Apple Pay is finally here; apparently very satisfied first banking partners; Apple expands NFC ecosystem; first promising customer reactions

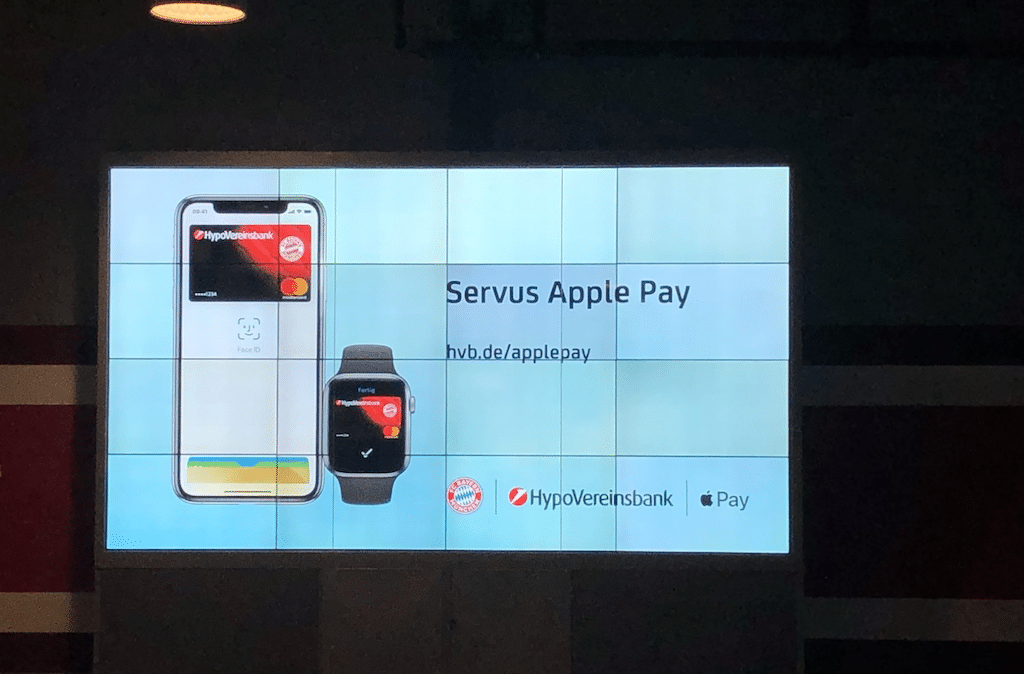

So now it´s time. Six iPhone generations (6, 6s, SE, 7, 8, X-series) were introduced in the meantime, until it came to the announced Apple Pay Launch in Germany. Germany comes into game very late: 26 countries were live before us. But Apple showed much more yesterday in the Allianz Arena in Munich than just mobile payment at the POS. Selected driving sources (including us from Paymentandbanking.com) and press representatives from tech news to lifestyle media, a whole range, were represented by Apple: The Allianz Arena is one of ten stadiums worldwide in which Apple has implemented mobile ticketing throughout. The fan can merely use his NFC phone or Smartwatch and his ticket in the Apple Wallet to enter the stadium and then sit down. Together with the Apple Pay Launch, this was presented to the public for the first time ever. In the stadium, all cash desks from the sausage to the beer to the merchandising shop were equipped with NFC terminals and card acceptance.

Even though Apple took a lot of time to launch in Germany, the launch in Germany seemed to have high priority and was perfectly organized, very Apple-like. Karlheinz Rummenigge made, publicly effective, a first Apple Pay transaction and Apple flew in the international Apple Pay executives. Among them are many former employees of PayPal, Visa, MasterCard, who master the payment business in every detail.

In a demo area Apple also showed the very successful and convenient mobile in-app payment with Apple Pay using the Munich mobility start-up Flixbus as an example. Even classic online shopping using Apple Pay on a Mac and iPad was not missing. In all three examples of mobile/online payment, the device automatically recognizes the Apple Pay support pf the acceptance point and displays the slim payment window before the customer even sees a payment page with other payment methods. The input of payment data, shipping addresses or even strong authentications, which are often not intended by the customer, are completely omitted. The customer pays with Touch-ID on the computer, iPhone and iPad and with newer mobile devices even with Face-ID. The trafficking will love the significantly higher conversion and the PayPals, Klarnas, direct debits, online transfers of this world will get, with a stronger customer use of the Apple users, a massive problem with the “Share of Checkout”. PayPal has been able to increase its market share in the online payment mix almost explosively in just a few years using Express Checkout. They offered fewer interruptions for the trade and more convenience for the customer. Apple tops this experience for its users, who according to their own statements, account for a market share of 29% in Germany.

