Einführung

Stichwort Digitalisierung. Eine schier nicht enden wollende Herausforderung. Ein komplexes Thema, gerade für Unternehmen die ihre Geschäfte hauptsächlich in und ums Internet abwickeln. Wenn diese dann noch Dienstleistungen anbieten wird es besonders kompliziert. Zu Beginn des Jahrtausends herrschte in der Technologiebranche eine regelrechte Goldgräberstimmung. Jeder ahnte, dass die Etablierung des Internets und digitaler Technologien die Wirtschaft zukünftig maßgeblich bestimmen und verändern würde. Entsprechend groß war das Interesse der Anleger. Unternehmen mussten sich nur irgendetwas mit „Internet“ und „Technologie“ auf die Fahnen schreiben, um eine hohe Bewertung zu erzielen.

Digitalisierung ist nicht mehr, wie vor 18 Jahren, ein Zukunftsthema, sondern Teil unseres Alltags, anfassbar, begreifbar. Hatten die Techunternehmen damals oft nicht mehr vorzuweisen als ein „.com“ oder „.de“ im Namen, steckt hinter den Bewertungen der Technologiefirmen heute echter Wert. Dieser Wert bemisst sich an Kunden, an realen Umsätzen und vor allem an Daten, Daten und noch mehr Daten.

Und gerade dieses Wissen um den Kunden, gepaart mit der Innovationsfähigkeit der Techkonzerne und dem Willen, sich stetig weiterzuentwickeln und zu wachsen, sind die Grundlage für die exponentiell steigenden Börsenbewertungen

Mit ihrem Einfluss, der ist mittlerweile soweit fortgeschritten, leben die GAFA die digitale Transformation per excellence. Ließ vor 18 Jahren das „.de“ oder „.com“ im Namen den Kurs steigen, ist es heute irgendetwas mit Coin, Krypto oder Blockchain, das die Anleger in Begeisterung versetzt. Was aus all dem deutlich wird, wir befinden uns in einem der größten digitalem Wandel und einem derart rasanten Umbruch, das manche Unternehmen nicht mehr in ihrer digitalen Transformation hinterherkommen.

Jochen Siegert erzählt von seinen Erfahrungen aus unzähligen Silicon Valley-Aufenthalten und möchte in seiner Nachfolgereihe der 7 Todsünden, die „6 Key Learnings von DotCom Unternehmen„ und deren Umgang mit diesem Wandel erklären. Er zeigt auf was wir uns heute bei dem Umgang mit der Digitalisierung abschauen können. Was waren die Strategien der großen Technologiekonzerne? In den kommenden Wochen wird er solche Rezepte, mit großer Empfehlung zum Nachmachen, hier im Blog genauer beschreiben und vorstellen.

Teil 2: Radikale Orientierung am Kundenverhalten. Eigene Defizite über M&A heilen und warum Übernahmen zu “Mondbewertungen” am Ende doch Sinn ergeben.

Der Kunde steht immer im Fokus. Ist das eine Binsenweisheit? Eigentlich schon! Wird es aber gelebt in unserer Industrie? Eher weniger, wenn man die viel zu spät gestarteten, oder längst gescheiterten Digitalaktivitäten der Deutschland AG und der deutschen Banken und Sparkassen anschaut. Neben den bekannten Beispielen, die ich bereits in der ersten Folge dieser Artikelreihe aufzählte, berichtet die Presse aktuell viel über deutsche Kreditinstitute und deren Ende ihrer Robo Advisor Projekte. Am eigentlichen Kundenbedarf kann das Ende der Projekte nicht liegen, denn die unabhängigen Robos wie z.B, Scalable Capital, Liqid und Co. überraschen mit immer neuen Erfolgsmeldungen bzgl. des von ihnen verwalteten Vermögens.

Wie gehen die DotCom Unternehmen mit veränderten Kundenwünschen um, wie kompensieren sie Produktdefizite und was können wir als Beobachter daraus als Lehren mitnehmen?

