Ein Gastbeitrag von Maximilian Fuchs

Für viele deutsche Händler war und ist die girocard als günstiges, domestisches Debitkartensystem ein Rettungsanker angesichts steigender Kosten für die Kartenakzeptanz. Jüngste Berichte deuten jedoch darauf hin, dass es durch das Issuing von Mono-Badge-Karten zunehmend bedroht ist. Da einige der nationalen Kartensysteme in Europa auf dem Rückzug sind, werfen wir einen internationalen Blick auf das Problem und fragen, wie Händler das aktuelle Klima am besten nutzen können, um sich und ihre Kunden vor steigenden Payment-Kosten zu schützen.

Die Gefahren des Mono-Badging

Für den deutschen Durchschnittsverbraucher ist es üblich, eine Debitkarte mit sich zu führen, auf der die heimische Marke girocard neben dem Logo eines internationalen Kartensystems abgebildet ist. Diese Karten stellen Händler und Verbraucher vor die Wahl: Inländische Zahlungen über die girocard abwickeln (mit verhandelbaren Interbankengebühren), oder sich an die globalen Systeme halten.

Projekte von CMSPI mit hunderten von Händlern in Europa zeigen, dass erhebliche Kosteneinsparungen durch die Nutzung des girocard-Systems möglich sind. Obwohl die girocard derzeit nur für stationäre Debit-Zahlungen genutzt werden kann, zeigt unsere Analyse, dass sie im Jahr 2020 für 61% der deutschen Kartentransaktionen verantwortlich war[1].

Mono-Badging hingehen bezieht sich auf Karten, die mit nur einem System für die Verarbeitung der Transaktion ausgestattet ist. Mit einer Karte, die mono-badged ist, entfällt nun also die Wahlmöglichkeit und die Transaktion muss über das vorhandene System abgebildet werden und konkurriert nicht mehr durch Kosten zur Zahlungsannahme um die Gunst des Handels.

Auf der ganzen Welt haben Regulierungsbehörden erkannt, welche negativen Auswirkungen dies auf den Wettbewerb haben kann. In den USA zum Beispiel hat das Durbin Amendment von 2011 vorgeschrieben, dass alle Debitkarten mit mindestens zwei nicht konkurrierenden Systemen ausgestattet sein müssen. Solche Mandate stellen die Marken auf jeder Karte in direkten Wettbewerb miteinander und erzeugen nachweislich einen nachhaltigen Abwärtsdruck auf Gebühren[2]. Auch die australischen Regulierungsbehörden haben kürzlich das Problem erkannt und in einer durchgeführten Konsultation vorgeschlagen, die Obergrenzen für Interbankenentgelte (die an die Issuing-Banken gezahlt werden) für Karten mit Mono-Badge zu senken, um die Ausgabe dieser Karten zu verringern[3].

Der Trend in Deutschland

Berichten zufolge begann der Aufstieg des Mono-Badgings in Deutschland etwa 2015[4]. In der ersten Phase schlossen internationale Kartenunternehmen Vereinbarungen mit deutschen Neobanken, um Debitkarten auszugeben, die nur mit ihrem System versehen waren, darunter zum Beispiel N26[5] und C24[6]. In jüngster Zeit hat sich der Trend auch auf traditionelle Banken ausgeweitet. Im August 2020 kündigte die Oldenburgische Landesbank beispielsweise eine Exklusivitätsvereinbarung mit Mastercard an, die mit einer Vereinbarung über die Ausgabe der neuen Mastercard-only „ec-Karte“ einherging – ein Name, der im Volksmund für Karten mit girocard-Funktionalität verwendet wird[7]. Es gibt auch Berichte über Mono-Badging bei größeren Issuing-Banken, wie zum Beispiel HVB, Comdirect und DKB[8] [9]. Solche Vereinbarungen können von Exklusivität bis hin zur Einführung des internationalen Systems als „Top of Wallet“ durch die Einführung von mono-badged Karten neben dem traditionellen Angebot der Banken reichen.

Kurzfristig könnten diese Entwicklungen neben dem Hervorrufen höherer Kosten den Händlern schaden, deren Terminals einzig und allein für die girocard freigeschaltet sind und sie dazu bewegen, diese Barriere für internationale Kartensysteme aufzugeben[10]. Langfristig könnten sie die Reichweite des girocard-Systems als Ganzes einschränken.

Was passiert in ganz Europa?

