Enormous growth of cryptocurrency market till today

A market analysis by Philipp Petzka, CEO, Mintfort

The market and usage of cryptocurrencies has gone through a rapid growth since the official release of the bitcoin whitepaper by Satoshi Nakamoto in 2009. To illustrate the exponential growth rates , some graphs are shown below:

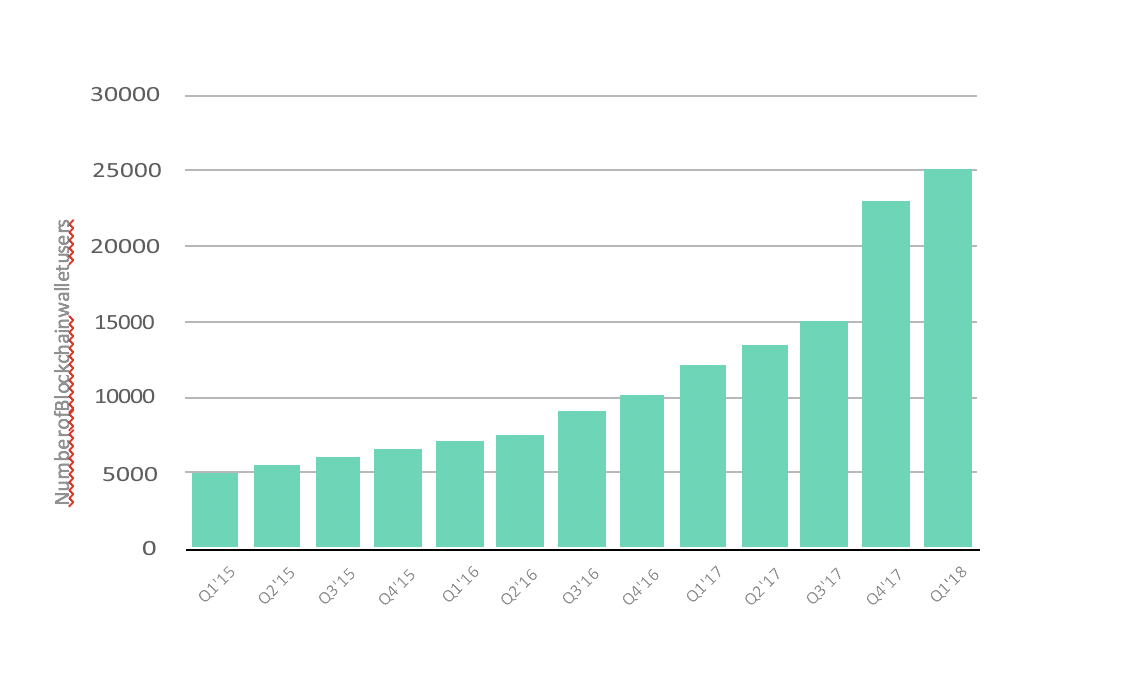

The number of registered bitcoin wallets has more than sevenfold over the last 3 years. Whereas in Q1 2015 around 3.180.000 wallets were registered on the blockchain, in Q1 2018 it were almost 24 million. That leads to an average compound growth rate of 96% and means, each year the number of bitcoin wallet users has almost doubled.

