Within the Amazon ecosystem, payment is somehow largely resolved and very smoothly integrated. No matter if web, app, mobile or on TV. Nevertheless, in the last few days, the Barclaycard cooperation and a „buy now pay later solution“ have created a News before the upcoming Christmas business.

In this context, the question arises for us, what else comes from Amazon Pay? And what’s the most outside of Amazon itself and the Amazon Marketplace?

Amazon Pay was launched in Germany more than 5 years ago in 2016 and followed its predecessor Pay with Amazon, which has been available since 2011 The pricing seems to be very competitive with 1.2-1.9 + a fixed fee of 0.35 cents compared to PayPal, for example. And although players such as Adyen also offer the payment option in their portfolio, Amazon Pay does not seem to have reached the breadth of e-commerce.

We asked the team and also asked them what we thought of the new „pay later“ variant with Barclaycard?

Jochen Siegert

The Amazon PayLater solution feels like it’s from the last decade. How can we make 2020 work in times of Klarna, RatepayPayPal PayLater and co. still seriously offering online sales financing with KYC, when the tech role models have been doing this for 10 years and Otto plus many other mail order companies have been doing it without KYC since the 1960s? This „well“ thought-out sales financing unfortunately complements the mixed-positive image that Amazon Pay makes. Somehow they can’t really emancipate themselves in the hawker’s tray of the many Amazon services.

For years it has been expected that Amazon Pay has what it takes as a standalone payment method to become a serious competitor to PayPal. Only they somehow do not deliver. Even the dissatisfaction expressed publicly years ago by Amazon founder and CEO Bezos about the lousy performance in the payment segment has not changed anything. I’m afraid that Amazon simply has too little focus on this topic. As long as it stays that way, Amazon Pay is the eternal candidate with potential to bring more, but who doesn’t deliver.

Kilian Thalhammer

Somehow there is nothing more to come – the logo appears on the payment method presentations of the common players but I hardly see it in the market. But that might also be due to my high Amazon frequency. I don’t need it there. So I am not a target group?

What strikes me is the lack of integration between the services. Why „payment by instalments“ with Barclaycard and not Amazon Pay and why do credit cards (with LBB), purchase on Amazon (with Arvato et al), cooperation with ING and Amazon Pay coexist? Product silos, haven’t we learned from the GAFA’s to integrate, to be open? Keyword ecosystem and so on.

There are very good products and features on their own, but often the role in the overall context is missing. Maybe this is not wanted and you want many small products instead and see what works. Maybe the big master plan behind it, which we all suggest, is missing.

Felt Amazon Pay has still not arrived in Europe and it remains an „American thing“. Apple and Google have better occupied the domain „Payment“ and made it usable for themselves. Facebook is still hanging around with Libra and other experiments. From this point of view GAFA is not the same as GAFA and ecosystem is not the same as ecosystem.

If we can draw the parallels to China, we will also wait there to see if JDPay follows the path that Alipay and WeChat have mapped out or remains in the niche like „the American“.

Christina Cassala

The list of payment solutions is now long, because somehow everyone is tinkering with their own payment method – sometimes more, sometimes less successful. But especially with Amazon Pay I would have thought at the time: „Sure, that makes total sense in the Amazon ecosystem“. But is that why it became a hit? I don’t think so! If you asked people on the street who were interested in payment about their top 5, this payment solution would probably not be there. The project still seems to be treated too much like a stepmother. So can Amazon Pay make up for this shortfall? Certainly with more steam on the boiler, because the payment solution already works quite well in the ecosystem, outside the … well, there are already providers who do it much better and easier. The battle for higher market shares will not be beaten when Amazon finally presents something like a master plan and resolutely goes through with it. Amazon has already proven several times that it can sort itself out and reoccupy supposedly lost segments with relevance.

