Es hätte so schön sein können. Nach unzähligen Versäumnissen und jahrzehntelange fehlgeleiteter Digitalisierungsversuchen der deutschen Bank- und Kreditwirtschaft schien es 2017 endlich ein Thema zu geben, wo es auf der einen Seite einen hohen Bedarf gibt und auf der anderen Seite das Thema noch nicht von irgendeinem Tech-Giant besetzt war: die digitale Identität in verifizierter Form, sozusagen der digitale Personalausweis. Die Idee war dort anzusetzen, wo einfache Single-Sign-On Dienste wie “Facebook Connect” oder ein “Login with Google” aufhörten und eine einfache E-Mail-Adresse oder leicht zu fälschende Profile nicht mehr ausreichten. Wie wichtig eine solche Lösung gewesen wäre, zeigt sich wie bei so vielen Dingen im Moment, die aktuelle Krise in der wir uns befinden. Bis heute hat der Durchbruch auf sich warten lassen und das, obwohl 2017 ein regelrechter Hype um das Thema startete und gleich drei nennenswerte Protagonisten startenden mehr oder weniger zeitgleich.

Die verifizierte Identität

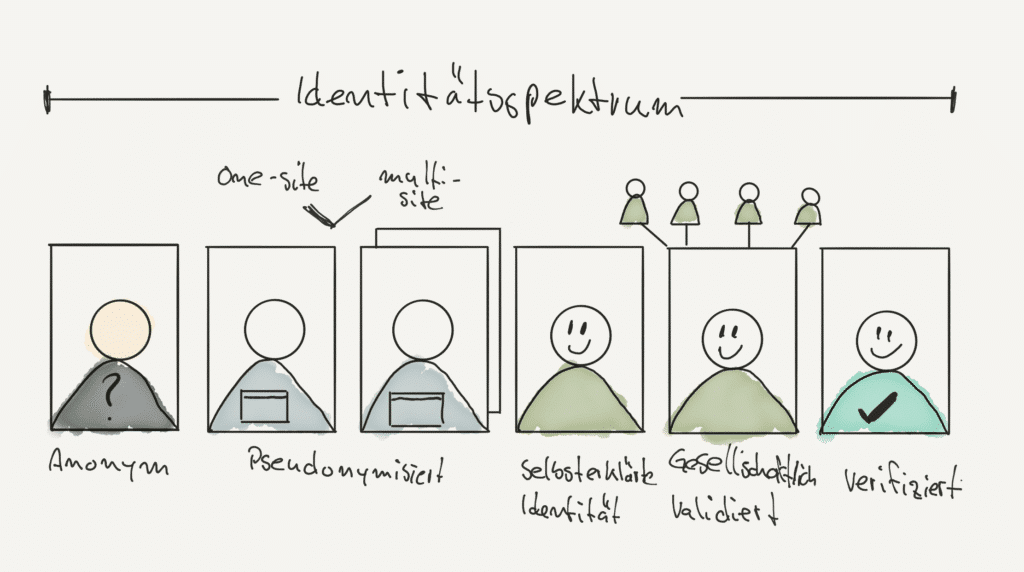

Wenn man von digitaler Identität spricht, dann gibt es “die eine Identität” nicht. Stattdessen müssen wir von einem Spektrum sprechen. Innerhalb des Identitätsspektrums gibt die verifizierte, digitale Identität. Diese Identität ist eine “gehärtete” Identität und entspricht der Aussagekraft eines Personalausweises oder Reisepasses. Eine verifizierte Identität braucht es z. B. bei Abschlüssen von Kreditverträgen oder der Eröffnung eines Bankkontos.

Die drei Musketiere

Der bekannteste, und bisher aktiviste in dem Bereich, ist VERIMI. Das Partnerprojekt von Deutsche Bank, Daimler, here, Allianz, Bundesdruckerei, Lufthansa, Telekom, Axel Spinger und CORE will mit dem verimi-Login der Generalschlüssel für verschiedene Dienste sein. Dazu muss sich der Nutzer auf der Plattform registrieren um dann den Verimi-Login bei bislang 22 teilnehmenden Drittanbieter (Stand Dezember 2019) nutzen zu können.