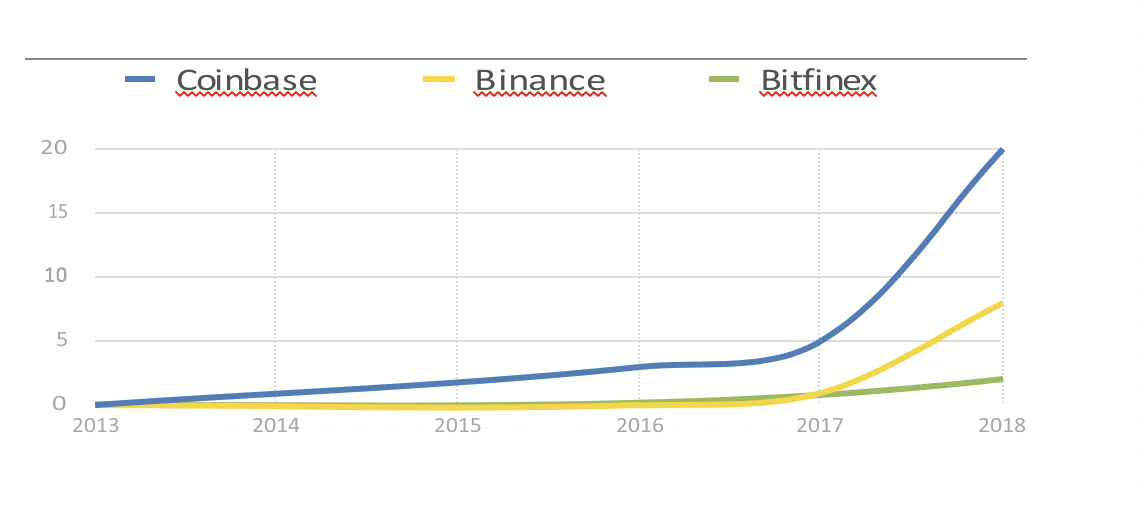

Another growth indicator is the number of users registered on exchanges. The largest exchanges today are Coinbase, Binance and Bitfinex measured by user numbers. The most dramatic growth faced Binance, the youngest exchange of the large ones in the market. Founded in June 2017 they are already managing a total of around 9 million users by today (Q2/2018). On January 10th they onboard 250.000 customers in just one hour according to their announcement one day later. Coinbase already surpassed 20 million users in Q2 2018.

Where are we in the market cycle?

Adoption: User Characteristics

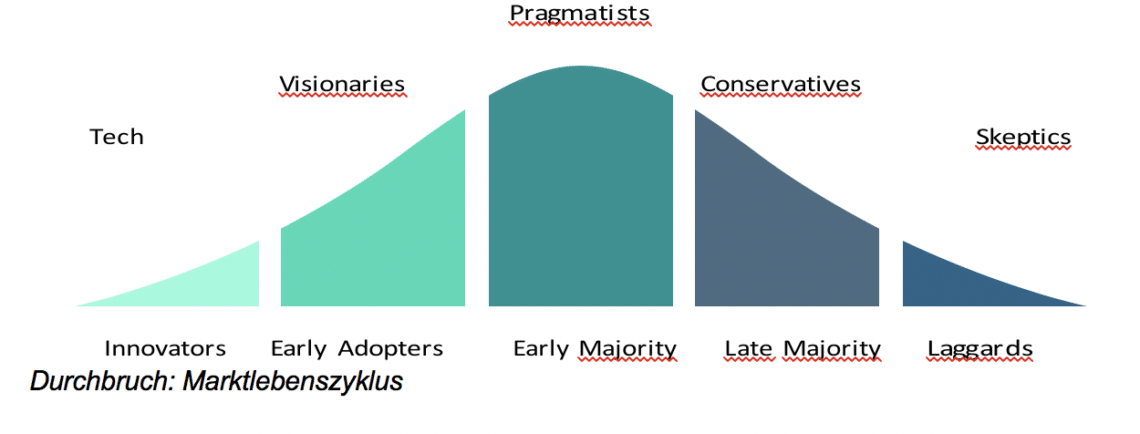

As much as the past market growth is appearing nicely it is only valuable in case the growth rates in the past can be continued in the future as well. An important indicator of where we are in regards to adoption in the market cycle is the characteristic of the average purchaser and user of cryptocurrencies and token.

Typical characteristics of current market participants are:

- Very tech-oriented

- Enthusiastic about blockchain and cryptocurrencies

- Consumes news and updates about the market on a daily basis

- Acts like a speculator and expects the market to rise massively

- Libertarian mindset and non-religious

- Is averagely at young age, between 18 – 30 years

Putting the described characteristics into the bigger picture of the adoption cycle, one can guess that we are still in the stage of early adoption. This conclusion aligns with the exponential growth rates we during the past years.