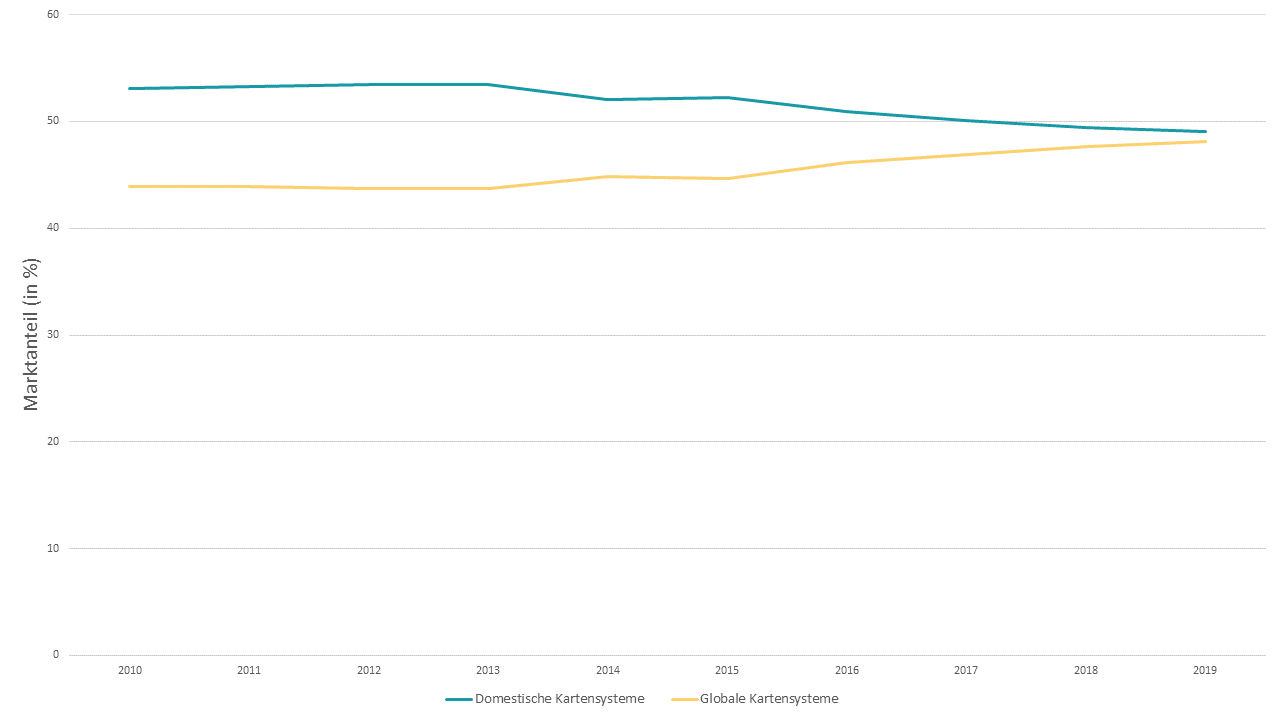

Deutsche Händler sind nicht die einzigen, die die Vorteile eines lokalen Kartensystems genießen; Frankreichs Cartes Bancaires, Italiens Pagobancomat und Belgiens Bancontact sind nur einige der Systeme, die den internationalen Marken in ihren jeweiligen Märkten mehr oder weniger stark Konkurrenz machen. Die Vergangenheit zeigt jedoch, dass das Schicksal eines europäischen Kartensystems nicht sicher ist. Im letzten Jahrzehnt wurden mehrere Systeme aufgegeben, darunter Finnlands pankkikortti (2013), Irlands Laser (2014) und Luxemburgs Bancomat (2011)[11]. In anderen Ländern, wie z. B. Spanien, gibt es zwar ein domestisches System, dieses verarbeitet jedoch keine Kartentransaktionen, sondern überlässt dies den globalen Systemen, mit denen sie Kollektivverträge abgeschlossen haben[12]. Abbildung 1 zeigt den bemerkenswerten Rückgang inländischer Kartensysteme in Europa im Laufe der Zeit.

Abbildung 1: Europäischer Marktanteil nach Wert (domestische vs. globale Systeme)

Quelle: CMSPI und Zephyre-Analyse auf Grundlage von Daten von Euromonitor International

Wenn ein lokales System verdrängt wird, ist das typische Ergebnis ein Markt, der von den beiden vorherrschenden, internationalen Kartensystemen dominiert wird. Ohne eine Alternative sind Händler gezwungen, sich mit den sukzessiven Gebührenerhöhungen der internationalen Anbieter auseinanderzusetzen. CMSPI schätzt, dass seit 2015 allein die Erhöhungen von Scheme Fees durch die globalen Systeme mehr als 1,46 Milliarden Euro an zusätzlichen jährlichen Kosten für europäische Händler[13] verursacht haben und das trotz der Präsenz lokaler Systeme, was darauf hindeutet, dass deren Wegfall das Problem noch verschärfen könnte.

Bringen Innovationen Hoffnung?

