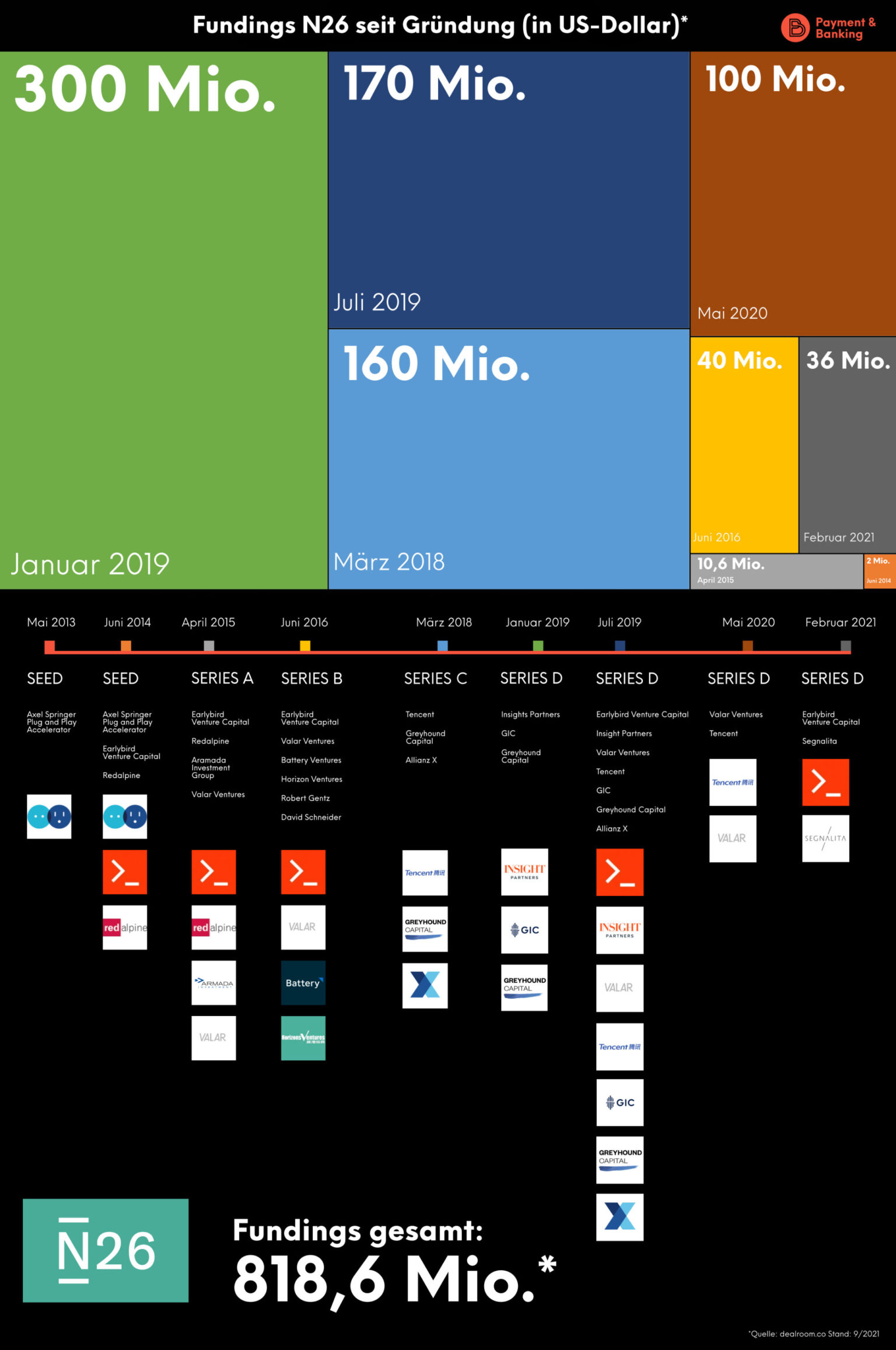

N26 is always making headlines – both positive and negative. Of course, financing rounds are always among the most interesting news. And this is where the rumor mill is currently bubbling. According to reports, they are currently preparing a Series E financing round and are looking to secure a valuation of 10 billion US dollars. This is said to be the last time that the Berlin-based company will reach out to investors before going public. But who actually pumped money into Neobank and when? Our infographic provides clarity and shows all fundings and investors of N26 at a glance!

We can see that since its humble beginnings in 2013, N26 has not only risen sharply in the favour of investors, but is also attracting illustrious international names such as Tencent. The fattest cash injection to date was in January 2019 ($300 million). This is 12,000 times the original seed investment of the Axel Springer Plug and Play Accelerator.

N26 investors also with Revolut

Incidentally, Greyhound Capital, an investor that had backed rival Revolut in a $66 million Series B and a $250 million Series C financing, is also on board. In the latter, Revolut was valued at $1.7 billion. In the meantime, N26 has also easily overcome this hurdle. However, Revolut’s current valuation ($33 billion) is still quite a bit lower than that. N26 has been Unicorn for a while, but comes in at a disproportionately lower valuation at around $4 billion.

But enough of words!

Click here to download our infographic: All N26 fundings at a glance as a high-resolution PDF!