Penetration: Market lifecycle

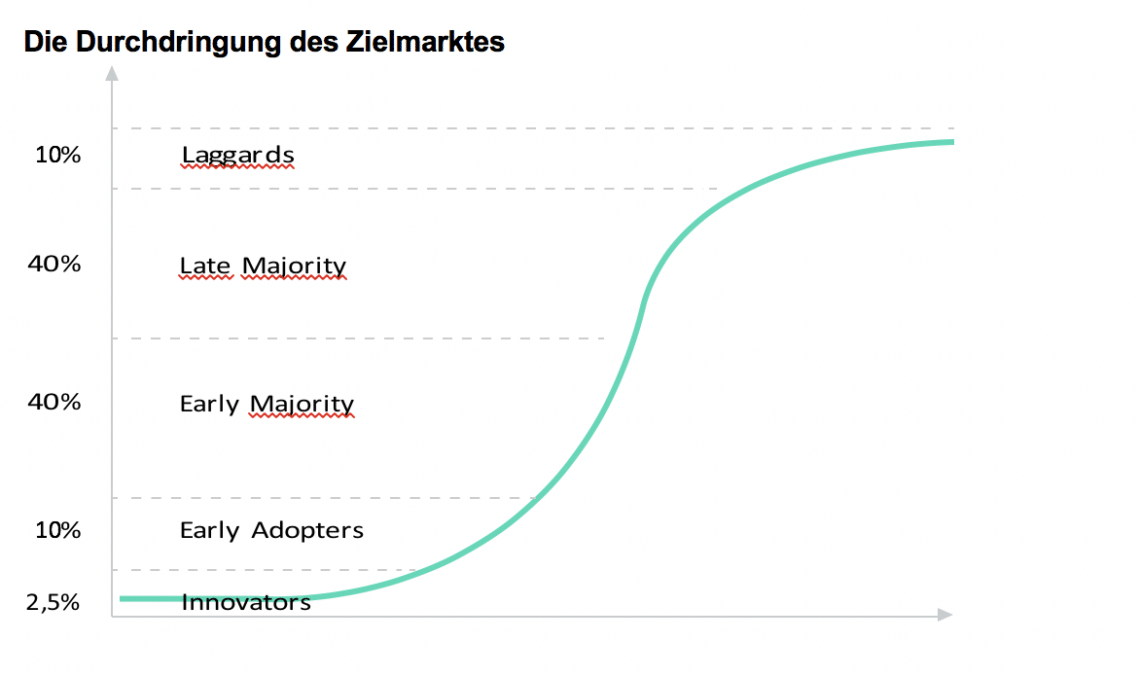

Another way to estimate the state of a market lifecycle in regards to a technology or product is to take a look at the market penetration. According to a survey made in Q1 2018, only 8% of Us-Americans have purchased cryptocurrencies. Though there are other countries such as South Korea, Japan or Singapore, where market penetration is at way further stage, America is taking the lead here in regards to adoption in the western world since another study showed, 53% of randomly interviewed cryptocurrency purchasers are from North or South America.

Assuming that virtual currencies are a potential key technology in regards to the exchange of value or goods and due to its characteristic as a circulating product it is a likely scenario that they are being fully or partly used by the majority of the society in the future. A usage among 8% of a population then indicates an early adoption stage, too.

Growth Expectations

Cryptocurrencies

As current market characteristics described above are showing, growth rates from the past are likely to be seen continually during the next years, too. Putting the results of the mentioned market penetrations study into relation, the huge upside potential becomes obvious.

- 53% of cryptocurrency investors are American

- In the US only 8% have purchased cryptocurrencies. In our calculation we are assuming this rate for whole North America.

- Population of the North America is 579 mio.

- World population is 7.6 billion

Adoption rate of cryptocurrencies in the world outside of North America could be calculated as follows:

People holding cryptocurrencies in North America:

579.000.000/100 x 8 = 46.320.000 people

People holding cryptocurrencies in the rest of the world:

46.320.000/53 x 47 = 41.076.226,40 people

Adoption rate outside North America: 100/7.021.000.000 x 41.076.226,40 = 0,585%

Growth expectations are depending on expected adoption rates:

8% adoption rate globally: 608 mio. people, potential growth rate: 595,68%

15% adoption rate globally: 1.140 mio. people, potential growth rate: 1.204,40%

30% adoption rate globally: 2.280 mio people, potential growth rate: 2.508,80%

Assumed growth expectations are calculated conservatively. In case cryptocurrencies are achieving a status where they take their place next to traditional assets such as stocks, gold as well as traditional currencies, an adoption rate of 30% can be easily seen. What is considered here is only the quantitative adoption. A potential deepness of market penetration could work as a multiplier on top of the calculated growth rates. The reason for such a development are several potential growth drivers. Some of them are named in the next chapter.

