Distributed ledger technology (DLT) will permanently change some industries. Thanks to its property as a decentralized, tamper- and censorship-resistant database, DLT contributes to generating new business models, increasing process efficiencies and establishing cross-company trust. Use cases for the technology range from industrial use cases in areas such as energy, manufacturing and logistics to financial use cases.

In order to exploit the full potential of the technology, it should be possible not only to exchange assets, goods and services via a DLT, but also to exchange money. Consequently, there is a significant need for a payment solution that is compatible with DLT-based decentralized networks and enables transactions in the respective widely used national currency, such as the euro. In this paper, we present a taxonomy of digital payments to provide a common ground around DLT-based payments, which is essential for the discussion around financial innovations such as digital central bank currencies (CBDCs) and stablecoins.

The three pillars of digital payments

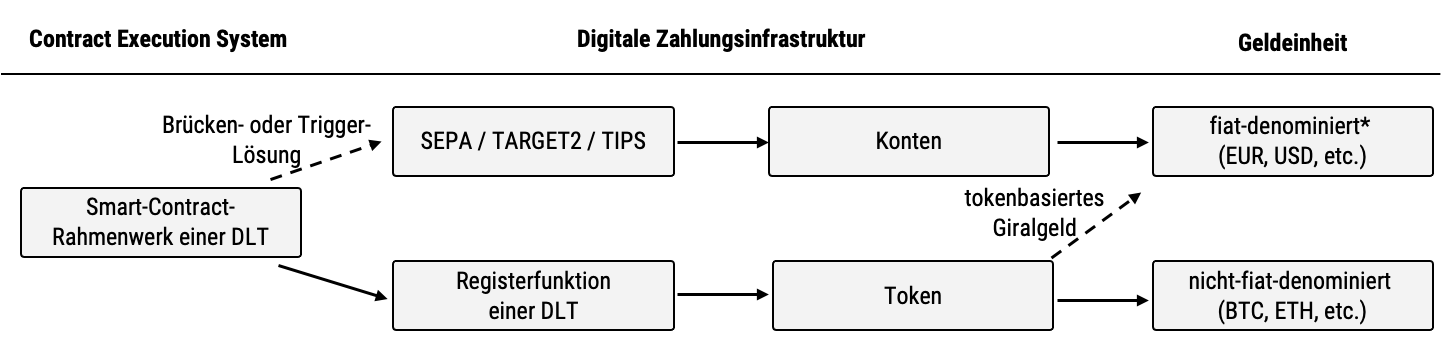

The digital payments value chain can be divided into three pillars: (1) the contract execution system, (2) the digital payment infrastructure, and (3) the monetary unit. This taxonomy is illustrated in Figure 1.

Figure 1: Value chain of digital payments

Source: Bechtel et al. (2020)

The Contract Execution System

The Contract Execution System is the first component of the digital payments value chain. This captures decentralized business logic that automates business processes and triggers payments in a predefined manner, similar to “if-then” functions. Such programmable payments can already be implemented in today’s banking system, for example in the form of standing orders and direct debits. However, the possibilities are limited due to restricted programming possibilities and system capacities.

DLT-based smart contracts promise efficiency gains due to greater flexibility. Such smart contracts can be used, for example, to execute, monitor and document transactions. In this way, money flows can be made programmable in a decentralized manner and payment processes can be automated considerably.

One particularly relevant application area is the Economy of Things. In the future, machines will become market participants in their own right, so-called autonomous agents that make decisions, negotiate prices and make payments on their own. Here is an example: In the future, an autonomously driving electric vehicle could drive to the next charging station, negotiate a price with the charging station, carry out the charging process and make a payment – without any human intervention at all.

“In the future, an autonomously driving e-car could drive to the nearest charging station, complete the charging process and pay – without human intervention.”

Theoretically, the payment could even be split and the corresponding amount transferred directly to all defined payment recipients (e.g. 70% to the electricity provider and 10% each to the manufacturer of the charging station, the filling station operator and the car manufacturer). All these process steps would be implemented via smart contracts in the contract execution system.

The digital payment infrastructure

The second pillar of the value chain is the digital payment infrastructure. It refers to the system through which payments are ultimately made. Payment infrastructure can be differentiated primarily based on the underlying technology, i.e., a DLT solution or a non-DLT-based solution. Today, payments are primarily processed via established banking infrastructures, such as SEPA, TARGET or TIPS. However, traditional bank accounts can also be used in the future to process payments triggered by DLT-based smart contracts. For this purpose, so-called bridge or trigger solutions can be used, which connect the DLT network (i.e. the DLT-based Contract Execution System) and the conventional payment system (in this case the banking infrastructure).

In the electric car example, the digital payment infrastructure defines the system through which the payment is processed. Since bridging solutions can currently only be used in test environments, payments triggered by a DLT-based contract execution system can only be processed via DLT-based payment channels, such as the Bitcoin or Ethereum blockchain. However, these channels do not yet allow euro-denominated transactions. This leads to the third pillar of the value chain in digital payments – the monetary unit.

The monetary unit

The monetary unit denotes the unit of account of the payment. Units of account can be fiat currencies such as the euro or the US dollar, as well as non-fiat currencies such as bitcoin or ether. Technically, currencies such as the euro could be transferred via various digital payment infrastructures. Euro-denominated payments are currently made via the traditional banking infrastructure.

DLT systems are primarily used to send non-fiat denominated currencies, such as Bitcoin and Ether. However, in the future it will also be possible to send euro tokens directly via a DLT. Financial institutions and central banks worldwide are currently working on such solutions. These include initiatives around tokenised fiat money, tokenised e-money and CBDCs.

Advantages of token-based, “onchain” euro solutions

If the euro were to be made available “onchain” via a DLT and if consequently the complete value chain of digital payments, i.e. contract execution system, digital payment infrastructure and monetary unit, were to be mapped via a DLT, there would be considerable advantages compared to the bridge solution. First, such an embodiment would enable real-time settlement with other assets or DLT-based currencies. For example, digital DLT-based securities or other assets could be settled instantaneously with a DLT-based euro (keyword “delivery-vs-payment”).

Consequently, intermediaries such as clearing houses would become redundant as counterparty risks would be significantly reduced. Moreover, a DLT-based euro could be used for innovative business models around tokenization. In this way, micropayments could be carried out efficiently, which is currently not (yet?) possible via the current banking infrastructure. For these reasons, it is welcome that financial institutions are looking at the “tokenization of the euro” to increase efficiencies, reduce risks, and enable innovative business models around tokenization.