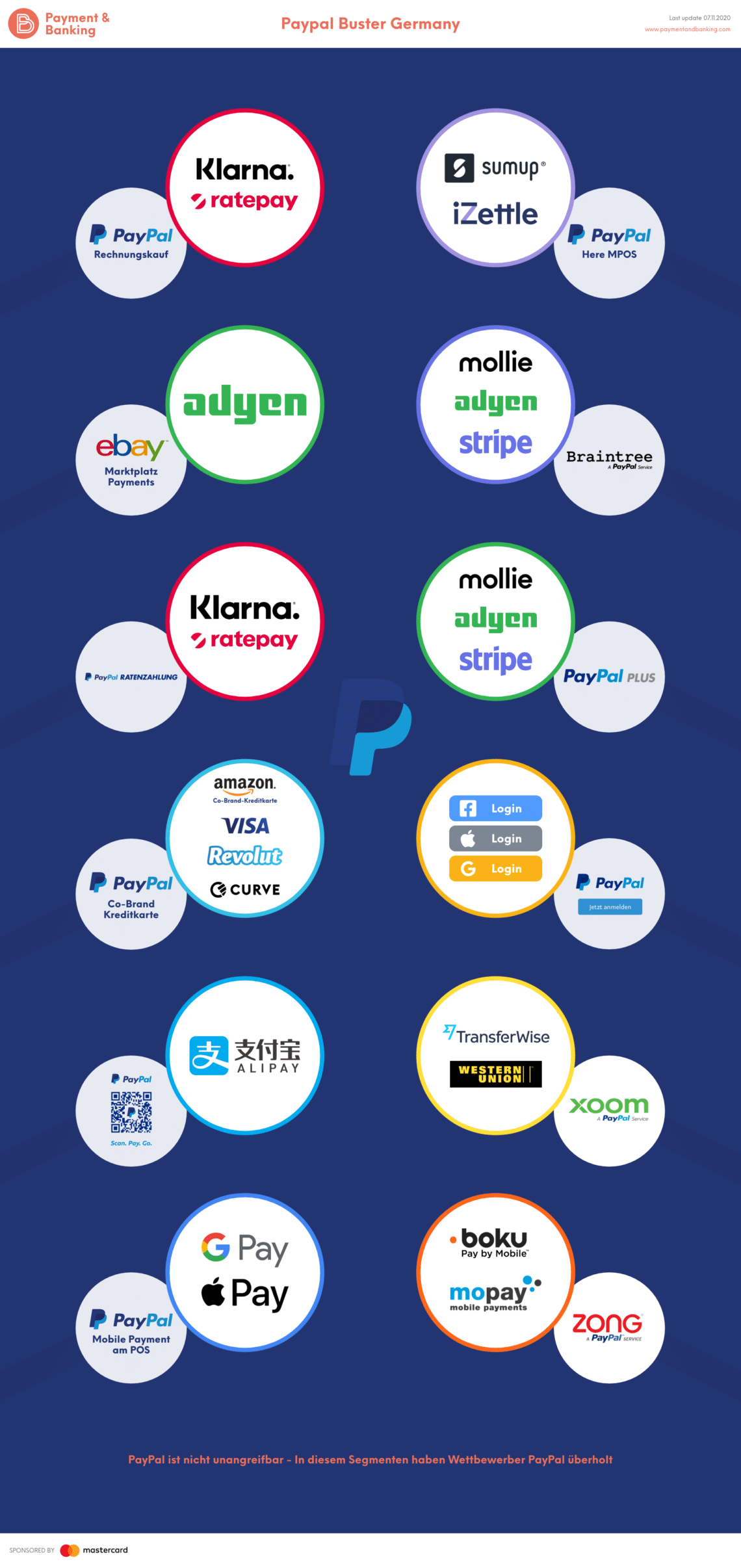

PayPal has taught many companies to fear this. In the infographics “Who was a victim of PayPal“we have summarized the companies that had to make way for the payment service in Germany or that were just stumbling through the company. However, there are always two sides of the same coin and that you cannot be attacked we have, among others, in the article “Why Klarna the better PayPal” illuminated.

Added to these are wallets such as those from Apple and Google, but also from Samsung, which reveal the failure of PayPal at the point of sale, i.e. in classic retail. Worse still, especially the solutions like Google Pay and Apple Pay are omni-channel proceeded, also work in e-commerce and whoever has been able to use one of the two solutions knows how simple and seamless the user experience is. The Apple Pay is now available worldwide on 507 million iPhonesFor example, if activated, the bazaar service might not like it either and shows how important a wallet strategy is. They are working on it with high pressure and plan for 2021 among other things the Integration of crypto currencies. This week the company presented its vision for the future of its digital wallet solution. During the third quarter earnings call on Monday, the company announced that it would be introducing substantial changes to its mobile applications over the course of next year and adding a number of new features, including improved direct deposit, check cashing, budgeting tools, bill payment, crypto support, subscription management, buy-as-you-go functionality and more.

PayPal has over 21 million users in Germany and even though the payment service is one of the most popular payment methods in e-commerce, there are some PayPal players who make life difficult for PayPal, not only in Germany. In this infographic we have collected the companies that we believe are real challengers for the group. If you have feedback, please feel free to write us!