The digital Token economy

Besides cryptocurrencies themselves the digital token economy is likely to play an important roll in the (near) future. Blockchain-based assets have high potential to disrupt markets globally. Some industries and assets expected to be traded on the blockchain in the future are (not limited to):

- Stocks and other forms of company shares

- Real estates

- Intellectual property rights

- Personal data/Digital advertising

- Cloud storage

- Insurance policies

- Charities

- Credits

- Energy

- Licenses

The world economic forum predicts that 10% of the worlds GDP will be stored on the blockchain by 2027. Taking the current worlds GDP in terms of purchasing power parity of 107.5 trillion US$

And assuming an expected annual average growth rate of 3%, 10% of the worlds GDP in 2027 leads to a 10/100 x 107.5 trillion US$ x (1,03^10) = 14.3 trillion US$.

This enormous potential market size is not to be obtained by institutional investors. The token economy is essentially characterized and driven by decentralization and its exchange between individuals by cutting out the middle-men. There is going to be a high demand for platforms and gateways to access und use Token as assets for the broad mass of individuals.

Growth drivers

Superior technology

When it comes to asset management it is obvious that a tokenization of assets could bring various advantages. Trading assets on the blockchain will lead to

- Higher liquidity of already liquid but especially illiquid assets such as real estates or licenses.

- With tokenization, whole new classes can be traded in public now, which was very difficult in the past. One can buy a fraction of a patent, license or publishing right.

- The reduce of information asymmetry due to immutable distributed ledger storage. Who owns how much of an asset can now be publicly monitored.

- (Currently) less KYC measurements are opening markets to private investors

- Enormous cost saving potential in regards to transaction costs between buyer and seller since the middle-man, the broker, is not needed anymore during the transaction process.

- Higher security and less fraud since actions and transaction are public and immutable. The blockchain secures the validation of transactions and ensures the possession relations of assets.

- A higher speed of asset exchange due to automated transaction validations.

Of course, these developments depending on the awareness and adoption of blockchain technology itself. Brokers or real estate agents will not just give up their market power which they undoubtedly have. Therefore, the adoption is rather to be expected from the „long-tail“: Individuals and smaller players who are not going the traditional way to raise capital or exchange assets. The positive effects such as cost reductions or speed are undeniable and will increase the pressure from the „bottom“ to the top and force big payers to change their business concepts and traditional way of management.

Further regulations for mass adoption

Regulators in almost every country have been hit by the rise of cryptocurrencies unprepared.

That’s why we experienced so many different approaches to the topic. From a complete crackdown in China, „half legalization“ of only top currencies in Thailand or paralyzed stillstanding in Germany all the way down to a quite open and free market approach in Singapore or even the official declaration as currencies in Japan we have seen almost everything so far.

After the first big wave will have calmed down a bit, the different approaches are likely to narrow each other and build a more homogenous character globally and then consenting in a widely accepted standard. Though such regulations often lead to restrictions of the free market they will help to allow big players as well as banks and less experienced individuals to enter the market less doubtful. Mass adoption can only be seen if each participant knows whats legal or illegal.

Asian market adoption

Asia Pacific will play a key role in regards to market growth. Its population as well as its markets are growing constantly. In addition, a high percentage of its population is still unbanked and have no access to assets bank accounts. They are high potential users for cryptocurrencies since no infrastructure but only smartphones are needed to exchange the digital money. Such key facts are pairing up with a high affinity to technology in Asian countries.

Last but not least we are expecting China to open its market again in the near future after its regulators have a clear picture of the situation which will cause a rapid growth of users in the ecosystem.

Low barrier of market entrance

We already hinted to this point in the ‚superior technology“ section. To participate in the token economy it is not a requirement to meet strict regulations. Any company can issue a token to display their cashflow or company value and any individual can buy them without going through strict KYC measurements of their broker. The costs of creating and issuing a token are vanishingly low in comparison to issuing company shares to investors or even publicly during an IPO. We are expecting many traditional companies to take first steps into the market in the near future. The messenger service „Telegram“ already showed how successful an ICO can be if the issuer has already a working business.

