Über die Revolution der urbanen Mobilitätsindustrie

Einführung

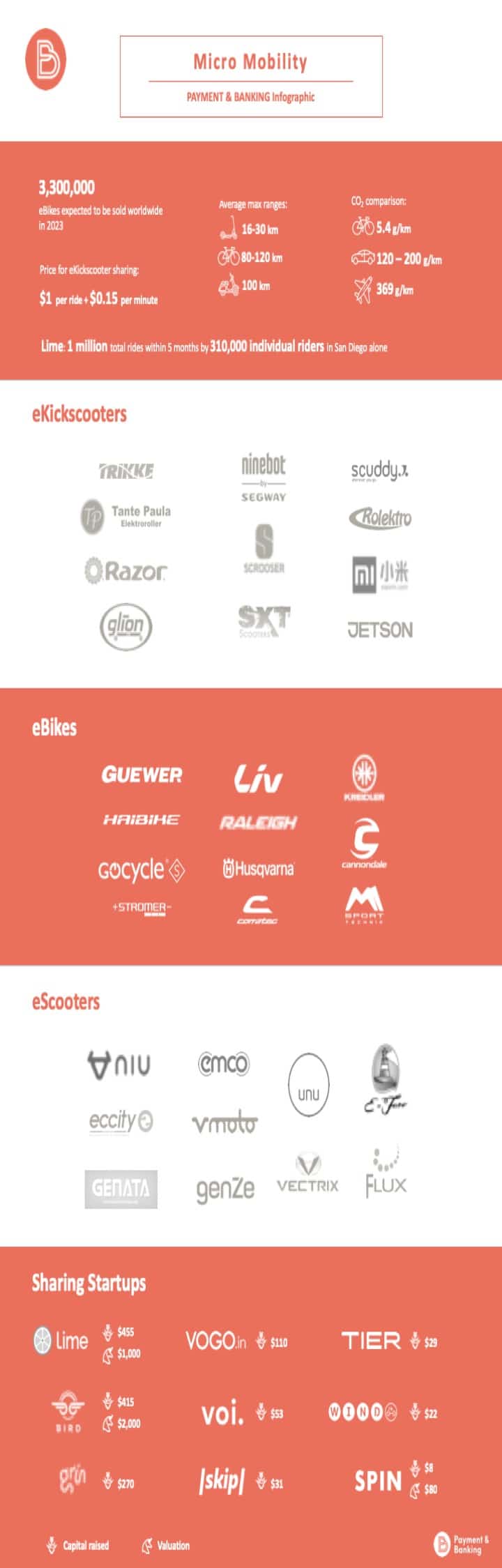

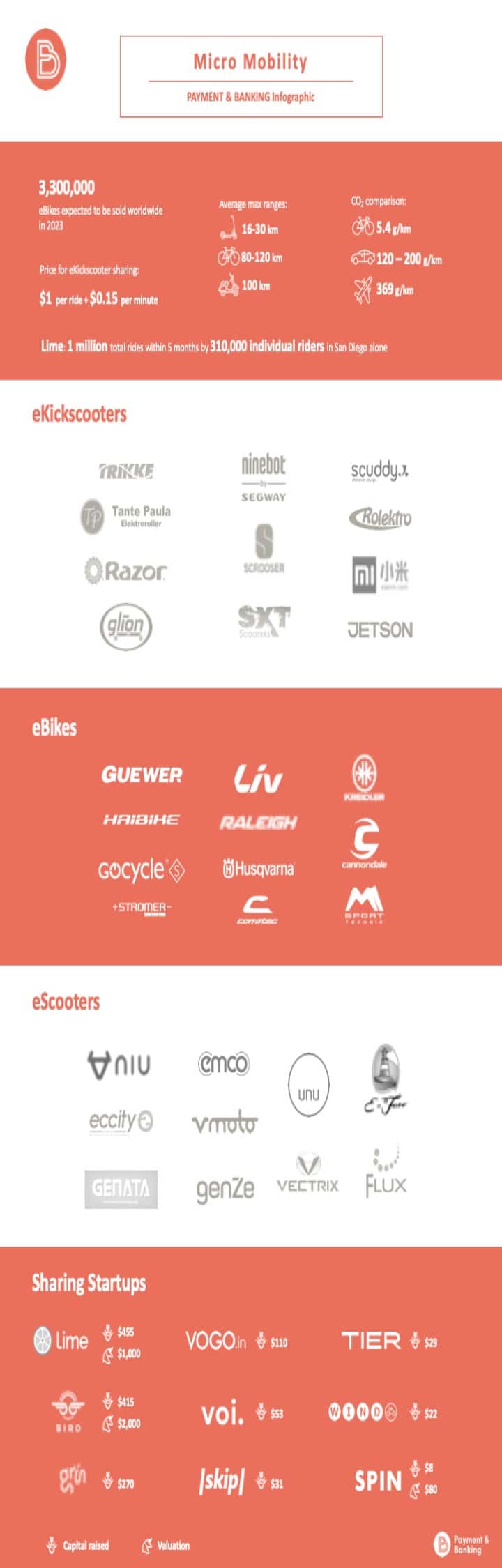

Die Weltbevölkerung wächst stetig und rund 60% aller Menschen werden bis 2030 in Ballungsgebieten leben. Dies wird sich direkt auf die Verkehrssysteme in solchen Bereichen auswirken, die bereits an ihrem Limit sind. Da sich die Präferenzen der Verbraucher ändern, arbeiten verschiedene Unternehmen und Start-ups an Lösungen, die den Bedürfnissen moderner Kunden entsprechen. Ein Auto zu besitzen ist nicht etwas, was jüngere Leute heutzutage so sehr anstreben – im Vergleich zu bisherigen Generationen.

Deshalb erleben alternative Verkehrsmittel eine Boomphase. Vor allem elektrisch betriebene Verkehrsmittel sollen das größte Potential haben, nicht nur weil sie umweltfreundlich sind. Denn hinzu kommt, dass sie zusätzliche digitale Dienstleistungen anbieten, die für technisch versierte Kunden sehr attraktiv sind.

Urbanisierung und neue Mobilitätstrends sind hier, um die urbane Mobilitätsindustrie zu revolutionieren. Ein Trend, der oft übersehen wird, aber spaltende Auswirkungen haben kann, ist die Mikromobilität.

Es handelt sich um eine brandneue Transportkategorie, die sich auf kürzere Distanzen oder gar auf die „letzte Meile“ konzentriert und eine Alternative zu traditionellen Autos und öffentlichen Verkehrsmitteln sein soll. Wir sprechen von eKickscooter, eBikes und eScooter.

Mikromobilität – alternative, elektrisch betriebene Verkehrsmittel

eKickScooter:

