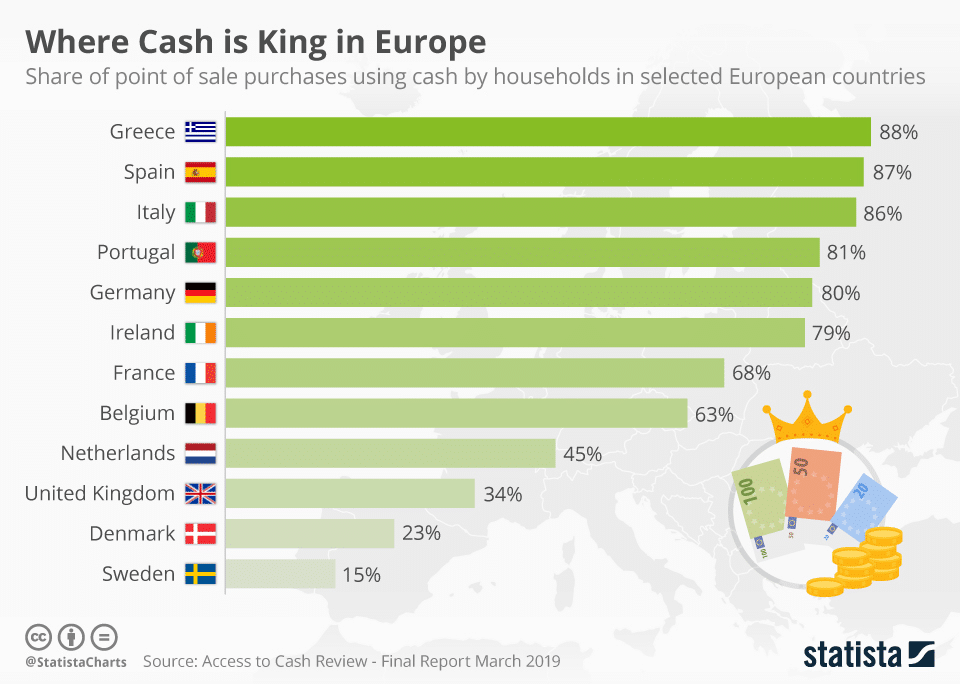

Die Bargeldversorgung in Deutschland ist sicher kein Problem. Denn Deutschland lacht, weil Bargeld lacht. In Europa gehört Deutschland zu den Top5 Bargeldländern. Während in Schweden nur noch 15 Prozent der Menschen bar bezahlen sieht es insbesondere in Griechenland (88 Prozent) und Spanien (87 Prozent) völlig anders aus. Deutschland steht an fünfter Stelle mit immerhin 80% der Deutschen zahlen regelmäßig bar. Die offiziellen Zahlen der Bundesbank sehen etwas anders aus, zeigen aber trotzdem die Liebe zum Bargeld in Deutschland eindrucksvoll: Im Schnitt führt jeder Deutsche 100 Euro Bargeld mit sich rum und mehr als 70% der Transaktionen am POS sind Barzahlungen und 48,6 Prozent der Umsätze werden mit Karte getätigt und 48,3 Prozent mit Bargeld (Stand 2018).

Bargeldversorgung und Geldautomaten in Deutschland

So weit nichts Neues. Welchen Preis Kunden für diesen “Luxus” zahlen und wie absurd gut die Bargeldversorgung in Deutschland ist, zeigt unsere neue Übersicht “Bargeldversorgung in Deutschland”. An ca. 57.800 Geldautomaten (Stand Mai 2015) können wir Deutsche uns mit Bargeld versorgen. Dazu kommt die Möglichkeit an über 12.000 Geschäften in Deutschland sich über das Barzahlen-Netzwerk zu versorgen und bei ca. 26.000 Geschäften im Zuge des Einkaufs mit Bargeld zu versorgen. Anders ausgedrückt: Vertreter der Fraktion “Nur bares ist wahres” brauchen keine Angst zu haben, denn diesen in Summe fast 100.000 Möglichkeiten in Deutschland Geld abzuheben. Auch die Nachteile von Bargeld, angefangen von der Tatsache, dass jede Geldnote ein Bazillenmutterschiff ist, bis hin das es keinen Sinn ergibt ein Kartenterminal in die Luft zu sprengen, sind hinreichend bekannt.

Wer den Preis zahlt für die Bargeldversorgung und Geldautomaten zahlt

Für die Bargeldversorgung braucht es vor allem Geldautomaten. Einmalige Kosten sind die Anschaffung von Geldautomaten. Da man die Dinger nicht im Media Markt kaufen kann und es auch keine Amazon Warehouse-Deals gibt kosten die etwas. Im Durchschnitt 20.000 Euro. Also ein Geldautomat. Dazu kommen monatliche Betreibungskosten von 2.000 Euro, was im Jahr noch mal 24.000 Euro ausmacht. Laut dem BKA müssen ca. 350 Geldautomaten jedes Jahr neu angeschafft werden, weil die alten explodiert sind, bzw. gesprengt wurden. Da Geldautomaten ja nicht von der Heilsarmee gestellt werden, werden diese Kosten auf den Kunden umgelegt. Nicht auszudenken was eine weitestgehend bargeldlose Gesellschaft an Kosten einsparen würde. Vom CO2 Fußabdruck mal ganz zu schweigen, wenn man mal eben zum nächsten Geldautomaten fahren muss, um Geld zu holen. Und selbst wenn man nicht mit dem Auto hinfährt: Frisches Geld wird ja nicht mit der Brieftaube zum Automaten gebracht.

