-

Value-added services in payment – a stocktaking.

Acquirers and PSPs are under pressure from falling margins and increased competitive pressure. They must reinvent their business model and expand their value creation. In the process, value-added services such as data analytics, couponing and loyalty are moving back into focus. However, payment itself has become too interchangeable and other players have long since improved…

-

Companies in the FinTech sector: Myos GmbH

The industry has grown up and has long outgrown its infancy. There are so many companies that shape the industry but not all of them are equally well known. Who are the companies that are the glue between finance and digital technologies? In our series “The Companies of the FinTech Industry” we give companies or…

-

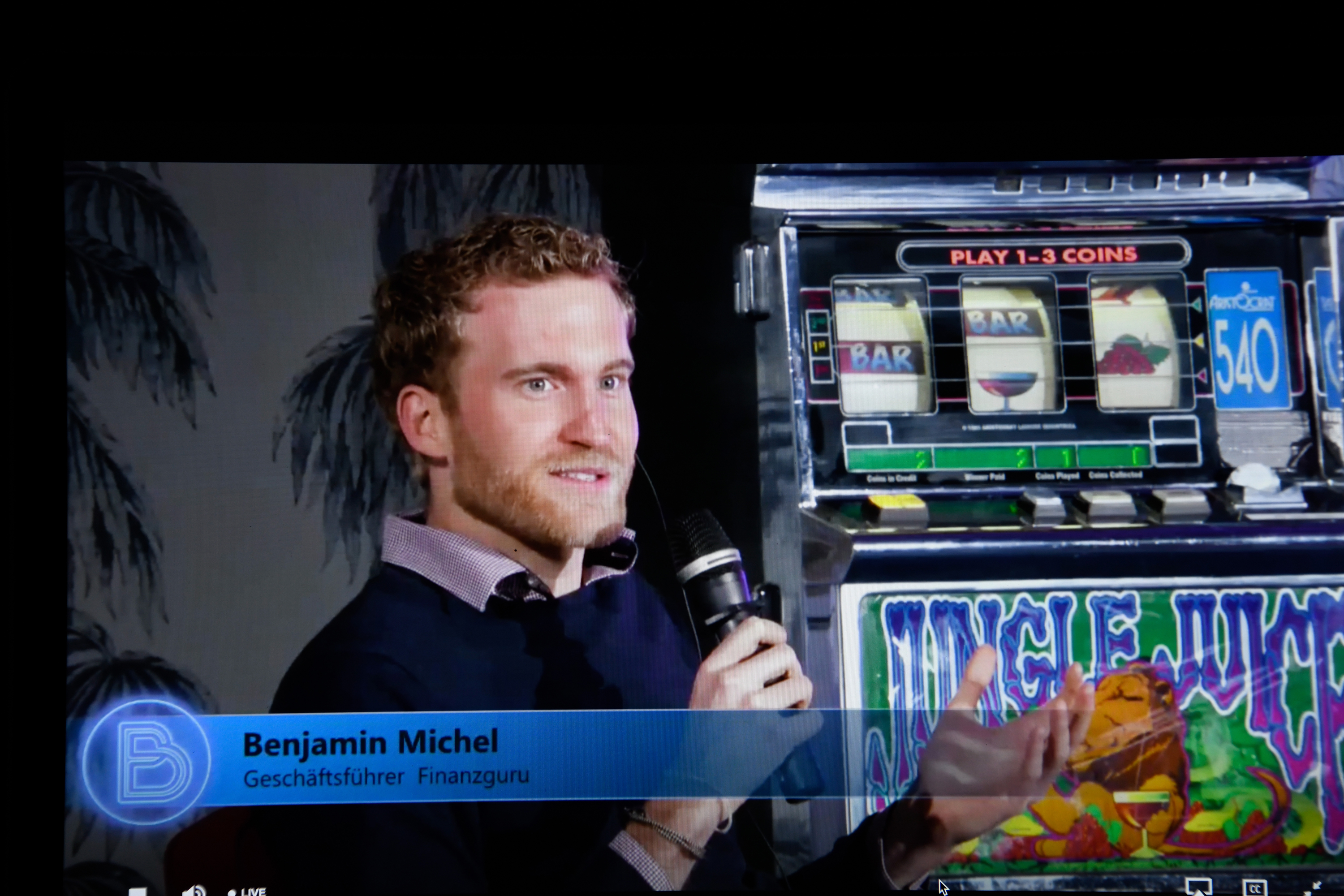

“Best to be afraid of us.” The future of Personal Finance Management

A video interview with Benjamin Michel (finance guru) at the Banking Exchange 2020 For the first time in the event history of Payment & Banking, the Banking Exchange, which was otherwise designed as an “invite only” event, took place in a stream accessible to all. Our goal was to live what other events only preach:…

-

Götterdämmerung – es wird ernst bei den Neobanken

Ist sie vorbei die Herrlichkeit der Neobanken bzw. Challengerbanken? – oder sind im klassischen Gartner Hype Cycle – bzw. haben den “Mount Stupid” (den uns Prof. Dück auf unserer Transactions.io 2019 so schön näher gebracht hat) überwunden? Monzo verbrennt mehr und mehr Geld, Starling hat seinen Pivot schon hinter sich und um N26 ist es –…

-

Is Tesla the new Wirecard?

