instant messages #12 by Marcus W. Mosen

Marcus W. Mosen comments on payment or banking topics on various portals and delights his followers on twitter (@mwmosen) with pointed contributions on payment, fintech or politics. From now on you will find his monthly guest column “instant messages by…” on the latest happenings in payment, banking & co.

The fact that Scholz’s bazooka for Corona financial aid has a few jams in it has now become painfully familiar to many entrepreneurs. On the other hand, digitalisation in this country is going pretty well – isn’t it?

The new year, which is already a month old, has already brought us a few exciting topics from the perspective of the payment and banking scene. However, social discourse, the political establishment, and the daily news flow continue to be dominated by one topic – Corona! On social media and in the traditional media, there is only one topic: when will who get the vaccination shot that will again allow carefree work outside the barracks in the home office and when may we again enjoy the old familiar freedoms of globetrotting!!!?

The experiences of the last 12 months have caught us cold at one point or another, or rather, they have shown us the feasibility of being in a life without crowded city centres, airports and motorways. And anyone who has actually strayed into a bank branch in recent years will have discovered in the meantime that they don’t really miss them. Corona is turning out to be a digitalization wake-up call in many areas of our lives and work – with sometimes serious consequences.

After my comments in my last column 2020 to a long overdue facelift of the Miles & More website, Lufthansa has responded promptly and now also gives up the plans from 2019 to attack the German credit industry with its own multibanking app again – corona conditioned(?)-. This is very regrettable, especially since with this function the Miles & More program would have gained height again… or do they rather want to throw off ballast in the crisis by sorting out everything that does not have to do with the core business “flying”? As a “consolation”, frequent flyers will be credited with twice as many status miles for all flights (in 2021) operated by the airlines of the Lufthansa Group – thus the last attempt to somehow maintain the Miles & More program, even if “frequent flying” will hardly be socially acceptable in the future…

Speaking of subsidies…even in pre-Corona times, we regularly read that our downtowns were dying out. Well, as a Cologne resident I can confirm that the only charm of the city centre is to be found at the end points between the cathedral and “Früh”. The pedestrian zones of German inner cities, celebrated in the 60s and 70s as a symbol of the new age, are now turning out to be a strategic mistake. In the pre-Corona early days, thousands of people rushed into the city every day just to shop; housing had long since retreated to the outskirts.

In the shutdown, people now mostly stay in their residential neighborhoods and greet colleagues from DHL, Hermes, UPS or one of Amazon’s many drivers every day, with increasing frequency and as a welcome change from the home office. Those who hope that after Corona, the central shopping temples of Galeria Karstadt and Kaufhof, which are now only supported by state guarantees, will once again exert a pull on the pedestrian zones of the city centres will, however, have to realise that the Amazon “Buy Now” button, which we have all come to love, has lost none of its appeal.

The city planners will have to come up with something else than just planting charging infrastructures in the inner cities to safeguard “e-mobility”. Omnichannel is the new normal. Whoever cannot do this – especially as a large (and also as a small) retailer – has lost sooner or later. State guarantees won’t help any more. Corona and digitization show more than just scratch marks here, too.

Ah yes, the good old bank branches. Before Corona, all banks and savings banks had already sung the melody of their own farewell. Currently, we are almost back to the post-war level of the 1950s with the number of stores. With this “back”, we are now off into the future. This means that the latest “strategy announcements” by Commerzbank and Deutsche Bank to halve the number of their branches again are almost a “turbo” into the digital future – but not necessarily for the employees.