Mit einem leisen Rauschen rollen sie über Wege und Straßen, oft mit überraschend starker Beschleunigung: moderne Roller – auch Kickroller genannt – mit Elektromotor und Batterie. Elektrisch getriebene Roller sind heutzutage Teil der Straßenszene auf der ganzen Welt. Nicht nur in amerikanischen Städten, sondern auch in Moskau, Tel Aviv, Paris und Wien gibt es eine rasante Verbreitung von elektrischen Kickrollern. Mietmodelle boomen vor allem in den USA, sind aber in Deutschland bisher verboten, denn Kraftfahrzeuge, die schneller als sechs Stundenkilometer fahren, benötigen in Deutschland eine Betriebserlaubnis und Versicherung für öffentliche Straßen, was bei Elektro-Kickrollern bisher nicht der Fall ist. Jedoch gibt es in internationalen Großstädten noch viel Potenzial.

eBike:

Fahrräder erleben das Zeitalter der Elektrifizierung genauso wie Autos. Mehr als 150 Millionen E-Bikes erreichten in den letzten zehn Jahren den Endverbraucher und 31 Millionen wurden allein 2014 verkauft. Der größte Anteil dieser Käufe fand in China statt, was 2012 93% des Weltmarkts umfasste. Aber die Marktdurchdringung nimmt weltweit zu. In Europa verzehnfachte sich der Umsatz zwischen 2007 und 2012 fast, wobei Deutschland und die Niederlande die beiden führenden E-Bike-Märkte waren. Dennoch ist der globale Markt noch lange nicht gesättigt: der weltweite Absatz wird bis 2023 auf 40 Millionen geschätzt.

eScooter:

Zum ersten Mal seit 1986 sind motorisierte Zweiräder wieder auf der Pariser Motor-Show vertreten. Darunter viele Elektroroller, die am Straßenverkehr teilnehmen und Geschwindigkeiten von bis zu 100 km/h erreichen können – ein langjähriger Trend in der französischen Hauptstadt. In den Städten wächst die Abneigung gegen Pkws, während die Akzeptanz alternativer Verkehrsmittel immer mehr zunimmt.

