6 Key Learnings from Dotcom Companies in Dealing with Digital Changes (5/6)

Introduction

Keyword digitization. A never-ending challenge. A complex topic, especially for companies that conduct their business mainly in and around the Internet. If they also offer services, it becomes particularly complicated. At the beginning of the millennium, the technology industry was in a veritable gold-rush mood. Everyone suspected that the establishment of the Internet and digital technologies would have a major impact on and change the economy in the future. The interest of investors was correspondingly high. All companies had to do was to make a name for themselves with “Internet” and “technology” in order to achieve a high rating.

Digital Transformation

Digitalization is no longer, as it was 18 years ago, a future topic, but part of our everyday life, tangible, comprehensible. Whereas the tech companies often had nothing more to show for themselves than a “.com” or “.de” in their name, the evaluations of the technology companies today are based on real value. This value is measured in terms of customers, real sales and, above all, data, data and even more data. And it is precisely this knowledge of the customer, coupled with the innovative ability of the tech groups and the will to constantly develop and grow, that forms the basis for the exponentially increasing stock market valuations.

With their influence, which is now so far advanced, the GAFA live the digital transformation per excellence. Whereas 18 years ago the “.de” or “.com” in the name caused the share price to rise, today it is something with coin, crypto or blockchain that is inspiring investors.

What becomes clear from all this is that we are in the midst of one of the greatest digital changes and such a rapid transformation that some companies are no longer able to keep up with their digital transformation.

Jochen Siegert talks about his experiences from countless stays in Silicon Valley and would like to explain the 7 deadly sins, the “6 key learnings of DotCom companies” and how they deal with this change in his successor series. It shows what we can learn today when dealing with digitization.

What were the strategies of the large technology groups? In the coming weeks, he will describe and present such recipes in more detail here in the blog, with great recommendations for imitating them.

Part 5: Acqui-Hire as an important tool in times of rapid change

In the keynote on which this series of articles is based, I naturally spoke about the term “Acqui-Hire”. A fusion word between acquisition and hiring. I was surprised to find that neither the term nor the concept was known to the majority of listeners, nor the use as a tactical element in managing change in a company. Acqui-Hire has become a completely self-evident approach for tech groups, which the big tech market leaders have been using for years to accelerate themselves and their organization in the face of change. Acqui-Hire means the takeover and integration of start-ups and their complete teams.

Recently, this approach has been reflected in the paradigm shift in user behavior from desktop-based PCs to mobile devices such as smartphones. Both Google and Facebook were challenged in their browser-based business model at the end of the 2010s. The press and investors were unsure whether the proven advertising business models would work on the small mobile screen or even in-app. It is said that Mark Zuckerberg had Facebook’s developers’ monitors forcibly switched to a mobile screen resolution so that they could move exclusively in the “new” environment for which they were developing.

New mobile world

At the end of the 2010s, developers were as unavailable as they are today. However, mobile developers and product managers were even rarer on the market. At the same time, the big tech companies had to adapt to the new mobile world. But unlike a small start-up, the corporations needed hundreds of people to deal with the area.

In addition to the need for talent and new technologies, it was clear to them that the window of opportunity was closing fast and the pressure from investors to adapt was very high.

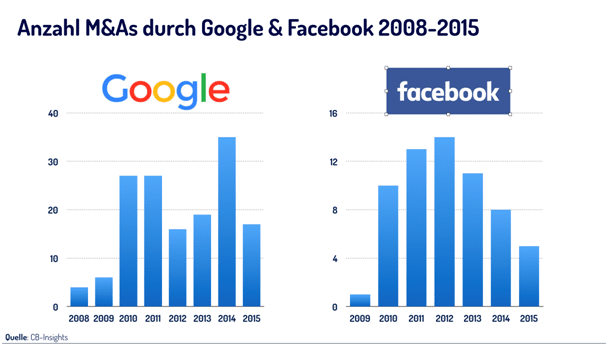

How did the companies react to this challenge? They accelerated the integration of talent and technology through Acqui-Hires. As you can see very clearly, the M&A activity of Google and Facebook first increased strongly in the relevant years and then calmed down again. The two groups have therefore systematically incorporated companies in order to adapt more quickly.

PayPal also faced this challenge. If customers use their mobile devices more frequently, they will also shop more mobile and therefore require a convenient mobile payment functionality. PayPal also took over companies to adapt faster. A particularly good example of Acqui-Hire in 2011 was the acquisition of the mobile payment provider Zong.

Acqui-Hire: PayPal takes over Zong

Zong, who specializes in payment by SMS via the telephone bill, brought talent to the PayPal organization. David Marcus, the founder and CEO of Zong, first became SVP Mobile of PayPal and replaced Scott Thompson as CEO/President of PayPal after he left for Yahoo. Hill Ferguson, the former Zong product manager, later became PayPal’s global product manager. Without Marcus and Ferguson at PayPal’s two key positions, the PayPal organization would not have made the rapid transition to “mobile” in this form and radicality. PayPal would probably never have been able to win the two talents via a headhunter, but only via Acqui-Hire.

After the promotions of various Zong managers to important positions at PayPal, some internally even spoke of a reverse take-over. So not PayPal would have taken over Zong, but de facto vice versa. Either way, it has done the PayPal product and organization extremely good and decisively shaped PayPal at an important time. What do these developments mean for local financial service providers who have to struggle with “this digitalisation”? Acqui-Hire is also a useful tool in our strategy toolbox.

“The acquisition of Zong has been extremely beneficial to the product and the organization and has had a significant impact on PayPal at an important time.”

Also with the many FinTech/Start-ups in Germany there are many possibilities for Acqui-Hires. Banks and savings banks can incorporate talent and technology in a much faster time than in a normal way. Time is money, this is especially true for digitisation. A very nice example for Acqui-Hire is the takeover of the Cringle team by the DKB Code-Factory.

Success Factors

In order for Acqui-Hire to be a success, the acquiring company must have appreciation for the team it has taken over. Only if the new employees can really make a difference on product and process level, their motivation for the company remains. Products can be digitized faster and more customer-centered. Will a FinTech founder perhaps soon chair the board of a classic bank like PayPal, for example? There will probably still be a lot of water from the Frankfurt Main flowing past the towers until something like this happens.

The prerequisite for this is probably first of all more digitization know-how and entrepreneurship in the supervisory board itself. Its “mind-set” is important when filling new executive board positions. It would be very good for the banks if not only the claim to entrepreneurship and technological leadership were mentioned in the keynote speeches of the board members, but actually fully implemented in the organization.

Overview of Key-Learnings published so far:

Teil 1: Unternehmerisches Handeln schlägt Corporate Politics