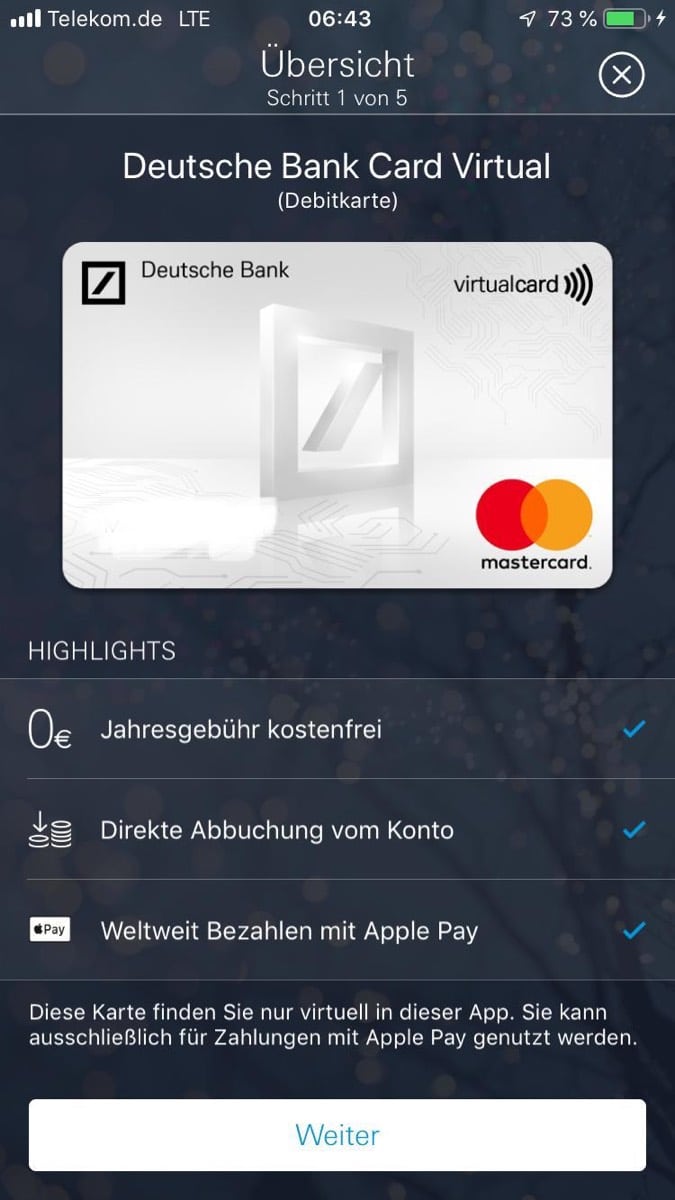

While the banks had been known for weeks for the launch of Apple yesterday, Apple presented three selected banking partners on site. Deutsche Bank had a box with MasterCard, Comdirect together with VISA and of course HVB as provider of the local FC-Bayern co-brand card. Deutsche Bank presented its new virtual MasterCard Debit Card on site for the first time. The customer can apply for this card, which is permanently exempt from the annual fee, directly from the banking app. The card, like any Girocard, authorizes directly from the banking app. In my opinion, the card registration and activation process for Apple pay from Deutsche Bank´s banking app is a “best-in-class” success. My other two cards could not be activated with the respective app, but “only” via the Apple Wallet. Afterwards there were frictions with the AppleWatch, combined with another separate activation of the cards exclusively for it. They way chosen by the Deutsche Bank via the app would have avoided this. Chapeau, Deutsche bank with its processes and its UX is really on the same level with the young competitive banks like N26 and Co. This is anything but self-evident, if you look at the other stumbling digital projects of the German banks and Sparkassen.Michael Koch, responsible for Deutsche Bank´s online and mobile banking, spoke of the MasterCard Debit Card and Apple Pay as Deutsche Bank´s strongest product launch ever. Key KPIs far exceeded expectations. Deutsche Bank was able to record high three-digit card applications per minute yesterday morning and visits to the Deutsche Bank homepage were six times higher than usual. This rush of costumers is very impressive. I think the bank alone sold or activated more than 50,000 new cards yesterday. A Comdirect employee also wrote on Twitter about a self-imposed daily target of 10,000 registrations (unfortunately Tweet can no longer be found) and the relatively small Hanseatic Bank also reported 1,200 registrations in the first hours. For the saturated German card market, these are almost unbelievable figures, which are probably viewed with great envy by national competitors.

What was missing?

