NoteThe following article is not an advertorial or sponsored post. No one was blackmailed and the text was written voluntarily without the influence of alcohol or other mind-expanding drugs. Nor is it a glossary or satirical pamphlet. Yes, it is serious: the big retail banks are not dead, and whether banks really die so quickly can be doubted. More than that, the savings banks in particular are on the way to becoming a neo-bank.

With the birth of the Fintechs about 15 years ago, the media simultaneously heralded the death of the banks. Especially in the B2C segment dozens of Fintech start-ups were founded to take a piece of the cake. No area of banking was not attacked by Fintechs and a whole armada of solutions came up, which tried to solve all kinds of problems better than any retail bank had done before. The initially ignorant attitude of the banks towards Fintechs led to comparisons like David against Goliath or rebels against the evil empire and accordingly a great sympathy for the start-ups. The Fintechs were something like the Icelandic football team at the European Championship 2016: Nobody had expected them and suddenly they were in the quarter finals and all the fans shouted “Hú”.

In the meantime, many Fintechs have come and gone, but some of the start-ups have developed into big players. The most prominent example is certainly the rise and fall of Wirecard, but also less scandalous and above all successful companies such as N26, Raisin or the Solarisbank are now an integral part of the industry.

In the B2C segment, the Unicorn N26 is repeatedly cited as the showpiece Fintech, which has seen itself not least as the nail in the coffin of classic retail banking. But what may look like a coffin nail may end up being nothing more than an acupuncture needle. The savings banks in particular are doing something. They seem to take their own TV commercials from the 90s seriously and are no longer just doing the flag thing. An analysis:

The mighty, mighty Savings Bank

With 379 Savings Banks, approximately 50 million customers and a business volume of EUR 2.980 billion, the Sparkassen-Finanzgruppe is the largest banking group in Germany. A comparison with one of the neo-banks would not only be unfair, but one between apples and pears. However, the figures make it clear just how big the lovingly called “reds” are. Very large. Of the 50 million customers, more than 50 % now manage their accounts online. This is good and bad at the same time, because on the one hand there is still a lot of room for improvement, but on the other hand the rate is bad compared to a neo-bank.

With the app it looks similar compared to the number of customers, not every customer* uses the app, but still there are many. Since its launch in 2009, the Sparkasse’s mobile apps have been loaded more than 20 million times. In the overview Banking Apps in Germany Accordingly, the Sparkasse provides the largest share of all banking apps. More important, however, is the number of MAUs (Monthly Active Users). As of August 2020, 9.15 million users* have actively logged into the banking app*. With 9 million credit cards, the Savings Banks are also the largest credit card issuer in Europe. It should be noted that, measured by the number of customers, there is a lot of room for improvement, but this does not have to be a bad thing.

“Innovations” made by Sparkasse

To mention the savings bank and innovation in one sentence is at least bold. But innovation has to be seen in context and in comparison with other banks, even neo-banks, savings banks do not have to hide. One can argue about whether the Haspa’s mouse account with Manni is the hot shit or the Knax Club in times of Netflix and Co. is bringing out the kids behind the stove, but the list of things the savings banks do is remarkable. What’s missing above all is what makes an ecosystem based on Apple or Google, a seamless user experience. Because basically everything is there, an excerpt:

- Apple PayWhether the Girocard is an isolated solution or not, the fact is that the savings banks were the first to bring the Girocard to Apple Pay. Even if they were very much listed with Apple Pay in the beginning. On Android they are not represented with Google Pay, but at least with their own solution. In short: Mobile Payment, for a long time withheld from neo-banks such as Boon (Wirecard) or N26, has arrived at the Sparkasse. And while the odd Fintech billboard advertisement can afford the one or other, the spot for Apple Pay comes to the Sparkasse at prime time