Potential Growth Restraints

Lack of legal frameworks (Token)

To attracted the broad mass of investors a legal framework in regards to their investment needs to be in place. So far, the whole token economy is based on trust. Investors need to trust the company or individual, who is issuing the token, that they are actually fulfilling their promises really working on the product. A damper here of course is the high liquidity. In case targets are not reached, investors can easily sell on the market.

Volatility

The high volatility of cryptocurrencies is definitely an issue. On the one hand it is scaring away conservative investors who are not open to step into such a high risk market. On the other hand, volatility is causing a negative effect in regards to a wide adoption of virtual assets as currencies. In case markets and currency prices are strongly rising nobody will buy their coffee with it but is rather leapfrogging a further increase of price.

Over-regulation

Governments tend to regulate rather stronger than less. Since the market for virtual currencies is quite young it is facing the risk to be recognized as a thread by governments which could cause in a crack-down on such assets and its use. So far, we do not see these development except in some specific regions such as China or the US but the latent risk is present.

Potential market for banking applications

General demand for digital banking

Due the global spread of the internet since the early 2000’s as well as wide adoption of smartphones and other mobile devices customers are increasingly expecting a digital service in regards to banking and fund management. The rise of banking apps such as Revolut or N26 are underlining this trend. A study published by Accenture is describing a shift of customer behavior and expectations. New characteristics are i.e.

- Younger consumers would increasingly prefer banking solutions from tech concerns such as Facebook or Amazon instead from traditional banking providers

- Automated support such as chat-bots are welcome

- A demand for personalization of the banking experience

- Strong protection of personal data builds trust.

Demanded tools defined by the fastest rising banking user, the so-called nomad, are

- Peer-to-peer transactions

- Contactless payment solutions

- Cheap cross-boarder wire transfer tools

- Direct access tools for virtual currencies

- Budget management tools.

Already today, 46% of customers are using only digital channels in regards to banking which is an increase of 19% in just a 4-year period whereas 82% of millennials who are owning a smartphone are using mobile banking solutions. That aligns with trends in APAC markets which are mobile first markets and where the majority of the population is using FinTech solutions to bank with their mobile phones.

General demand for virtual currency banking

The rising adoption of cryptocurrencies as well as the ongoing technical development of blockchain-based asset management are leading to a demand for banking applications capable of handling the new requirements. Current solutions are split up and are specializing in certain processes i.e. exchanging assets (market places) or storage (wallets). Spending often only works while staying in the same currency. Besides, the majority of current solutions are poorly implemented in regards to their interfaces. From a UX/UI point of view there is a room to improve customer experience which is also necessary for broad adoption and frequent usage. According to the mentioned study of Accenture, 50% of banking nomads are demanding access to virtual currencies already today. That is another indicator of a rising adoption since nomads are a growing user group.

Demand in emerging markets – banking the unbanked

Researches of the world bank in 160 countries have uncovered a 380$ billion opportunity in regards to banking demand in certain regions around the globe. Whereas in western countries like Norway, UK or Germany more than 98% of the population at an age older than 15 years have a bank account, regions in central Asia and Africa are far behind. The bottom here builds Turkmenistan where only 1.8% have an account. It is accompanied by Nigeria (3.5%), Madagascar (5.7%) and Guinea (6.3%).

Summing up the numbers is leading to approximately 2 billion people who are financially excluded.

People in emerging markets usually do not participate in the formal banking system. Most transactions are settled in cash. Access to institutional credit is very limited and there are no ways to securely safe and invest money. In total, only 17.9% of adults in low-income economies have a debit card. But there will be a shift. As studies of major market researchers, such as PwC, show, emerging markets are about to grow significantly faster than the established ones. PwC predicts Vietnam, Indonesia and Nigeria to be the fastest growing economies within the next 30 years. China and India are expected to surpass the USA and becoming the two largest economies on the planet. Emerging markets are already leading the growth in global banking revenue which is likely to be continued.

The largest demand is being generated by small- and medium-sized businesses who need credit to grow. In total, there are approximately 200 mio financially unserved enterprises causing a 2.2 trillion credit gap according to a McKinsey analysis. Here, as well as in regards to consumer banking, digital and in particular mobile banking plays an important role. Reasons are the easy access with mobile devices (most of those countries are mobile-first markets), efficient onboarding and fast handling in regards to payments and micro loans. In addition, such remote structures mobile banking provides, leads to lower risks and efforts on the banks side. Penetration can be reached at much lower costs, which causes benefits on customer side as well.

