When the payment buddy PayPal, was launched 20 years ago, e-commerce was still in its infancy and the word Fintech did not even exist. Nevertheless, PayPal was exactly that, a startup that linked finance services with technology and significantly shaped and advanced online payment traffic as we know it today. PayPal has 23 million customers in Germany.

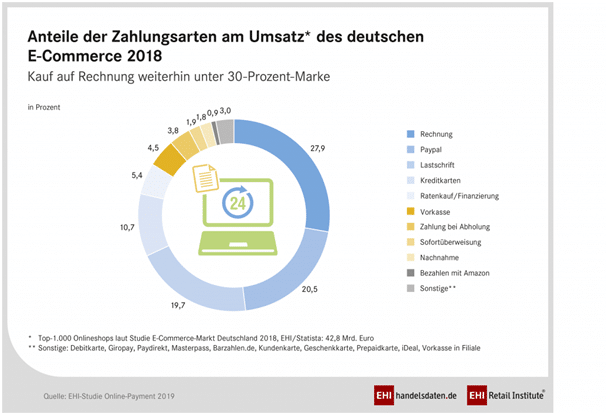

One third of adults in Germany use PayPal and according to calculations PayPal is the most popular online payment method. PayPal’s business results are also impressive, with 12% more revenue in the first quarter of 2019 and 31% more profit. But as Voltaire already said: „the better is the enemy of the good“.

Klarna vs. PayPal, not all that limps is a comparison

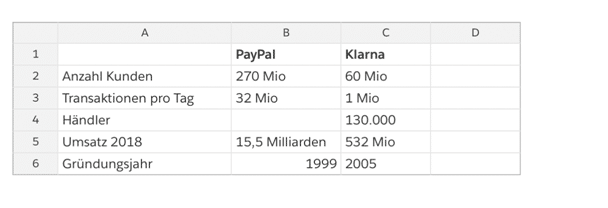

Klarna made a revenue of 5.451 billion in 2018, PayPal 15.45 billion. PayPal has not only made more turnover, but the currency is also a different one: PayPal’s 15.45 billion dollars compared to Klarnas’s 5.451 billion Swedish crowns – which is about 532 million euros. In order to not confuse completely: PayPal makes 30 times more revenue than Klarna. Klarna’s growth is nevertheless more than impressive.

In 2018 Klarna was able to increase its transaction volume by 26% and to approximately 24.6 billion euros. Klarna was also able to win 25,000 new merchants, including big names such as IKEA and H&M. In other words: Klarna is there and won’t leave that quickly. Above all, Klarna’s purchase on account is a big piece of the cake.

What Klarna does right (and good)

Klarna has developed continuously since its foundation in 2005 and has focused strongly on end customers in recent years, which was not least reflected in its re-branding in late summer 2017. Since then Klarna has developed from a rather boring purchase on account to a real end customer brand. When the rapper Snoop Dogg joined Klarna at the beginning of 2019 as a shareholder and figurehead, the new brand image was perfect and the claim „Get Smoooth“ rounded off the whole thing. Klarna has something that PayPal and many others are missing: a brand with an identity. Neuroscientists assume that over 90 percent of decisions are based on emotions. Klarna plays on these emotions in an excellent way and at the same time offers important product benefits. In direct comparison PayPal looks bad, because Klarna offers:

- with Sofortüberweisung a „comparable“ fast online payment procedure and the important invoice and installment purchase

- Klarna Checkout“ is a „hosted payment page“ that takes over the entire checkout and fraud check for the merchant and drastically reduces the process for the end customer

- a physical debit card for the users

- users mobile payment with Google and Apple Pay

- a customer portal with the possibility of variable payment terms for all payments made via Klarna platform

- with Snoop Dogg a testimonial, which makes the dull payment traffic to a „hip“ topic

- a global identity platform

Klarna offers an ecosystem geared to end customers. Those who have used Klarna for their purchase bevor, know what they are talking about. Pending invoices and outstanding payments are reminded by e-mail. The payment goes comfortably by direct debit. Payment targets and installments etc. can be defined just as easily.

Klarna’s Debit Visa Card works on the same principle: payments can be made immediately or after 14 days, depending on the amount. For example, payments over 500 euros can be paid after 14 days if desired, while the rest is paid immediately.

The fact that the card also supports Google and Apple Pay, comes in four different designs and is free, rounds off this ecosystem. And with Sofortüberweisung on board, they can cover the entire online banking process. It is quite possible that at some point they will make products such as Outbank or financial guru superfluous, or at least give a view of the current account – until Klarna perhaps offers its own bank account at some point.

When an online shop like boohoo advertises on TV that Klarna is offered as a payment method, either Klarna has paid a lot for it, or it has become so relevant that it is a real USP for shop operators to offer the Swedish Klarna.

The business model

Primarily, Klarna earns from the transactions through the shop operators. But also with overdue fines, because in case of non-payment Klarna earns money from the end customer. Online there are always reports of rip-offs and high fees if a rate is not paid or paid too late. According to Klarna this is not correct. Instead the customer is to be reminded altogether four times to pay a due amount, which corresponds in sum to up to 49 days delay and overdue fines of maximally 3,60 euro. Only then a debt collection company is to be called in.

Conclusion

It’s all right. Klarna has shown that you can build an alternative to PayPal. The Dutch proved this with IDEAL and Klarna shows it in a big way. Klarna has done a lot right, especially the focus on the user, which is reflected in the UX as well as in the product. Must a market leader like PayPal be afraid? Certainly not afraid. But respect.

„PayPal doesn’t need to be afraid of Klarna, but has to have respect.“

Klarna is ahead of PayPal in many areas. And Klarna is likely to expand the platform further. It doesn’t take much imagination to imagine that a European Fintech like Klarna, with so many customers, will also offer a real checking account in the future – including multibanking. Everything is already there and Klarna would only have to press the button.

What a pity, that Klarna is not from Germany.