Volumenstarker Vertriebskanal – Bancassurance, also die Verbindung von Banking und Versicherungen, gibt es bereits seit den 1970er Jahren. Das vorrangige Ziel von Bancassurance-Partnerschaften zwischen Banken und Versicherungsunternehmen besteht darin, Cross-Selling-Potenziale zu nutzen. Obwohl sich Bancassurance bislang auf den Offline-Vertrieb von Versicherungen in Bankfilialen beschränkte, hat sie bereits heute ein weltweites Beitragsvolumen von über einer halben Billion Euro. Werden nun über PSD2-konforme Schnittstellen und sinnvolle Integrationen auch die Datenfülle, die Interaktionsfrequenz und die Convenience aus Online- bzw. Mobile-Banking genutzt, so lässt sich davon ausgehen, dass das Potenzial für digitale Bancassurance-Lösungen noch sehr viel größer ausfällt.

Insurtechs als Enabler

Die Notwendigkeit neue Einnahmequellen zu erschließen, veränderte Kundenanforderungen und steigender Digitalisierungsdruck – für Banken und auch für Versicherungsunternehmen gibt es genug Gründe im Digitalen Bancassurance-Bereich aktiv zu werden. Laut einer Studie der Unternehmensberatung Sopra Steria will jede dritte Bank das Bancassurance-Geschäft wieder stärker in den Fokus nehmen. Doch die Entwicklung eigener Bancassurance-Plattformen ist oft sehr zeit- und kostenintensiv. Viele etablierte Banken und Versicherungsunternehmen greifen daher bei der technischen Umsetzung auf die Kooperation mit Insurtechs bzw. Fintechs zurück, die die Versicherungslösungen oft agiler, kundenzentrierter und günstiger umsetzen können.