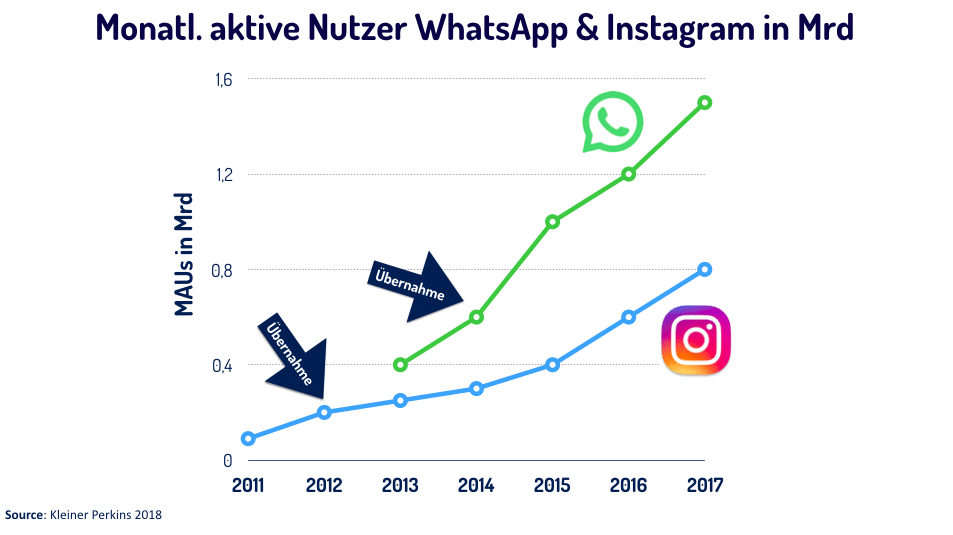

Schauen wir uns dazu erst einmal Facebook an. Facebook schaffte zuerst eine beeindruckende Wende vom Desktopbrowser in die mobile Welt und folgte sehr aggressiv mit mobilen Produkten ihren Kunden in die mobile App Welt. Facebook überraschte aber auch durch atemberaubende Übernahmen der damals noch kleinen mobile only Anbieter Whatsapp und Instagram. 2014 übernahm Facebook das, gemessen an Mitarbeitern, Mini-StartUp Whatsapp für $19Mrd. Die Bewertung von Whatsapp entsprach damals $42,22 pro Whatsapp Nutzer. 2 Jahre vorher bei Instagram gestaltete es sich ähnlich. Facebook übernahm Instagram für $1Mrd, was einer damaligen Bewertung von $33,33 pro Nutzer entsprach. Beide Bewertungen erschienen zum Dealzeitpunkt extrem hoch, vor allem aufgrund der Tatsache, daß beide Apps bei den Erträgen pro Kunde bei weitem nicht auf Augenhöhe von Facebook waren. Banker hätten damals vermutlich behauptet, daß beide Apps kein Geschäftsmodell haben und es als Übertreibung in einer Blase abgetan. Aber war es wirklich eine Übertreibung? Beide Deals erscheinen heute als günstige Schnäppchen für Facebook!