Das Potenzial für Elektroroller ist enorm: Allein in China sind bereits rund 25 Millionen Elektroroller in Betrieb. Nirgendwo sonst gibt es mehr Elektroroller als hier. Europa hingegen weist nur eine fünfstellige Anzahl von verkauften Elektrorollern auf, verzeichnete aber in den letzten Jahren hohe Wachstumsraten beim Verkauf von Elektrorollern.

Beispiele

Niu

Niu ist ein relativ neues Startup, das 2015 von Li Yinan, ehemaliger Chief Technology Officer von Chinas größtem Internet-Suchanbieter, Baidu, gegründet wurde. Innerhalb von etwas mehr als zwei Wochen nach der Einführung auf Indiegogo wurden eScooter im Wert von über zehn Millionen Euro verkauft. Diese Kampagne zählt auch heute noch zu den zehn erfolgreichsten Crowdfunding-Kampagnen. In 2018 erhob NIU 63 Millionen Dollar mit dem Gang an die Börse, in den USA, was dem Startup einen Marktwert von rund 654 Millionen Dollar zu diesem Zeitpunkt bescherte.

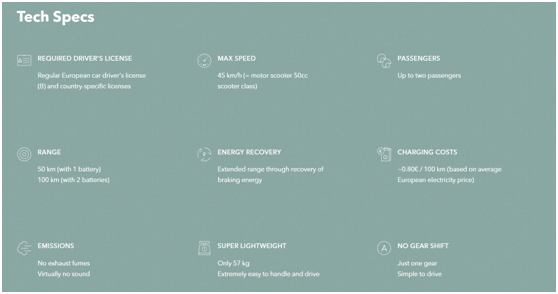

UNU

Ein bekannter Vertreter aus Deutschland ist UNU. Das Startup wurde vor sechs Jahren gegründet, ist einer der Marktführer in Deutschland und verkauft seine Modelle auch in Österreich, der Schweiz, Frankreich sowie den Niederlanden. UNU hat verstanden, wie man den Kunden direkt anspricht und ein Online-Verkaufsmodell entwickelt, das die meisten Zwischenhändler eliminiert. Dazu konfiguriert der Kunde seinen eScooter auf der UNU-Website und bekommt ihn an seine Haustür geliefert.

Mando

Mando hat eine globale Innovation auf den Markt gebracht. Mit „Mando Footloose“ wurde das weltweit erste kettenlose eBike eingeführt. Hinter dem Modell steht der globale Automobilzulieferer Mando, der BMW, Volkswagen, Ford und General Motors mit Lenk- und Fahrwerksystemen beliefert.

Amplerbike

Ein innovatives Startup aus Deutschland ist Amplerbike, das vor fast 4 Jahren gegründet wurde und derzeit 3 verschiedene Modelle auf dem Markt anbietet. Das Außergewöhnliche an den Modellen: Sie haben einen regulären Fahrradlook und sind daher von herkömmlichen Fahrrädern nicht zu unterscheiden. Gleichzeitig haben sie jedoch eine Vielzahl von intelligenten Funktionen an Bord. Über die mobile Ampler-App kann man die Motorassistenzeinstellungen anpassen, die Fahrten verfolgen, mit integrierten Karten navigieren und Firmware Updates über das Internet empfangen.

Sharing-Startups

Rund um die Mikromobilität hat sich eine gesamte Wertschöpfungskette gebildet. Ein Beispiel sind die zahlreichen Sharing-Startups, die vor allem in den USA, China und einigen europäischen Ländern zu finden sind. Eines von ihnen ist Bird, das derzeit einen Wert von rund 2 Milliarden Dollar hat.

Es war das erste Kickroller-Unternehmen, welches zunächst im September 2017 in Santa Monica eingesetzt wurde. Im Oktober 2018 verkündigte Bird, dass sie 10 Millionen Fahrten in über 100 Städten mit mehr als 2 Millionen Fahrern erreicht hatten.

Angefangen als Startup-Unternehmen für Fahrrad-Sharing, sprang Spin schnell auf den Zug auf und stieg in das E-Kickscooter-Sharing Geschäft ein, wobei es sein Portfolio für Fahrrad-Sharing ganz aufgab. Im November 2018 wurde Spin von Ford, im Rahmen eines Deals im Wert von fast 100 Millionen US-Dollar, übernommen.

