A guest article by Dr. Andreas Spengel, Senior Vice President Market Development at Mastercard Germany & Switzerland

Fueled by the digital transformation and changing customer needs, European fintechs have been shaking up the payment world for several years now with their new, often disruptive business models. Thanks to their lean organisation, agile working methods and innovative digital mindset, fintechs can often implement technological solutions faster and more pragmatically.

But the fintech sector is also in a state of upheaval. Second- or third-generation fintechs are competing with industry pioneers. With increasing market maturity, new requirements arise. Those start-ups that meet the high expectations of customers or occupy a niche, for example by addressing a specific target group, will prevail.

Growth market Gen Z

Gen Z, for example, is considered an attractive growth market for neobanks. Many see great potential in the segment of children and young people born between 1997 and 2010. Gen Z is highly digitally savvy.

The smartphone is their constant companion and they expect everything with a tap on their screen. For example, the start-up pockid specifically addresses these young customers and offers them a modern digital service with a mobile bank account, a debit mastercard and a convenient banking app. In this way, young people learn to manage their finances independently.

Most have little exposure to financial products at this age. 30 percent do not yet have a bank account at all, a third use their parents’ cards or other means of payment to shop online. At the same time, the product also allows parents to control their children’s spending or set limits for them.

Innovation in the fintech space is not only being driven by startups, but more and more customer aggregators are discovering the opportunity to offer additional value to their customer base. At the end of last year, Germany’s largest comparison portal Check24 launched C24 Bank. This is an open banking platform which in the medium term is also to offer Check24’s sales partners a sales interface, for example for mortgage finance, investment products or loans. The core product of C24 Bank is three account models that are offered to customers exclusively with the Debit Mastercard. The focus is primarily on the 15 million Check24 customers who search for and compare products on the Internet. Check24 has a loyal customer base and knows the relevant touchpoints of its customers. The offers can thus be optimally tailored to the needs of the bank’s customers. At the same time, they benefit from more transparency and choice on the portal.

But the B2B segment is also becoming increasingly important in the fintech world. Increasingly, especially in a global context, companies, which often operate in the background, are playing an important role. They enrich the established banking world with additional features, enable simpler and faster processing between the numerous payment partners in certain niche areas or, last but not least, ensure that customers get what they are looking for thanks to automation and comprehensive data analyses.

“The B2B segment is becoming increasingly important in the fintech world.”

Applications and functions can be obtained flexibly “as a service”. The Open Banking approach also enables the use of standardized API interfaces.

A good example of this is the Danish start-up Pleo, which provides medium-sized companies with virtual and physical company credit cards for employees with software to automate expense reports, making it easier than ever for them to be reimbursed for company expenses. With the corresponding app, images of payment receipts can be uploaded and inserted into the appropriate expense category. Completely digital and automated accounting saves companies time and money. In addition, with the help of Mastercard technology and joint product development with J.P. Morgan, Pleo was able to take user-friendliness to a new level with interfaces to accounting tools such as DATEV.