Status quo im Herbst 2020

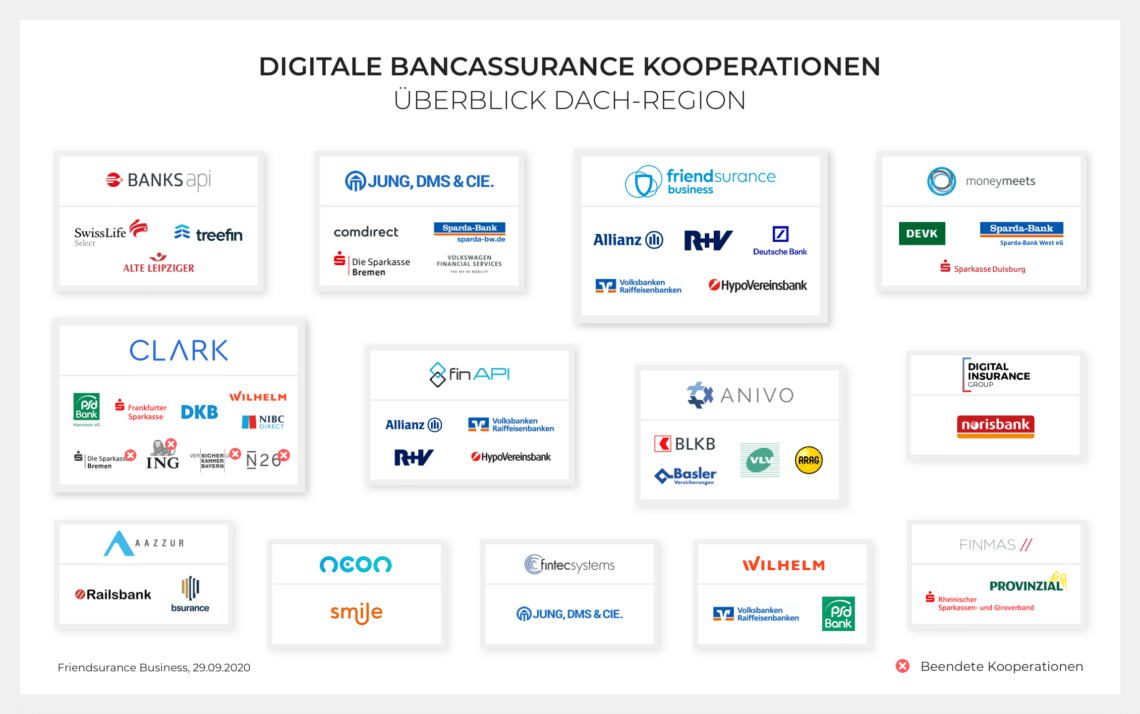

In der DACH-Region gibt es seit 2017 immer mehr Digitale Bancassurance-Kooperationen zwischen Tech-Unternehmen und etablierten Banken sowie Versicherungsunternehmen. Aktuell verteilen sich mindestens 37 Kooperationen auf 13 Anbieter. In der aktuellen Digital Bancassurance-Übersicht von Friendsurance haben wir Insurtech-, Fintech- und andere Unternehmen berücksichtigt, die mit Banken kooperieren und gemeinsam online Versicherungslösungen anbieten. Darüber hinaus enthält die Infografik auch Kooperationen mit Nichtbanken wie Versicherungsunternehmen oder Insurtechs, soweit im Rahmen der Kooperation Bankdaten genutzt werden.

Intelligente Bedarfsanalysen

Bankdaten werden – die Zustimmung des Kunden vorausgesetzt – beispielsweise im Rahmen von digitalen Kontoanalysen genutzt. So können mithilfe von künstlicher Intelligenz aus Kontobewegungen Informationen über bereits bestehende Versicherungsverträge direkt in eine digitale Versicherungsübersicht übertragen werden. Und auch wichtige Lebensereignisse werden erkannt, wie zum Beispiel die Geburt eines Kindes, wenn neue Kindergeldzahlungen eingehen. Solche Ereignisse haben einen großen Einfluss auf das Leben des Kunden und machen es ggf. notwendig, dass der Versicherungsschutz angepasst wird. Versicherungsunternehmen können mithilfe der neuen Informationen Anknüpfungspunkte für Kundeninteraktionen entwickeln und auf die individuellen Bedürfnisse zugeschnittene Angebote unterbreiten, die deutlich höhere Umsatzchancen haben als unpersönliche Angebote nach dem Gießkannenprinzip.

Verdopplung bis 2025

Digitale Bancassurance ist Win-win-win-Lösung für alle Beteiligten: Banken runden das klassische Bankangebot sinnvoll ab, Versicherungsunternehmen profitieren von der Alltagsrelevanz im Banking sowie der Smartness datengetriebener Erkenntnisse, und die Kunden bekommen mehr Convience. Seit 2017 sind jedes Jahr durchschnittlich zehn neue Partnerschaften im Digital Bancassurance-Bereich bekannt gegeben worden.

Vor diesem Hintergrund gehe wir davon aus, dass sich die Anzahl der Digitalen Bancassurance-Kooperationen in den nächsten fünf Jahren mindestens verdoppeln wird. Begünstigt wird diese Entwicklung durch PSD2. Nach Berichten von Euroactiv plant die Europäische Kommission aktuell weitere Schritte in Richtung Open Finance, welche die Entwicklung zusätzlich beschleunigen könnten.

Gute Chancen für Mix-Modelle

Während die ersten digitalen Bancassurance-Kooperationen mit dem so genannten Tippgeber-Modell gestartet sind, sehen mittlerweile viele Kooperationen eine direkte Integration in die Online-Welt der Banken und Versicherungsunternehmen vor – mit tatkräftiger Tech-Unterstützung durch Drittanbieter. Angeboten werden dabei sowohl maßgeschneiderte Bancassurance-Lösungen als auch Whitelabel-Modelle. Auf individuelle Lösungen setzen vor allem größere Banken und Versicherungsunternehmen, um sich mit ihrem Angebot von der Konkurrenz abzugrenzen. Stärker verbreitet in den DACH-Märkten sind Whitelabel-Modelle, die eine schnelle und kostengünstige Integration ermöglichen.

Darüber hinaus gibt es bei Plattform-Anbietern wie Friendsurance die Möglichkeit, Module einer White-Label-Lösung mit maßgeschneiderten Teillösungen zu kombinieren. Insbesondere für diese Art von Mix-Modellen aber auch für die anderen Bancassurance-Lösungen sehen wir eine wachsende Nachfrage im Markt und werden unsere Infografik sicher bald erweitern müssen.