Welcome to the Transactions 2020the event at which the most important heads of the Digitization-, Payment– and Banking-industry.

This is a series of interviews with this year’s Transactions 2020 speakers – Today we will be Sasha Dewald I’ll be available for questions and answers. Sascha is Senior Vice President Retail Banking (Head of Retail Banking) of DKB.

The number of cases is skyrocketing everywhere and the situation is serious. However, our events live from exchange and in the last few months we have learned that many things can also take place virtually. Nevertheless, we feel that personal exchange on site is important and in order to do justice to both, we have decided to use Transactions 20 to make two events.

The first part will take place as „Berliner Runde“ as planned on 19.11.20. A completely virtual event with two keynotes from Sasha Lobo and Verena Pausderwho will share with you in their keynotes their vision for a digital Germany and the extent to which Covid-19 is shaping our industry In addition, we have invited the man who contributed significantly to the Wirecard case and who made Wirecard the topic of 2020 in the industry: Dan McCrum. He talks to us about the revelations in the Wirecard scandal. Afterwards there will be a discussion round. Everything in the live stream to shorten your waiting time until the „real“ transactions.

Transactions 20.5 as the second event in February

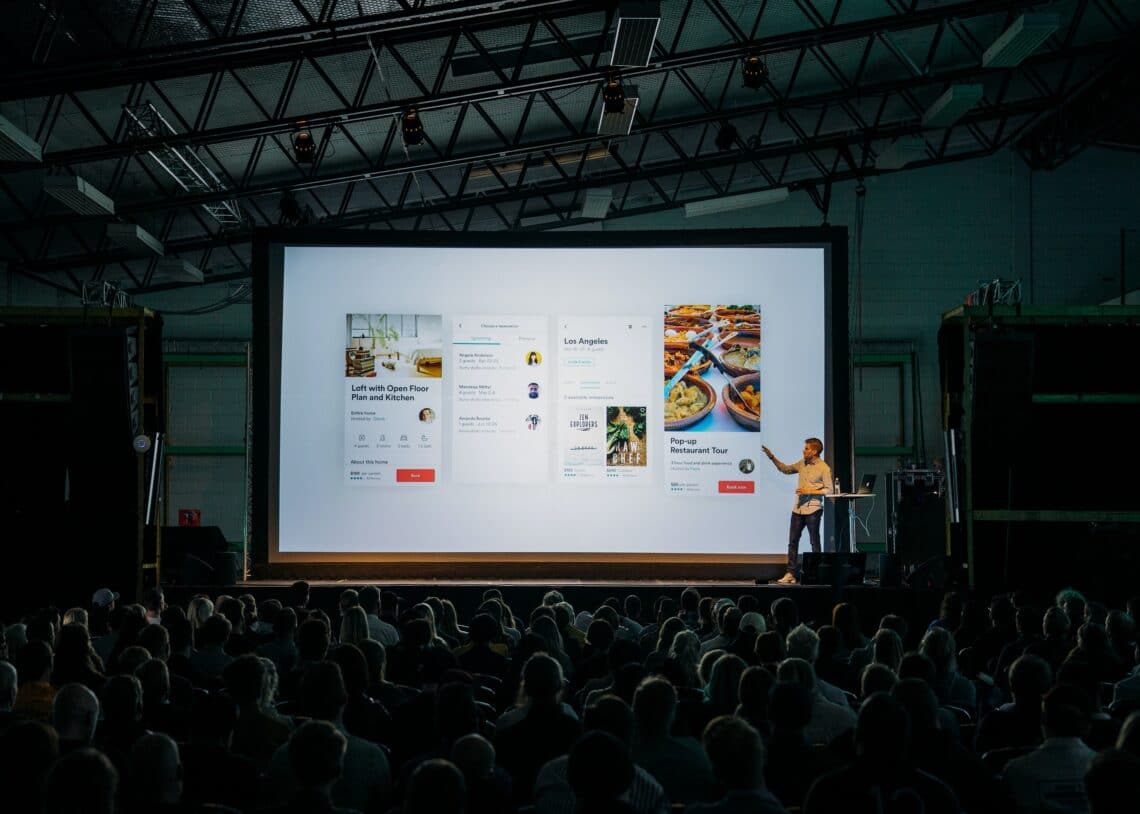

Transactions 20.5 takes place on 25 February 2021 as a hybrid event, i.e. in stream and (hopefully) as a presence event, as originally planned, in Offenbach in the old steel construction. Of course we hope that the situation will have relaxed by then and that as many guests as possible will be able to attend not only in the stream but also on site. Every ticket purchased is valid on 19.11.2020 as well as on 25.02.2021. One ticket for two events. So if you have a ticket, you can be present at both events.