Massives Wachstumspotential

Als nächstes steht Limeauf der Liste, das überwiegend als Fahrrad-Sharing-Firma bekannt ist. Im Februar 2018 kündigte Lime an, in elektrische Kickroller zu investieren und sein Geschäft auf über 127 Städte weltweit auszudehnen. Lime ist zudem auch eine Partnerschaft mit Uber eingegangen und bietet seine Roller über die Uber App an.

Skip ist ein weiteres Roller-Sharing-Startup. Es kam etwas zu spät ins Spiel, hat aber einen großen Vorteil gegenüber den anderen: Zusammen mit der Moped-Sharing-Firma Scoot besitzt das Unternehmen die Lizenz zur Platzierung ihrer Roller im Silicon Valley.

International bekannt sind Start-ups wie Grin und Yellow, die hauptsächlich in Lateinamerika tätig sind. Grin schloss einen 47,5 Millionen Dollar Serie A Deal mit Y Combinator ab, während Yellow es schaffte, 63 Millionen Dollar in seiner Serie A Runde zu erreichen.

Es wird erwartet, dass diese Sharing-Start-ups massiv wachsen und sich weiter in internationale Stadtgebiete ausdehnen werden.

Digitalisierung des Fahrens

Gleichzeitig eröffnen sich neue Wege, um mit dem Kunden in Kontakt zu treten und neue Dienstleistungen anzubieten. Das eigentliche Potenzial liegt in den Daten, die eScooter- /eBike-/sharing-Unternehmen sammeln. Durch die Aufzeichnung von GPS-Daten sowie von Zeit und Entfernung sammeln Unternehmen beispielsweise wichtige Nutzungs-muster, die für Stadtgemeinden und Unternehmen von Interesse sein können, um datengestützte Stadtplanung-sentscheidungen zu treffen.

„Das eigentliche Potenzial liegt in den Daten, die eScooter-/eBike-/sharing-Unternehmen sammeln.“

Einige potenzielle Merkmale und Dienstleistungen sind z.B.

- Fahrer zu informieren, wenn sie eine Halteverbotszone betreten haben oder Roller falsch parken

- Weiterleitung des Kunden an sein gewünschtes Ziel (Turn-by-Turn-Navigation)

- Fernwartung

- Und vieles mehr

Ein Beispiel für großartige digitale Dienste ist das von 22Motoren. Das Modell Flow bietet eine Funktion, um den Kunden vor bevor-stehenden Schlaglöchern und Unebenheiten zu warnen, indem es Sensor- und GPS-Daten analysiert, um eine virtuelle Karte der vorhandenen Schlaglöcher und Straßenfehler in einem Gebiet zu erstellen. Auch führt 22Motors Simulationen ihres Fuhrparks durch, um Probleme und Routinewartungen vorherzusagen, lange bevor sie in der Realität auftreten. Auf diese Weise können sie Besitzer über die zu ergreifenden Maßnahmen informieren.

Zukünftige Versionen von Elektrorollern und Fahrrädern werden mit sprachgesteuerten, Al-angetriebenen Assistenten ausgestattet, die aufgrund von Präferenzen, Nutzungsmustern und lokalen Kapazitäten Vorschläge machen können.

Für Dienstleistungen bezahlen

Über eine App auf ihrem Smartphone oder – falls das Fahrzeug dies enthält – auf dem Anzeigefeld des Fahrzeugs kann jeder digitale Service sofort gebucht und bezahlt werden. In der Regel werden die Kosten von einer Kreditkarte oder einer alternativen Zahlungsmethode abgebucht.

Einige Unternehmen integrieren eWallets, die nachgeladen werden müssen, inkl. Auto-Reload-Feature. Diese können auch verwendet werden, um Treueprogramme und ein Bonus-Belohnungssystem einzurichten, um Freifahrten oder andere digitale „Goodies“ zu verdienen.

Fazit

Wir leben in einer Zeit, in der die Digitalisierung immer stärker in unseren Alltag vordringt. Dies hat auch Auswirkungen auf die Art und Weise, wie wir in Zukunft verschiedene Verkehrsmittel nutzen. Wir werden sehen, dass noch mehr Hersteller in den Bereich eScooter und eBikes eindringen und neue Geschäftsmodelle entwickeln. Bald wird es überall elektrische Verkehrs-mittel geben. In Zukunft wird es entscheidend sein, mehr Daten und Informationen über den Kunden zu sammeln, um die Produkte an die Bedürfnisse dder Abnehmer anzupassen und digitale Dienstleistungen anzubieten, die einen echten Mehrwert schaffen.