Did the results really surprise us? Or isn´t it actually just „business as usual “– everyone expects it.

New big reports are a negative report. PayPal goes its way unobtrusively but constantly.The quarterly comparison of the 3rd quarte in 2017:13% more turnover ($3.68 billion9

15% more profit ($436 million)

37% more payment volume ($134 billion) – other sources speak of 25%

9 million more active accounts in total now 245 million (these are not to be confused with for example Paydirekt numbers, or the HCE apps download numbers of German banks, where all cardholders are scraped together and counted)

78% increase in Venmo P2P transactions

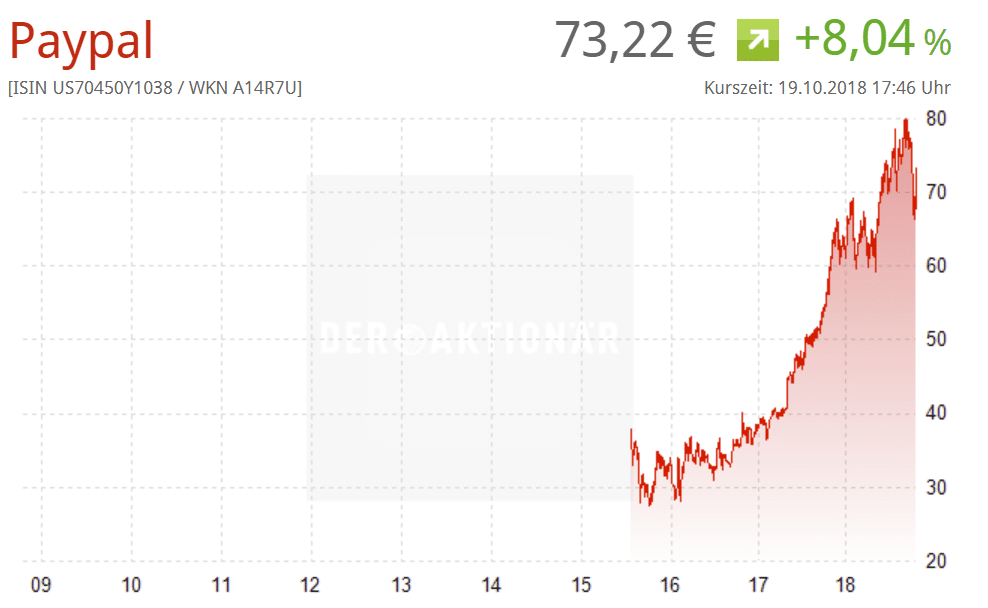

The stock development supports the trend – even if “one or the other analyst” shows a slight disappointment – greedy dogs :-) – On the day of the quarterly reports there was at least a short jump of 8% – then down 3% again – but you can read a “slight stomach ache” from the figures – anyway – the growth counts more here.

The news about the P2P payment procedure Vemno are remarkable – a short quote from the PayPal CEO:

“I´m especially pleased with the strong overall momentum surrounding Vemno, while it is still early, our monetization efforts appear to be reaching a tipping point.”

Should you really manage to “draw” money out of Vemno – and if so, what can you learn from it – is the old wisdom “P2P is just a feature” no longer valid?

What does this mean for the banks, payment and Fintech world?

- Continue as before – who is PayPal? WE have the customer confidence.

- Pump even more money into the alternatives “our solution has no alternative, no matter how many millions it still devours” – we continue to hope for the customer, whom we have long lost. And if we force them! In the western payment world, no (too late) bank challenger of PayPal is successful, if one excludes markets like the Netherlands, which had already established a successful bank solution before the PayPal dominance. Despite this overwhelming reality, the political PR story for the bank´s own solutions continue to be played until even they every last primary banker have understood that it is them who have to pay the party with their levies more and more, without ever having a ROI flowing. Would the same decision-makers finance such excursions from non-bank companies through loans? Very unlikely!

- Resigning and giving up the “B2C Payment” – now “captivating” the corporate customers – not that they will run away too.

- Develop a smart cooperation strategy – maybe even cooperate with Apple and Google?

- Now quickly invest in HCE Apps and develop In-App Payments in pure German. Because without own really established in In App acceptance and the basic conditions, does one de facto not control the acceptance side as a bank anymore?

- Slowly come to terms with the role of “processor and stirrup holder” and focus on it. The bad predecessors inhouse have just not correctly classified the PayPal development and you have to pay for it now. Disclaimer: This strategy only works if you haven´t been in the bank yourself during the years 2003-2015 :-).