market diversification

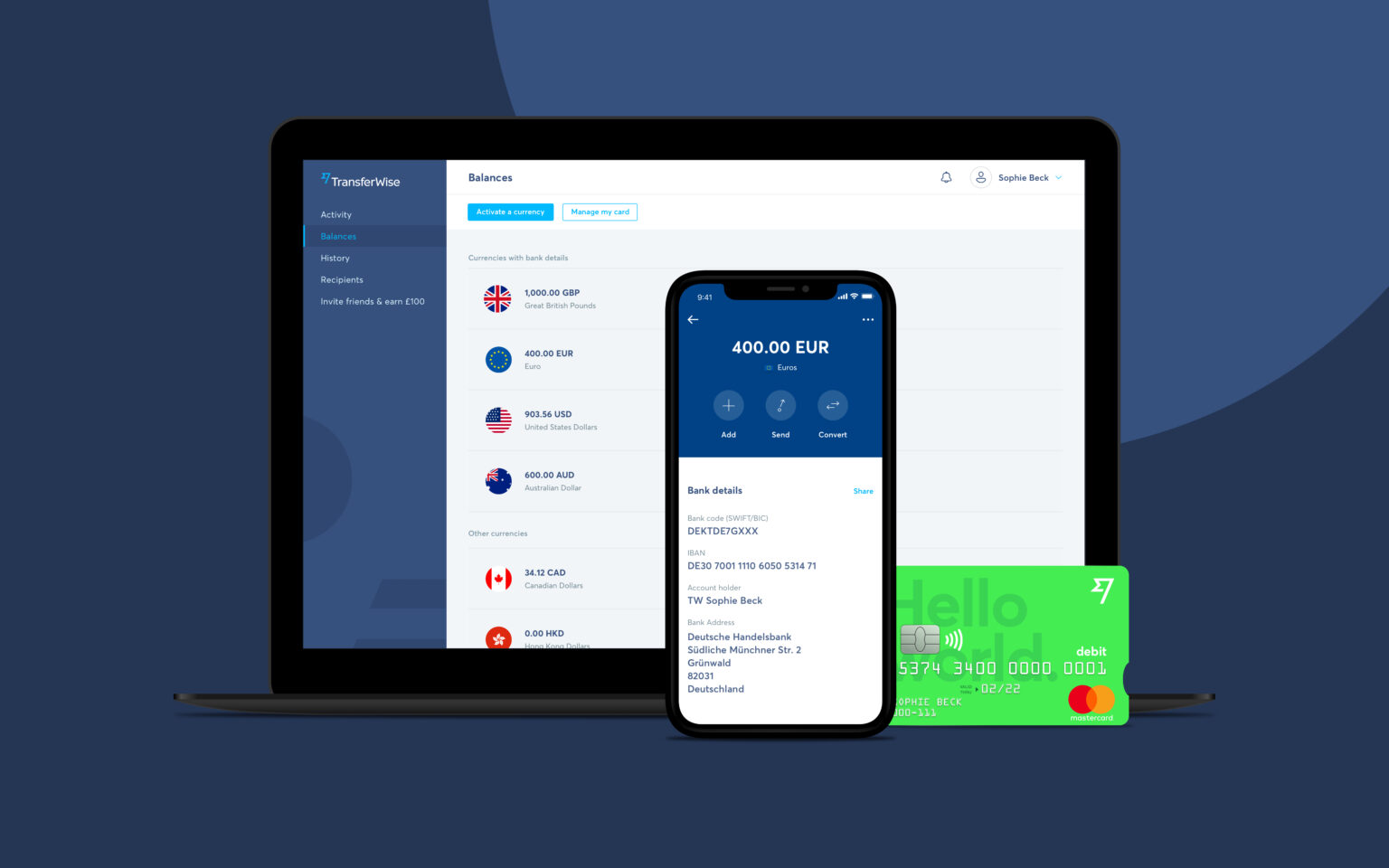

Another example of the market fanning out further is fintech Wise. Wise aims to replace the traditionally expensive international remittance business with a borderless multi-currency account with debit mastercard for expatriates, freelancers, travelers and businesses. Wise customers are increasingly using the borderless account, which now includes direct debit and instant transfers to friends, as a fast, easy and affordable international banking alternative. Since its launch in 2018, Wise has issued over one million Mastercard cards, which cardholders can also use to access numerous mobile payment solutions in the European Economic Area. In addition, customers with a Wise multi-currency account in selected European countries can send money to any Mastercard card in near real-time using Mastercard Send.

There are many new opportunities for fintechs in the banking and payments industry, and the Corona pandemic has reignited digital issues that were already on the agenda. In the future, however, it will probably be even more important for fintechs to become part of a comprehensive ecosystem and to maintain and further sharpen their own positioning within this.

Equal competition for all

One thing is clear: the digital transformation will intensify and continue to be aligned with the needs of the market. There is no alternative to this. Collaboration with fintechs can serve as a catalyst in this regard.

The interface, and thus access to the account for third parties, levels the playing field between traditional financial institutions and fintechs, which have been operating on an equal footing at the latest since the PSD2 directive came into force. The aim of PSD2 is to enable competition for all participants on equal terms through open banking, thus creating the space for technical innovation.

Mastercard has been committed to fintechs for many years and helps them to successfully shape the digital transformation. Through itsFintech Expressprogram, Mastercard leverages its partnerships and provides startups with its expertise and technologies that enable efficient access to the ecosystem, rapid market entry and global expansion.

The potential for digital financial services is enormous and largely untapped – both for fintechs and established financial institutions. Where some are faster at product development, others enjoy long-built trust, which is especially crucial in the payments industry. In the future, fintechs can become the link between retailers and banks and fill interesting market niches in some places that banks have left behind or have not yet actively occupied.