The UK is one of the most important e-commerce markets for the EU. In 2019, the UK accounted for 34% of online sales in Western Europe. Now, as a consequence of Brexit, Mastercard wants to classify the UK as “inter-regional” from October 2021, which will result in interchange fees for “card not present” (CNP) transactions by UK customers increasing five-fold. Visa recently announced that they will follow suit, but the implementation date has not yet been given.

Consequences of interchange reclassification for traders in the EU

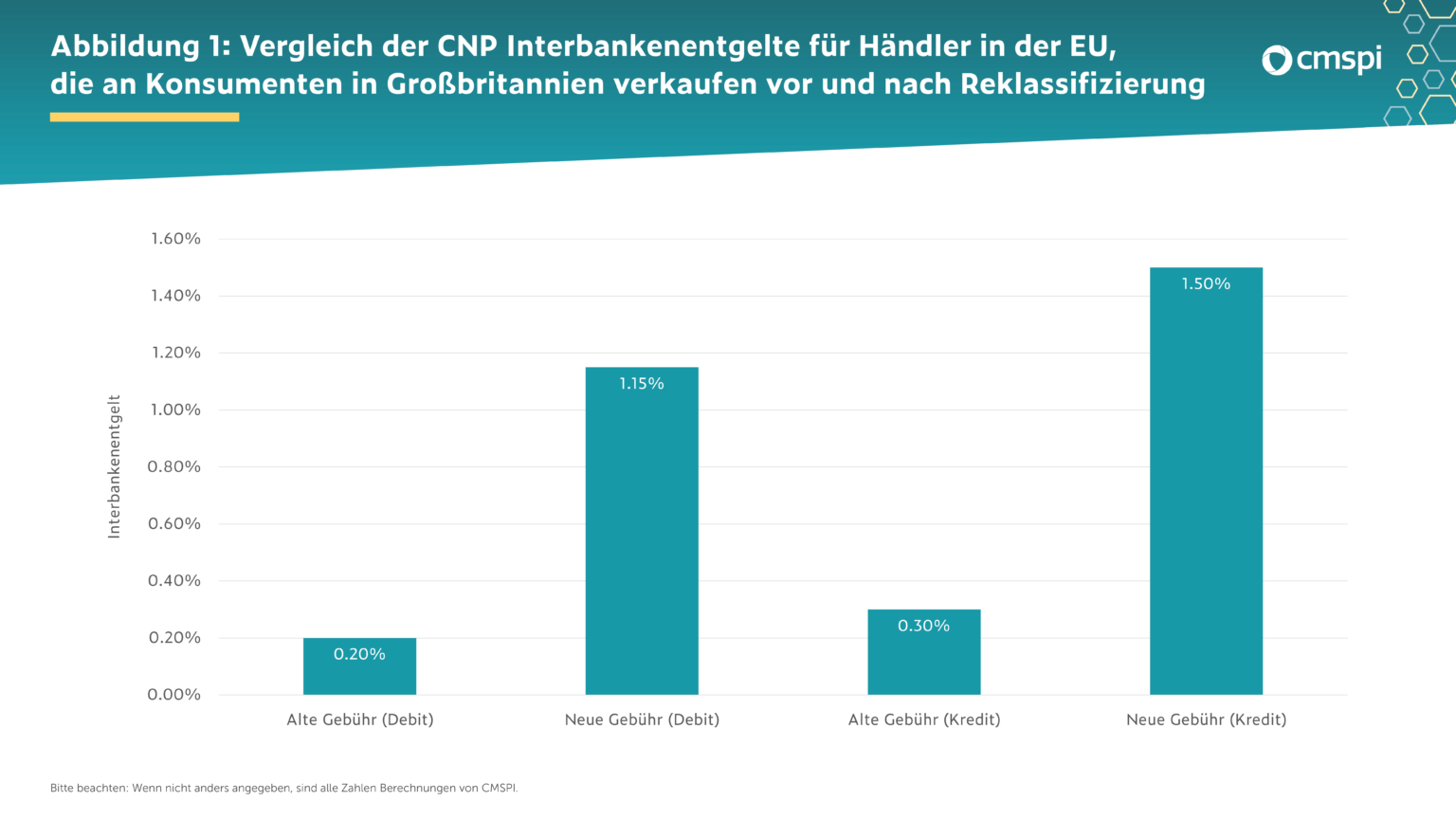

The recent announcements mean that interchange fees for EU merchants selling online to UK consumers will increase from 0.2% to 1.15% for a debit transaction and from 0.3% to 1.5% for a credit card transaction, as shown in Figure 1. Interchange fees are paid by the merchant to the cardholder’s card-issuing bank and can represent 80% of the total cost of accepting card transactions for large merchants.

Thus, according to CMSPIestimates, traders in Europe must, the world’s leading independent payments consultancy, will now pay €117.54 million in interchange fees for the same number and amount of transactions as a result of the reclassification instead of €21.48 million, an increase of €96.06 million, at a time when stores are closed and online transactions are often the only way to keep business going.

Is this just the beginning?

