Everything used to be better! Yes, really! In former times you had a wallet filled with banknotes, many heavy coins and only a few payment cards. The wallet was so heavy and thick that it bulged out of your pocket. Other people used to have a big bulky wallet as an alternative to a purse. This dented the sack instead of the pocket and this too was so heavy that it did not fall out. Rumour has it that there have been cases where the wallet tore open the seam of the jacket pocket and crashed to the ground with a thunderous noise.

Everything used to be better because even older men with hearing problems noticed that their wallet or purse fell out. Today the man of the world has a small, light clip with the essential cards and a few banknotes in it. The clip is so small and light that it slips out of your pocket quickly, quietly and unnoticed. So it happened to me the other day and then the real drama started: I had to wonder how unthinking, sometimes catastrophic, the process of blocking cards was: Dear card issuers, let me just block my cards!

The “WTF” moments

So there are these frustrating moments when using financial services. Sometimes you can’t and don’t want to understand the world how far away from the customer some product people are from the customer and how they design their customer processes. One wonders whether managers ever used their own processes when the customer was so obviously forgotten.

I felt that way when I lost my card clip. I was very angry with myself, but as the story unfolded I was first angry, then amused and finally horrified at how the card issuers almost systematically prevented me from quickly blocking my cards.

We had already recorded such WTF moments several times here in this blog. André described his the very last visit to a savings bank branch and the problems with cash deposits, which were intended by the savings bank structures and not by the customer. He wrote in another blog post frustrated as the German banks and savings banks him of it to be able to pay “simply” for once. Our guest author Vassil Gedov was very active here in the blog about the customer obligations if a card has expired and why card schemes and issuers cannot find better processes. Now I had to live through another WTF experience after losing my card clip. At times I had problems to control myself and not to shout loudly into the phone: God damn it, let me cancel my cards….

Annoying calls and time-consuming reconciliation

How did the little evening drama come about? I was standing at the station and was ready to get on my ICE when I realized that my map clip was missing. Bahncard 100, Amex credit card, Miles&More credit card, Comdirect Girocard and -visa card, new identity card and driver’s license as well as nearly 100 Euro… away… presumably alone somewhere on the way through Frankfurt in the crack of the S-Bahn seat.

After the first shock, the quick reaction: the cards must be blocked! Then the real drama began: I was sitting on the train. So I couldn’t call the blocking hotline 116 116. Two profane reasons made this impossible:

- Firstly: constant disconnection of telephone calls on the train

- Second: annoying ID questions about the blocking of the card with the personal answer, which not necessarily every fellow traveller should hear

In times of banking/card apps with strong authentication, blocking should be much more convenient than annoying calls in a call center, minutes of elevator music on hold, and the comparison of any data. But most of the issuers of my cards somehow don’t see it that way. It seems that they prefer expensive occupational therapy for their call agents. But first things first: I started with my Amex card. That, as it later turned out, was a mistake. By chance I chose the best process with the first card blocking and after that it got worse and worse card by card.

American Express – The benchmark process: Blocking by swipe, done.

Amex app opened, card selected, account settings pressed, card blocking selected, card blocked at the touch of a button, done! No 10 seconds later the card was closed! World class! The concept of Amex is especially well thought-out: current subscriptions/recurring transactions on the card cannot be blocked, only new incoming transactions. Very well thought out by the customer. Amex, you have set the benchmark! There is nothing more to say than thank you!

Amex app opened, card selected, account settings pressed, card blocking selected, card blocked at the touch of a button, done! No 10 seconds later the card was closed! World class! The concept of Amex is especially well thought-out: current subscriptions/recurring transactions on the card cannot be blocked, only new incoming transactions. Very well thought out by the customer. Amex, you have set the benchmark! There is nothing more to say than thank you!

Comdirect – Well thought-out halfway through the day, leaving customers out in the rain

After the simple card blocking of my Amex card, my expectation was that my colleagues at Comdirect would have solved this just as well. So I opened the app, clicked settings, “My cards”, blocked my Visa card, done! Just like Amex… but wait… although it says “my cardn” but there’s only one of my two cards from the bank. Where is the Girocard? So I searched up and down through the app No way to block the Girocard! So I called the call center and blocked the card. That’s what I had done after an hour and a half late arrival.

The friendly person on the other side was “always trying” and visibly overwhelmed. To my question why I couldn’t block the Girocard in the app he had no answer. When I asked if I could get a new visa card or if I had to do something else, he said “You can apply for a new one where you have blocked the card”. When I asked him if he could see in the system if a new card was applied for with the blocking, he just repeated the sentence “You can apply for a new card where you blocked the card”.

The screenshot of the lockout shows that a replacement order is required, but not how. OK he probably can’t see it in the system and doesn’t know what to do. I have kindly moderated off and hung up, after all other cards have to be blocked and whether I get this card or not doesn’t matter, it won’t fit into my new card clip anyway. Less cards are more! Comdirect, you started well but, for whatever reason, you didn’t think the process through. What a pity.