1. Well-known large banks boycott further

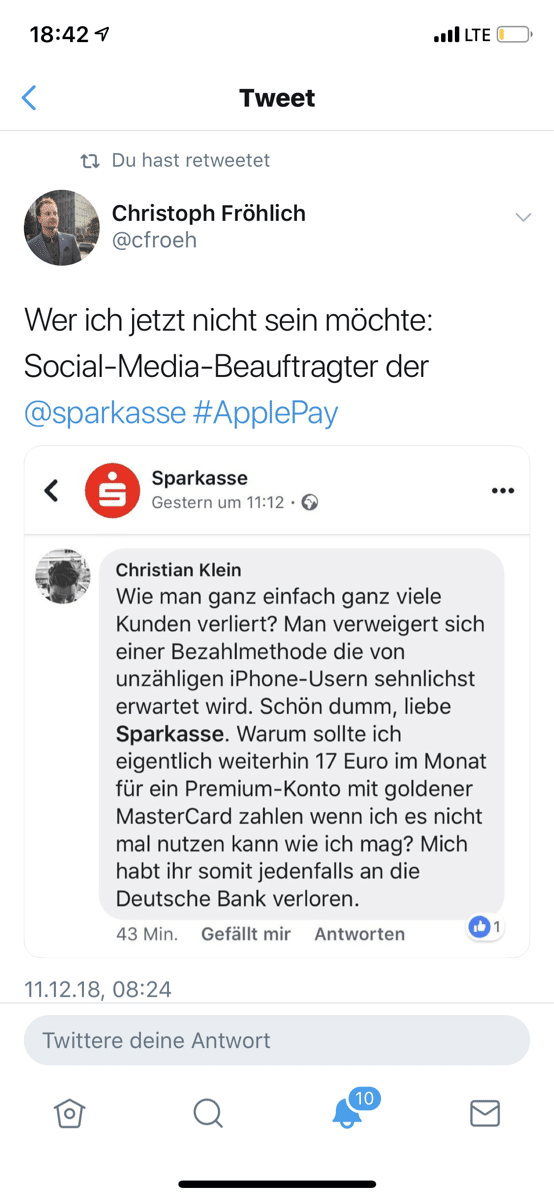

Simultaneously with the launch of ApplePay, other banks have announced their participation as “coming soon in 2019”, including DKB,ING, Consors, Revolut. But there is a crack in the German banking industry: Commerzbank, Postbank and, above all, the Sparkassen and VR banks are still missing as major well-known credit institutions. In my Twitter filter bubble, I read about many customers who complains to the social media teams of banks about their non-participation. Even if one or the other banker denigrates such customers as (original) “Apple fanboys”, the example of Barclaycard in the UK should be a lesson. An Apple manager grinningly pointed out that Barclays initially resisted Apple Pay with hands and feet. The lack of customer traction on their own alternative products and the migration of customers in the highly competitive card market of the UK have finally led to a concession. The manager also emphasized that the first mover banks in the UK are still “to of wallet” at the customers and thus record significantly higher transactions and turnover on the cards. If this is the case with us, it means good news for Deutsche Bank, Comdirect and Co. The German Sparkassen-Association even felt compelled to issue a press release yesterdayand once again claimed to open the NFC interface through Apple. Here, too, a look abroad helps: banks in Australia haven even failed in courtwith similar strategies. Should politics once again be more important than customer wishes and should be played for time? The success of PayPal, Google and now Apple in digital payment transactions with customers and retailers is due to the fact that the customer demand was completely ignored for decades by the payment managers of German banks and Sparkassen. Thus, the Sparkassen position themselves as the best pro-bono marketers of the solutions of Ames, Boon, Comdirect, Deutsche Bank, Hanseatic, N26 and VIMpay. Because the message to their customers who are interested in Apple Pay is clear: There is no Apple Pay for the time being. Instead, we (as small regional Sparkassen from one of the largest companies in the world) demand something that all banks worldwide have failed to do so far: Opening a proprietary API and interface. Conversely, this means that the customer will wither have to wait until Apple moves (very unlikely) or the Sparkassen may have to assert themselves at the EU level in a multi-year cartel procedure (possibly possible). If two argue, a third party is happy and the possible third parties are the fist movers at Apple Pay.

2. Girocard does not matter

The large banks have not integrated their traditional account debit cards (Girocard, Maestro, VPay) into the launch. At the press conference, representatives of Deutsche Bank and MasterCard, for example, justified this with the far greater international and above all online acceptance compared to the classic Girocard. I have never heard such clear positioning against Girocard from the mouth of a leading German bank.

3. Apple Pay Cash

The person-to-person payment method Apple Pay cash introduced in other countries has not been offered in Germany. If I may speculate, the Apple Pay coverage among customers is simply not large enough in Germany. In my opinion, Apple will only introduce this when the bank and customer coverage is larger.

4. Devaluating statements on NFC acceptance in trafficking

For a long time, the lack of NFC acceptance in retail was a problem in Germany. This played yesterday no more a role. As naturally one spoke already of the “approximately comprehensive acceptance”. Also, on-line, not least to on the example Flixbus, considerable (international) dealers and platforms offer long a broad acceptance for the customer. Retailers and retail chains that cover all relevant areas of daily life have done their homework in recent months and years and converted their online shops and POS terminals to contactless acceptance.

Summary

All in all, it was a very successful market launch of Apple Pay in Germany. Now it is up to Apple and the first banks to stimulate the use of customers. We can still expect some marketing campaigns on TC and online as well as print media. Deutsche Bank has secured the sound of a successful Apple Pay payment “Ba Bing” as a word mark and using it in its Apple Pay marketing campaign. With the success in usage, as well as the already impressively visible success with new customers and activation of existing customers, the still hesitant banks will certainly follow soon. So “different is Germany” then also not. Why should things be different here than in other countries.