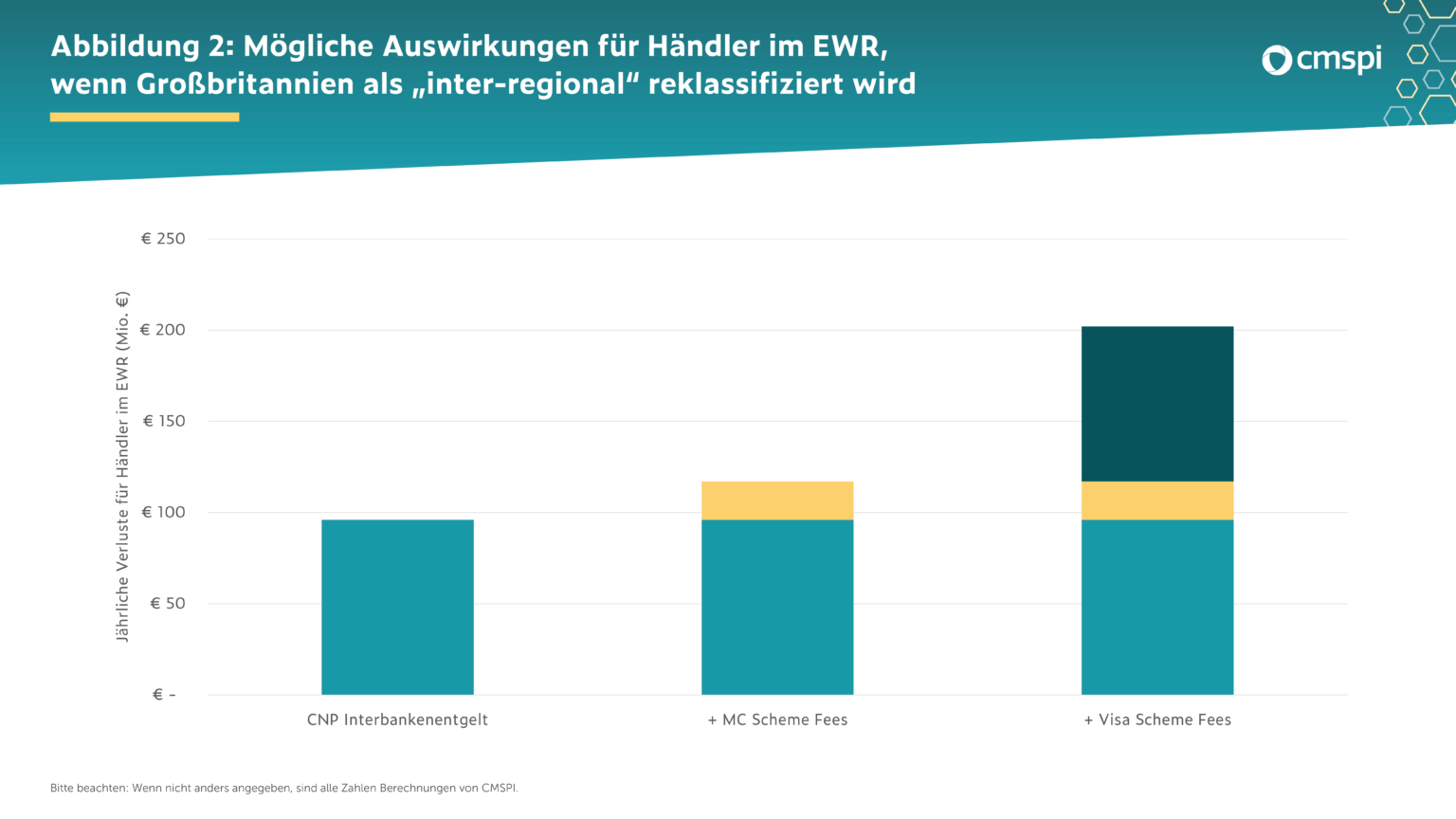

CNP transactions by UK consumers in the EU are only a small subset of the transactions for which this reclassification may be relevant in the long term. The additional cost of €96.06 million may therefore be the first step in many theoretical increases:

- The classification as “inter-regional” could also be applied to Mastercard Scheme Fees, which would increase them from around 0.197% to the inter-regional average of around 0.77% (CMSPI estimates) – and not just in e-commerce.

- Estimated additional costs for European traders: +€20.99 million (+€117.05 million total)

- Visa could also reclassify scheme fees.

- Estimated additional costs for European traders: +€84.99 million (+€202.04 million total)

The following diagram illustrates the different stages of development. As of today, we are at step 1, but dealers should be prepared to pay a total of more than €202 million extra annually if they sell to customers in or from the UK, should reclassification continue.