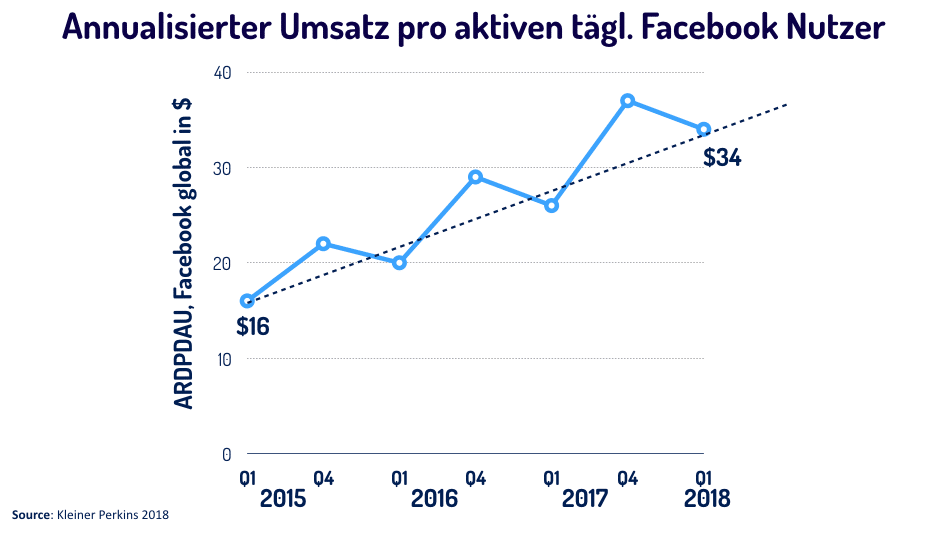

Interessant in diesem Kontext ist die Bewertungen pro Kunde im Verhältnis mit dem Umsatz, den Facebook selbst generiert. Erlöste Facebook Anfang 2015 noch jährlich $16 mit jedem täglichen aktiven Kunden, hat sich der Ertrag Anfang 2018 schon auf $34 pro Kunde und Jahr erhöht. Extrapoliert man die Kurve, kann man Erlöse der kommenden 1-2 Jahre recht einfach prognostizieren. Ich mache jetzt einmal eine einfache Milchmädchenrechnung auf: Facebook hat 2012 für jeden Instagram-Kunden soviel bezahlt, wie sie aktuell im Gesamtjahr 2018 mit diesen Kunden erlösen. So gesehen war der 1Mrd Deal für Facebook recht “günstig”. Auch ohne diese Milchmädchenrechnung scheint der Deal für Facebook sich xfach auszuzahlen, denn es wird erwartet daß Instagram für Facebook sehr bald der wichtigste Ertragskanal für Werbung sein wird.

Viel relevanter zeigen sich die Übernahmen aber im Kontext der Unternehmensstrategie des Facebook-Konzerns. Der eigene Anspruch von Facebook ist die Marktführerschaft im Bereich Soziale Netzwerke. Die Entwicklung der Nutzer, gemessen an den MAUs (monthly active user) auf den Plattformen zeigt, daß es eine sehr sinnvolle Entscheidung war die potentiellen späteren Wettbewerber Whatsapp und Instagram zu einem frühen Zeitpunkt zu übernehmen. So wurden diese Unternehmen vom Markt “weggekauft”, bevor diese selbst zu groß sind und somit für Facebook zu einer ernsthaften Konkurrenz werden konnten. Was wäre passiert, wenn Instagram und Whatsapp in die Hände von Google (hat gerade das Facebook-Konkurrenzprodukt Goople plus eingestellt) oder Apple (plante mit dem eingestellten Ping ein Soziales Netzwerk für Musik) gefallen wäre? Das hätte sicherlich zu einem dynamischeren Wachstum einer der anderen konkurrierenden DotComs im Bereich Soziale Netzwerke geführt. Entsprechend war eine Übernahme von Instagram und Whatsapp für Facebook genauso wichtig, wie es für eine klassische Bank oder Sparkasse eigentlich wichtig wäre das Thema “Mobile Banking” nicht alleine den unabhängigen N26s, Starlings, Revoluts zu überlassen. Ziehen die Verantwortlichen in den Banken die gleichen Schlüsse wie Mark Zuckerberg? Im Falle der BBVA mit den Übernahmen Simplebank (Retailbanking, USA) und Holvi (Corporate Banking, Europa) gibt es dafür schon genau solche Beispiele.

Ein anderes schönes Lerhrbeispiel ist eBay und der Bereich Zahlungsverkehr. Heute stellt niemand mehr die Frage, daß eine voll integrierte Kauf- und Paymentabwicklung bei Marktplätzen ein “must-have” ist. Alle relevante Massen- und Nischen-Marktplätze bieten heute eine vollintegrierte Zahlungsabwicklung. Ende der 1990er / Anfang 2000er Jahre, als eBay der dominante Marktplatz war, verstand das eBay Management um die CEO Meg Whitman dies längst. Die nicht-integrierte Zahlungsabwicklung war ein Quell ständiger Kundenprobleme. Um diese Probleme zu lösen übernahm eBay 1999 von der WellsFargo-Bank das Paymentstartup Billpoint. Sie bezahlten damals knapp $50 Mio für das StartUp und integrierten es in ihrem US-Marktplatz als Zahlmethode. Es begann dann Kampf auf dem eBay-Marktplatz zwischen dem unabhängigen und wendigen StartUp PayPal und der integrierten eBay Corporate Lösung Billpoint, der äußerst lesenswert in einem Buch des frühen PayPal CMOs Peter Jackson beschrieben ist. PayPal entwickelte sich als die präferierte Lösung der eBay-Nutzer. Sowohl Händler als auch Kunden zogen es der heute längst vergessenen eBay-Corporate-Lösung Billpoint vor. Wie reagierte eBay? Verdoppelten Sie die Investments in die eigene Lösung in einer “jetzt-erst-recht”-Mentalität, oder beugten sie sich dem Kunden und ließen Billpoint zugunsten von PayPal fallen?

