A guest contribution from Bjorn Wessel

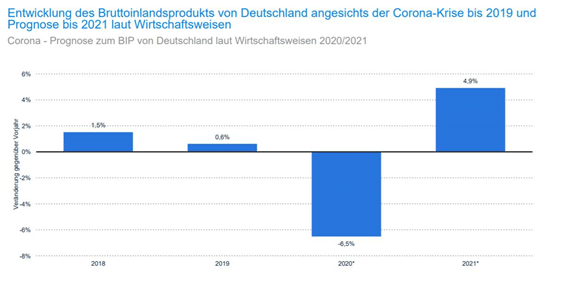

Corona is changing the world and with it the trade. Not through new insights, but rather by accelerating existing developments. What took 5-10 years before is now happening in 3 months. In retail, the „final breakthrough“ of eCommerce, long awaited by some and feared by others, has become visible and tangible for all.

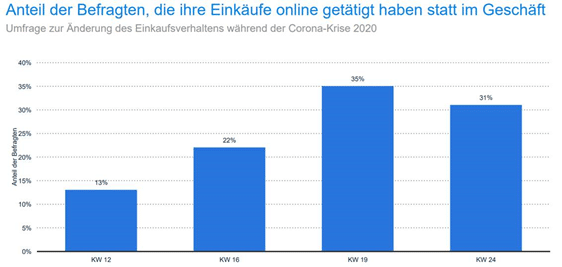

More than 30% of consumers say that they now shop online instead of in local stores. This trend will no longer be reversed, because positive experiences (time savings, cost savings, etc.) will remain and inertia – or more neutrally speaking: convenience – is winning.

The trend of empty shops will continue

This effect is accompanied by a development that was already there before Corona, but which is now becoming visible: Empty city centers. If you are now hoping for a hundred percent rebound, let us say: the trend of empty shops and shopping centres will continue! The previously mentioned experiences of the Corona period even reinforce this trend.

So what will be the motivation to go into the stationary business in the future? Because the equation „city centre equals consumption“ is no longer tenable. So what is coming, what will move us in the future? Will there be comparable approaches to that of McFit founder Rainer Schaller with „The Mirai“ (https://www.themirai.com/) be in Oberhausen: The combination of fitness, entertainment, shopping and medical care in a holistic concept? More likely than in times of streaming cinemas, which act as magnets for city centres.

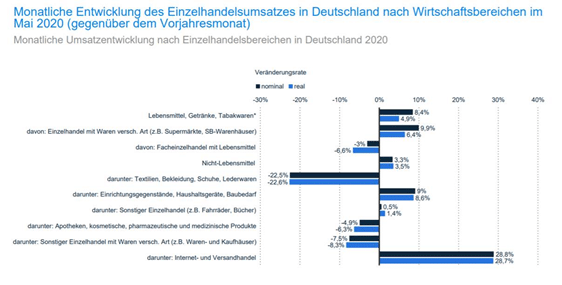

As can be seen in the following list, the eCom business, food retail and DIY stores are growing during the Corona period.

The big loser of the lockdown is the textile industry. The change has reached the fashion sector and cannot be denied by the figures. The problems of Zara and H&M are obvious and the simultaneous growth of companies like Zalando and AboutYou, the big online players, could not be more impressive.

It remains to be seen whether we will also see this development in the food retail sector. The challengers in this sector are also just around the corner: Hellofresh, message in a bottle, Picnic, Amazon Fresh etc., to name but a few. Through Corona we have learned that a single trigger is enough to turn a business model that has proven itself over decades upside down.

What remains for stationary trade and what are the approaches to keep up with the shrinking market? A good question, perhaps the following theses will provide some ideas:

Thesis 1. As dreary as it is today, won’t it always be?

No, but it won’t be like before!

The farming methods assume a rebound, which will take place after Corona. Therefore, the necessary preparations should be made to set up the products and services for this period.

Thesis 2: Creating stores with added value

At present, rents and retail revenues are in a countervailing trend. What to do now, with such a property or a rental agreement? Let’s look at the big players in the industry and see how they approach the issue. Amazon is in takeover negotiations with JCPenney. What is it about? Do they want to save the retail sector or is it all about the real estate portfolio, about building up logistics hubs in inner city locations.

Of course this remains speculation for the time being, but there are increasing signs that we will see logistics or service hubs in the city centres. It is obvious that this makes sense for online marketplaces such as Zalando and Amazon. But how „monobrands“ will fare remains to be seen. Similarly, Mediamarkt already has its first markets that follow the approach described above and serve as service points or pick-up points.

„There are increasing signs that we will see logistics or service hubs in the inner cities.“

Thesis 3: Customer experience is key

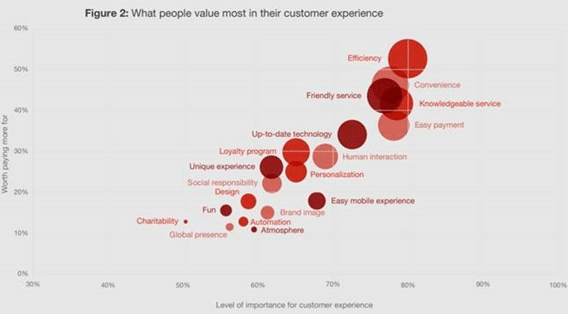

It remains the case that even in the post-corona period, customers must be picked up where they stand. We will increasingly see different approaches, as there is no such thing as one homogeneous target group. What data am I willing to share with the retailer, what technical innovations/paths do I want to participate in and what should the payment process look like? It is important to remember that the customer experience, regardless of the target group, must be more important than ever. As early as 2018, PwC published „the future of cx“, a study that illustrates what is needed to create a positive customer experience.

It is much easier to do this in a stationary environment than in a purely digital communication. Two essential topics, which were not mentioned in the study at the time, are sustainability and the local shopping idea. While the local idea was strengthened by Corona and will most likely continue to grow, sustainability has taken a breather. But with the overcoming of the pandemic it will be resumed.

Thesis 4. Bringing eCom approaches into stationary trade and vice versa

Definitely, it is time to bring the worlds of experience from the eCom to the stationary trade and thus everything that arises around the topic „personalization“. These are from identification, active cross and upselling at the POS, highly personalized communication (via digital signage, smart shelf labels, smartphone) to freely selectable checkout scenarios (@counter, @kiosk or @app).

In the same way, the stationary and established topics such as sustainability and local products must be credibly brought into the eCom business.

What’s the bottom line?

Expectations must be defined correctly. New customer experiences must be created, ideally based directly on omnichannel approaches that give new meaning to the stationary business and clearly demonstrate its strengths over the eCom. From my point of view this evaluation remains:

- Availability of goods – eCom

- Delivery speed – POS

- Convienence – eCom

- Prize – eCom

- Fitting – POS

- Sales consulting – POS

- Sustainability – POS

- New Local – POS

The lever is there, but we have not yet seen the solutions that are needed. Perhaps it is the „neighbourhood stores“, stationary areas in residential areas with gastronomy and retail elements paired with logistics functions.

Stationary trade need not fear the swan song, but it must break new ground despite all obstacles (rental/leasing contracts).

About the author:

Björn Wessel has been working for Wirecard as Head of POS Global Product since 2019, where he is responsible for the development of a global POS product. Prior to this, he held the position of COO at TWINT AG, focusing on mobile payment schemes/issuer/acquirer development. Björn also has experience in the Miles&More business when he worked for the Loyalty Partner Group.