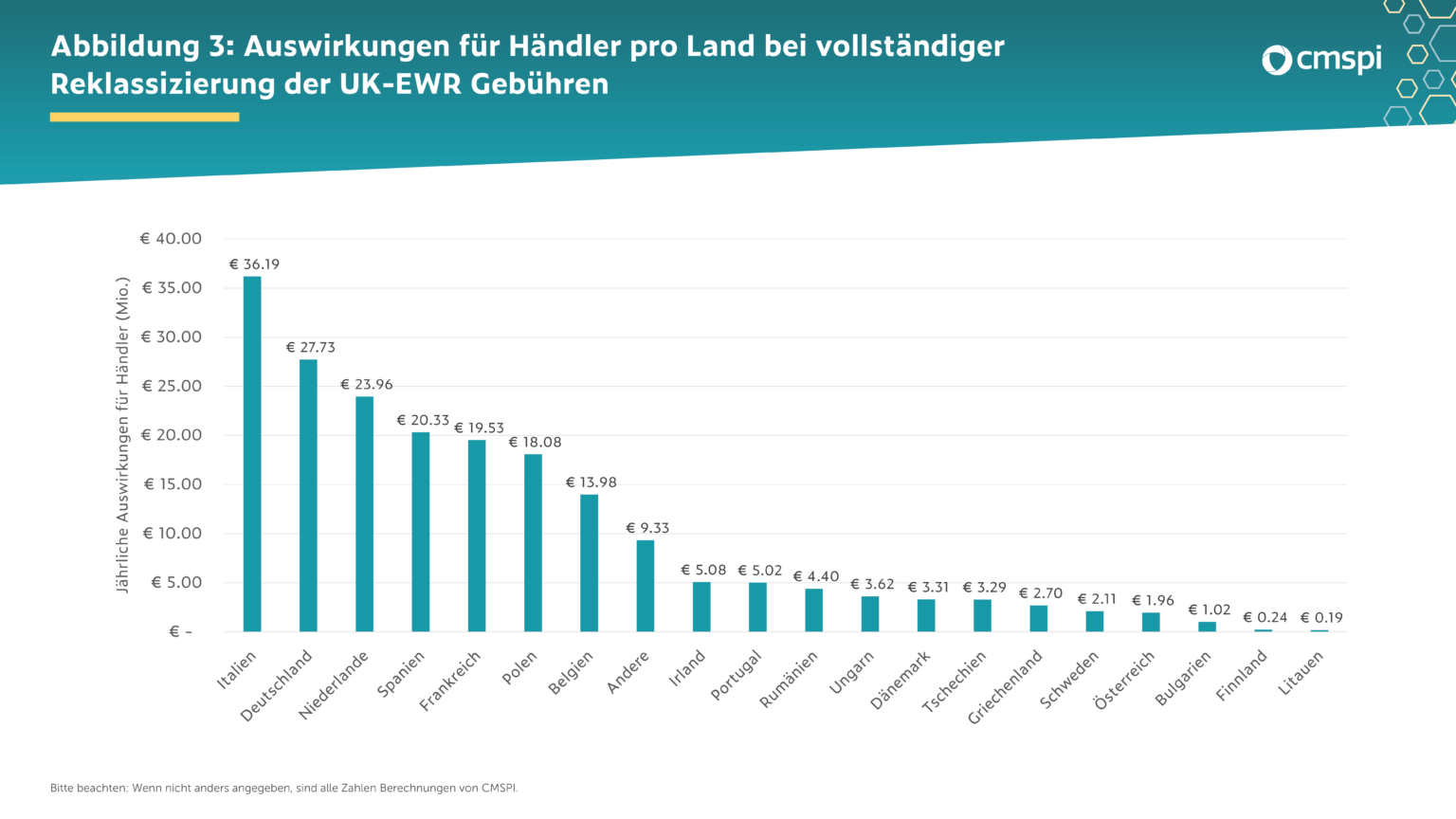

German dealers have second highest additional costs

If the UK is fully reclassified as “inter-regional” (scheme fees, interchange fees, Visa and Mastercard), CMSPI calculates that European merchants will have to pay approximately €202 million more per year than they would pay now for the same transactions.

Of this €202 million, Germany would bear almost 14%, meaning that German traders would have to reckon with additional costs of up to €27.73 million.

Cause? Regulatory Gaps

In 2015, the EU Interchange Fee Regulation (IFR) set caps on interchange fees for domestic and intra-EEA card transactions of 0.2% (debit card transactions) and 0.3% (credit card transactions).

However, the Regulation does not regulate “inter-EEA” transactions (i.e. those where the merchant is located within the EEA and the consumer uses a card issued outside the EEA). Instead, for such transactions, an additional agreement has been reached between the EU and the card schemes to reduce these fees. The ceilings for card-present transactions have been taken from the Regulation (0.2% and 0.3% respectively), while ceilings for card-not-present transactions of 1.15% and 1.5% have been agreed. These are exactly the fees that will now apply to UK consumers when making online transactions. While the UK has retained the Regulation as part of its withdrawal from the EU, there is nothing to stop Visa and Mastercard classifying the UK as “inter-regional” in its transactions with EU merchants.

