Als vor 20 Jahren der Bezahlkumpel PayPal an den Start ging stand der E-Commerce noch am Anfang und das Wort Fintech gab es noch gar nicht. Trotzdem war PayPal eben genau das, ein Startup welches Finance Services mit Technology verknüpfte und den Online-Zahlungsverkehr wie wir ihn heute kennen maßgeblich gestaltet hat und nach vorne gebracht hat. In Deutschland hat PayPal 23 Millionen Kunden.

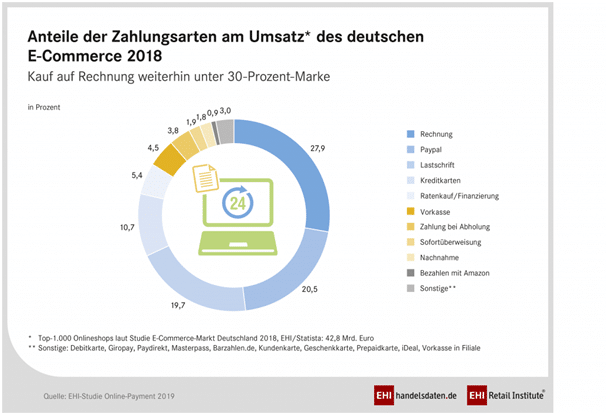

Ein Drittel der Volljährigen in Deutschland nutzt PayPal und nach der Rechnung ist PayPal das beliebteste Online-Bezahlverfahren. Auch das Geschäftsergebnis von PayPal kann sich sehen lassen, 12 Prozent mehr Umsatz im ersten Quartal 2019 und 31 Prozent mehr Gewinn. Aber wie sagte Voltaire schon: “das Bessere ist der Feind des Guten”.

Klarna vs. PayPal, nicht alles was hinkt ist ein Vergleich

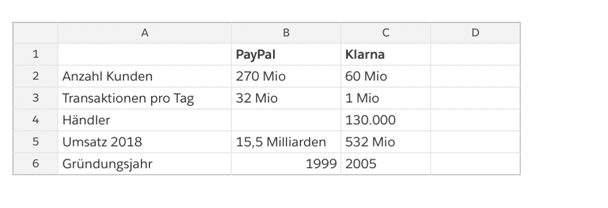

Klarna hat 2018 einen Umsatz von 5,451 Milliarden gemacht, PayPal 15,45 Milliarden. PayPal hat nicht nur mehr Umsatz gemacht, sondern die Währung ist auch eine andere: Den 15,45 Milliarden Dollar von PayPal stehen Klarnas 5,451 Milliarden Schwedische Kronen gegenüber – was ca. 532 Mio. Euro entspricht. Um nicht komplett zu verwirren: PayPal macht 30 mal so viel Umsatz wie Klarna. Das Wachstum von Klarna ist dennoch mehr als beeindruckend.

2018 hat Klarna das Transaktionsvolumen um 26 Prozent und auf ca. 24,6 Milliarden Euro steigern können. Auch konnte Klarna 25.000 neue Händler darunter Größen wie IKEA oder H&M gewinnen. Anders ausgedrückt: Klarna ist da und geht auch so schnell nicht mehr weg. Vor allem adressiert Klarna mit dem Rechnungskauf ein großes Stück vom Kuchen.

Was Klarna richtig (gut) macht

Klarna hat sich seit der Gründung im Jahr 2005 kontinuierlich weiter-entwickelt und sich gerade in den letzten Jahren stark auf den Endkunden fokussiert, was sich nicht zuletzt beim Re-Branding im Spätsommer 2017 bemerkbar machte. Seit dem hat sich Klarna von einem eher langweiligen Rechnungskauf zu einer echten Endkunden-marke entwickelt. Als dann Anfang 2019 noch der Rapper Snoop Dogg bei Klarna als Anteilseigner und Aushängeschild bei Klarna einstieg, machte das neue Markenbild perfekt und der Claim “Get Smoooth” rundet das Ganze ab. Klarna hat etwas, was PayPal und vielen anderen fehlt: eine Marke mit Identität. Neuro-wissenschaftler gehen davon aus, dass Entscheidungen zu über 90 Prozent auf Emotionen beruhen. Diese Emotionen bespielt Klarna auf exzellente Art und Weise und bietet gleichzeitig einen nicht weniger wichtigen Produktnutzen. Im direkten Vergleich sieht PayPal schlecht aus, denn Klarna bietet:

