The year 2020 as the Year of the receipt To call it a global pandemic would not be an accurate description. Nevertheless, the topic has developed relatively quickly in Germany. After the legal requirement and obligation to issue receipts came into force in January 2020, small retailers or bakers were more likely to be seen in the media with red heads ranting about the fact that now all available baskets are filled with unaccepted paper receipts instead of delicious pastries.

But even during the year, one could observe that the public discussion moved away from the complaining retailer to the possibility of rethinking the matter and approaching it digitally. Now, at the turn of the year 2020/2021, you can find about 10+ digital solutions in Germany, plus the retailer-specific solutions, keyword Lidl, Edeka, Rewe App etc.. However, their emphasis is rather on the digitization of offers and the shopping experience, the generation of the receipt is sometimes solved a bit complicated.

The „digital receipt“ challenge

Now it has become apparent during the year that it is not easy to bring another app for precisely this purpose of digital receipts to end users on mobile devices. The most successful approaches of this kind so far, e.g. Epap or anybill, probably currently have between 25,000 and 30,000 users. However, both providers are already further along in their realization and the functional scope of their apps now goes beyond the receipt and management of receipts, e.g. into the area of PFM with the integration of bank accounts via Open Banking interfaces or anybill sees further possibilities in the app collaboration with retailers. End-user apps from other start-ups or POS system providers themselves, however, are likely to have experienced even less diffusion;

Furthermore, it is not intuitive to require the end user to now take a picture of paper receipts, whereas before the paper receipt was simply pushed into your hand. So far, it shows that among receipt app users, one-third to about half do this a few times a month. This with over a billion paper receipts a month, well, it’s a bit of a longer road to change behaviors to that end. The fact that Google Pay in November 2020, in their major relaunch also announced they would use the same process is really only surprising. Despite downstream OCR processing, if nothing is scanned, you can also not much OCR:en.

And finally Corona shows itself rather hindering in the digitization topic of the cash receipt, because the investment hunger of the dealers was damped by it, above all if you are to have both investment and running costs for it. The significant saving of the thermal paper, ok, that probably comes already sometime, but probably not yet in the first years of the use of the digital receipt.

It seems to show once again that a renewal of an analogue object, in this case the paper receipt, is not simply a copy when transformed into its digital variant. Neither an image copy of the receipt information nor a copy of the value chain on the way from merchant to buyer. We need to rethink this.

Automatic instead of manual

We need the automated generation of the digital receipt. Manually snapping these pictures will not work. Even installing additional hardware at the POS just for that, retailers won’t go along with that. The jury is still somewhat out on the QR code that would have to be scanned during the payment process. Pulling out the phone at the checkout just for that is probably a little too costly right now to make it sufficiently widespread as a standard method. However, with increasing mobile payments, this would be in hand anyway, so the extra step would be less. Maybe that will come in the next few years. What we can already do today, completely automated, is to generate the digital receipt in real time when paying digitally with a card or wallet through card linking. In this process, the data of the purchase from the checkout and the payment terminal are merged and made available to the end customer as a digital receipt seconds after the payment process.

The second part of automatic provision is that this „provision“ works better via apps that the user already has on the mobile device anyway, e.g. banking apps, 3rd party payment/loyalty apps or merchant apps, and does not tie the distribution to its own mostly then additional receipt app. Thus, the receipt appears digitized seconds after the purchase automatically in the mobile device of the end customers, without them having done anything additional during the payment process. Of course, only with the consent of the end customer in the respective app.

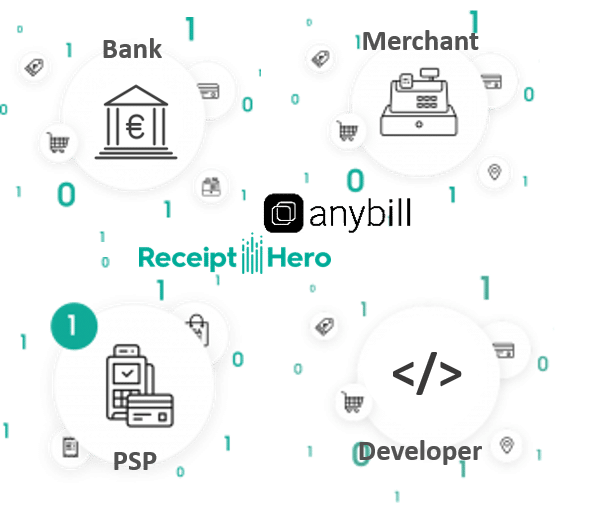

ReceiptHero from Helsinki and anybill from Regensburg are now planning to launch in this form in Germany this year, in 2021. The approach needs some lead time and pre-investment, as it is a platform approach that integrates with POS systems, payment terminal service providers and banks. Additionally, of course, merchants need to be convinced. For ReceiptHero it took about 18 months from initial talks to the service being live and established in Finland. In December, approximately 4 million digital receipts were generated.

Of course, in other European markets, it is possible to build on the cross-border providers in the payment industry. Anybill already works with several PSPs or network providers such as Concardis (Nets Group) and some POS systems including Etron or the Zuchetti Group.

ReceiptHero does this with PSPs like the Worldline/Ingenico and Verifone and also some POS systems including Diebold Nixdorf. And both companies are doing their first integrations with banks in German-speaking countries.

Possible usage scenarios

Now one could interject that this only works with the card payment or via the wallet. In September 2020, the German Trade Association suspected the share of non-cash payments to have grown up to 60 % in 2020, mainly due to the pandemic. With this accelerated trend, a 75 % or more share of these payment methods in the next 5 years would not be a surprise. Moreover, someone who wants a digital receipt is most likely to pay digitally.

However, the platform approach, in which many interested parties can participate, changes the value chain and offers more places of added value generation. In ReceiptHero’s data service, the major Northern European bank Nordea and the corporate card specialist Eurocard have been participating since autumn 2020. The following usage scenarios have been implemented so far or are about to be implemented:

- End customers can find the right receipt quickly and without administrative effort via a product search, even after a longer period of time. The service is free of charge for end customers.

- The banking or payment app provider gets another element that increases app usage time, a KPI of many digitally oriented banks.

- The bank uses product data to improve service offerings for the respective end customer, e.g. insurance for certain products with higher value or, in the PFM area, simply knitted instalment loans to ensure liquidity by the end of the month, planned for 2021

- The bank automates expense reporting for business or corporate debit/credit cards and routes digitized cash receipts to downstream expense mgmt or accounting systems which represents a cost savings in the range of 2-4 EUR.

- The retailer would like to achieve a cost saving in the processing of returns, warranty claims, etc.. For the retailer, the digital receipt as such is free of charge

„Significant expansion of the payments industry“.

Initial expressions of interest and discussions show that, particularly on the retailer and product manufacturer side, further added value can be realised in the area of data analysis on product and consumer segments, especially in conjunction with loyalty offers.

„Further added value in the area of data analysis is feasible.“

Anybill is also currently working on data-based value-added services for end customers based on their purchases, in order to enable personalized services such as extended warranties or, for example, in food retailing, the display of allergens and other information.

Considering that in general card payments (excluding fuel cards), and thus in the majority of all payments, information has only existed at the merchant and total level, the addition of purchased products is a significant expansion of the payment industry. It’s probably quite possible that this will generate discussions of the data use of purchased products. Ultimately, however, there are more advantages than disadvantages for all parties involved. Therefore, the digital receipt as a platform with structured data will already be realized in Europe.