Nicht viel weniger bekannt, zumindest wenn es um die Diskussionen um den Dienst geht, ist yes. Vor allem die Sparkassen und Volks- und Raiffeisenbanken setzen auf yes. Die Idee: ohne einen dedizierten yes-Account anlegen zu müssen, sollen sich Konsumenten auf Basis des bestehenden Online-Banking-Logins bei Drittanbietern identifizieren können. 1.000 Sparkassen und Volks- und Raiffeisenbanken unterstützen den Dienst bereits, den dazugehörigen yes-button auf Seiten der Drittanbieter sucht man derweil vergeblich. Was irgendwie für manche Anwendungsfälle auch nachvollziehbar ist. Einer der Hauptnutzen – der KYC-Prozess bei der Eröffnung eines neuen Kontos – wollen die Sparkassen und Volks- und Raiffeisenbanken sicher nicht für andere Banken pushen. Kaum vorstellbar, dass eine NEO-Bank das Haus und Hof Identverfahren der Sparkassen und Volks- und Raiffeisenbanken nutzt, um Konsumenten dort ein Konto eröffnen zu können.

Außerhalb der Bank-Branche kündigte im selben Jahr 2017 eine Daten-Allianz bestehend aus United Internet, Pro Sieben, SAT.1 und RTL den Dienst netID an. Etwas später, 2018, kam dann mit der European netID Foundation (EnID) eine Stiftung dazu, die nichts Geringeres zum Ziel hat als eine europäische Single Sign-on als die Alternative zu den US-amerikanischen Anbietern zu etablieren. Bis heute gibt es knapp 60 Partner, bei denen sich der Kunde mit seiner netID anmelden kann. Im Grunde versucht netID eine Klammer zu bilden zwischen den Teilnehmern der Daten-Allianz. Konsumenten können sich also bei teilnehmenden Partnern sowohl mit ihrem netID-Account aber auch mit dem Account von Pro Sieben, Web.de, RTL, oder GMX anmelden. Wichtig dabei ist zu verstehen, dass es eben nur ein deutsches Single-Sign-On System ist, keine verifizierte Identität.

AUTHADA und AusweisApp 2

Drei Musketiere. Trotzdem darf man AUTHADA (gestartet 2013) und AusweisApp 2 (gestartet 2014) nicht unerwähnt lassen. Beide bieten digitale Identifizierungslösungen auf Basis des elektronischen Personalausweises. Die Idee: das Smartphone wird zum Lesegerät des Personalausweises. Während die Lösungen lange Zeit nur von Android-Geräten genutzt werden konnte, sind diese seit 2019 auch auf dem iPhone verfügbar (ab iPhone 7). Beide, AUTHADA und AusweisApp 2 bieten SDKs und damit anderen Unternehmen die Möglichkeit zur Integration an. Voraussetzung ist ein Personalausweis mit eID Funktion. Seit Mitte 2017 ist diese Funktion bei jedem neuen Personalausweis standardmäßig aktiviert. Zusammen mit der PIN kann dann der Personalausweis genutzt werden. Nach Integrationen in der Fläche sucht man vergeblich. Die AusweisApp 2 listet zwar einige Anbieter, die meisten sind allerdings behördliche Institutionen. Auch bei AUTHADA sind die teilnehmenden Anbieter überschaubar, prominentester Partner ist hier die comdirect Bank.

Das Hauptproblem beider Lösungen: es müssen zu viele Voraussetzungen erfüllt sein.

- Nicht wissen: obwohl alle Ausweise ab 2017 die eID Funktion aktiviert haben, stellt sich die Frage inwiefern dies dem Bürger bekannt ist? Das wird spätestens dann deutlich, wenn es zur PIN-Abfrage kommt. Hat man diese vergessen oder nicht mehr greifbar, muss eine neue beantragt werden. Im Bürgerbüro seines Vertrauens. Analog.

- Wenige Anbieter: keine der Lösungen ist in der breiten Masse verfügbar. Das kann daran liegen, dass Drittanbieter die Nutzung der eID Funktion des Ausweises bei der Vergabestelle für Berechtigungszertifikate (VfB) des Bundesverwaltungsamtes beantragen muss und das sieht nicht nach Spaß aus.

