-

What or who will be the super app in Europe?

While at the beginning of the iPhone the motto was rather ‘there is an App for that’, but for some time now we have been seeing a kind of counter-movement…

-

How much sense do financial products make for women?

Financial service providers are always on the lookout for ways to sharpen their segmentation – the right offer for the right customer at the right time, is the measure of…

-

The Trend is your Friend

One of the last editions of the Handelsblatt was about the success of the direct banks in comparison to the affiliated banks and that the first one mentioned are turning…

-

Study by Google and the savings banks: An evidence of incapacity

Together with Google, the German Savings Banks and Giro Association (DSGV) has commissioned a representative GfK survey on banking products. What was to become a study on customer behavior in…

-

The 7 biggest customer problems in Banking, Fintech & Insurtech

A couple of weeks ago André M. Bajorat asked here the question what Open Banking is. This was my answer: “Ideally for me Open Banking is a central place, where…

-

Transaction 19: A Payment & Banking event

Four years ago, in summer 2015, the idea for the Payment Exchange laid the foundation for many other events. With the Payment Exchange we wanted to create an event that…

-

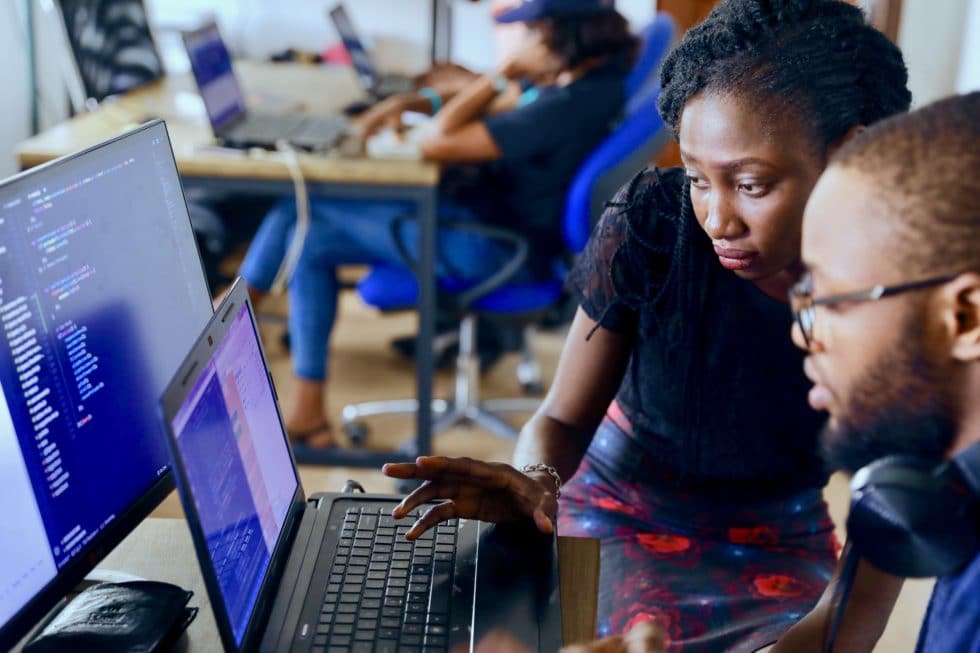

IT talent shortage: The achilles heel of the digitalization

Part 1: The German labor market is missing tens of thousands IT talents When people in Germany talk about digital transformation, they usually do so from a strategic point of…

-

Bye, bye debit or not?!

One of the most popular payment methods used by Germans seems to begin to totter. While many find this good, others shed tears. Here a short summary and the opinions…

-

IT talent shortage: The achilles heel of digitalization (Part 2)

How can I find the right tech-talent? Two case studies What experiences do people make who are busy every day finding the right tech colleagues for their company? Does a…

-

Choosing a bank, with sense and reason!

Why it matters at which bank you are To have ethical principles is a good thing and one of the most important tasks of education. Ethical or moral action is…

-

Why Klarna is the better PayPal

When the payment buddy PayPal, was launched 20 years ago, e-commerce was still in its infancy and the word Fintech did not even exist. Nevertheless, PayPal was exactly that, a…

-

Sign in with Apple – the facts

When two people quarrel, a third rejoices. After the two analyses by the colleagues, Jochen Siegert and Rafael Otero, what a Sign in with Apple means for the market –…

-

The world of eScooters – or why payment is “not yet” an infrastructure

The topic “Mobility”, in particular the eScooter, has often been the subject of our discussions as a “payment-related” topic. Coming from theory, now practice: tough reality in the form of…

Apple

-

What or who will be the super app in Europe?

While at the beginning of the iPhone the motto was rather ‘there is an App for that’, but for some time now we have been seeing a kind of counter-movement…

-

How much sense do financial products make for women?

Financial service providers are always on the lookout for ways to sharpen their segmentation – the right offer for the right customer at the right time, is the measure of…

-

The Trend is your Friend

One of the last editions of the Handelsblatt was about the success of the direct banks in comparison to the affiliated banks and that the first one mentioned are turning…

-

Study by Google and the savings banks: An evidence of incapacity

Together with Google, the German Savings Banks and Giro Association (DSGV) has commissioned a representative GfK survey on banking products. What was to become a study on customer behavior in…

-

The 7 biggest customer problems in Banking, Fintech & Insurtech

A couple of weeks ago André M. Bajorat asked here the question what Open Banking is. This was my answer: “Ideally for me Open Banking is a central place, where…

-

Transaction 19: A Payment & Banking event

Four years ago, in summer 2015, the idea for the Payment Exchange laid the foundation for many other events. With the Payment Exchange we wanted to create an event that…

-

IT talent shortage: The achilles heel of the digitalization

Part 1: The German labor market is missing tens of thousands IT talents When people in Germany talk about digital transformation, they usually do so from a strategic point of…

-

Bye, bye debit or not?!

One of the most popular payment methods used by Germans seems to begin to totter. While many find this good, others shed tears. Here a short summary and the opinions…

-

IT talent shortage: The achilles heel of digitalization (Part 2)

How can I find the right tech-talent? Two case studies What experiences do people make who are busy every day finding the right tech colleagues for their company? Does a…

-

Choosing a bank, with sense and reason!

Why it matters at which bank you are To have ethical principles is a good thing and one of the most important tasks of education. Ethical or moral action is…

-

Why Klarna is the better PayPal

When the payment buddy PayPal, was launched 20 years ago, e-commerce was still in its infancy and the word Fintech did not even exist. Nevertheless, PayPal was exactly that, a…

-

Sign in with Apple – the facts

When two people quarrel, a third rejoices. After the two analyses by the colleagues, Jochen Siegert and Rafael Otero, what a Sign in with Apple means for the market –…

-

The world of eScooters – or why payment is “not yet” an infrastructure

The topic “Mobility”, in particular the eScooter, has often been the subject of our discussions as a “payment-related” topic. Coming from theory, now practice: tough reality in the form of…

Trending

Sponsoren und Partner

Schleichwerbung

Der beste Newsletter ever

Mit dem Payment & Banking-Newsletter versorgen wir dich täglich mit News, ausgewählten Artikeln und Kommentaren zu aktuellen Themen, die die Finanz-Branche bewegen. Meld Dich an!