What fundamental shifts will we see in the finance industry?

The rise of decentralized money

Blockchain technology in combination with digital banking enabling people to take back control over their money. Though the problem of trust in regards to banks is playing only a small role in western countries, it becomes obvious in certain countries or situations. Events like the bail-in in Cyprus in 2013 or the bankruptcy of Lehman Brothers in 2008 as well as hyper-inflation periods in countries such as Venezuela or Zimbabwe where access to cash is limited to prevent a bank run are sharpening the mind of the affected people. Another infamous example was the sudden devaluation of the 500s and 1000s Rupee notes in India, a country where the majority of savings is being hold in cash. Those examples show: Savings and properties are not safe in case of a financial emergency. We already saw how cryptocurrency adoption drastically rose in the named countries. They are easy to be adopted and are protected from seizure of third-parties (the governments in this case). As shown above, money will become digital, especially in emerging markets. The combination of such a trend and the fact that especially those countries in emerging markets are more exposed to risks due to their often unstable economies and politic situations is leading to a almost necessary next step which is decentralized money. Cryptocurrencies are becoming a safe haven first. A wider adoption will then expose the advantages of them, whereas in western countries, embossed by individualism and digital trends, the awareness will rise as well.

Tokenization of assets

Due to the superior technology of the blockchain and its possibilities, okenization will become a major trend. It’s potential to reduce costs and enhance transaction speed will attracted major players in the market to tokenize their assets instead of issuing them in the traditional way. Besides blockchain-related companies who are already choosing an initial coin (or oken) offering instead of traditional finance rounds we will see more traditional companies entering the space too. Such a development will be very healthy for the image of token as we as cryptocurrencies in general and attract a broader mass of investors. As mentioned in the beginning of this paper, the world economic made a prediction in regards to future asset storage. Being stored on the blockchain will enable them to be traded on a marketplace. It means, besides obvious values such as shares, other types of assets will be tokenized as well to be traded and exchanged.

Currency competition

Besides Bitcoin which is currently being seen as a commodity rather than a currency by the majority of investors, there are more than 1500 other decentralized currencies available to be used. In addition, central banks are also considering to issue their currencies on the blockchain. Cheaper conversion fees and lower maintenance costs are now giving owner/users the free choice to prefer a certain currency. In addition, in case of mis-use or low value stability a fast switch to other alternatives is easy to be made. Such a scenario setup will lead to a competition between all currencies existing. Again, power is being redistributed to the private individual.

Investments becoming private

Cryptocurrencies and Token are the assets of the „small investor“. Low costs and the possibilities to break down values into tiny digital fractions (Token) enable even low net-worth individuals to enter a market and make an investment. The Long-tail of „average“ people behind institutional investors is likely to bring a wave of new liquidity across markets, re-adjusting the distribution of power in regards to market influence and causing a shift into the direction of a more privately owned distributed economy.

