On the revolution of the urban mobility industry

Introduction

The world population is growing steadily and around 60% of all people are going to live in urban areas by 2030. This is going to have a direct impact on transportation systems within these areas which are already reaching their limits. As consumer preferences are changing, various companies and start-ups are working on solutions to meet the needs of modern customers.

Owning a car is not something younger generations strive for nowadays as compared to previous generations. That’s why alternative transportation modes are experiencing a booming phase. Above all, electrically powered means of transportation are considered to have the greatest potential in the future, not only because they are environment-friendly, but also due to them offering additional digital services which are appealing to tech-savvy customers.

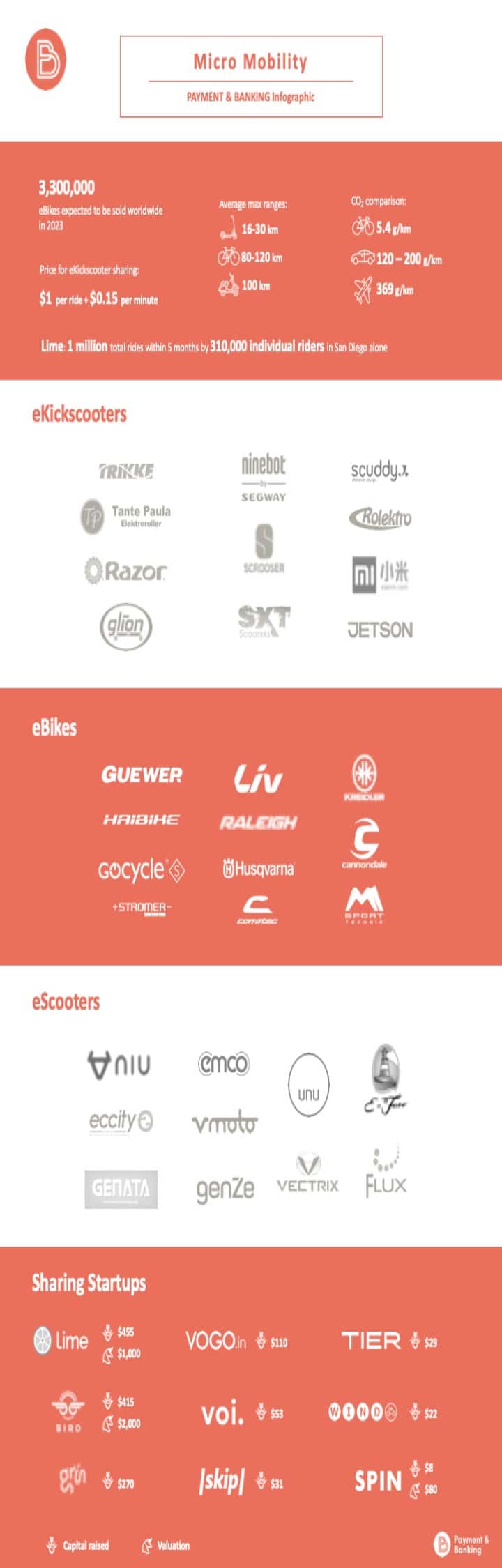

Urbanization and new mobility trends are here to revolutionize the urban mobility industry. One trend that is often overlooked, but may have a disruptive impact, is micro mobility. It refers to a brand-new category of transportation that focuses on shorter distances or even on the “last mile” and is thought to become an alternative to traditional cars and public transport. We are talking eKickscooters, eBikes and eScooters.

Micromobility – alternative, electrically powered means of transport

eKickScooter:

With a quiet whirring do they roll over paths and roads, often with surprisingly strong acceleration: modern scooters – also called kick scooters – with electric motor and battery. Electrically powered scooters are now part of the street scene all over the world. Not only in American cities, but also in Moscow, Tel Aviv, Paris and Vienna there is a rapid spread of electric kick scooters. Rental models are booming especially in the USA, though they have been banned in Germany until now, because motor vehicles that drive faster than six kilometers per hour require an operating license and insurance for public roads in Germany which has not been the case for electric kick scooters. However, there is still a lot of potential in international urban cities.

eBike:

Bicycles are experiencing the age of electrification the same way cars do. More than 150 million e-bikes have reached end-users during the last decade and 31 million were sold in 2014 alone. The lion’s share of these purchases took place in China, which encompassed 93% of the global market in 2012, but the market penetration is picking up worldwide. European sales grew almost tenfold between 2007 and 2012, with Germany and the Netherlands as the two leading e-bike markets. Still the global market is far from saturated and worldwide sales are expected to hit 40 million units by 2023.

eScooter:

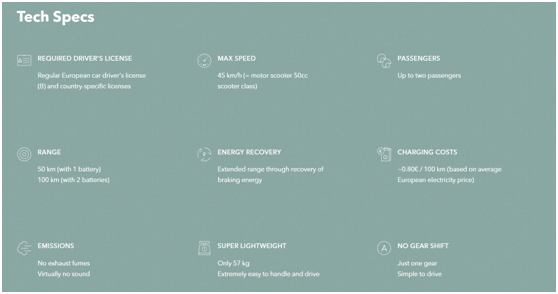

For the first time since 1986, motorized two-wheelers are again represented at the Paris Motor Show. Among them are many electric scooters that take part in road traffic and can reach speeds of up to 100 km/h – a long-standing trend in the French capital. In the cities, aversion to personal cars is growing, while the acceptance of alternative transport methods is gaining momentum. The potential for electric scooters is huge: in China alone, around 25 million electric scooters are already in operation. Nowhere else can you find more electric scooters than here. Europe, on the other hand, saw only a five-digit number of electric scooters sold, but has also recorded high growth rates with regard to sales of electric scooters in recent years.

