Haben uns die Ergebnisse wirklich noch überrascht? Oder ist das nicht eigentlich “business as usual” – jeder erwartet es. Neue große Meldungen sind Fehlanzeige. Unauffällig aber stetig geht PayPal seinen Weg.

Der Quartalszahlen-Vergleich zum 3. Quartal 2017

13 % mehr Umsatz (3,68 Mrd $)

15 % mehr Gewinn (436 Mio $)

37% mehr Zahlungsvolumen (134 Mrd $) – andere Quellen sprechen von 25%

9 Mio mehr aktive Accounts in Summe nun 245 Mio (die sind nicht zu verwechseln z.B. mit Zahlen von Paydirekt, oder den HCE-Apps Downloadzahlen dt. Banken, wo sämtliche Karteileichen zusammengekratzt und mitgezählt werden)

78 % Steigerung bei den Venmo P2P-Transaktionen

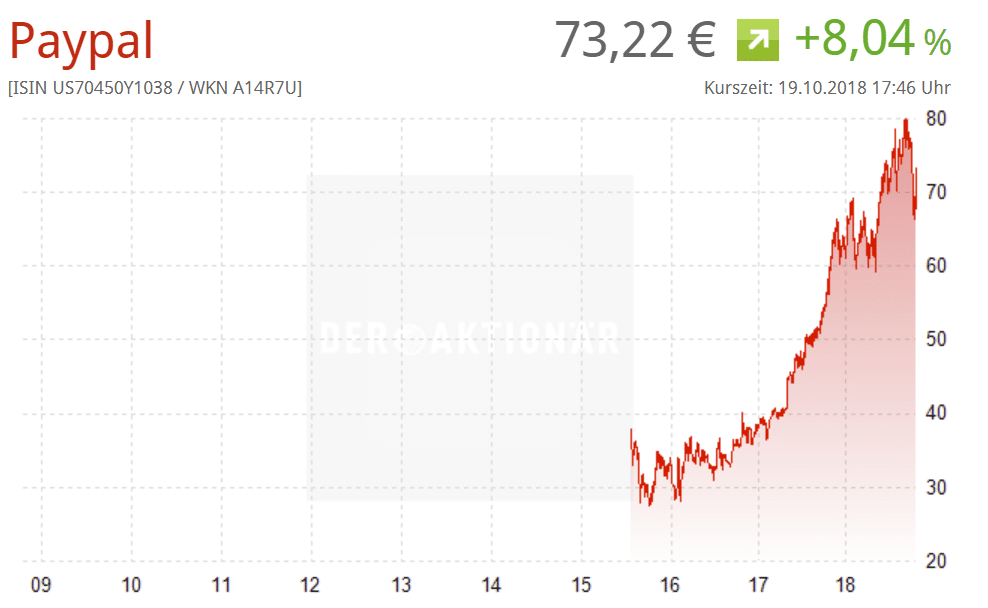

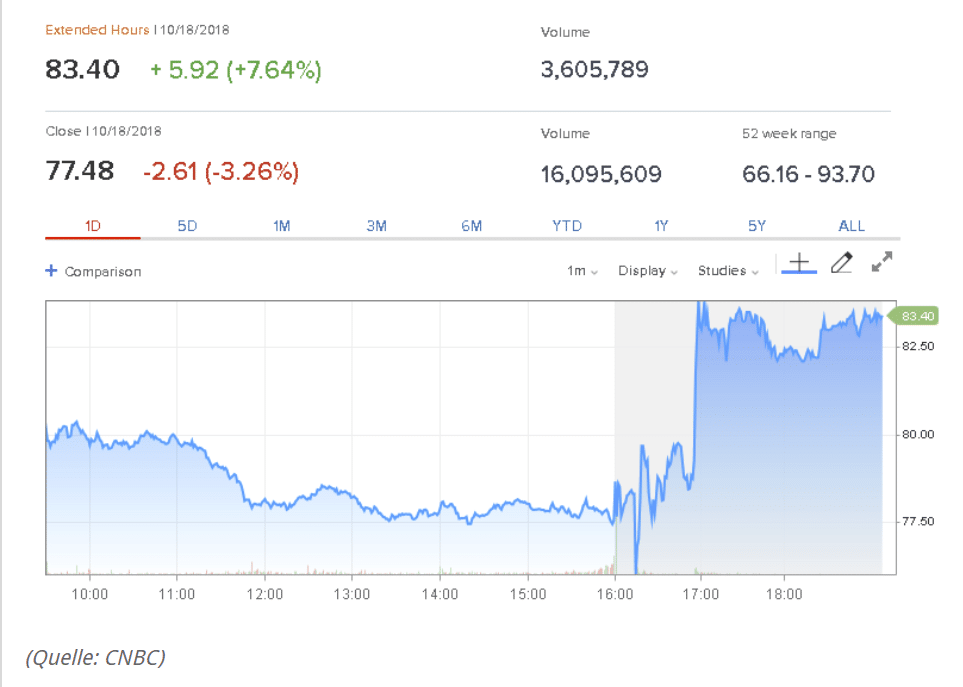

Die Aktienentwicklung unterstützt den Trend- auch wenn der “ein oder andere Analyst” sich leicht enttäuscht zeigt – gierige Hunde :-) – Am Tag der Quartalsmeldungen gab es zumindest einen kurzzeitigen Sprung um 8% – dann wieder 3% runter – einen “leichten Margendruck” kann man aus den Zahlen aber herauslesen – anyway – das Wachstum zählt hier mehr.

Bemerkenswert sind die Nachrichten zum P2P Zahlverfahren Vemno – kurzes Zitat des PayPal-CEOs:

“I’m especially pleased with the strong overall momentum surrounding Venmo. While it is still early, our monetization efforts appear to be reaching a tipping point.”

Sollte man es wirklich schaffen rein aus Venmo Geld zu “ziehen” – und wenn ja, was kann man daraus lernen – gilt die alte Weisheit “P2P ist nur ein Feature” am Ende gar nicht mehr?

Was bedeutet das für die Banken, Payment und Fintech Welt?

- Wer ist eigentlich PayPal? WIR haben doch das Kundenvertrauen.

- Noch mehr Geld in die Alternativen pumpen “unsere Lösung ist alternativlos, egal wieviel Millionen sie noch verschlingt” – wir hoffen weiter auf den Endkunden, den wir längst verloren haben. Und wenn wir ihn zwingen! In der westlichen Payment-Welt ist kein (zu spät) eingeführter Bankenchallenger von PayPal erfolgreich, wenn man Märkte wie Niederlande exkludiert, die vor der PayPal-Dominanz schon eine erfolgreiche Bankenlösung etabliert hatten. Trotz dieser erdrückenden Realität wird die politische PR-Story für die bankeigenen Lösungen weiter gespielt, bis auch die allerletzten Primärbanker verstanden haben, daß sie es sind, die die Party mit ihren Umlagen immer weiter bezahlen müssen, ohne daß jemals ein ROI fließt. Würden die gleichen Entscheidungsträger solche Ausflüge von bankfremden Gesellschaften mittels Kredite finanzieren? Sehr unwahrscheinlich!