DKB-Miles and More card – worst start with surprisingly positive end

Next up was my Miles&More MasterCard, issued by the direct bank DKB. Many good friends of mine work there, who actually think of the customer… actually. Haaaallooooooo, colleagues! Please check out the user stories in the Designthinkinglab while enjoying Club Mate… really now! But, after all, you got the hang of it at the very end.

After the benchmark American Express and the Comdirect blockage, which was made so mediocre, the next step was the Miles&More app. I had high expectations of the process, especially since the Miles&More card was the first card where I could set a selective rejection of transactions in individual countries for what felt like an eternity. So I expected a similar case to Amex – a switch for the total rejection of all transactions. In the app, I clicked on the card and searched for the rejection field. Well, despite the possibility to block the card on a case-by-case basis, the complete app blocking of the card was missing, or I simply couldn’t find it. In the context Blocking of the card only the reference to a phone number is shown.

Beyond that, however, the colleagues at DKB are making a serious mistake: If you already offer the customer a telephone number in an app, then please do so in a format that can be called with one click. But DKB chooses the most stupid format possible: An international number, starting with the international area code for Germany +49 and then the first digit of the area code with a 0 in brackets.

So: +49 (0) 69xxx. Why that, dear DKB team? Since Steve Jobs introduced the iPhone in 2007, an algorithm in iOS automatically recognizes phone numbers from texts and makes it extremely easy for the user to dial them directly with a simple click. Especially from an app developer one should expect this extremely useful feature of the operating system to be supported.

Positive surprise

It would have been no problem to call a +49 69xxx with the touch of a finger, as it is shown elsewhere in the app under “Contacts”! Alternatively, 069xxx would have been transferred to the phone app as a number. But not so with the blocked number you used in the format +49 (0)69xxx. So in a stressed situation the user has to learn the number by heart and enter it via the phone keyboard. Sorry dear DKB team. What a terribly bad user experience! Have any of you ever used it yourself?

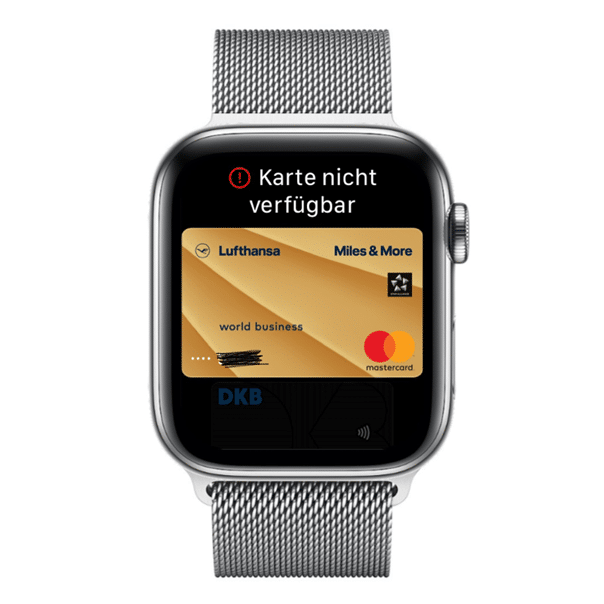

While I was on the phone with the call center after the number brain training and blocked the card, you surprised me very positively. As the only card issuer in this little evening blocking game, the ApplePay version of the card was also automatically deactivated with the card blocking. So DKB was the only bank that really thought the blocking process through to the end! My ApplePay counterparts from Amex and Comdirect are still active in both the iPhone and Apple Watch despite the blocked card. DKB, unfortunately I only have 0 points in the obligation, but 10 great points in the freestyle for you!

The train… well the railway… what can you expect

What remained was the Bahncard 100, where I had called the Bahncard Service immediately, because I didn’t believe in a solution as comfortable as the one from Amex. Clicked in the voice computer to the card blocking an interesting announcement came: “You can block your Bahncard online in the Bahncard portal”.. Wow, so hung up and went to the Bahncard portal. The only problem is that you can’t block the Bahncard there and you refer to … exactly the phone number I just called and which referred me online. Once turned in a circle without exit.

So I called again, listened again to the wrong saying of the online reference and just stayed on the line… after what felt like an eternity of silence, out of nowhere came the computer announcement: “We connect you with the next employee”. There I could finally block the card. I don’t want to know how many customers before me gave up in this process unnerved.

Conclusion – Call center-dominated processes are similarly anachronistic as branch-dominated processes

I blocked the identity card via the city’s citizen service and had to draw a final, somewhat desperate conclusion: In the event of a blockage, the call center has the same anachronistic function as the branch at the banks, which only stick to yesterday’s branch processes! On the one hand, the card issuers obviously prefer occupational therapy for their cost-intensive call center employees. On the other hand, card misuse does not seem to play a role. Otherwise, the customer would not be expected to spend what feels like eternities on hold, instead of building a simple switch into the app. Therefore, dear card product people: please let the customers simply block their card. They will thank you for it.