At the event in February 2021 the most important heads of the digitization, payment– and Banking-industry. Besides the many great participants, an event is only as good as its speakers on stage. The Transactions is one of the few interdisciplinary conferences in the DACH region that offers a stage for lateral thinkers from various industries on the subject of „digital structural change“. We are once again looking forward to national and international stars from the digital business who will give an outlook on the most important trends in the industry.

Who are these great minds #TRX20,5, you can read about this in the following pages, despite the shift in next weeks in our interview series.

Next year’s participants include Sascha Dewald, Head of Private Customers at DKB, who introduces himself in this interview. He will also take part in the panel discussion: Data Driven Banking – Pandora’s data treasure or box

We are happy about your acceptance of the Transactions 20.5 in February: Please introduce yourself briefly.

Thank you – I am happy to be part of it again. My name is Sascha Dewald and I moved from FinTech to the bank in early 2019. at DKB, I am now responsible for the Private Clients division.

Since when have you been dealing with the topic of your panel and why are you enthusiastic about it?

Personally, I am excited about the topic in everyday life in many ways and I especially appreciate the convenience and accuracy when, for example, I am offered exactly the film that meets my taste. And I also have the feeling that it was created individually for me.

My claim is that we also inspire our customers – this is only possible with individual – and not with 0-8-15 – products and/or services.

I believe that we still have a long way to go in banking to be able to make the right and, above all, individual offer to customers at the right time and at the right touchpoint. But this is where we have to get to: offering a personalized, highly relevant customer experience. But: together with the customers – they should not become the product, but be enthusiastic about it. That’s why they also need to know what happens to their data.

What expectations do you have as a speaker for the upcoming TRX?

I have the expectations above all as a participant: as always, an open exchange at eye level with known and new co-creators* of the scene.

The TRX takes place for the second time: What relevance did the event have for you and the industry?

In addition to the two other events of Payment and Banking, Transactions is successfully in line. In my opinion, it is of great relevance, especially with the selection of topics that not only open up an exchange on classic banking topics. TRX consciously takes up topics with social responsibility – especially for our industry – . All the more I am looking forward for example to the contribution of Verena Pausder and the role of digitalization in education and equal opportunities.

Adapted to the situation, this year’s TRX will take place for the first time as a hybrid format. What experiences have you had so far with such digital event formats?

So far I have only had experience with small or internal hybrid event formats.

Most of the events were indeed completely virtual during the last months or recently offline on a small scale. My experience with virtual events is generally very positive – I still appreciate the personal meeting very much, which is why I’m looking forward to the hybrid version.

What questions would you like to ask your fellow panelists yourself?

In your opinion, which use-cases should have been data-driven by banks long ago, but are not yet being executed?

The TRX takes place in Offenbach. Why should FinTech also be an issue beyond the big hubs?

I am convinced that FinTech is also a growing topic beyond the hubs – nevertheless entrepreneurs* are attracted to locations where the framework conditions and infrastructure are better than in other places. But especially at locations that are not „hyped“, I know some entrepreneurs who have had very positive experiences there, for example with regard to long-term employee retention.

Looking back over the year – what has changed massively in your particular sphere of influence? Which of these is positive, which negative?

Looking back, this year in particular, I can see the effects in relation to Corona. What has changed in a positive way is that we have grown even closer together on a human level than before – I notice that especially with all our colleagues. Before, we had almost no video conferences – all of a sudden, these are now almost exclusively taking place, so we were also able to give and take a little more insight into private life, virtual coffee roulettes and sports groups were established and the informal exchange was consciously brought to the fore again. As the management team, we deliberately wanted to over-communicate. In weekly town halls we always answered all questions of our colleagues – and sometimes with my daughter on our laps.

Nevertheless, I find the exchange on a personal level to be missing – especially for bringing several teams together and organizing team events offline.