In addition to the growing trend towards cashless payment, as well as payment via mobile phones or the discussion about “connected cars”, which (should) open up completely new possibilities for “mobile commerce”, terms such as “platform ecosystem” or “platform economy” dominate various specialist and entertainment media.

https://www.ehi.org/de/pressemitteilungen/liebe-zum-bargeld-laesst-nach/

https://www.mobilemarketer.com/news/how-in-car-tech-will-give-new-meaning-to-mobile-commerce/530422/

https://www.cio.com/article/3139401/platform-ecosystems-a-new-strategy-for-generating-profit.html

https://hbr.org/2019/05/a-study-of-more-than-250-platforms-reveals-why-most-fail

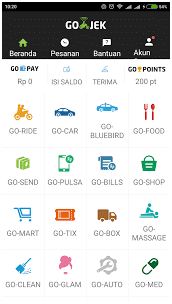

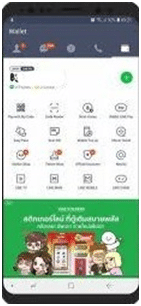

At one point or another, the term “SuperApp” is mixed under publications. While the term “SuperApp” was first coined almost ten years ago in the context of a Blackberry competition, its success story is closely linked to two suppliers from China, whose logo can also be found at many points of sale in Germany. In addition, providers from such diverse areas as mobility services (Grab, GoJek) or social networks (Line) are standing for the triumphal march of SuperApps in large parts of South East Asia and have become an indispensable part of the daily life.

https://channeldailynews.com/news/the-blackberry-super-apps-challenge/11529

https://businessmirror.com.ph/2019/05/27/grab-turns-7-with-the-super-app-services

https://payspacemagazine.com/tech/super-app-what-is-it/

https://www.straitstimes.com/business/companies-markets/uphill-battle-for-s-e-asias-super-apps

What they all have in common is that a wealth of functions and services such as chatting, planning and inviting appointments and meetings, ordering taxi or other transport services, buying products or services, buying local transport tickets, booking excursions or hotels, organizing and using vouchers and promotions, making money transfers, etc. are bundled under the umbrella of a core service for daily needs.

A Single sign in as well as integrated payment functions for customers and service providers in the ecosystem, underline the “seamless” customer (CX or Customer) as well as retailer experience. Two factors identification is usually guaranteed by ID data or telephone number and OTP (pin code via SMS). In addition to the possibility for small and medium-sized enterprises (SMEs) to tap into new customer groups and connect to the digital age without large initial investments, regional and international e-commerce players are increasingly jumping on the train and entering into partnerships.

https://www.entrepreneur.com/article/333897

https://kr-asia.com/go-jek-introduces-e-commerce-feature-go-mall-in-partnership-with-jd

https://www.techinasia.com/planting-thriving-forest-partnerships-key-grabs-superapp-vision

Against the background of the rapidly growing importance of integrated payment options (e-wallets) of SuperApp operators as well as other service providers (especially telecommunications providers) in the economies still dominated by cash years ago as well as the already started or announced integration of financial and insurance services within the framework of SuperApps, the first banks have started to extend their app solutions to e-commerce offers (goods and services).

The gradual liberalization of financial systems in various countries within the region, which is reminding of initiatives in Europe (not at least PSD II, Open Banking), is accelerating development to the benefit of the customers. This is increasingly taking place instead of an abundance of individual apps (almost) everything in one place.

In addition to customers, it is also small and medium-sized enterprises that are increasingly being courted with digital diversity by financial service providers in addition to SuperApp operators.

https://www.finews.asia/finance/28952-grab-eyes-banking-licence-in-singapore

As an answer to the question “is this also possible in Germany”, one could conclude the article with an “Of course”, the development of other technologies (Internet, mobile phone, e-mail and e-commerce, social media and chat providers or, most recently, cashless payment) and their not always linearly increasing acceptance in the country of thinkers and poets (as well as inventors) suggests that it could sometimes take a little longer, just as in the well-known advertising of a chocolate bar manufacturer.

In the meantime, a comparison with the digitally more enthusiastic countries in Southeast Asia and their overall economic environment may be worth it, in order to work out commonalities and, if necessary, obtain impulses for one’s own solutions.

Besides the question of the daily needs or the roll out strategy (initially large cities, comparable core services per target market/-country with regionally differing additional services), the integration of “SMEs” (with regional differentiation) could also serve as a starting point. The interest of the e-commerce giants seems, according to the findings from Asia, to come (almost) “by itself”.

Further questions, like “which industry provides the starting point” and “why should the customer want that” are certainly opportune, but shouldn’t hide the fact that the train is already rolling, just like with cashless payment a few years ago, and the question should rather be “do I dare the leap and bind other (local) providers for a SuperApp or do I wait until another provider brings his offer to Germany and Europe and then jump on the train”.

“Which industry provides the starting point?” “Why should the customer want that?”

In this context, the discussion about “connected cars” described at the beginning opens up completely new options for a “platform economy”, which are no secret even for the so-called BigTechs.

https://www.pymnts.com/google/2019/qsr-food-ordering-connected-vehicles/

It will be exciting to see who (only) supplies the hardware and who actually earns money from the software and the connected platforms/super apps.