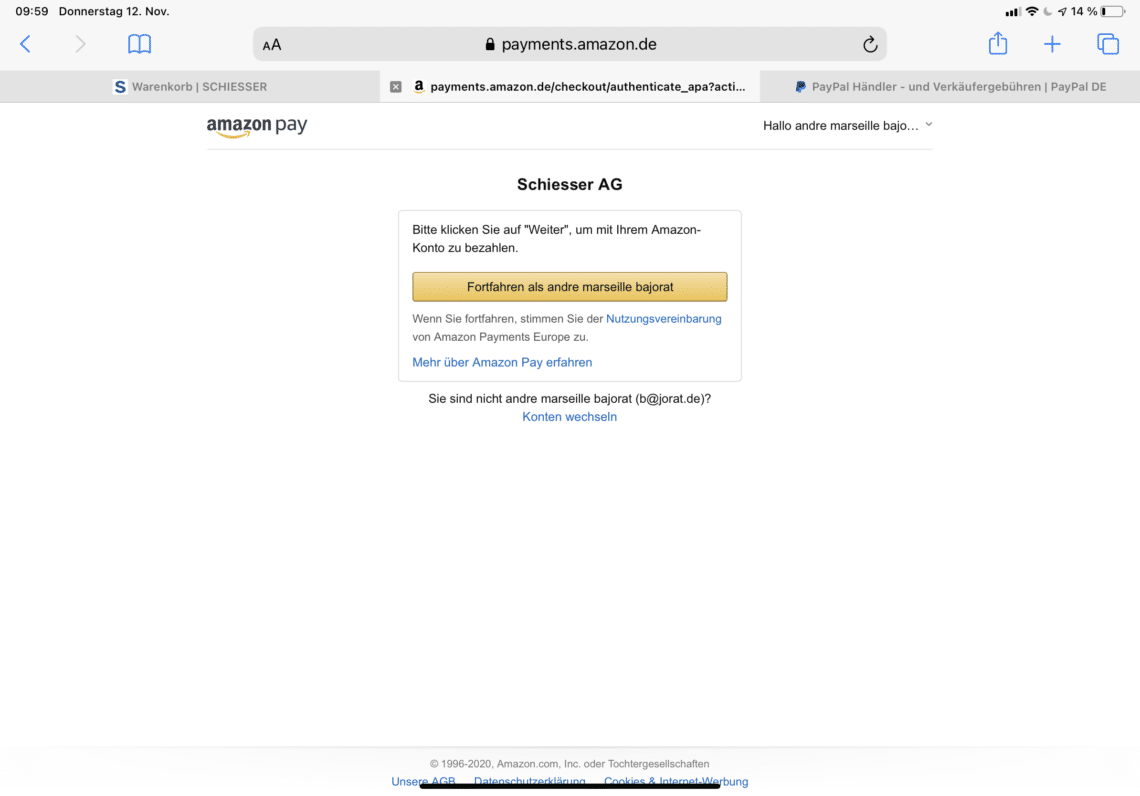

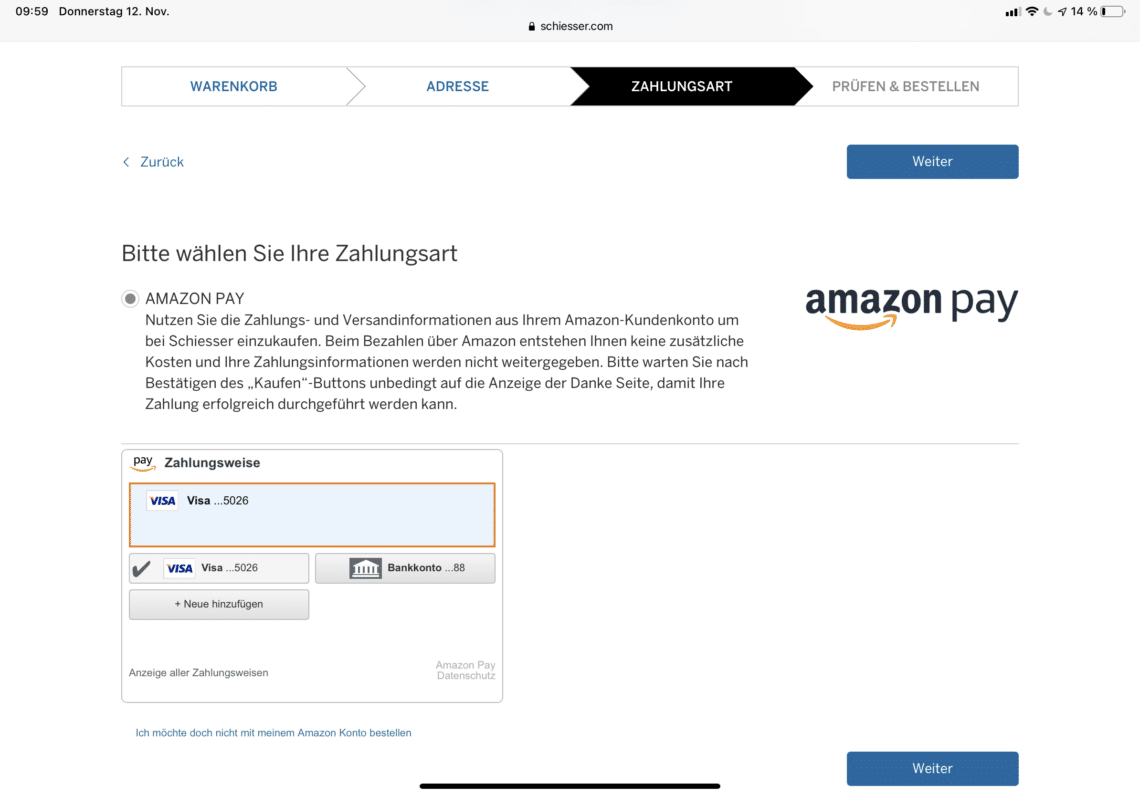

André Bajorat

I myself encounter Amazon Pay in the „free“ Internet every now and then. Mostly parallel to PayPal and then I am always spoilt for choice :-) – the solution itself feels in the places where I used it, unfortunately often a bit „frickelig“ and „old school on“. Yes, it works and I can also „choose“ a lot and decide a lot myself. But what I like about PayPal or Apple Pay is that I don’t have to choose a lot myself, the process is very fast and easy. So my choice is mostly: Amazon Pay in Amazon’s own ecosystem and outside I use the order Apple Pay, PayPal and then credit card.

Do I expect a further spread of Amazon Pa? – Yes, I do. I think every merchant who also goes to the Amazon marketplace will integrate Amazon Pay in his own shop. Will the new Pay Later option help Amazon Pay? – certainly, even if it is available outside your own ecosystem.