A contribution from Robin Brass Wirecard has long been the most traded and hotly discussed share in Germany. Many people ask themselves whether Tesla does not also have many parallels with Wirecard.All in all, the picture does indeed show some parallels, but also some major differences, which should certainly not only be of interest to…

-

What has this “Fintech” ever brought us?

Or why the credit process is still at the status of the 70s? Disclaimer: This article arises from a phase of emotionality, I know you should never do that and it is in every good education book. But I’m doing it anyway, because I have a grant.We have tried to get a company loan, yes…

-

Joonko and his credit plans

A few days ago, we had it at Newsletter already reported. Under the headline “Joonko now also arranges consumer loans”, it was announced that the financial portal Joonko now also offers consumer loans. Joonko wants to offer customers a fast, fully digital consumer loan agreement without lock-in offers with guaranteed interest rates. Identification is carried…

-

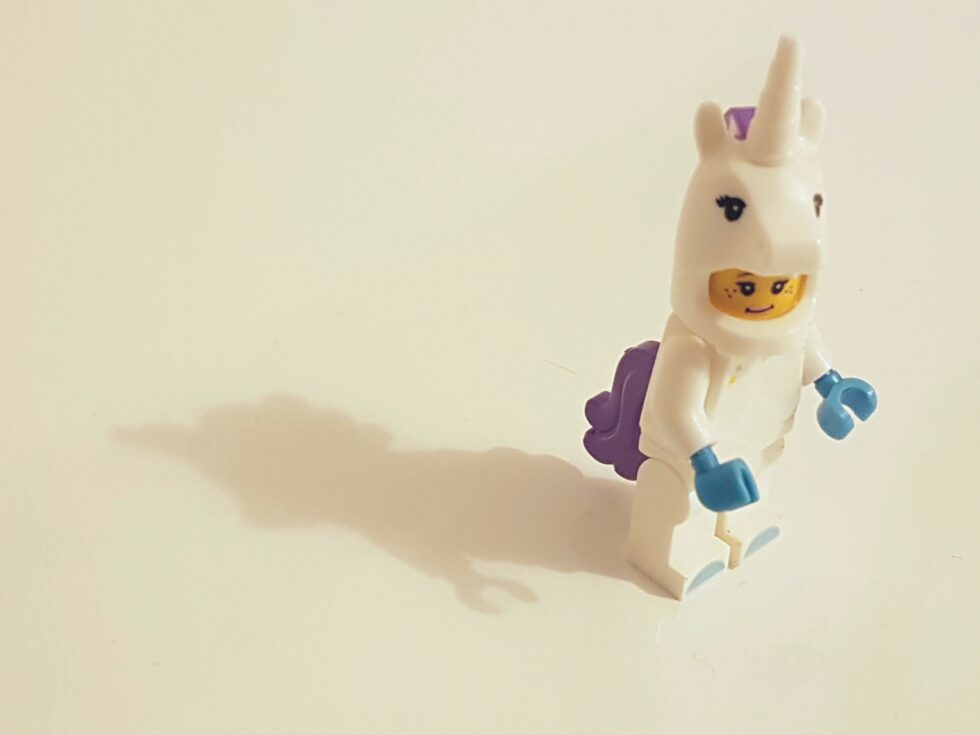

N26 – NEINhorn Bank in the best sense of the word

This right in advance: This contribution is first of all personal and then also political. In 2013, I made a Angelinvest into a founding team that had a very cool product idea and which gave me the impression that it was deeply convinced of its idea. The product was called Papayer and was basically a Teenager Debitcard with an app that could also…

-

N26: A no horn.

In the Herzwald lives a small, cute little unicorn. But although everyone is very fond of him and feeds him sugared clover, the little animal does not behave like a unicorn at all. He simply says no all the time, so that soon everyone will call him just NOHORN.The NEINHORN is one of the best…

-

Summer slump in German payment traffic – yes, where is it?

Instant messages by Marcus W. Mosen: #8 Marcus W. Mosen comments payment or banking topics on various portals and delights his followers on twitter (@mwmose) with pointed contributions to Payment, Fintech or politics. From now on you will find his monthly guest column “instant messages by…” on current events in Payment, Banking & Co. The…

-

And now Bank – The rearguard to the bank

On our own behalf: In recent months it has become clear that some of our Payment & Banking members are moving to Deutsche Bank in their main job. As a result, the protagonists are writing individual statements. After the vanguard Andre and Rafael yesterday now the rearguard today Jochen Siegert “Of all people, the bank…

-

The stationary trade – a swan song?

A guest contribution from Bjorn Wessel Corona is changing the world and with it the trade. Not through new insights, but rather by accelerating existing developments. What took 5-10 years before is now happening in 3 months. In retail, the “final breakthrough” of eCommerce, long awaited by some and feared by others, has become visible…