Hiesige Banken und Sparkassen reagieren mit ihren “naja performenden” Digitallösungen in vergleichbaren Situationen mit dem sturköpfigen “jetzt erst Recht”-Ansatz oder Aussagen wie: “Die Lösung ist alternativlos”. eBay hat aber damals auf die Kunden gehört und PayPal, nur 2 Jahre nach der Billpoint Akquisition, für $1,5Mrd übernommen. Michael Moritz, der Partner des PayPal-Investors Sequoia, erzählte Jahre später aus dem Nähkästchen auf einem Führungskräfte Event von PayPal: Den PayPal Börsengang gab damals überhaupt nur deswegen, weil das eBay Management und die Paypal Investoren sich nicht auf einen Kaufpreis einigen konnten. Der Börsengang war daher der Ausweg einer “neutralen” Bewertung und eBay übernahm Paypal mit einem Aufschlag von 77% zum Börsenkurs unmittelbar nach dem IPO, delistete die PayPal-Aktie und der Rest ist Geschichte.

PayPal selbst wiederholte im übrigen diese frühe und erfolgreiche eBay Strategie mehrmals. In all den Segmenten, wo Paypal selbst gegenüber dem Markt zurückgefallen ist, gab es Übernahmen:

- Der Online-Absatzfinanzierer BillmeLater wurde 2010 für 1 Mrd übernommen weil PayPal Credit nicht performte und BillMeLater bei Amazon, Overstock und co vorgezogen wurde.

- Das P2P Payment-Verfahren Venmo wurde zusammen dem Online-PSP Braintree 2013 für $800 Mio übernommen, weil PayPal im eigenen P2P Payment zurückgefallen war.

- In Europa war 2012 die erste PayPal-Akquisition das deutsche Rechnungskauf-StartUp BillSafe. Grund: BillMeLater nach Europa zu bringen war teurer als die Übernahme des Earlystage StartUps in Deutschland und der nordische Marktführer Klarna griff Paypal in Deutschland an.

- Vor wenigen Wochen generierte die Übernahme des schwedischen MPOS-Anbieters iZettle für $2,2Mrd Schlagzeilen. Auch hier der Grund: Die Umsetzung des In-House-Produktes PayPal Here war “suboptimal umgesetzt” und schlicht nicht erfolgreich am Markt.

Die Beispiele Facebook, eBay und PayPal stehen nur exemplarisch für viele andere, in denen Internetkonzerne auf das veränderte Konsumentenverhalten durch M&A antworten. Schnellere, innovativere Unternehmen, die sehr nah am Kernprodukt sind, Traktion bewiesen haben, und zu ernsthaften Konkurrenten werden könnten, wurden und werden (teuer) übernommen. Gleichzeitig investieren Konzerne, auch Kreditinstitute, bei uns in Deutschland im Vergleich lediglich “Kleingeld” in Minderheitsanteile von vielen Early-Stage-StartUps mit oft noch unbewiesenem Geschäftsmodell. Noch lieber versenken sie signifikante Geldbeträge in In-House-Digitalprojekte, die oft zeitlich zu spät an den Markt kommen und nicht unternehmerisch geführt wurden und werden. Wer hat die bessere Strategie? Die konservative Mischung aus vorsichtigem Investment und In-House Projekten oder teure Übernahmen von bewiesenen Geschäftsmodellen mit Traktion aus denen ernsthafte Wettbewerber hervorkommen können? Die Vorbilder aus dem Silicon Valley sprechen jedenfalls eine klare Sprache.