- mit Sofortüberweisung ein vergleichbares” schnelles Online-Bezahlverfahren und den wichtigen Rechnungs- und Ratenkauf

- mit “Klarna Checkout” eine „Hosted-Payment-Page“ an, die den gesamten Checkout und Fraud-Prüfung für den Händler übernimmt und für den Prozess für den Endkunden drastisch verschlankt

- den Nutzern eine physische Debitkarte

- den Nutzern mobiles Bezahlen mit Google und Apple Pay

- ein Kundenportal mit der Möglichkeit von variablen Zahlungszielen aller Zahlungen, die über die Klarna-Plattform getätigt wurden

- mit Snoop Dogg ein Testimonial, welches den eigentlich sterbenslangweiligen Zahlungsverkehr zu einem “hippen” Thema macht

- eine globale Identity Plattform

Klarna bietet ein auf Endkunden ausgerichtetes Ökosystem. Wer Klarna mal für seine Einkäufe genutzt hat weiß wovon die Rede ist. An anstehende Rechnungen und ausstehende Zahlungen wird per Mail erinnert. Die Zahlung geht bequem per Lastschrift. Zahlungsziele und Raten etc. lassen sich genau so einfach festlegen.

Die Debit-Visa Card von Klarna funktioniert nach dem gleichen Prinzip: Zahlungen können auf Wunsch sofort oder nach 14 Tagen ausgeführt werden, in Abhängkeit mit der Höhe des Betrages. So können z.B. Zahlungen über 500 Euro auf Wunsch erst nach 14 Tagen ausgeführt werden, während der Rest sofort vom Konto geht.

Dass die Karte auch noch Google und Apple Pay unterstützt, mit vier unterschiedlichen Designs kommt und auch noch kostenlos ist, rundet besagtes Ökosystem ab. Und mit Sofortüberweisung an Board können sie das komplette Online-Banking abdecken. Gut möglich, dass sie irgendwann Produkte wie Outbank oder Finanzguru überflüssig machen, oder zumindest auch eine Sicht auf das Girokonto geben – bis Klarna vielleicht irgendwann ein eigenes Konto anbietet.

Wenn ein Online-Shoop wie boohoo in der TV Werbung damit wirbt, dass Klarna als Bezahlverfahren angeboten wird, hat entweder Klarna viel Werbekostenzuschuss dafür bezahlt, oder aber ist inzwischen so relevant, das es ein echter USP für Shopbetreiber ist, die schwedische Klarna anzubieten.

Das Geschäftsmodell

Klarna verdient in erster Linie an den Transaktionen durch die Shopbetreiber. Aber auch an den Mahngebühren, denn bei Zahlungsausfall verdient Klarna dann am Endkunden. Online gibt es immer wieder Berichte von Abzocke und hohen Gebühren, sollte eine Rate nicht oder zu spät bezahlt werden. Laut Klarna soll das nicht richtig sein. Stattdessen soll der Kunde insgesamt viermal daran erinnert werden einen fälligen Betrag zu bezahlen, was in Summe bis zu 49 Tage Aufschub und Mahngebühren von maximal 3,60 Euro entspricht. Erst dann soll ein Inkasso-unternehmen eingeschaltet werden.

Fazit

Es geht. DasUnternehmen hat gezeigt, das man eine Alternative zu PayPal bauen kann. Das haben die Holländer im Kleinen mit IDEAL bewiesen und Klarna zeigt das im großen Stil. Klarna hat vieles richtig gemacht, allen voran die Fokussierung auf den Nutzer, was sowohl im UX zeigt als auch im Produkt zum Ausdruck kommt. Muss ein Marktführer wie PayPal Angst haben? Angst sicher nicht. Aber Respekt.

„PayPal muss vor Klarna keine Angst haben. Aber Respekt.“

In vielen Bereichen ist der Zahlungsanbieter aus Schweden PayPal voraus. Und das Klarna die Plattform weiter ausbauen wird, ist wahrscheinlich. Es braucht auch nicht viel Phantasie um sich vorzustellen das ein europäisches Fintech wie Klarna, mit so vielen Kunden, in Zukunft auch ein echtes Girokonto anbieten wird – inklusive Multibanking. Es ist alles schon da und Klarna müsste nur noch aufs Knöpfchen drücken.

Schade, das Klarna nicht aus Deutschland kommt.