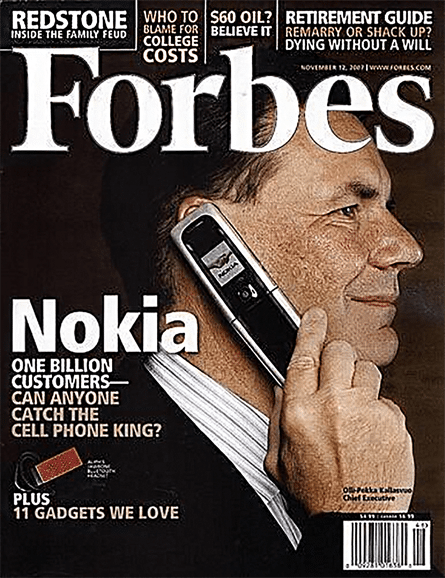

Some of you may still remember the year 2007, the year in which the earth stood still for a short time and the first real smartphone was presented: the Apple iPhone. Almost exactly 13 years ago, the iPhone marked the end of the so-called feature phones and with it the end of the successful mobile phone division of manufacturers such as Nokia, Siemens, Sony Ericsson and Co. until 2007, feature phones or “mobile phones” dominated the entire market, especially Nokia, which just 3 months before the introduction of the iPhone was the title of the Forbes magazine with the headline “CAN ANYONE CATCH NOKIA?

The feature phone was regarded as a replacement for the old, analogue world of telephones. The mobile phone market started at the beginning of the 90s and by 2000 had already started to grow with 48.15 million customers basically every German household is a feature phone popularly called a mobile phone. Every year a new category of device was launched on the market. Mobile phones that could do even more than the previous model. Like Swiss Army Knives, the phones could do a lot, but none of them could do it properly, let alone operate them. It took a customer-centric design company like Apple, and later Google, to revolutionize our lives. The smartphone we know today.

Something similar is happening in the banking market. NEO banks have come to replace the old world of old analog banks. Fintechs like N26, bunq, Revolut, Vivid and Co. have gained a considerable number of customers in the last few years because they saw the weaknesses of the traditional banks and served them differently. So far so good. If there aren’t two little problems.

Problem number 1: The failures of traditional banks can be solved

The distinguishing features of NEO banks can be summarized in one sentence. Better UX in the (mobile) apps, a fancy credit card, cheeky marketing and a few features for nerds. That’s enough for over 5 million customers at N26 after all. But the world keeps on turning and the sluggish retail banks are still sluggish but more lively than a few years ago. As the speed of innovation of neo-banks is also limited, the gap is narrowing. So what remains of the digital edge? Apple or Google Pay? They all do that now.

Better user guidance? There are big differences. Whether bunq’s UX is better than that of the Sparkasse or Deutsche Bank is a big question mark. N26 is undoubtedly at the top of the list, but that is a solvable problem. And if you compare the Internet branch of the Sparkasse, i.e. web banking, with that of N26, the difference is not so big either. In other words, neo-banks are better at addressing customers and UX in many ways. But not everything that glitters is gold.

“Neo-banks are better at addressing customers and UX in many ways. But not all that glitters is gold.

That leaves the fancy credit card, which in times of Google and Apple Pay is no longer seen as a big thing anyway. Marketing? Not every bank campaign was boring or old-fashioned. On the contrary. There are still the features. Neo-banks come with a different, sometimes extended range of functions. Most of them are add-ons. Goodies that are Nice-2-have, but play a minor role when displaying the account balance, making a transfer and looking where the money went. And the supposed strength of the NEO banks to be 100 % digital becomes a disadvantage if you have a problem and can’t solve it in a personal conversation. Anyone who has ever had a financial bottleneck knows what the talk is about.

Problem number 2: NEO banks boil with the same water

Every account, whether from the local branch bank or from the chic chai latte hippster bank in Berlin-Mitte, is the same in the end. There is nothing revolutionary about it. To stay with the metaphor from the beginning: there are telephones, but what is missing is the smartphone among banks. And if this comes, be it from Google, Apple, Facebook or any other player brave enough to break new ground, everyone will look out of the laundry equally. Then banking will be redefined. And you can see the signs. On the one hand at Apple with the Apple Card and on the other hand at Google together with Citigroup who want to launch a bank account. Because one thing is certain: there will be no more boiling with water.

Conclusion

Fintechs such as Kontist, Solaris, Penta or Qonto, which are not in the end customer segment, need not worry. These are niches, even large niches, into which end-customer-focused GAFAs of this world usually do not go. Too special and not so easy to scale. Retail banks still have the bulk of customers and are (like Goldman Sachs in the US or Citigroup in the US) also large enough for cooperation.