- Collect money and buy the stall – only who can afford this? – except GAFA and BAT

Meanwhile, a lot is also happening at the feature and cooperation level and the “gap” between PayPal and the Paydirekts or HCE app attempts of the banks is growing without a hint of a chance of ever getting the product “at eye level” at all.

There are now cooperation of different kinds with every scheme – no fear – rather “embrace”

- https://techcrunch.com/2018/10/19/paypal-and-american-express-expand-partnership-will-allow-use-of-points-for-paypal-purchases/amp/

- https://www.wsj.com/articles/paypal-strikes-partnership-with-visa-1469135090

- https://techcrunch.com/2016/09/06/paypal-partners-with-mastercard-for-store-payments/

also, at GAFA´s et al there seems to be nether friend nor enemy

- https://techcrunch.com/2017/07/12/paypal-expands-apple-integration-will-become-a-payment-option-in-11-new-markets/?_ga=2.123354763.1673581568.1539543993-1510196584.1533849207

- https://techcrunch.com/2018/05/24/paypal-starts-deeper-integration-with-google-users-can-now-pay-directly-in-gmail-youtube-and-more/

- https://techcrunch.com/2017/07/17/paypal-to-become-a-payment-option-in-samsung-pay-including-in-app-online-and-in-store/

and the merchants anyway

interesting is also the product page

https://www.internetworld.de/e-commerce/paypal/paypal-bringt-funds-now-deutschland-1593651.html

What does the Payment&Banking-Team have to say about this?

Maik

Analogies sometimes help to understand the drama: Imagine trying to start a national search engine, social network or music service now. Good idea? I´m not sure. The main problem is that you wouldn´t do anything new, you would just copy what already exists. At least you would have to copy better than the original and that wouldn’t work either. The path of PayPal is not surprising, it is predictable, and I lack the fantasy on how to catch up to that.

Andre

The colleagues of PayPal do little wrong, much right and are not to be excluded from the everyday life of merchants and payers anymore. Sometimes you want to shake your colleagues up because you don´t understand why certain things aren´t done faster, but that´s probably due to the size, the worldwide approach and the success. For the former rulers of payment – the banks – bitter to see and probably hard to catch up with. As was once the case with Visa and Mastercard, the only way here, too, seems to be through meaningful cooperation in the interests of the users.

Jochen

We have already described the dilemma in many blogs and podcast. We have very often predicted the developments precisely. This was often reacted with anger, political and personal pressure and often simply ignorance. In fact, we were and are us the analysts and messengers of the obvious bad news. The advantage of PayPal on product level, financial equipment, customer confidence, acceptance and network effects are de facto not to be caught up by the small German banks and Sparkassen. The war is lost! Is it time to ask the German payment generals whether their strategy of decades of ignoring, politicizing, sitting out, initiating too late and simply bade copying was wise. Many developments were easily predictable – even in the early 2000s!

What now? PayPal seems to be the beetle of payment… it runs and runs and runs and runs and runs. US-American banks have long resigned and have long since they turned to the path of partnership. The only German bank that has understood this for a long time is DKB. It does not dictate to its customers how they have to pay and does not fight against windmills. Unlike many other German banks that invest millions in their online payment activities, DKB earns good commission income through its cooperation with PayPal, among others.

Kilian

Surprise looks different – it´s actually worth reporting anymore. Somehow normal – but I think it is important to keep in mind where PayPal is at the moment. And that the train here for Europe has actually departed, i.e. there is no more “against” PayPal – only one “with PayPal”. We have nothing more to oppose this. The network effect does the rest and the cooperation with Google shows how well PayPal has understood this. While the German/European banker still calculates whether one can earn money at transaction level (which will certainly be difficult) – PayPal thinks in reach and network. Even the phase of “weakness” and a “innovation hole”, that PayPal can certainly be describes as in 2015-2017, nobody could use. Unfortunately, there are also manual mistakes here. Interesting mind game – why not “buy” – the price would be high and questionable whether both US government and Google would allow this, but it would be a “Bold Move”. If you have a strategic plan after this, otherwise the money is badly invested, you can certainly find it.

Sources

- https://www.itreseller.ch/Artikel/87876/Paypal_steigert_Umsatz_und_Gewinn_deutlich.html

- https://www.cnbc.com/2018/10/18/paypal-slated-to-report-third-quarter-earnings-after-the-bell.html

- https://paymentandbanking.com//www.deraktionaer.de/aktie/paypal—405120.htm