Der US-Web/Domainhosting-Anbieter godaddy hat die Übernahme des Silicon Valley Payment-StartUps Poynt für $365 Millionen angekündigt. Der Innovator des Smart-POS-Konzepts mit App-Stores auf POS-Zahlungsterminals geht sowohl für Silicon-Valley-Maßstäbe als auch im Kontext hoher Payment-Multiples vergleichsweise günstig an einen reinen Onlineanbieter. Ist das Smart-POS-Konzept mit App-Stores auf den Zahlungsterminals gescheitert?

Poynt wurde 2013 gegründet von Osama Bedier, einem ehemaligen hochrangigen Manager von PayPal und Google. Bei PayPal schaffte er eine Karriere vom Entwickler bis hin zum Vice President unter dem Vorstand und war unter anderem Ende der 2000er Jahre zuständig für die neue Paypal-Entwicklerplattform und die Mobile-Strategie. Danach wechselte er zu Google und baute dort Google Wallet (heute Google Pay) auf – der erste große Versuch von Google im Payment. Danach gründete er Poynt. Glaubt man Techcrunch, so hat Poynt seit Gründung insgesamt $133 Millionen eingesammelt, unter anderem vom Payment-Acquirer Elavon.

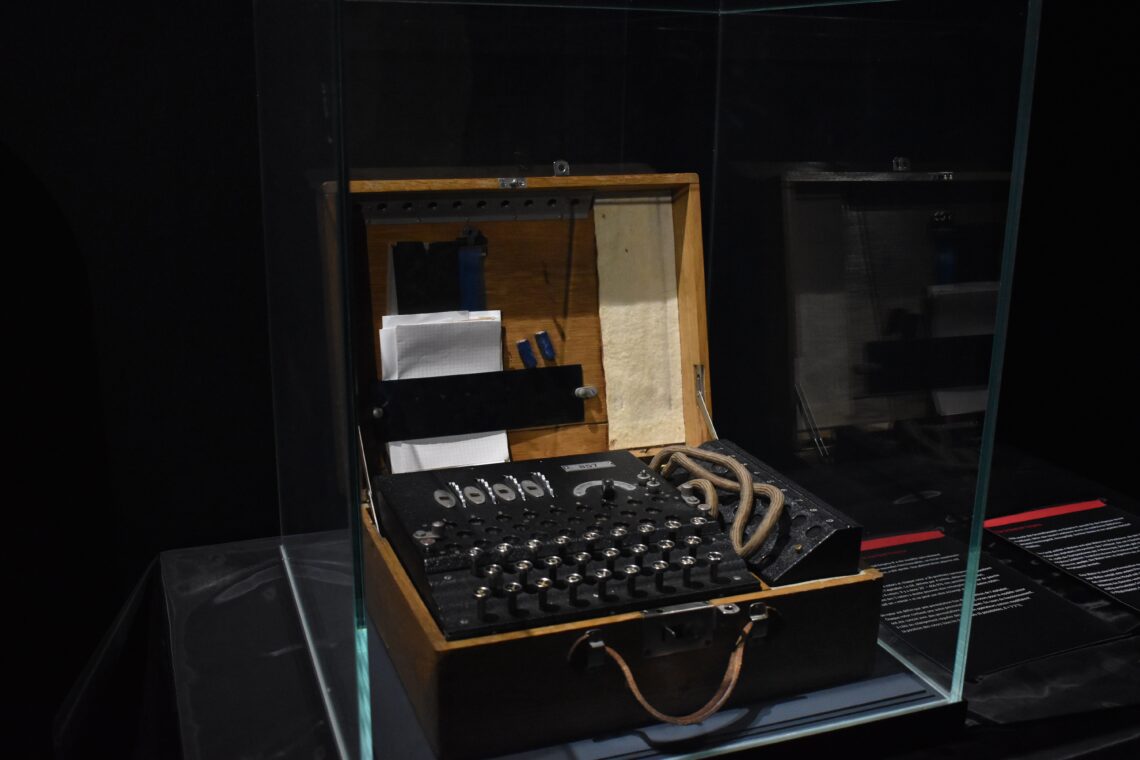

Poynt ist zum einen angetreten die POS-Payment-Terminals aus dem Design-“Schick” der 1970er zu befreien und diese ins 21. Jahrhundert zu bringen. Warum auch 2020 POS-Terminals immer noch aussehen müssen wie klobige Rechenmaschinen aus dem letzten Jahrtausend bleibt das Geheimnis der etablierten Hersteller.