- Resignieren und das “B2C Payment” aufgeben – jetzt den Firmenkunden “fesseln” – nicht dass der auch noch wegläuft.

- Eine schlaue Kooperationsstrategie entwickeln – vielleicht sogar mit Apple und Google kooperieren?

- Jetzt schnell die weiteren Investments in HCE Apps stecken und In-App Payments zusätzlich rein deutsch entwickeln. Da ganze ohne eigene wirkliche etablierte In-App Akzeptanz und den Rahmenbedingungen, daß man die Akzeptanzseite als Bank de-facto nicht mehr kontrolliert?

- Sich langsam mit der Rolle als “Abwickler und Steigbügelhalter” abfinden und darauf fokussieren. Die bösen bösen Vorgänger im Haus haben halt die PayPal-Entwicklung nicht richtig eingeordnet und man muß es jetzt selbst ausbaden. Disclaimer: Diese Strategie funktioniert nur, wenn man selbst noch nicht in der Bank war in den Jahren 2003-2015 :)

- Geld sammeln und die Bude kaufen – nur wer kann sich das noch leisten? – außer GAFA und BAT

Unterdessen tut sich auch an der Feature- und Kooperationsebene einiges und die “Lücke” zwischen PayPal und den Paydirekts bzw. HCE-App-Versuchen der Banken wird von Quartal zu Quartal größer ohne einen Hauch einer Chance das Produkt überhaupt jemals “auf Augenhöhe” zu bekommen.

Kooperationen unterschiedlicher Art gibt es nun mit jedem Scheme – keine Angst – lieber “umarmen”

- https://techcrunch.com/2018/10/19/paypal-and-american-express-expand-partnership-will-allow-use-of-points-for-paypal-purchases/amp/

- https://www.wsj.com/articles/paypal-strikes-partnership-with-visa-1469135090

- https://techcrunch.com/2016/09/06/paypal-partners-with-mastercard-for-store-payments/

auch bei den GAFA’s et al scheint es weder Freund noch Feind zu geben

- https://techcrunch.com/2017/07/12/paypal-expands-apple-integration-will-become-a-payment-option-in-11-new-markets/?_ga=2.123354763.1673581568.1539543993-1510196584.1533849207

- https://techcrunch.com/2018/05/24/paypal-starts-deeper-integration-with-google-users-can-now-pay-directly-in-gmail-youtube-and-more/

- https://techcrunch.com/2017/07/17/paypal-to-become-a-payment-option-in-samsung-pay-including-in-app-online-and-in-store/

und die Merchants sowieso

interessant auch die Produktseite

Was sagt das Payment&Banking-Team zu den PayPal Zahlen?

