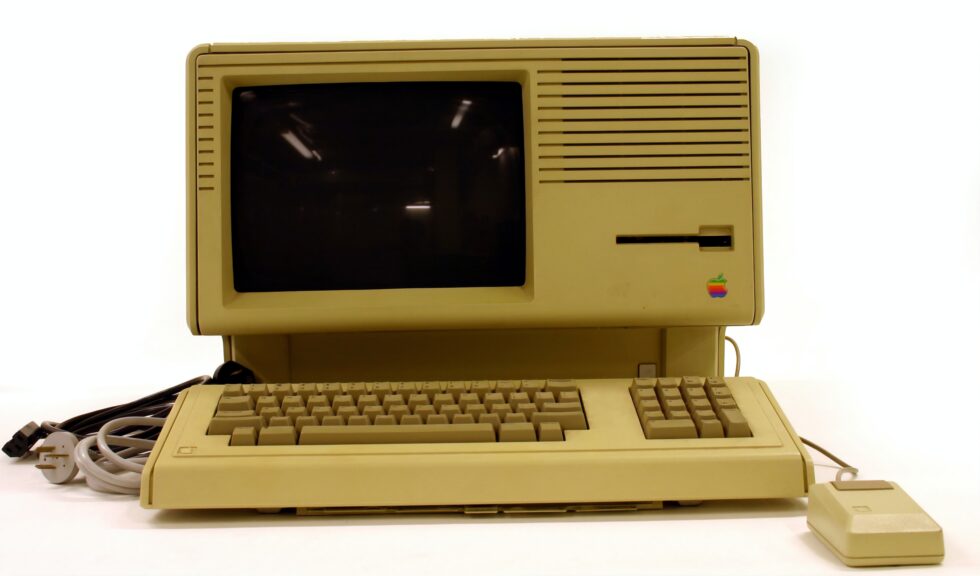

Or why the credit process is still at the status of the 70s?

Disclaimer: This article arises from a phase of emotionality, I know you should never do that and it is in every good education book. But I’m doing it anyway, because I have a grant.

We have tried to get a company loan, yes as Payment & Banking or the GmbH behind it, that would give us some flexibility in our seasonal business, give us a buffer and help cushion everything.

Actually nothing special and also the core product of every bank. Wouldn’t have been millions, 100K, maybe 200K maximum, for the day-to-day business.

It can’t be that difficult, especially with a product that actually has a high degree of standardization. Can…

After we had already accepted that the challenger banks are rather weak in the product category „credit“ and at the same time are not accredited by the KfW, we had tried to get a loan through the „incumbents“.

- Hurdle number one: Find a bankThe KfW is accredited and offers online account opening (for B2B), so it’s getting thin (and no, we didn’t want to spend a day in a nice branch, because it doesn’t fit into the daily work routine). But after 3 weeks it worked out.

- Hurdle number two: The credit application – the old „we’ll call her back,“ which of course never happens. But we didn’t want a call back either, we wanted a clear digital process – absolutely no chance. After that, a lot of PDF’s were filled out, printed, signed, scanned and sent by e-mail, which makes the customer experience rating only „so medium“.

- Hurdle number three: The feedback – „You must have your main account with us for at least 1 year before you can get a loan“! No punch line. And thanks for nothing!

It is clear that you have to check creditworthiness, no question. But why still using procedures and variants from the 30-year war? What economic potential (and also business potential) is being lost here (assuming that banks generally have risk management in place, even in „after sale“, to the extent that it is profitable overall)? If you want to help SMEs, then this is the place to do it. One should not always wait for the „state“ to solve the problems for the world (watch out: it won’t)!

Or are we indirectly punished for using challenger banks (which I can’t believe)?

The questions I’m asking:

- Why not use the technical possibilities you have – e.g. account view?

- Why always look „backwards“ and not forwards?

- Why can the process not be „realtime near“ and „digital“?

- Why are the elementary rules not transparent (or only hidden)?

Now we’ve been tinkering in the Fintech bubble for 10 years and now this.

Is this whole Fintech disruption just a „fig leaf“? Or why is it still possible to operate on the market, when all the challengers are there and yet supposedly put everyone under pressure? (Because pressure looks different, you would have to enchant the customer) For years you hear „digital, digital, digital“, what happened to the reputation? Or are our expectations simply too high and completely wrong?

Let’s open a discussion…