One of the last editions of the Handelsblatt was about the success of the direct banks in comparison to the affiliated banks and that the first one mentioned are turning more and more into so-called house banks or first banks.

This increasing trend of direct banks becoming house banks has take, all in all, quiet a long time, if you consider if one considers that the market leaders DKB, ING or comdirect are now more than 20 years old.

This chart clearly illustrates the development of direct bank customers in Germany – a wonderfully linear development. So even as a “stupid board of directors” one can extrapolate 1:1.

The trend among the so-called Challenger banks seems to be even faster and certainly cross-fertilizing, and here I will only have a look at the German market with the players N26, Tomorrow and Penta.

The figures of N26

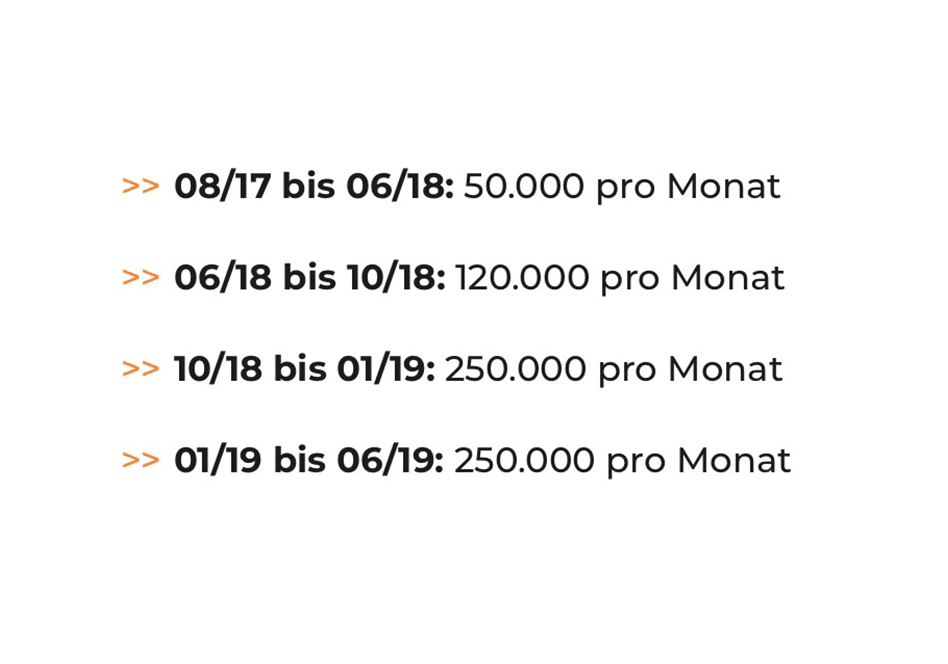

Let’s look at the figures known in the market. N26, for example, is particularly impressive with a monthly growth of more than 250,000 customers, according to its own statement. In total, this has now brought together almost 5 million customers. This means that N26 (all countries combined) now has more customers than, for example, comdirect (with 2.6 million) or DKB (with 4.2 million customers in Germany). This makes the comparison a bit misleading, but it is nevertheless permissible.

In the financial scene newsletter, the N26 figures have already been critically examined in recent weeks and a thesis of weakening growth has been established, which I would not like to speculate about at this point.

If we look at another segment, corporate clients, I think the growth of Penta, the Berlin-based banking start-up, is impressive. The still young team has (in a market that cannot be compared with) won more than 12,000 corporate clients.

In contrast to N26, it can and must be assumed that Penta’s customers are not „test customers“ but use Penta for their business. However, if you look at the number of companies (> 3 million) in Germany, Penta still has great potential for further growth, especially since other European countries are also on the roadmap.

At last let´s have a look at the newest player: Tomorrow. The team from Hamburg, which describes itself as the illegitimate child of GLS Bank and N26, has been able to convince around 16,000 people in the last six months for its sustainable approach to an account. A piece of cake compared to the Primus N26, but also here a number that positively surprised me. What is the reason for the growth of these new providers?

„What is the reason for the growth of these new providers?“

The most important thing is certainly the convincing product with mostly very few wow-effects paired with the, in all cases, strong customer focus.

In addition, from my point of view, there is something that I call the trend, which in my view strongly promotes growth:

- Growth figures that create confidence in public

- Recommendations from satisfied customers who often mutate into fanboys

- Visibility in the „new“ public the social network

- many positive news through new growth figures, new features, new employees, new investments etc.

- In short: A very positive image is being created, which customers would like to have rubbed off on them

And what is the reason for the ignorance of affiliated bankers

Let us try to illustrate this with examples:

Martin Zielke (CEO Commerzbank) said in 2016: „There is no reason to shake the affiliate strategy with additional affiliates. Apple and Amazon are also opening affiliates“: https://twitter.com/_yo_osman/status/770899183192735744?s=20. This is countered by facts instead of believing in yesterday’s news: Since 2016, a further 3 million customers (linear development) have decided in favor of direct banks and against affiliated banks.

Second example, another board member of the same bank at a conference last week:

Despite the known growth figures of N26 (from 50,000 customers per month at the beginning of 2018 to 250,000 customers per month currently), Mr. Hessenmüller (COO Commerzbank) believes that banking must be possible out of the pocket in the future. The Commerzbank Group is already growing significantly weaker in terms of customers (+100,000 more private customers in Q3 2019 vs. 250,000 at N26 per month!) than N26 with its mobile-only banking product, but it sees the need for such a product only in the future. At least at first glance, this strategy seems rather incomprehensible to laypeople like me.

At the moment, I do not see any serious signs of a changing trend in favour of the established, but rather an acceleration of change. In the coming months, this will certainly be reinforced by the increased entry of major players such as CHECK24, PayPal, Google, Apple and Facebook into the banking game.