Maik

Analogien helfen manchmal um das Drama zu verstehen: Man stelle sich vor, man würde jetzt versuchen eine nationale Suchmaschine, soziales Netzwerk oder Musik-Dienst zu starten. Gute Idee? Bin mir nicht sicher. Das Problem ist vor allem, das man nichts neues macht, sondern nur kopiert. Man muss dann schon wenigstens besser kopieren als das Original und auch das klappt nicht. Der Weg von PayPal überrascht nicht, ist vorhersehbar und mir fehlt die Phantasie wie man das einholen will.

Andre

Die Kollegen von PayPal machen wenig falsch, vieles Richtig und sind aus dem Alltag von Merchants und Zahlenden nicht mehr wegzudenken. Manchmal möchte man die Kollegen schütteln, da man nicht versteht, warum bestimmte Dinge nicht noch schneller gemacht werden, aber das ist wohl Folge der Größe, des weltweiten Ansatzes und des Erfolgs. Für die einstigen Herrscher über das Payment – die Banken – bitter zu sehen und wohl schwer aufzuholen. Wie einst mit Visa und Mastercard, scheint der Weg für Banken auch hier nur noch über die sinnvolle Zusammenarbeit im Sinne der Anwender zu führen.

Jochen

Wir haben das Dilemma hier im Blog bereits xfach in diversen Artikeln und Podcasts beschrieben. Wir haben sehr oft die Entwicklungen präzise vorhergesagt. Darauf wurde oft mit Wut, Ärger, politischem und persönlichem Druck und oft einfach Ignoranz reagiert. De-facto waren und sind wir nur der Analyst und Überbringer der offensichtlichen, schlechten Nachrichten. Den Vorsprung von PayPal auf Produktebene, finanzieller Ausstattung, Kundenvertrauen, Akzeptanz und Netzwerkeffekten ist de-facto von den, im Bedeutungsvergleich sehr kleinen, deutschen Banken und Sparkassen nicht mehr aufzuholen. Der Krieg ist verloren! Es ist Zeit die deutschen Payment-Generäle zu fragen ob ihre Strategie des jahrzehntelangen Ignorierens, Politisierens, Aussitzens, zu spät initiierens und handwerklich einfach schlecht gemachten Kopierens sinnvoll war. Viele Entwicklungen waren leicht vorhersehbar – auch schon Anfang der 2000er Jahre!

Was nun? PayPal scheint der Käfer des Payments zu sein… es läuft und läuft und läuft und läuft. US-amerikanische Banken haben sich längst damit abgefunden und sind schon lange auf den Weg der Partnerschaft umgeschwenkt. Die einzige deutsche Bank, die das schon seit langem verstanden hat ist die DKB. Sie schreibt ihren Kunden nicht vor wie sie zu bezahlen haben und führt keinen Kampf gegen Windmühlen. Anders als viele andere deutschen Banken, die Millionen in ihre Online-Payment-Aktivitäten versenken, verdient die DKB durch ihre Kooperationen u.a. mit PayPal gute Provisionserlöse.

Kilian

Überraschung schaut anders aus – eigentlich ist es gar keine Meldung mehr wert. Irgendwie normal – aber doch denke ich muss man sich immer wieder vor Augen halten, wo PayPal aktuell steht. Und dass der Zug hier für Europa eigentlich abgefahren ist, d.h. es gibt kein “gegen” PayPal mehr – nur noch ein “mit PayPal”. Wir haben dem nichts mehr entgegenzusetzen. Der Netzwerkeffekt tut sein übriges und wie gut dies PayPal verstanden habt, zeigt die Koop mit Google. Während der deutsche/europäische Bänker noch rechnet, ob man auf Transaktionsebene überhaupt Geld verdienen kann (was sicherlich schwer sein wird) – denkt PayPal in Reichweite und Netzwerk. Selbst eine Phase der “Schwäche” und einem “Innovationsloch”, dass man PayPal sicherlich 2015-2017 andichten kann, konnte niemand nutzen. Hier kommen handwerkliche Fehler leider dazu. Interessantes Gedankenspiel – warum nicht “kaufen” – der Preis wäre hoch und fraglich ob das sowohl die US Regierung als auch Google zulassen würden aber es wäre ein “Bold Move”. Wenn man danach einen strategischen Plan hat, sonst ist die Kohle schlecht investiert, auftreiben kann man sie bestimmt.