-

paydirekt and giropay merger-Girodirektkwittpaycard 2.0 – the new normal?

Thought about #dk – what is the situation and development? Banks are talking about merging paydirekt and giropay Just over a week ago, some news appeared in the press, in which people speculated about the merger of paydirekt and giropay – once again. The Kwitt service is also to be merged with the other payment…

-

Digital currencies: Europe threatens to lose its access

Bitkom publishes information paper “Digital Euro on the Blockchain“ Not only practically all central banks worldwide are discussing the topic of digital central bank money, but also commercial banks, technology- and financial companies and, of course, politicians are involved in the wide-ranging discussion about the advantages and disadvantages of CBDCs. One thing seems clear to…

-

What is… finstreet actually doing?

As the Payment & Banking team we try to keep a continuous overview of the industry and report on small and large Fintechs and InsurTechs, on established banks as well as neo-banks, on digital strategies, on major investments of national and international financiers, report about exits and provide analyses on current topics. Some companies appear…

-

The Federal Court of Justice-defeat of the German Banking Associations on Open Banking

We have been following the major topic of Open Banking in our blog in various podcasts and articles long before PSD2 came into force. We are also continuously dealing with the topic in interviews. Now a large further chapter has been closed for the time being with a BGH defeat of the German banking associations…

-

What is… fino actually doing?

As the Payment and Banking team we try to keep a continuous overview of the industry and report on small and large Fintechs and Insurtechs, on established banks as well as neo-banks, on digital strategies, on major investments of national and international financiers, write about exits and provide analyses on current topics. Some companies appear…

-

“The core of a transformation is the willingness to rethink.”

Almost unnoticed, the Estonian Fintech Modularbank opened its office in Berlin at the beginning of this year. The company is managed by Vilve Vene. She has been working in the industry for 25 years and developed financial technology long before Fintech became a household name. For example, she led the IT department of the Baltic…

-

How to process credit requests quickly even in special situations

A guest article by Andreas Sonnleitner – Arvato Financial Solutions Many companies are currently in urgent need of liquidity, and loans must be granted quickly. However, traditional loan review routines are rarely up to the current onslaught. In order to cope with the flood of applications to banks, the digitalization of the credit application process…

-

Die BGH-Niederlage der deutschen Bankenverbände zum Open Banking

Wir begleiten den großen Themenkomplex Open Banking bei uns im Blog in verschiedenen Podcasts und Artikeln schon lange bevor die PSD2 in Kraft getreten ist. Auch in Interviews beschäftigen wir uns kontinuierlich mit dem Thema. Nun ist mit einer BGH-Niederlage der deutschen Bankenverbände gegen das Kartellamt ein großes weiteres Kapitel vorerst beendet worden.Eine Auseinandersetzung, die…

-

Diese Corona-Hilfsmaßnahmen für Start-ups laufen schon – UPDATE

Nicht nur Mediziner sprechen angesichts der Corona-Pandemie von einer „historischen Zeit“, auch die Wirtschaft steht vor Herausforderungen von bislang unbekanntem Ausmaß. Es wird die traditionelle Wirtschaft ebenso treffen, wie Digitalunternehmen und auch die Fintechs. Die aktuelle Lage kann bei vielen großen und kleinen und Start-up – Unternehmen bereits kurzfristig zu massiven Geldnöten führen. Das Bundeswirtschaftsministerium…

-

What or who will be the super app in Europe?

While at the beginning of the iPhone the motto was rather ‘there is an App for that’, but for some time now we have been seeing a kind of counter-movement to so-called super apps. The combination of different services in a single app. Often it starts with a few functions (food or taxi), but then…

-

Head to head – race: After Revolut, Klarna is again the most valuable Fintech

Well, who now? Just last week, Revolut was named the most valuable Fintech in Europe, with a funding of 500 million dollars and a valuation of around 5.5 billion dollars. Barely seven days later, the British company has already been pushed from the throne again. The Swedish payment service provider Klarna could now climb the…

-

“We make the digital fingerprint irrecognizable”

The name David Chaum might not mean much to the ordinary mortal, but Blockchain followers know exactly who is being meant. Chaum is a mastermind and one of the prime fathers of technology. Under the title “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups” he wrote his dissertation in 1982. With E-Cash he…