Fazit

Was weniger bekannt ist, sind die Kosten die durch eine fast lückenlose Bargeldversorgung in Deutschland entstehen.

Wir dürfen uns in Deutschland nicht wundern, das so wenig bar bezahlt wird oder Geldautomaten gesprengt werden, wenn an jeder Ecke einer steht. Kartenzahlung wird spätestens dann von den Kunden gefordert, wenn der nächste Geldautomat nicht 100 Meter weit weg ist, sondern 15 Kilometer. Ausrede meines Friseurs: Sorry hier kannst Du nicht mit Karte zahlen, aber da vorne ist ein Geldautomat. Solange wir es den Menschen so leicht machen nicht nur bar zu zahlen, sondern Dienstleistern und Händlern keinen Grund bieten Karte zu akzeptieren, wird es noch lange dauern bis zu einer barlosen Gesellschaft.

Bargeldversorgung via Cashpool

ca. 3.200 Geldautomaten in Deutschland

Mitglieder

- Bank für Sozialwirtschaft, Köln

- Bank Schilling & Co., Hammelburg

- Bankhaus Bauer, Stuttgart

- Bankhaus J. Faisst, Wolfach

- Bankhaus Max Flessa, Schweinfurt

- Bankhaus Hafner, Augsburg

- Bankhaus Gebr. Martin, Göppingen

- Bankhaus E. Mayer, Freiburg im Breisgau

- Bankhaus Neelmeyer, Bremen

- Bankhaus C. L. Seeliger, Wolfenbüttel

- Bankhaus Ludwig Sperrer, Freising

- BBBank, Karlsruhe

- Berenberg Bank, Hamburg

- Degussa Bank, Frankfurt am Main

- Donner & Reuschel, Hamburg

- Fürstlich Castell’sche Bank, Würzburg

- Gabler-Saliter Bankgeschäft, Obergünzburg

- Merkur Bank, München

- National-Bank, Essen

- Oldenburgische Landesbank, Oldenburg (Oldb)

- Pax-Bank, Köln

- Santander Consumer Bank, Mönchengladbach

- Sparda-Banken (alle 11 Banken des Verbunds)

- Steyler Bank, Sankt Augustin

- Südwestbank, Stuttgart

- Targobank, Düsseldorf

Volks- und Raiffeisenbanken

ca. 18.000 Geldautomaten in Deutschland

Mitglieder

Alle 875 Volks- und Raiffeisenbanken

Sparkassen

ca. 24.600 Geldautomaten in Deutschland

Mitglieder

Alle 385 Sparkassen

ING

Ca. 1.200 eigene Geldautomaten

Arbeitsgemeinschaft Geldautomaten

Ca. 4.000 Geldautomaten

Mitglieder

- Bankhaus August Lenz

- Cardpoint

- IC Cash Services

- NoteMachine Deutschland

- transact Elektronische Zahlungssysteme

Bargeldversorgung via Cash Group

ca. 9.000 Geldautomaten in Deutschland + 1.300 Shell-Tankstellen

Mitglieder

- Deutsche Bank

- DB Privat- und Firmenkundenbank

- Postbank

- Norisbank

- Commerzbank

- Comdirect Bank

- Unicredit Bank (Hypovereinsbank)

Barzahlen bietet Bargeldversorgung

Bargeldabhebung via App bei ca. 12.000 Filialen in Deutschland, unabhängig von der Kartenzahlung

Mitglieder (Filialen)

- REWE (3.300 Filialen)

- dm (2.000 Filialen)

- PENNY (2.148 Filialen)

- ROSSMANN (2.196 Filialen)

- real

- OMV (270 Tankstellen)

- mobilcom debitel (560 Filialen)

- Budni (154 Filialen)

- Ludwig Eckert (63 Filialen)

- Adams Barbarino (30 Filialen)

- toom (330 Filialen)

Mitglieder (Banken)

N26

DKB

bunq

GRENKE

Sparda-Bank

TargoBank

fidor Bank

Sparkasse Worms-Alzey-Ried

O2 Banking

Bankomo

Die Bargeldversorgung im Handel

Im Zuge des Einkauf bei Bezahlung mit der Girocard bei ca. 26.000 Filialen

Mitglieder (Filialen)

- Rewe (ab Einkaufswert 10 Euro / 3.300 Filialen)

- Aldi (ab Einkaufswert 5 Euro / 4.200 Filialen)

- Lidl (ab Einkaufswert 5 Euro / 3200 Filialen)

- dm (unabhängig vom Einkaufswert / 2.000 Filialen)

- Edeka (ab Einkaufswert 10 Euro / ca. 11.000 Filialen)

- Penny (ab Einkaufswert 10 Euro / 2.148 Filialen)

- Globus (ab Einkaufswert 10 Euro / 130 Filialen)