Ein Gastbeitrag von Ralf Wischmann (STARCON CO. LTD)

Langsam aber stetig nimmt er Fahrt auf, der Trend zum bargeldlosen Zahlen in Deutschland. Nachdem noch vor einem Jahr über eine eher abwartende bis zurückhaltende Haltung berichtet wurde, scheint der Damm, nicht zuletzt nach dem werbewirksamen Roll-Out in Deutschland zweier fast schon „Legacy Anbieter“ von E-Wallets, gebrochen. Bargeldloses Zahlen und die dahinterstehende Technologie sowie zentrale Player sind aus der Berichterstattung nicht mehr wegzudenken.

Dabei wird allerdings oft noch nicht zwischen digitalen Lösungen (etwa E-Wallets) auf der einen und Bezahlsystemen bzw. /-netzwerken auf der anderen Seite, unterschieden.

Zwischen dem Ausrollen eines Angebotes zum Bargeldloszahlen und damit auch erfolgreich zu sein, besteht dabei ein grosser Unterschied – das durfte auch in Deutschland so manches StartUp im Bereich Payment erfahren. Das Thema „Merchant Aquiring“ oder „wie schaffe ich es als Payment Service Provider, dass der Händler auch die von mir angebotene Bezahllösung anbietet“ (und der Kunde sie natürlich auch nutzt bzw. installiert), liefert dabei Stoff für einen eigenen Artikel.

Erfolgsfaktoren

Ein Schlüssel zum Erfolg, und das dürfte wenig überraschen, ist neben der Nachfrage durch den Kunden auch ein eigenes Aquiringteam. Übrigens Bestandteil nicht nur bei vielen Banken sondern auch bei ursprünglich als „Händler“ gestarteten Anbietern von Bezahloptionen in Asien.

Eine möglichst gute „Merchant Experience“ scheint dabei genauso wichtig wie die oft zitierte User Experience und dürfte ein Grund dafür sein, dass eine Akzeptanz auch bei kleineren Händlern mit in der Regel „kleinen Tickets“ (etwa im Nahrungsmittelbereich) gesichert ist. Gut möglich, dass gerade die eigenen Erfahrungen und das „Verstehen“ der Anforderungen eines Händlers, den Erfolg der E-Wallets von Anbietern mit Händlerhintergrund ausmachen.

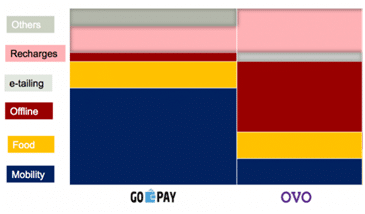

https://www.kr-asia.com/go-pay-rules-indonesias-mobility-payments-ovo-leads-offline-report

Die Verteilung des Einsatzes von E-Wallets bei unterschiedlichen Akzeptanzstellen zweier ursprünglich im Mobilitybereich gestarteter Anbieter (Grab und Go-Jek) verdeutlicht die Rolle eines Aquiringteams.

E-Wallets zentraler Mobility Anbieter und Category Split des Einsatzes

Neben den beiden zitierten Anbietern setzt eine Fülle von Händlern – ebenso wie Anbieter digitaler Kommunikationsplattformen (Beispiel Line) in Asien – zwischenzeitlich auf eigene Payment- / E-Wallet-Lösungen. Sie haben frühzeitig, nicht zuletzt durch den auch in Europa zwischenzeitlich bekannten überregionalen Siegeszug der beiden bekanntesten Anbieter aus dem Reich der Mitte, die Bedeutung von Payment erkannt:

SuperApp am Beispiel Go Jek und Line

https://nextunicorn.ventures/who-is-winning-in-the-battle-for-e-wallet-domination-in-southeast-asia/

Potentiale auf der Kostenseite durch das Bezahlen mit einer E-Wallet aus dem eigenen Hause am eigenen „POS“ werden zwar presseseitig nicht beschrieben, dürften aber insbesondere bei überregional tätigen Unternehmen nicht auszuschliessen sein.

An der ein oder anderen Stelle wird der Scope zudem bereits deutlich erweitert und das eigene Angebot ehemals klassischer Händler neben Payment um weitere Finanzdienstleistungen ergänzt. Zuletzt etwa durch ein über eigene Beteiligungen auch in Deutschland tätiges Unternehmen.

Wie schnell die eigene Bezahloption eines Händlers dabei zum zentralen Player wird und eindrucksvoll die Gunst des Kunden erobert, zeigt die Entwicklung des eingangs genannten Anbieters mit Stammsitz in Indonesien eindrucksvoll.

Ob sich lokal dominierende Anbieter auch überregional durchsetzen können, wird sich zeigen. Das Rennen um die Gunst des Kunden ist jedoch eröffnet. Dieser kann (noch) ausgiebig aus einem breiten Angebot an E-Wallets wählen. Sowohl von klassischen Finanzdienstleistern als auch anderen Anbietern, zunehmend Händlern.

„Das Rennen um die Gunst des Kunden ist eröffnet.“

Eine Option oder Vision auch für Deutschland?

Zum Autor

Ralf Wischmann, Co-Founder von STARCON CO LTD, eines in Bangkok ansässigen Unternehmens mit Fokus StartUp Advisory sowie Payment Innovation und bis Mitte 2018 treibende Kraft unternehmensübergreifender Initiativen im Bereich Kundenzahlungslösungen C2B und B2B bei der Deutschen Lufthansa AG.