Das es anders geht, zeigten Poynt und diverse mPos-Anbieter wie SumUp und Co. Neben einem modernen Design dachte Poynt das Payment-Terminal auch in einem neuen Kontext. Poynt ist einer der ersten Innovatoren des Smart-POS und stellte erstmals einen App-Store für das POS-Terminal vor. Händler, Payment-Service-Proivder und Acquirer konnten erstmals einfach und bequem zusätzliche Anwendungen auf dem Terminal installieren. Unternehmen wie Clover (von First Data übernommen) oder Aevi (Spin-Off von Wincor-Nixdorf, heute Diebold-Nixorf) bis hin zu Enfore haben das Konzept übernommen. Schon 2016 stellten wir uns im hier im Blog bzw. in einem unserer Podcasts die Frage, wo die “Smartness” besser aufgehoben ist am Point-of-Sale: in der Kasse oder im Terminal.

Der Poynt-Deal überrascht auf mehreren Ebenen

1) Bewertung: Die Bewertung von Poynt ist angesichts von sehr hohen Payment-Multiples und Silcon-Valley-Bewertungen eher niedrig. Das ist ein starker Indikator, dass die Business-KPIs offensichtlich nicht so rosig waren. Ob Poynt nun anhand von hohen Payment-Multiples und noch viel höheren Software-As-a-Service Multiples bewertet wurde. Offensichtlich hat die “smarte” Komponente des Smart-POS-Konzeptes nicht so stark eingeschlagen wie erhofft.

2) Exit an Domain-Hoster: Ausgerechnet ein reiner Onlineplayer, ein Anbieter von Domainhosting für KMUs, übernimmt Poynt als POS-Player um seine Payment-Kompetenz zu erhöhen. Ja, ein Domainhoster kann seinen KMU-Händlern jetzt neben Online auch stationäres Payment anbieten. Aber braucht es dazu eine Übernahme? Warum keine Kooperation und warum für diese eher niedrigere Bewertung? Warum kein Exit an einen Payment-Player? Haben die nicht “genug” geboten?

3) Elavon als strategischer Investor von Poynt, mit den besten Erfahrungen im POS-Payment-Business, hat seinen Anteil sogar verkauft. Wäre das POS-Business von Poynt relevant für den Handel, so hätte Elavon sicherlich nicht verkauft, sondern eher übernommen.

Was bedeutet das für die Industrie? Ist Smart-POS-gescheitert?

Wir hatten schon 2016 im Podcast zu dem Thema lange diskutiert und uns die Frage gestellt, wo eine zusätzliche “Smartness” im Payment besser angesiedelt ist: im Zahlungsterminal (Aevi, Poynt) oder der Kasse (Clover, Enfore). Interessanterweise müsste jetzt, Ende 2020 die Frage eher sein: Braucht es überhaupt eine Smartness im POS-Zahlungsverkehr?

Was über alle Player auffällt: Sie haben alle mehr versprochen als geliefert. Poynt und Aevi waren sehr laut, wenn es um die App-Store-Konzepte in Terminals ging. Von beiden Playern hörte man in den letzten Jahren immer weniger. Aevi beispielsweise rutschte von der ehemals profitablen Business-Unit des Wincor-Nixdorf-Konzerns (Jahresüberschuss und Bilanzgewinn des Rumpfgeschäftsjahrs 2015/2016 betrug jeweils €2,5 Millionen) in rote Zahlen und konnte sich bis 2019 nicht davon erholen. Der 2019er Jahresfehlbetrag liegt bei € -3,1 Millionen und der Bilanzverlust aller Fehlbeträge seit 2016 liegt mittlerweile bei € -31 Millionen. Auch bei den Umsätzen ist Aevi keine Wachstumsstory. Als Anfang 2017 mit Nelson Holzner ein Fintech-Experte als CEO-Gründertyp angeheuert wurde, hatte man noch einen PR-Stolz auf €80 Mio. Umsatzerlöse und nannte sich “eines der größten FinTech-Unternehmen in Europa”.

Und weg ist die Fantasie

Die 2019er Umsätze liegen nur noch bei €29 Millionen, was ein kleines Wachstum seit 2018 darstellt, als das Unternehmen noch €25,5 Mio. Umsatz machte. Der Vergleich Enfore/numberfour AG, die auch bei uns im Podcast Anfang 2019 viel ankündigten, ist leider nicht möglich da die Gesellschaft im deutschen Handelsregister seit 2016 keine Bilanzen mehr veröffentlicht.

Die “durchwachsenen” Zahlen von Aevi, die fehlenden Zahlen von Enforce und der “bescheidene” Exit von Poynt an einen branchenfremden Domainhoster und nicht an den strategischen Investor Elavon zeigt vor allem eines: Die Fantasie aus dem Smart-POS-Segment ist entwichen. Wurde das Thema einfach zu früh angegangen? Haben Lösungen ein Problem des Handels gesucht und schlicht nicht gefunden? Wer weiß… Es bleibt weiter interessant zu sehen wie sich Poynt beim neuen Inhaber und wie die anderen Smart-POS-Anbieter sich weiter entwickeln.