-

Die Gesichter der Branche: Dr. Verena Thaler

Dürfen wir vorstellen: Dr. Verena Thaler von Raisin Das Arbeiten in der FinTech Branche gleicht einem Kommen und Gehen, setzt ein hohes Maß an Professionalität in einem durchaus lockeren Arbeitsumfeld voraus und ist vor allem geprägt von Innovationen sowie guten, klugen und zukunftsorientierten Ideen, so der weit verbreitete Konsens. Doch wer sind eigentlich die Köpfe…

-

The piggy bank is far from dead!

German children are brought up to save conservatively Children and money – often this is a delicate combination. Because dealing with one’s own finances needs to be learned. While children, for example, are becoming more and more adept at dealing with social media and are several steps ahead of their parents, things are different when…

-

What does… CrowdDesk do?

As the Payment and Banking team we try to keep a continuous overview of the industry and report on small and large Fintechs and Insurtechs, on established banks as well as neo-banks, on digital strategies, on major investments of national and international financiers, write about exits and provide analyses on current topics. Some companies appear…

-

Talk is silver – making is gold! A reflection on the rush jobs after Paydirekt & Co

A column by Marcus W. Mosen Some know better and better, others have always known better, and only the very few know what they are writing about – and knowing nothing obviously makes nothing. This is the motto of numerous comments in the last days and weeks in our banking and payment bubble on the…

-

The faces of the industry: Laura Wirtz

May we introduce: Laura Wirtz from ING-DiBa Working in the FinTech sector is like coming and going, requires a high degree of professionalism in a thoroughly relaxed working environment and is above all characterised by innovations as well as good, clever and future-oriented ideas, according to the widespread consensus. But who are actually the brains…

-

News show in August – The most important facts at the end

Our monthly review in the August In the Fintech world it never gets boring. New companies are founded, investments are made and new products are brought to the market. Sometimes it is difficult to keep track of things. We take care of that and summarize the most important news of the past month in a compact overview.…

-

Deutsche Bank: Why you can’t buy happiness

In recent weeks, Deutsche Bank has been on everyone’s lips, especially by hiring well-known industry leaders. Directly four finders from us, Payment & Bankinghave switched to Deutsche Bank. But other familiar faces like Alexander Bechtel of the podcast Bitcoin, Fiat & rock’n’roll is another change from the industry. Better bought well than badly done is…

-

Value-added services in payment – a stocktaking.

Acquirers and PSPs are under pressure from falling margins and increased competitive pressure. They must reinvent their business model and expand their value creation. In the process, value-added services such as data analytics, couponing and loyalty are moving back into focus. However, payment itself has become too interchangeable and other players have long since improved…