In der Kartenbranche wird die European Payments Initiative (EPI) oft als Lösung für das Aussterben lokaler Systeme angepriesen. Ein neues, paneuropäisches Kartensystem könnte in der Tat den dringend benötigten Wettbewerb zu den Global Playern herstellen und scheint von der Europäischen Kommission stark unterstützt zu werden. Auch wenn die Aussichten für EPI stark umstritten sind, zeigen Vorschläge[14], dass EPI die lokalen Systeme vollständig ersetzen wird, nur noch stärker die Notwendigkeit eines verpflichtenden Co-Badgings auf.

Glücklicherweise ist Wettbewerb bei Kartenzahlungen vielleicht nicht die einzige Option. In den letzten Jahren hat die Verbreitung alternativer Zahlungsmethoden in ganz Europa neue Möglichkeiten geschaffen, mit denen Händler die Kosten zur Zahlungsannahme in den Griff bekommen können.

Die Niederlande ist ein gutes Beispiel: Während das lokale Kartensystem (PIN) 2012[15] aufgegeben wurde, machte die kostengünstige alternative Überweisungslösung iDeal im Jahr 2019 bereits 56 % des Online-Zahlungsmixes des Landes aus[16]. Ähnliche Fortschritte werden mit dem polnischen Blik und der Entwicklung von Instant-Payment-Systemen wie SCT Inst gemacht. Mit Blick auf diese langfristigen Trends ist die Nutzung alternativer Zahlungsarten – auch solcher, die historisch bekannt sind, wie zum Beispiel SEPA-ELV – für Händler, die der Zeit voraus sein wollen, wichtiger denn je.

Alternative Zahlungsmethoden allein sind jedoch nicht genug. Ohne ein System, das verlangt, dass Zahlungsinstrumente um Händlerpräferenz kämpfen müssen, könnten alternative Zahlungsmethoden mit unternehmenseigener Benutzerbasis zu Mini-Monopolen führen und Händler unter Druck setzen, noch höhere Gebühren für einen Teil ihrer Transaktionen zu akzeptieren. Scheinbare Innovationen können auch das Gegenteil bewirken; im Fall des nordischen Instant Payment Systems P27 beispielsweise wurde Mastercard bereits als wichtiger Technologiepartner ausgewählt[17].

Was können Händler tun?

Bislang scheint das girocard-System standhaft zu bleiben, da der geschätzte Marktanteil im Zeitraum von 2015 bis 2019 von 58 % auf 61 % gestiegen ist[18]. Mono-Badging-Vereinbarungen könnten jedoch eine Bedrohung für die langfristige Überlebensfähigkeit der girocard und für die Händler, die sich auf das System verlassen, um die Kosten (und die Preise für die Verbraucher) niedrig zu halten, darstellen. Eine ähnliche Geschichte hat sich bereits mehrfach auf der europäischen Bühne abgespielt. Aufgrund dessen ist es für Händler wichtig, eine Lobby zu bilden und für Co-Badging Regularien – ähnlich wie in den USA – einzustehen, da die Pläne für die European Payments Initiative derzeit noch unbekannt sind.

Selbst wenn die girocard ihre Dominanz beibehalten kann, hat die sinkende Bargeldnutzung in Deutschland zu einem geschätzten Anstieg des absoluten Wertes der von den internationalen Kartensystemen abgewickelten Transaktionen um 30 % in nur vier Jahren geführt[19]. CMSPI schätzt, dass die durchschnittlichen Gebühren, die deutsche Händler für diese Transaktionen zahlen müssen, zwischen 2015 und 2020 um über 60 % gestiegen sind. Angesichts dieser Trends sind die Händler gezwungen, neue Wege zu finden, um Wettbewerb zu generieren. Diese reichen von der Nutzung neuer Zahlungssysteme bis hin zur Einführung alternativer Zahlungsmethoden, die einen weitaus komplizierteren Business Case erfordern, als dies bei Karten jemals der Fall war. Für deutsche Händler hat das aktuelle Klima daher eine ausgeklügelte Payment-Strategie genau zu dem Zeitpunkt am relevantesten gemacht, als sie am komplexesten aufzubauen war.

Quellen:

[1] CMSPI Schätzungen und Analyse auf Basis von Euromonitor International (2021) Daten

[2] Siehe CMSPI Analyse des Federal Reserve Regulation ii Report

[11] Centre for European Reform (2021). Don’t imitate – innovate! Why Europe doesn’t need a rival to Visa and Mastercard.

[12] Comision Nacional de los Mercados y la Competencia (2018)

[13] Siehe CMSPI & Zephyre Scheme Fee Study (2020)

[14] Siehe CMSPI Debatte zur EPI

[15] Centre for European Reform (2021). Don’t imitate – innovate! Why Europe doesn’t need a rival to Visa and Mastercard.

[18] CMSPI Schätzungen und Analyse auf Basis von Euromonitor International (2021) Daten

[19] CMSPI Schätzungen und Analyse auf Basis von Euromonitor International (2021) Daten. 2015 – 2019