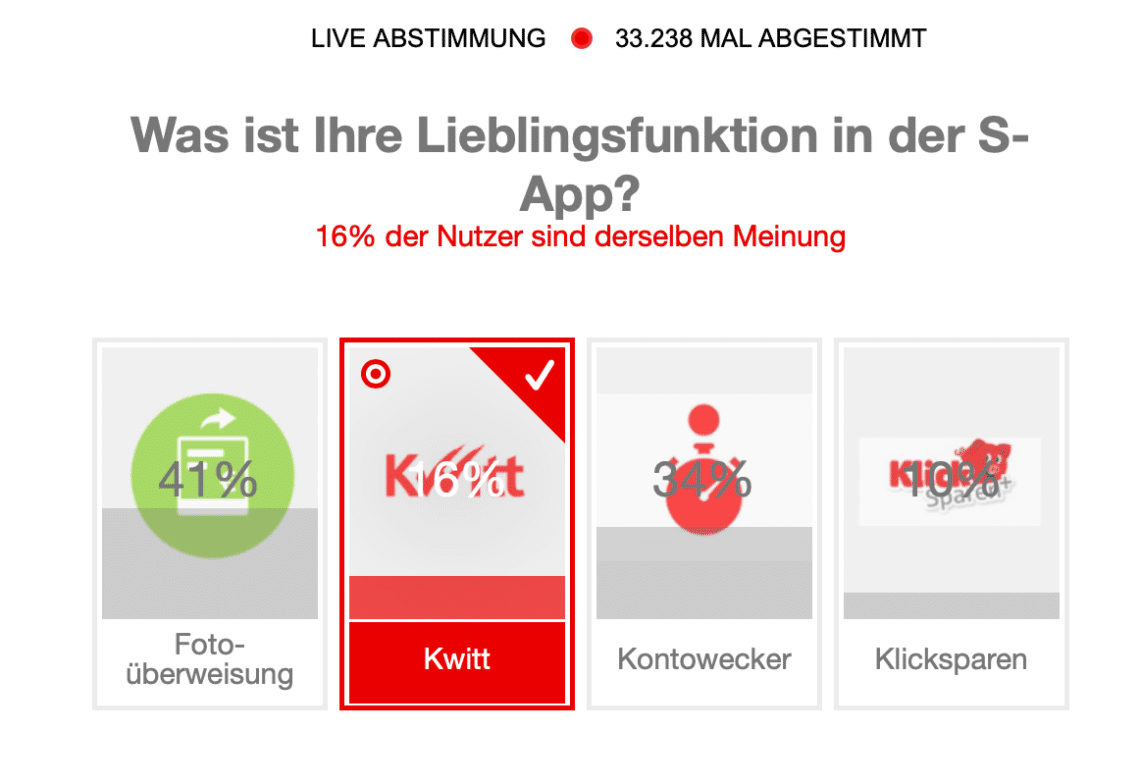

- peer-2-peer payment: Kwitt’s UX comes straight from hell. There’s nothing nice about that. Nevertheless, according to the live poll at savings bank.com 16 % of users* use this function. But more interesting are the real transaction figures*: 2.3 million Kwitt-users the Sparkasse counts as of July 2020. 620,000 times the function was used for sending and 90,000 times for receiving in the same month. This may seem small compared to PayPal, but it is also not that nobody uses it. As written: The UX from hell.

online bankingThe Internet branch (aka online banking) is to become a truly open branch this year PSD-API based financial platform and offer a complete multibanking service (turnover inquiry and transfers) including Paypal. This will then also be found in the apps.

- BranchesThe savings bank’s network of branches, often considered superfluous, is a very double-edged sword. There is no doubt that in times of progressive digitalisation, there is no need for a branch density as in the 90s. However, whether it needs no more branches, one can put a big question mark over it. The question is not whether it needs branches, but how many and in what form. You can’t take every complexity out of products today. Apple knows that, which is why there are Apple Stores, where you can find out about products and, in the event of a problem, you can also use the Genius Bar. Despite good telephone support, you are sometimes sent to the stores because a problem cannot be solved over the phone or is difficult to solve. The same applies to financial products. Creating a disposition with one click in the app is comfortable. It is less convenient for a real financial problem where a personal conversation is needed. IDEO, the world’s largest innovation agency, has developed various concepts for banks on what branches of the future could look like. User research has shown that branches are not superfluous in principle – only the way they are designed today. Two examples can be found here and here.

PaymentWith the acquisition of three value-added providers by DSV and over 300,000 medium-sized customers, the savings banks want to build up an app- or payment-based loyalty programme for customers and merchants. All of this is to start in Q1 2021 with a new mobile payment app including Paylater and Loyalty. All the “fun” is intended to make it easier for smaller merchants in particular to enter the world of cashless payment transactions.

UX (User Experience) and UI Design (Interaction Design)The Savings Bank and UX is one of those things. While the design of the online banking on the website (in the jargon Internet branch) can be put in the “Okay” category, the mobile apps from the house & Hof software supplier Star Finanz are only medium-hot. Yet it doesn’t seem that they can’t do it. Looking at the projects of their own innovation hub, one wonders why they get it there, but only there. Even the Yomo, which has since been discontinued, was anything but bad compared to the other solutions. At least not worse than some of the solutions that Fintech has given us over the past years. One is surprised that none of the solutions presented on the page of the Innovation Hub has made it to the public. In short: something like “knowledge and insight” seems to be there and just needs to be implemented on a broad scale.

Conclusion

As is well known, there is a world of difference between an available toolbox and knowing how to use the tools. Nevertheless, the savings banks have a toolbox full of interesting tools that others have yet to put together. In short: there is a lot available and it is above all a matter of “connecting the dots”.

A platform is not the sum of the possibilities, the art is to combine these possibilities in a meaningful way and to make the whole thing appealing. The savings banks (like most banks) are lagging behind many a challenger or neo-bank, and in times of stylish credit cards such as those offered by N26, Klarna and Co. Desired motives as they are offered by one or the other savings bank In a network like the savings banks, the many cooks who stir the porridge certainly do not help to bring the necessary horsepower to the streets.

But the launch of e.g. Apple Pay and the integration of the Girocard show that it is possible. Savings banks are not afraid of completely new topics. The, admittedly very slow, cooperation with Identity Start-up yes is one such example. Also the launch three years ago of Mastercard red (Debit-Mastercard (DMC), where sales are posted daily from the current account) at Sparkasse Siegen or the early cooperation with Mobile Payment Alternative Bluecode are examples of new topics. And even if Yomo is buried, a lot has already been tried. What is missing in the end is the courage to pull things through and to carry them across Germany. To fill my karma account at the Sparkasse completely: I think the Sparkasse lacks in the end much less for a real ecosystem as you would expect from tech giants than any neo-bank out there. And the lead that these neo-banks in particular still have today in digital contact points is catchable. You just have to do it.

* Someone who knows someone who knows the cousin of the person who knows the exact numbers twittered the numbers to me