-

Payment Trends 2023: Womit Händler und Konsumenten nächstes Jahr rechnen können

Zum Jahresende gibt die Payment-Beratung CMSPI einen Ausblick auf wichtige Trends 2023. So stehen etwa regulatorische Änderungen, Kostensteigerungen und eine „neue Ära“ der beliebten girocard bevor. Ausgabe Girocard läuft aus…

-

Deutsche Händler spüren den Druck der Inflation, während Kartenkosten steigen

Nach einem monatelangen, schwindelerregenden Anstieg der Verbraucherpreise erreichte die Inflation in Deutschland im Juni 8,2 %.[1] Der Markt ist gefangen zwischen der anhaltenden Energiekrise und einer weit verbreiteten Lieferkettenstörung, wobei…

-

Weg mit dem Alten, her mit dem Neuen: Umgestaltung der Strategie

Die deutsche Payment-Landschaft verändert sich in rasantem Tempo. Die jüngsten technologischen Entwicklungen in Verbindung mit dem Shift zum digitalen Zahlungsverkehr und der elektronische Handel während der Pandemie haben den Händlern…

-

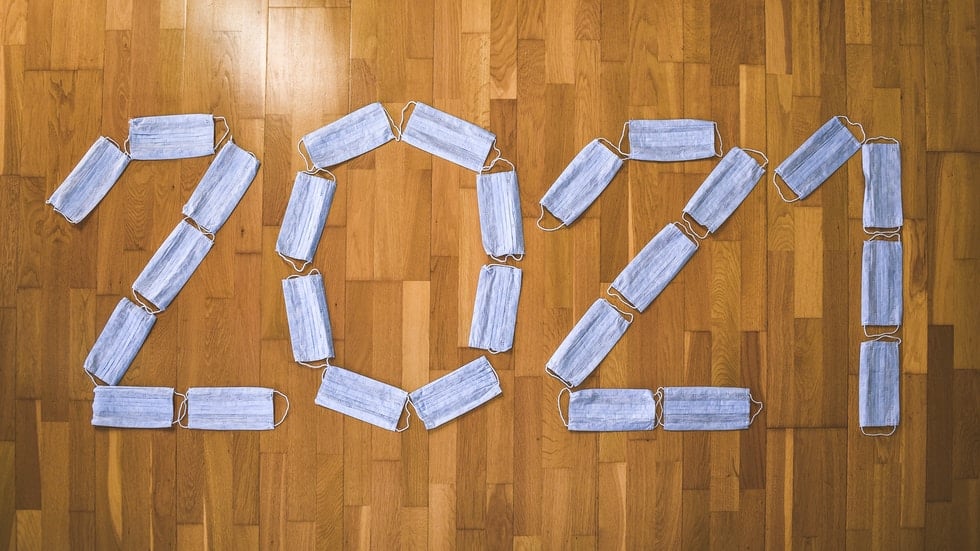

Gute Zeiten, teure Zeiten: Payment in Deutschland in 2021

Im Jahr 2021 wurde die Arbeit eines Payment Managers in Deutschland schwieriger denn je. Komplexe Gebührenänderungen, Bedrohungen für den Transaktionserfolg und eine Vielzahl neuer und rapide wachsender Zahlungsarten stellten selbst…

-

5 weitverbreitete Payment-Mythen, die das Umsatzwachstum behindern

In den letzten zehn Jahren hat Payment einen wichtigen Platz in der Strategie von Händlern eingenommen. Es kann nicht nur der größte Kostenfaktor eines Händlers nach Personal und Immobilien sein,…

-

Sind lokale Kartensysteme in Europa bedroht?

Ein Gastbeitrag von Maximilian Fuchs Für viele deutsche Händler war und ist die girocard als günstiges, domestisches Debitkartensystem ein Rettungsanker angesichts steigender Kosten für die Kartenakzeptanz. Jüngste Berichte deuten jedoch…

-

Wie ändern sich die Gebühren zur Kartenannahme für deutsche Händler?

Die Gebühren zur Annahme von Kartenzahlungen ändern sich ständig. Schätzungen von CMSPI nach kosten sukzessive Erhöhungen der Scheme Fees seit 2015 europäische Händler jedes Jahr rund 1,46 Milliarden Euro. Diese…

-

Payment & Brexit – Welche Zusatzkosten kommen auf deutsche und europäische Händler zu?

Großbritannien ist für die EU einer der wichtigsten E-Commerce Märkte. In 2019 entfielen 34% der Online-Verkäufe in Westeuropa auf die UK. Jetzt möchte Mastercard Großbritannien als Konsequenz des Brexit ab…

-

5 Jahre MIF-Regulierung: Welche Vorteile sind für Händler europaweit noch übrig?

Vor ziemlich genau fünf Jahren beschloss die Europäische Kommission, die multilateralen Interbankenentgelte für Debit- und Kreditkartentransaktionen europaweit auf 0,2 % bzw. 0,3 % zu regulieren. Heute stellt die globale, unabhängige…

Gastautor Maximilian Fuchs

Trending

Sponsoren und Partner

Schleichwerbung

Der beste Newsletter ever

Mit dem Payment & Banking-Newsletter versorgen wir dich täglich mit News, ausgewählten Artikeln und Kommentaren zu aktuellen Themen, die die Finanz-Branche bewegen. Meld Dich an!