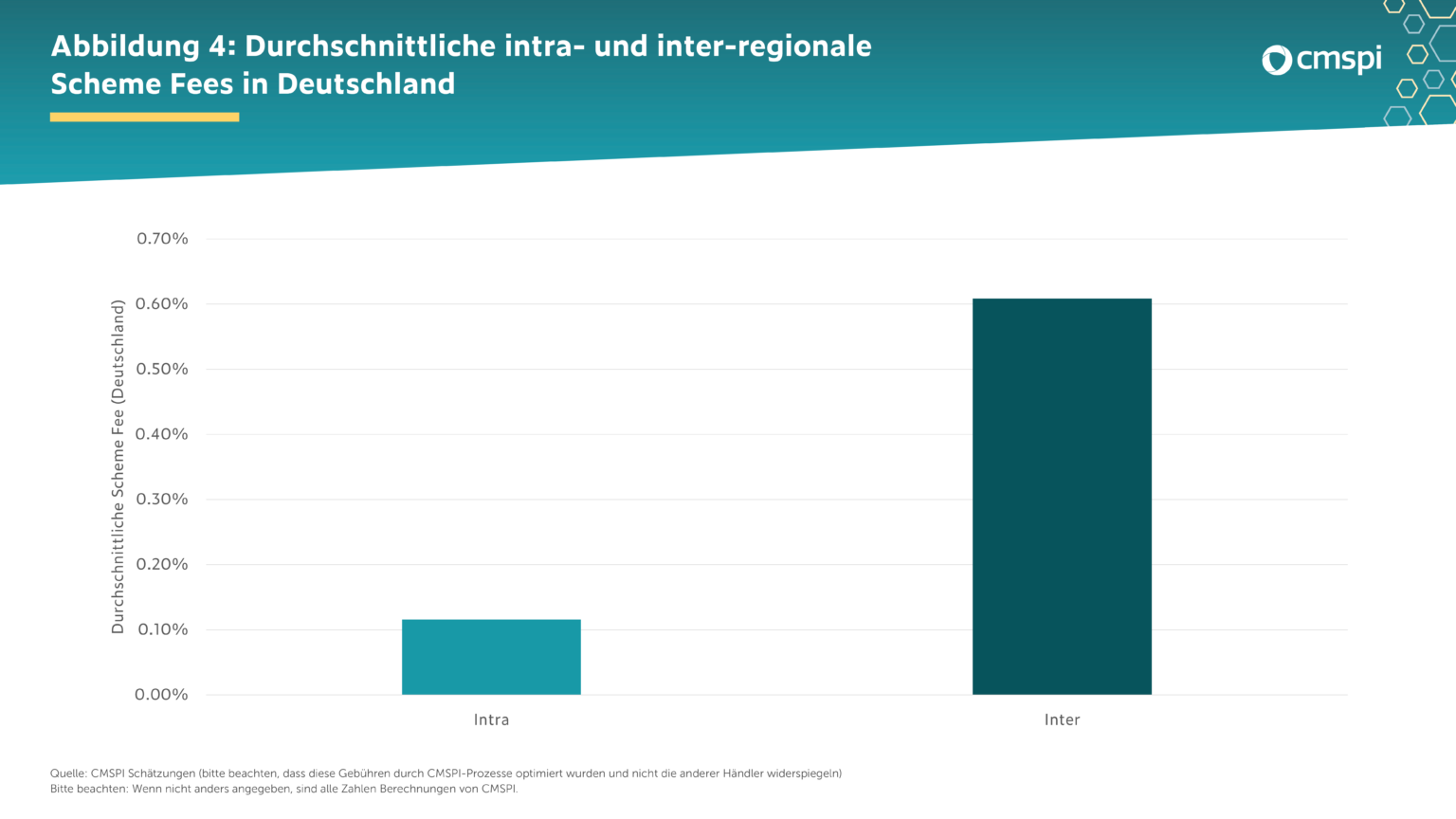

The regulation was a major victory for traders and consumers in Europe. However, the announced changes once again clearly show that there are large gaps in the legislation and that this creates immense problems. Scheme fees, which are unregulated, are a clear example of this. They are paid by merchants to card schemes via their acquirers. Our data suggests that successive increases in Scheme Fees since 2015 have resulted in traders now missing out on more than €1bn of the €9.4bn in annual savings from the regulation. The Brexit reclassification is of particular concern in this context, as “inter-regional” scheme fees are significantly higher than intra-EEA fees. The following chart shows average system charges for Germany for illustrative purposes.

Not to mention interchange fees; another pattern that threatens to emerge is that interchange fees will be increased for non-regulated transactions and card types – such as those with commercial cards in the EU. CMSPI estimates that the 2020-2021 changes to Mastercards Corporate Prepaid Interchange will cost European merchants an additional €15.5 million each year. Although Brexit now provides card schemes with a “good” argument for further fee increases, this comes against a backdrop of similar changes that have seen merchants incur significant additional costs for years.