Examples

Niu

Niu is a relatively new startup that was founded by Li Yinan, former Chief Technology Officer of China’s largest internet searching provider Baidu, in 2015. Within just over two weeks after launching on Indiegogo, eScooters worth over ten million euros were sold. This campaign ranks still today among the ten most successful crowdfunding campaigns. In 2018, NIU raised $63 million in its downsized U.S. initial public offering, giving the startup a market value of around $654 million to that time.

UNU

A well-known representative from Germany is UNU. The 6 year old startup is one of the market leaders in Germany and sells its models also in Austria, Switzerland, France and the Netherlands. UNU has understood how to address the customer directly and has created an online sales model that eliminates most of intermediaries. For that, the customer configures his eScooter on UNU’s website and gets it delivered to his front door.

Mando

Mando has introduced a global innovation to the market. With ‚Mando Footloose‘ they launched the world’s first chainless eBike. Behind the model is the global automotive supplier Mando, which supplies BMW, Volkswagen, Ford and General Motors with steering and suspension systems.

Amplerbike

One innovative startup from Germany is Amplerbike, which was founded almost 4 years ago and currently offers 3 different models on the market. The extraordinary thing about their models: They have a stealthy regular bicycle look and thus are indistinguishable from conventional bicycles. However, at the same time they also have a broad range of smart functions on board. Via the Ampler mobile app you can customize the motor assist settings, track your rides, navigate with built-in maps, and receive over-the-air firmware updates.

Sharing-Startups

An entire value chain has formed around Micro Mobility. One example are the numerous sharing startups that can be found particularly in the U.S., China and in some European countries. One of them is Bird– currently valued at around $2 billion – that was the first electric kickscooter company to launch, having first deployed in Santa Monica in September 2017. In October 2018, Bird announced it hit 10 million rides across its 100-plus cities and over 2 million riders at the time.

Starting as a bike-share startup, Spin quickly jumped on the bandwagon and got into the electric kickscooter sharing business, abandoning its bike-sharing portfolio altogether. In November 2018, Spin was acquired by Ford in a deal worth close to $100 million.

Next on the list is Lime which is predominantly known as a bike-sharing company. In February 2018, Lime announced it would invest into electric kickscooters and has expanded its business to over 127 cities worldwide. Lime has further entered into a partnership with Uber, offering its scooters via the Uber app.

Skip, another scooter-sharing startup, was a bit late entering the game, but has one major advantage over the others: together with the moped-sharing company Scoot, it holds a license to place its scooters across Silicon Valley.

Internationally, there are startups like Grin and Yellow – mainly operating in Latin America – worth mentioning. Grin closed a $47.5 million Series A deal with Y Combinator, while Yellow managed to raise $63 million in its Series A round.

These sharing startups are expected to grow massively and expand further into international urban areas.

Digitalization of Driving

At the same time, new ways are opening up to get in touch with the customer and provide new services. The real potential is the data that eScooter/eBike/sharing companies collect. For instance, by recordings GPS data as well as time and distance, sharing companies are collecting crucial usage patterns that may be of interest for municipalities and businesses to make data-driven city planning decisions.

„The real potential is the data that eScooter/eBike/sharing companies collect.“

Some potential features and services include, e.g.:

- Informing riders when they’ve entered a no-parking zone or when scooters are improperly parked

- Routing the customer to his desired destination (turn-by-turn navigation)

- Remote maintenance

- And many more

One example of great digital services is that of 22Motors. Its model Flow offers a feature to warn the customer of upcoming potholes and bumps by analyzing sensor and GPS data to create a virtual map of existing potholes and road imperfections in an area. Also 22Motors is running simulations of their fleet to predict problems and routine maintenance long before they occur in real life. Therefore, they can inform owners way ahead about actions to take.

Future versions of electric scooters and bicycles will be equipped with voice-activated, AI-driven assistants that can make suggestions based on preferences, usage patterns and local capacity levels.

Paying for services

Using an app on your smartphone or – if the vehicle includes one – a display panel of the vehicle, any digital service can be booked and paid for instantly. Usually, the expense is debited from a credit card or alternative payment methods.

Some companies integrate eWallets which need to be topped up, incl. auto-reload feature. These can also be used to set up loyalty programs and a bonus reward system to earn free rides or other digital goodies.

Conclusion

We live in a time in which digitalization is slowly pushing into our everyday lives. This also has an impact on the way we will use different transportation modes in the future. We will see even more manufacturers pushing into the field of eScooters and eBikes and coming up with new business models. Soon, electrical means of transport will be present everywhere.

Prospectively, it will be crucial to collect more data and information about the customer in order to customize the products to the needs of the customers and offer digital services that create real added value.