-

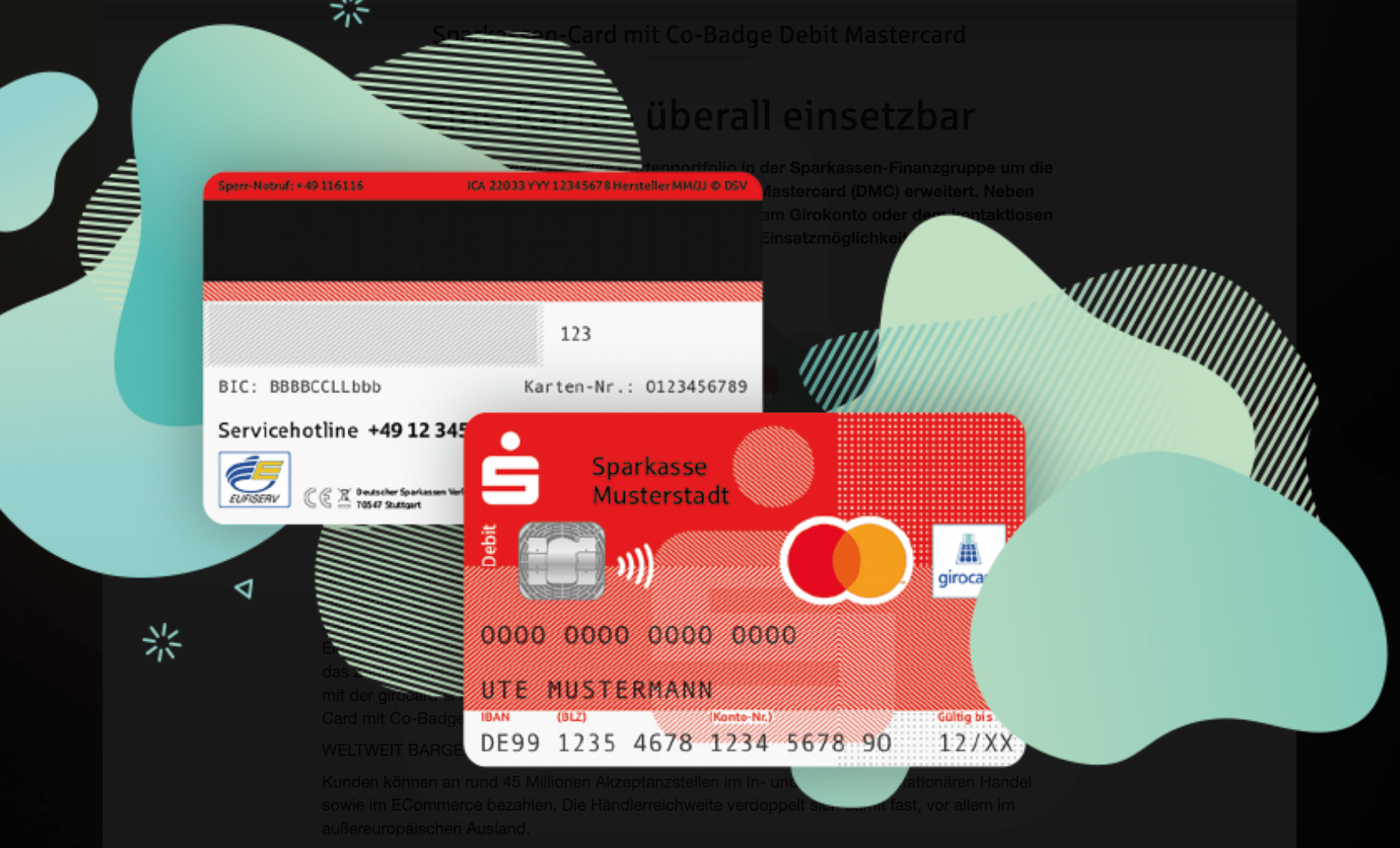

Sparkasse merges Girocard with Mastercard Debit

Our analysis: What does this step mean for the card business, customers and last but not least xPay/DK & Paydirekt? It became known that the Sparkassen financial syndicate is merging the well-known Girocard with Mastercard Debit. Mastercard Debit is obviously intended to replace the previous Maestro logo for international use. We here at Payment &…