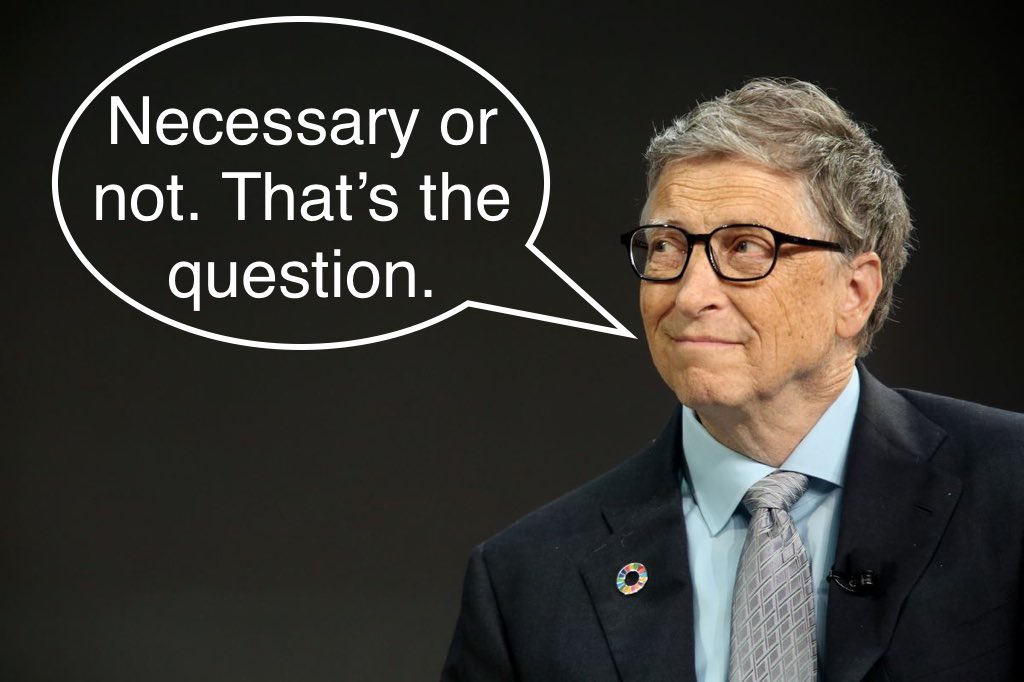

As an interested observer one asks oneself: what is still strategy here and what is already creative destruction? Or is it just window dressing for downtown consolidation in Frankfort? Now, at the latest, the strategic vision of Bill Gates (1994) comes true: Banking is necessary, banks are not!

Ah yes, the good old bank branches. The melody of their farewell had already been sung by all banks and savings banks themselves before Corona. Currently, we are almost back to the post-war level of the 1950s with the number of stores. With this “back”, we are now off into the future. This means that the latest “strategy announcements” by Commerzbank and Deutsche Bank to halve the number of their branches again are almost a “turbo” into the digital future – but not necessarily for the employees. As an interested observer one asks oneself: what is still strategy here and what is already creative destruction? Or is it just window dressing for downtown consolidation in Frankfort? Now, at the latest, the strategic vision of Bill Gates (1994) comes true: Banking is necessary, banks are not! But for those who now think that the “three pillars of the banking industry” in Germany have simply undergone a course of streamlining through consolidation, it should be pointed out that the pandemic has revealed a strengthening of the new, fourth pillar – the fintech banks. Although initially all fintech banks took a bit of a hit from the Corona impact, many older people have now come to appreciate the convenience of smartphone banking, and mobile payments in particular, in recent months. And the “trading boom” via app – thanks to Bitcoin and Gamestop – has once again shown that the usage frequencies of an app are many times higher than we have ever experienced in traditional retail banking. Banking is no longer a commodity, but is becoming a lifestyle event.

Last but not least: at the POS the last bastion of indirect coercion to pay cash falls. The “card payment only from €10 turnover” notices that have been posted for years have finally become a “no go” even at the bakery. But with only 30% cashless payments in Germany in 2020 – as the Bundesbank reported in January – Germany is still a developing country in digital payment. This means that all friends of cash can breathe a sigh of relief. We will carry the “cash in the bag” around with us for many years to come – and provide us payment nerds with some discussion material. Hopefully not exclusively via #Zoom, #Teams or #Clubhouse ;-)

Previously published in the “instant messages” series:

- instant messages #1 – 2020 – a key year for European payments?

- instant messages #2 – Socialist Phantasialand Berlin

- instant messages #3 – Dirty Money in times of Corona

- instant messages #4 – Corona cash killer?

- Instant messages #5 – Schumpeter’s legacy – COVID19 as creative destruction?

- instant messages #6 – Acts of strength in politics! Power moves in payment?

- instant messages #7 – Wirecard and the German payment world – a cauldron of colorfulness

- instant messages #8 – Summer hole in German payments – yes where is it?

- instant messages #9 – Fast, faster – Instant?

- instant messages #10 – Corona – the key event of the payment industry

- Instant messages #11 – The theory of relativity in payment & banking – observations and thoughts at the end of the year