- Unterstützte Plattformen: Auf Mac und PC braucht es zusätzliche Hardware und bei den Smartphones war es lange Zeit eine reine Android-Party. Erst seit Herbst 2019 kann der Personalausweis auch vom iPhone ausgelesen werden, zumindest ab Model 7.

Ein Use Case, den es kaum gibt

Es mag paradox klingen, aber es gibt nur wenige Anwendungsfälle für eine verifizierte, digitale Identität. Und die, die es gibt, kommen selten vor. Das bekannteste Beispiel ist der KYC-Prozess einer Bank bei der Beantragung einer Kreditkarte oder der Eröffnung eines Bankkontos. Beides erfordert den Personalausweis, gelöst wird heute z. B. mit Video-Ident, was zweifelsohne besser als das alte Post-Ident oder der Besuch bei einer Filiale ist, aber alles andere als charmant. Hier könnte eine digitale Identität eine einfache Lösung sein. Das Problem: die Häufigkeit des Use-Cases.

Alles was eine harte Identität benötigt wie Eröffnung eines Kontos, Abschluss eines Mobilfunkvertrages oder das Ummelden beim Amt, etc. kommt vergleichsweise selten vor.

Was nützt eine große Zielgruppe, wenn der Bedarf vergleichsweise selten vorkommt? In unserem Fintech Podcast 161 mit VERIMI sollte ein Anwendungsfall tatsächlich die An/Abmeldung der Hundesteuer sein oder der Hauskauf auf Mallorca. Jetzt werden Hunde zwar nicht so schrecklich alt, aber zwischen 9 und 12 Jahre lebt so ein Zeckentaxi und auch der Hauskauf auf Mallorca mag zwar vorkommen aber die Alltagsrelevanz ist in beiden Fällen eher so Mittel. Auch so ein Mobilfunkvertrag für die Kinder wird nicht jeden Tag abgeschlossen. Um es kurzzumachen: den Anwendungsfall mag es geben, aber der kommt eben nicht jeden Tag vor. Nicht jede Woche und auch nicht jeden Monat.

Time to Market

Obwohl wir schon seit zwei Jahren intensiv über das Thema digitale Identität diskutieren, sind wir in Deutschland noch nicht so furchtbar weit. Im Gegenteil. Während VERIMI zumindest live und bei zwei Dutzend Partnern nutzbar ist, hat man yes noch nicht in der freien Wildbahn gesehen. Das soll in diesem Jahr dann endlich der Fall sein, drei Jahre nach offiziellem Start. Und bei netID fehlt die Fantasie wie aus dem Konglomerat irgend etwas Relevantes werden soll. Eine deutsche Single-Sign-On-Alternative zu Google und Facebook mit dem “Mehrwert” Datenschutz? Echt jetzt? AUTHADA und AuweisApp 2 waren viele Jahre nicht in der Breite nutzbar und die Bundesregierung hat versäumt für die Funktionen des digitalen Ausweises Werbung zu machen oder die Lösung in der Breite auf den eigenen Seiten zu implementieren. Inzwischen haben ohnehin Apple und Google das Thema für sich entdeckt. Entdeckt bedeutet nicht gelöst, aber man kann erkennen wie wichtig das Thema für Google als auch Apple ist. Apple baut die Wallet sukzessive aus. Erst waren es Kundenkarten, Flugtickets etc. Dann kam mobile Payment dazu und nun Sign-In with Apple. Auch die Öffnung der NFC Schnittstelle für Ausweise geht in diese Richtung.

Fazit

Aktuell scheint es nicht weiterzugehen. Keine der groß angekündigten Dienste ist in der Fläche verfügbar und insgesamt ist es ruhig geworden bei dem Thema. Es scheint sich zu wiederholen, was seinerzeit beim Thema mobile Payment aus passiert ist: viele Ankündigungen, wenige fertige Lösungen, ein unklarer Use-Case und wenig Akzeptanz beim Konsumenten und aufseiten der Anbieter. Und auch bei diesem Thema gilt wie so oft der Grundsatz: Der Wurm muss dem Fisch und nicht dem Angler schmecken. Und am Ende stellt sich die Frage, ob der Fisch überhaupt einen Wurm möchte.