-

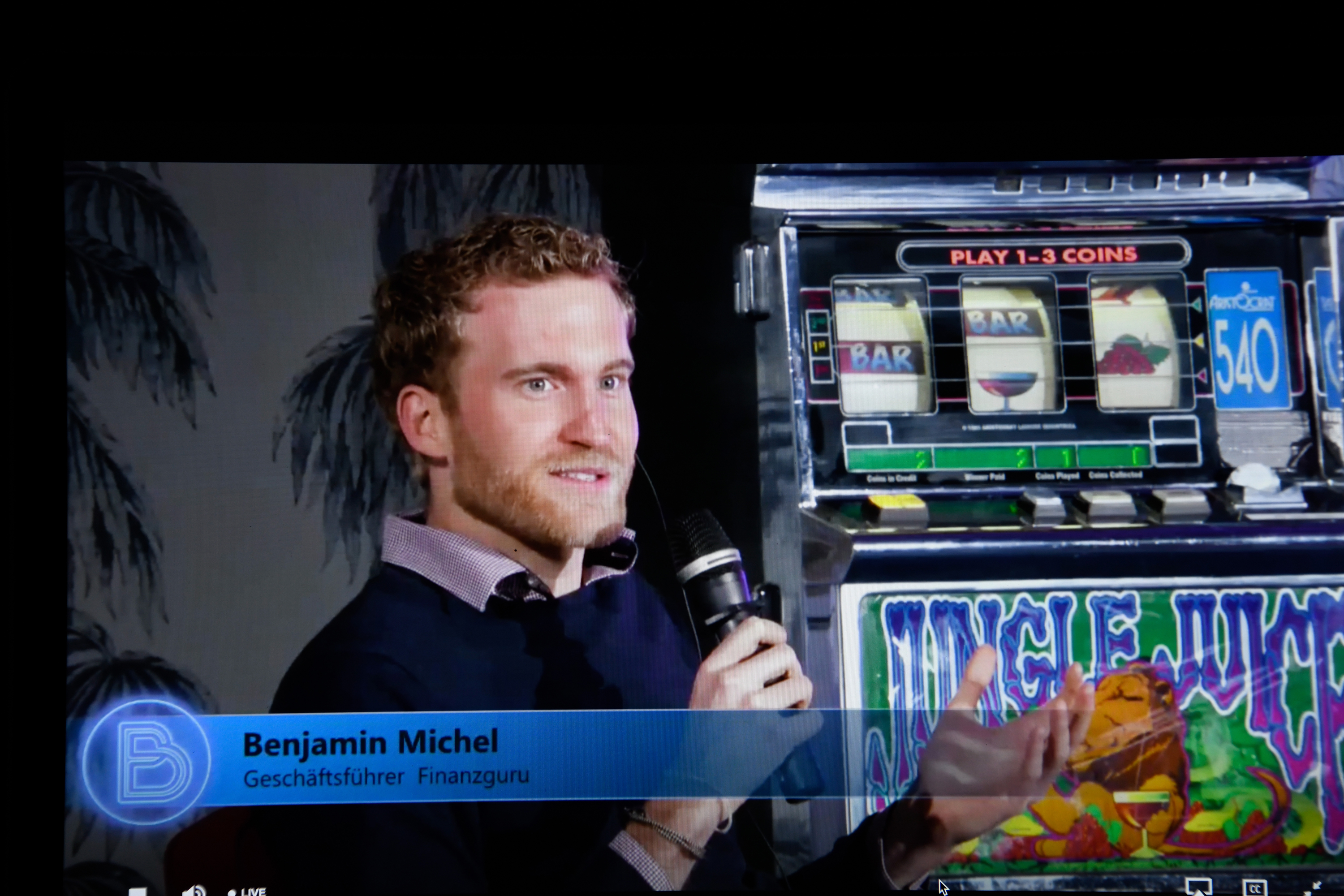

“Best to be afraid of us.” The future of Personal Finance Management

A video interview with Benjamin Michel (finance guru) at the Banking Exchange 2020 For the first time in the event history of Payment & Banking, the Banking Exchange, which was otherwise designed as an “invite only” event, took place in a stream accessible to all. Our goal was to live what other events only preach:…

-

Götterdämmerung – es wird ernst bei den Neobanken

Ist sie vorbei die Herrlichkeit der Neobanken bzw. Challengerbanken? – oder sind im klassischen Gartner Hype Cycle – bzw. haben den “Mount Stupid” (den uns Prof. Dück auf unserer Transactions.io 2019 so schön näher gebracht hat) überwunden? Monzo verbrennt mehr und mehr Geld, Starling hat seinen Pivot schon hinter sich und um N26 ist es –…

-

Is Tesla the new Wirecard?

A contribution from Robin Brass Wirecard has long been the most traded and hotly discussed share in Germany. Many people ask themselves whether Tesla does not also have many parallels with Wirecard.All in all, the picture does indeed show some parallels, but also some major differences, which should certainly not only be of interest to…

-

What has this “Fintech” ever brought us?

Or why the credit process is still at the status of the 70s? Disclaimer: This article arises from a phase of emotionality, I know you should never do that and it is in every good education book. But I’m doing it anyway, because I have a grant.We have tried to get a company loan, yes…