Full Digitization

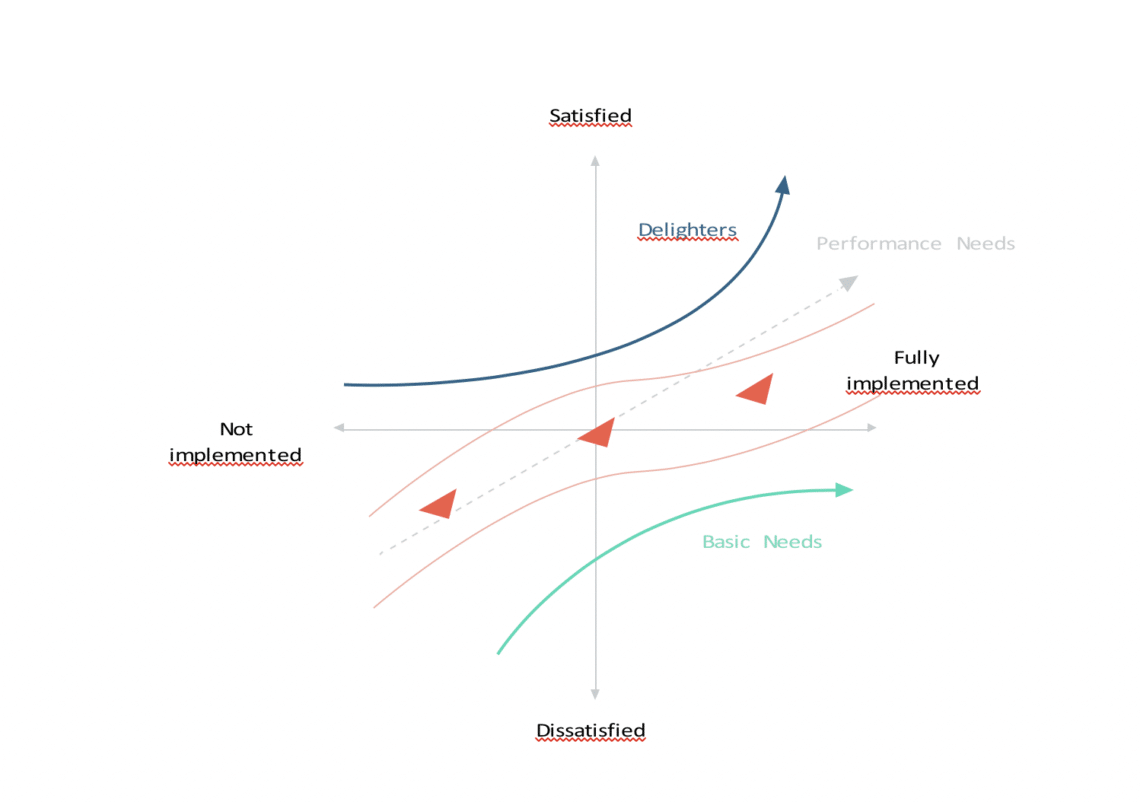

Digitization already changed the way people are banking and investing. Interfaces activities are available online and mobile banking is on the rise. We will see an ongoing trend within the next years. A further integration of digital components in our daily lives is sharpening the awareness of digital values. It will become usual to have digital-only access to services and to purchase digital counterparts of real assets. In exchange, advantages of the digital economy are becoming more normal. In regards to banking characteristics features such as fast transactions, on-demand management or global access are shifting from exciting features to a basic need demanded by customers. To fulfill the Gap on the delightful innovation side the blockchain technology will come in place.

Commentary Conclusion

Banking as we know it is facing a disruptive change. Traditional banks with large branches, a lot of paperwork, high fees and slow service are going to be things of the past. Globalization, digitization and the rise of new technologies are driving customer requirements onto a new level and fueling the growth of new users groups. The adoption of cryptocurrencies and tokenized assets are likely to be continued all around the globe due to the advantages they bring to the people. Once again superior technology has paved the path for the next global revolution, this time a financial one.

Sources

- https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/financial-services/sea-fsi-digitaltransaction-banking-noexp.pdf

- https://www.accenture.com/t20170125T114252Z__w__/us-en/_acnmedia/Accenture/next-gen-3/

- DandM-Global-Research-Study/Accenture-Banking-Global-Distribution-Marketing-ConsumerStudy.pdfla=en

- https://news.bitcoin.com/survey-says-8-of-the-american-population-now-own-cryptocurrency/

- https://www.zerohedge.com/news/2013-03-10/demographics-bitcoin

- https://cointelegraph.com/news/bitcoin-users-who-they-are-and-what-they-do

- http://go.csiweb.com/rs/361-IGT-147/images/WP_NPT_MER_DigitalBanking.pdf

- https://thefinancialbrand.com/65628/digital-banking-consumer-trends/

- http://www.atimes.com/mobile-banking-asia-future-now/

- https://www.pwc.com/gx/en/world-2050/assets/pwc-world-in-2050-slide-pack-feb-2017.pdf

- https://centricdigital.com/blog/digital-transformation/how-emerging-markets-are-tapping-intoconsumer-banking-technologies/

- https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/

- Employment%20and%20Growth/

- How%20digital%20finance%20could%20boost%20growth%20in%20emerging%20economies/

- MG-Digital-Finance-For-All-Full-report-September-2016.ashx